by Melida Montemayor | Sep 24, 2025 | Informe Option Levels

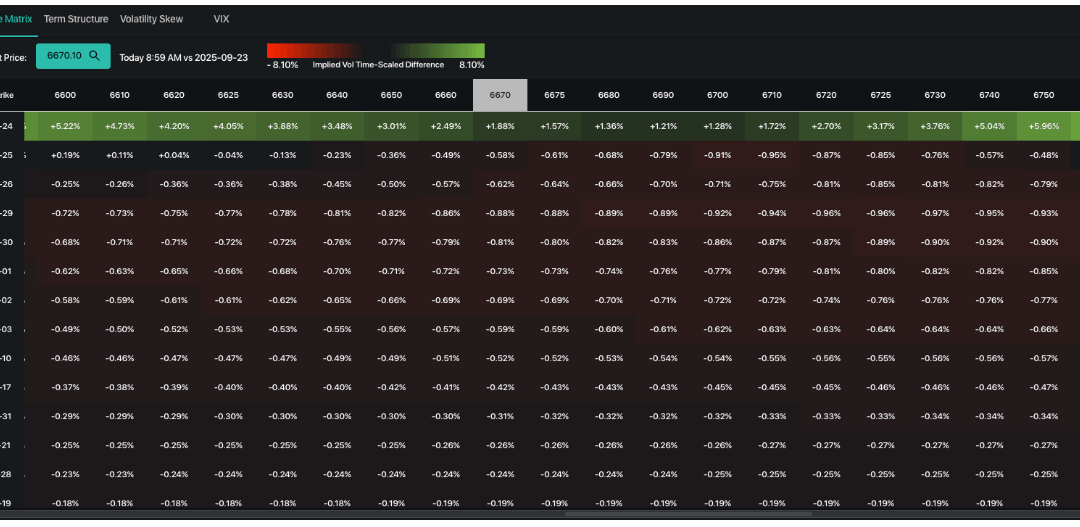

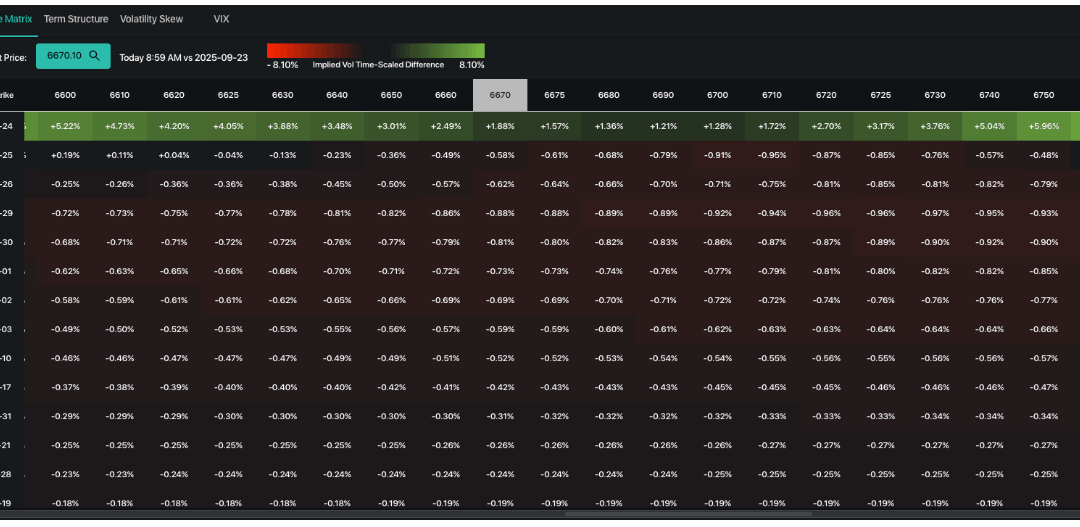

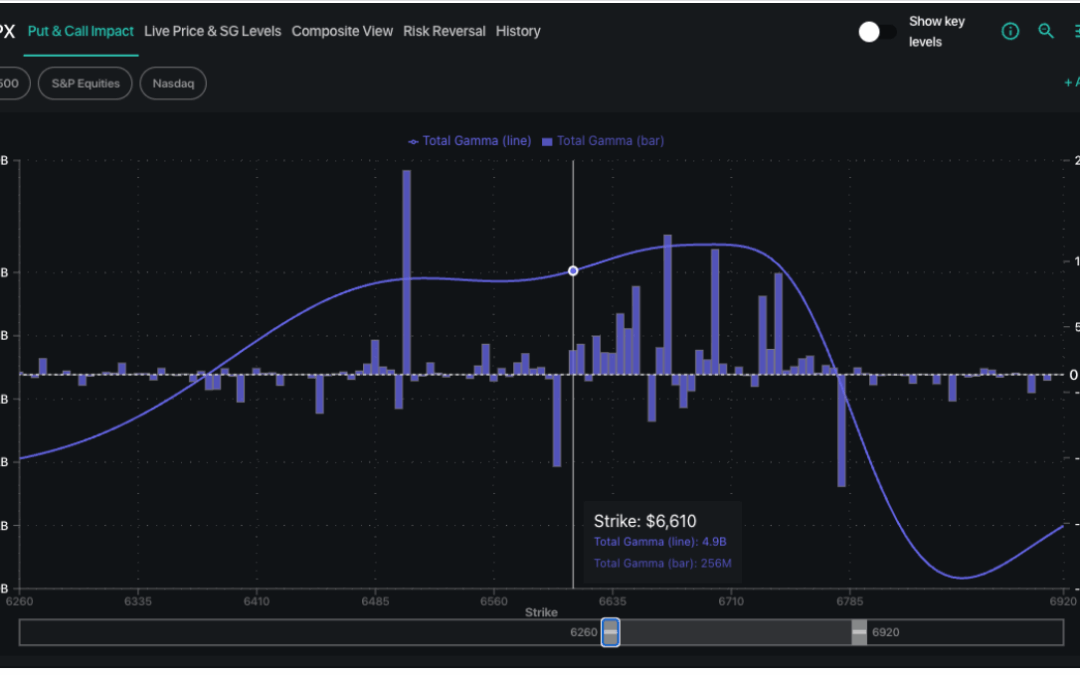

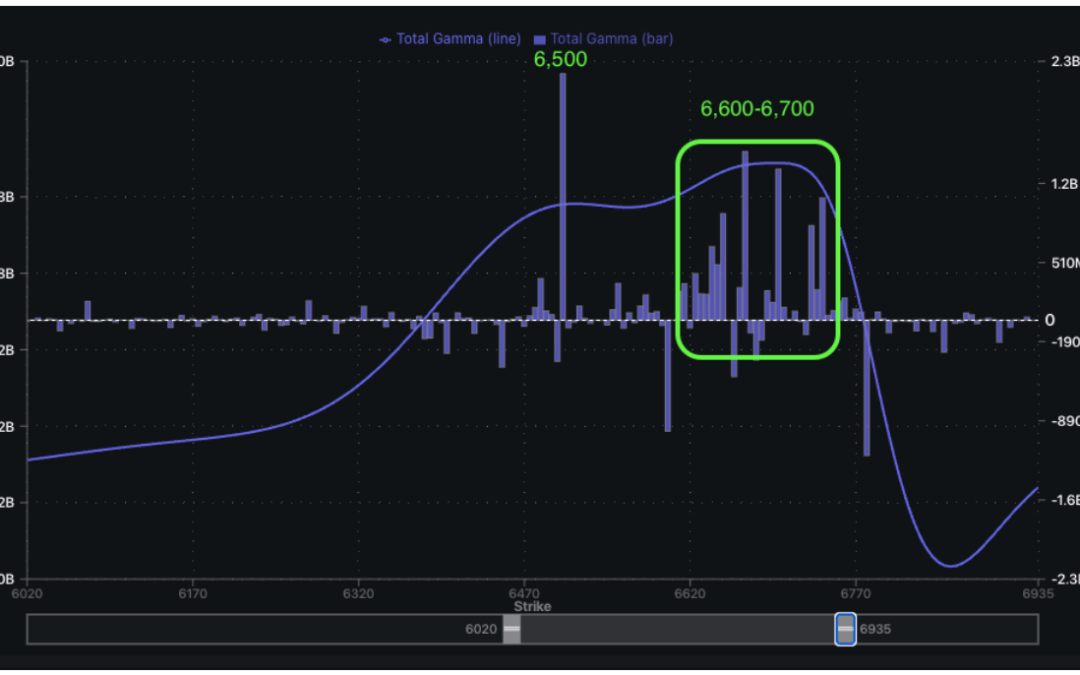

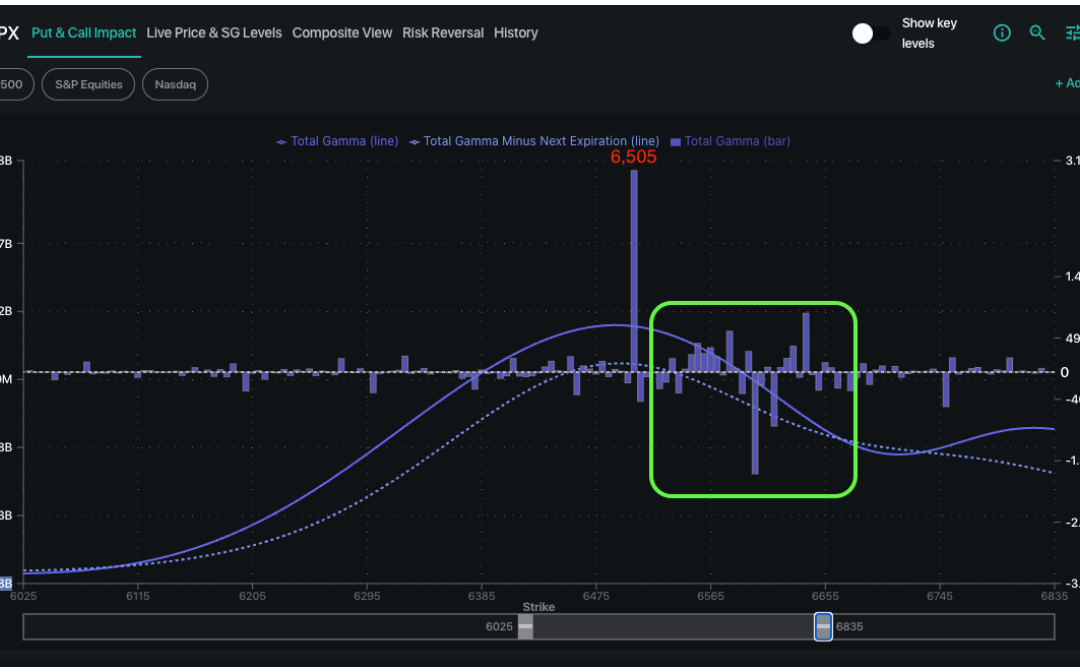

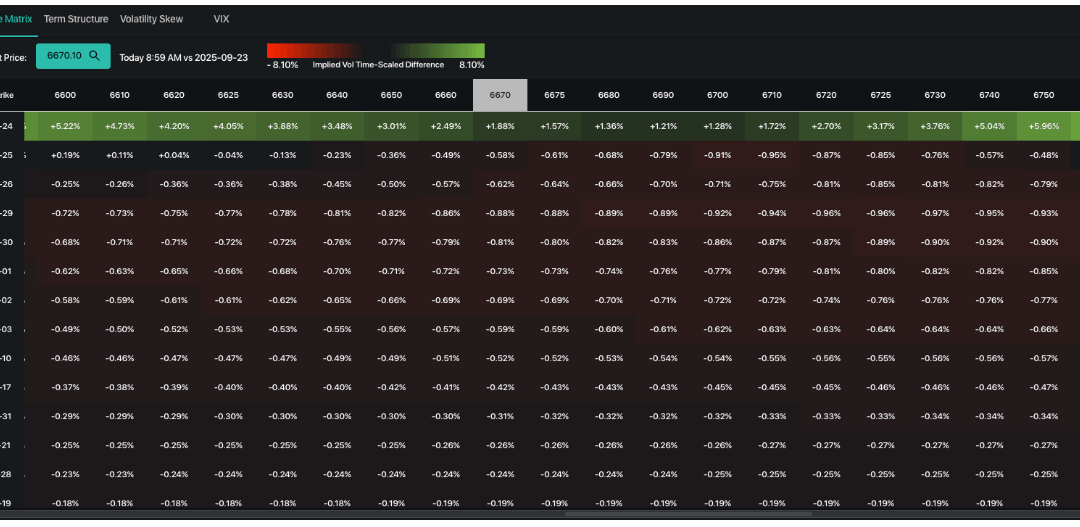

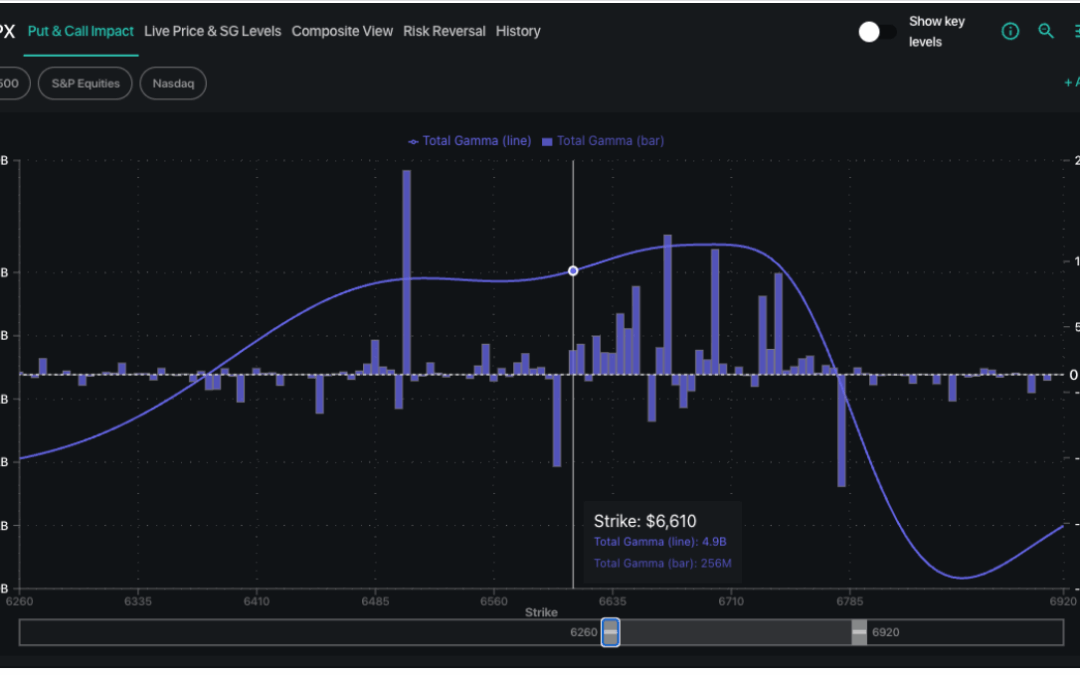

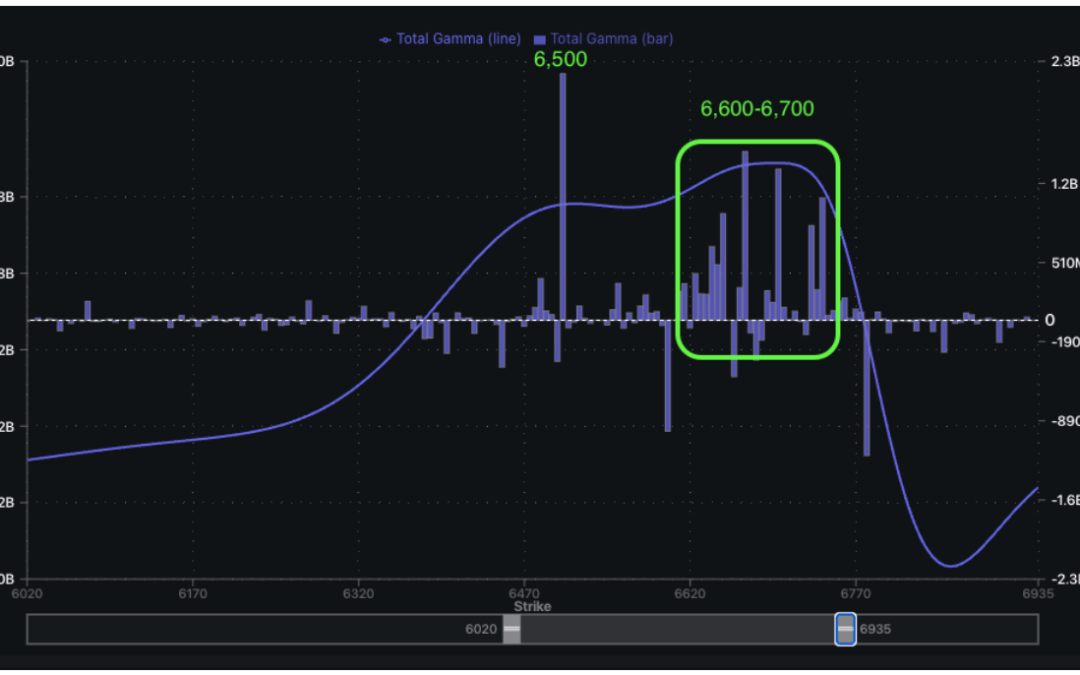

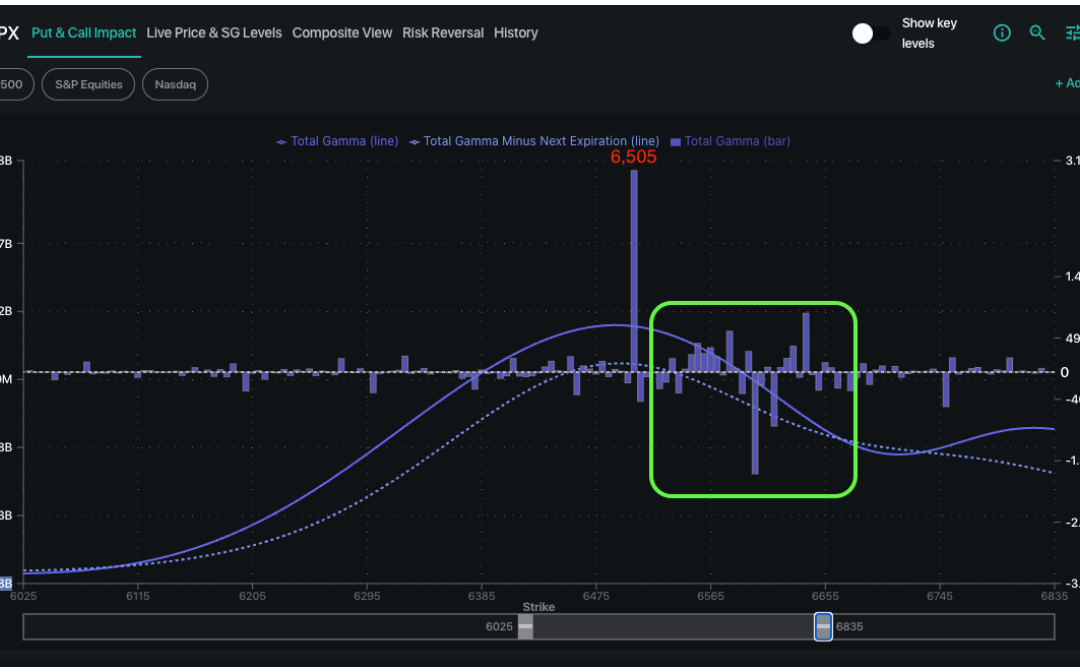

Macro Theme: Key dates ahead: 9/30: Quarterly OPEX 9/19: We remain bullish with SPX >6,600, but we will be adding put spreads and/or put flies for expirations near 9/30, playing a potential move to the massive 6,505 JPM strike. 9/18: We look for the rally to...

by Melida Montemayor | Sep 23, 2025 | Informe Option Levels

Macro Theme: Key dates ahead: 9/23: Home Sales, Powell Speaking 9/30: Quarterly OPEX Update 9/19: We remain bullish with SPX >6,600, but we will be adding put spreads and/or put flies for expirations near 9/30, playing a potential move to the massive 6,505 JPM...

by Melida Montemayor | Sep 22, 2025 | Informe Option Levels

Macro Theme: Key dates ahead: 9/23: Home Sales, Powell Speaking Update 9/19: We remain bullish with SPX >6,600, but we will be adding put spreads and/or put flies for expirations near 9/30, playing a potential move to the massive 6,505 JPM strike. 9/18: We look for...

by Melida Montemayor | Sep 19, 2025 | Informe Option Levels

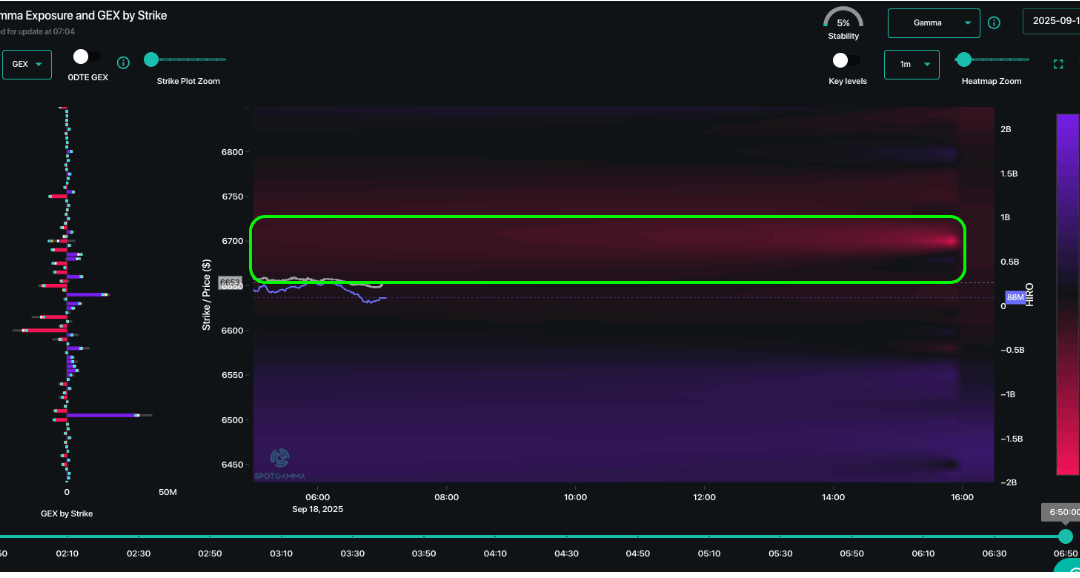

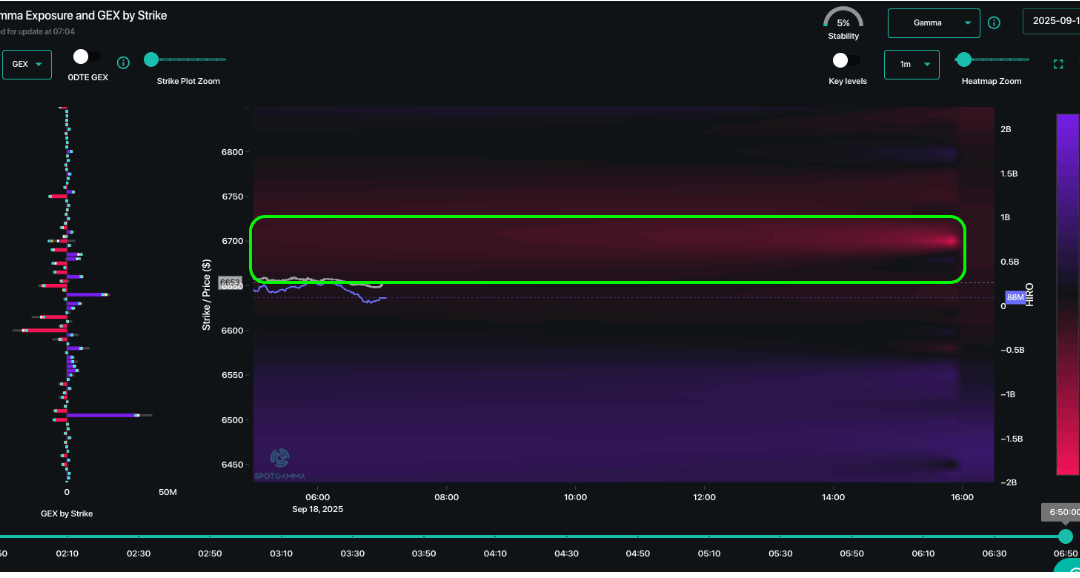

Macro Theme: Key dates ahead: 9/19: OPEX Update 9/19: We remain bullish with SPX >6,600, but we will be adding put spreads and/or put flies for expirations near 9/30, playing a potential move to the massive 6,505 JPM strike. 9/18: We look for the rally to continue...

by Melida Montemayor | Sep 18, 2025 | Informe Option Levels

Macro Theme: Key dates ahead: 9/19: OPEX Update 9/18: We look for the rally to continue into Friday OPEX, and then look for a correction next week. 9/30 is circled as potentially a more destabilizing expiration. 9/16: Our core view one is vol is cheap. We like short...