by Melida Montemayor | Sep 18, 2025 | Informe Option Levels

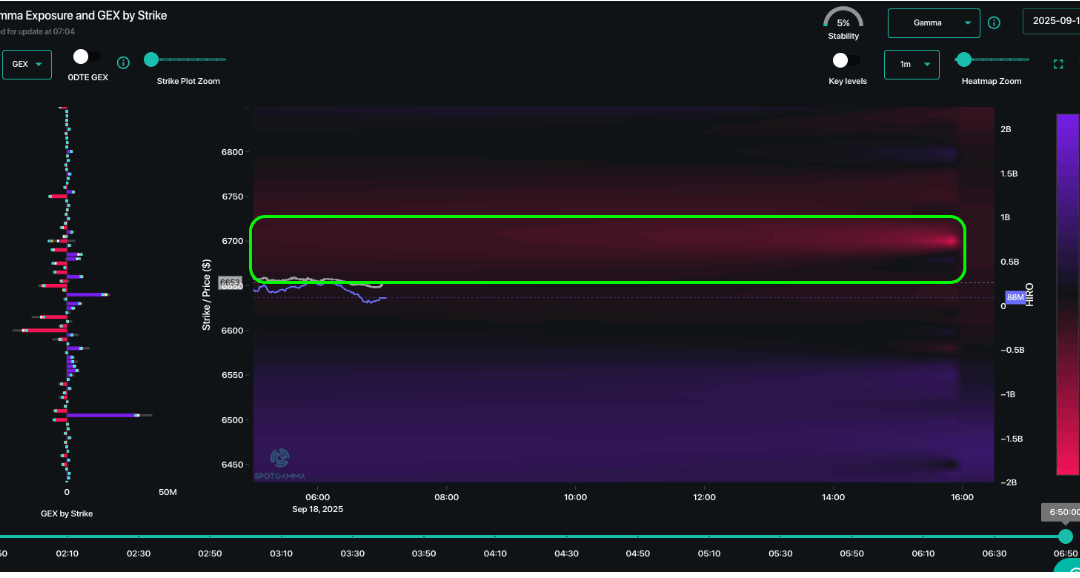

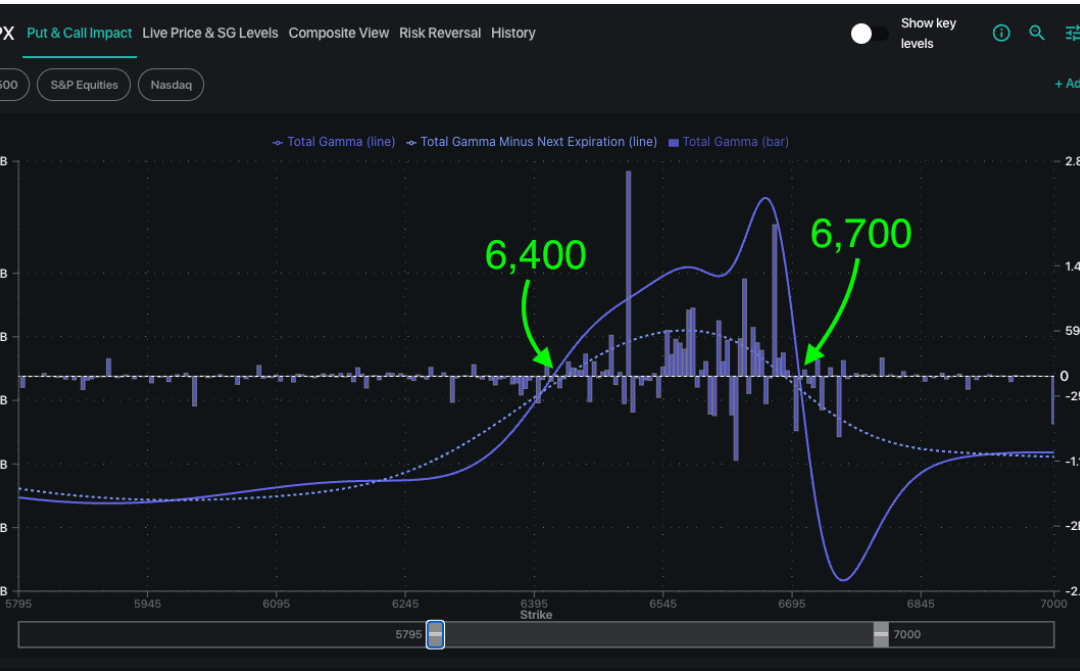

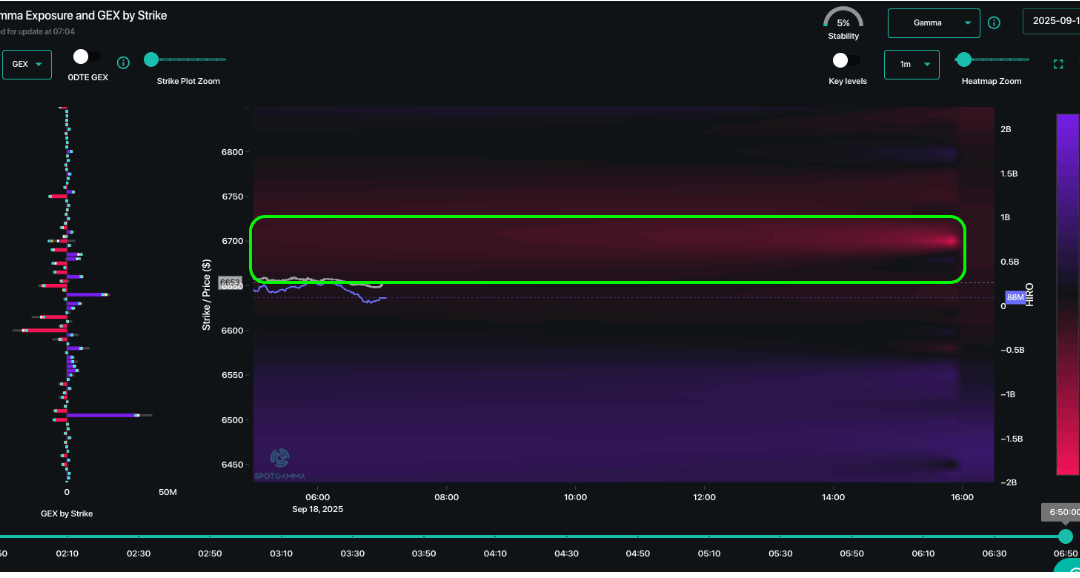

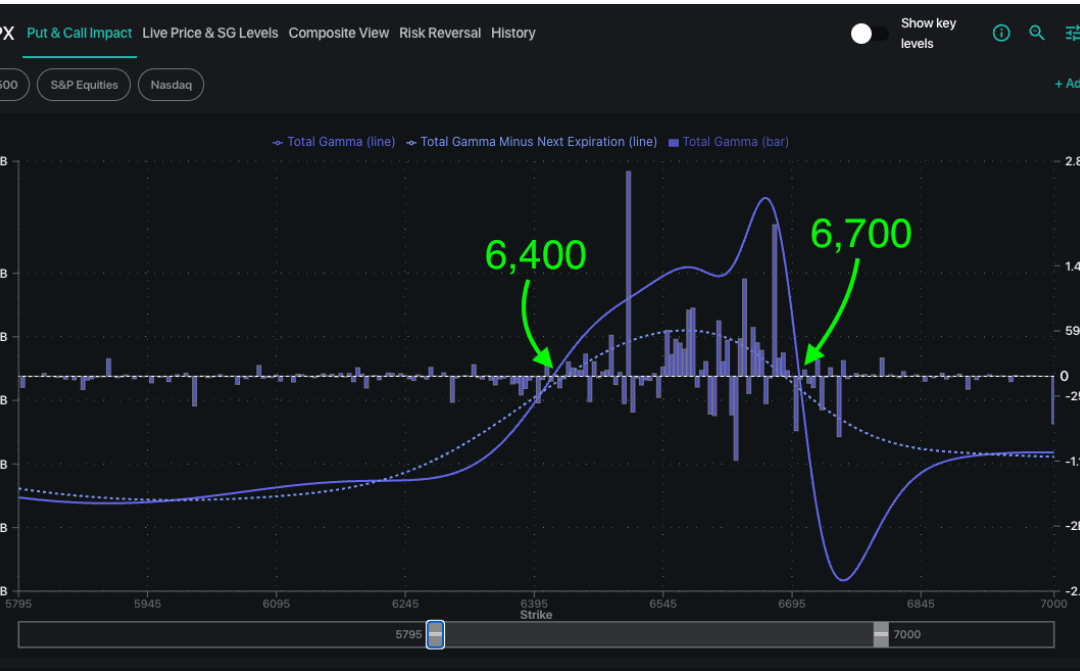

Macro Theme: Key dates ahead: 9/19: OPEX Update 9/18: We look for the rally to continue into Friday OPEX, and then look for a correction next week. 9/30 is circled as potentially a more destabilizing expiration. 9/16: Our core view one is vol is cheap. We like short...

by Melida Montemayor | Sep 17, 2025 | Informe Option Levels

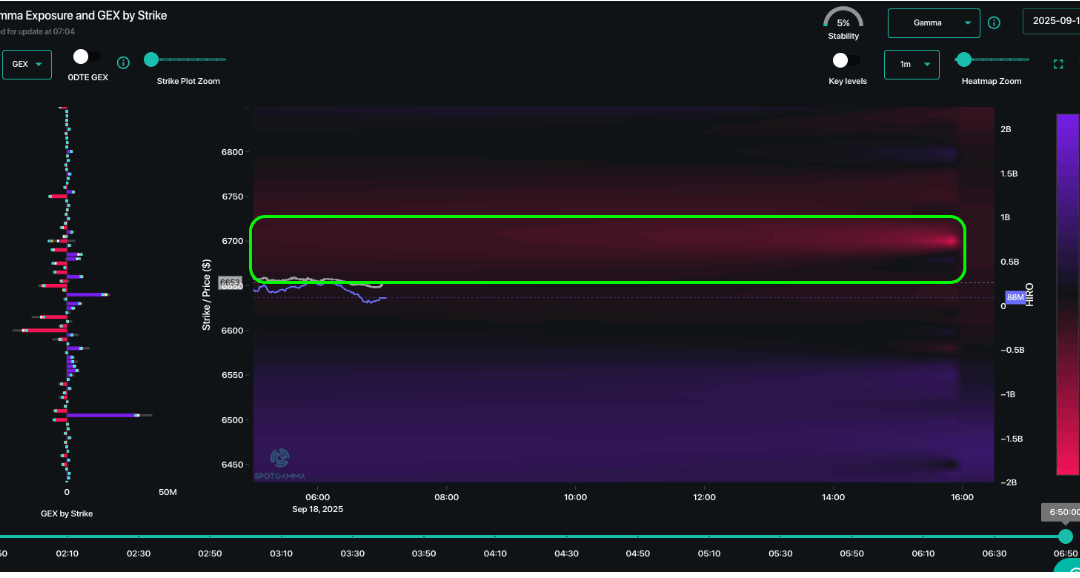

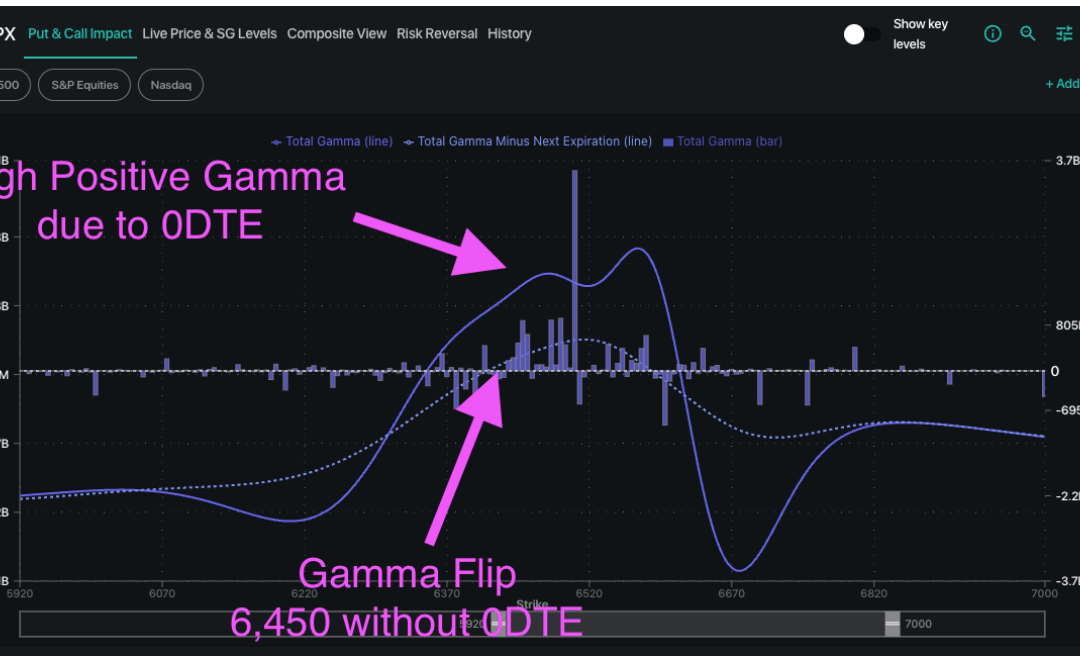

Macro Theme: Key dates ahead: 9/17: VIX Exp, FOMC 9/19: OPEX Update 9/16: Our core view one is vol is cheap. We like short term put structures >=1week to 1-month out. For bears a break of <6,600 gives bears the edge, and we’d look for a test of 6,500 (JPM...

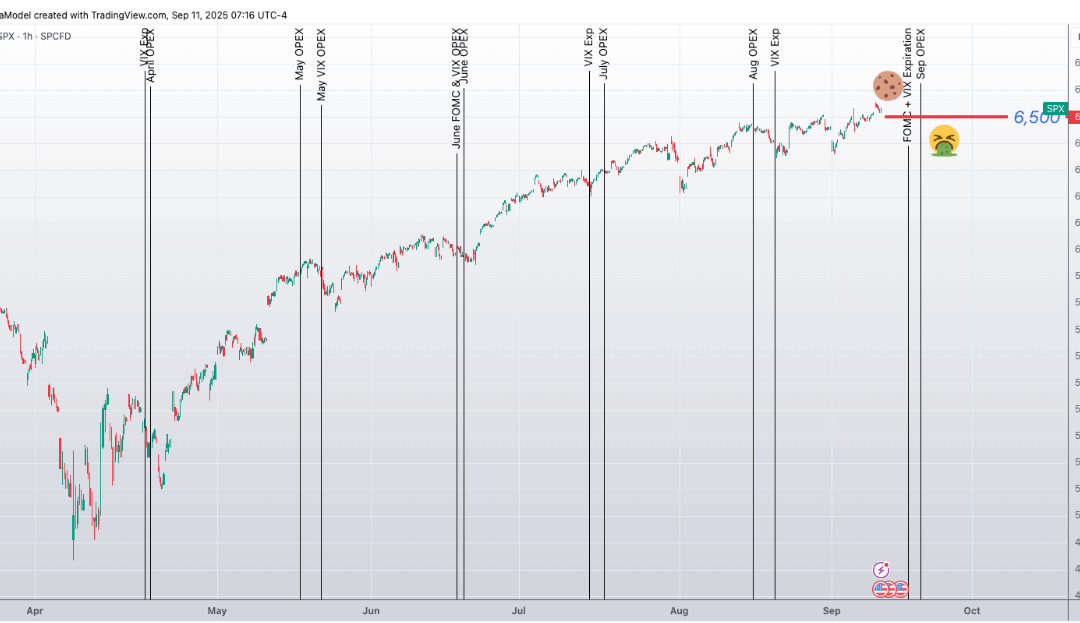

by Melida Montemayor | Sep 11, 2025 | Informe Option Levels

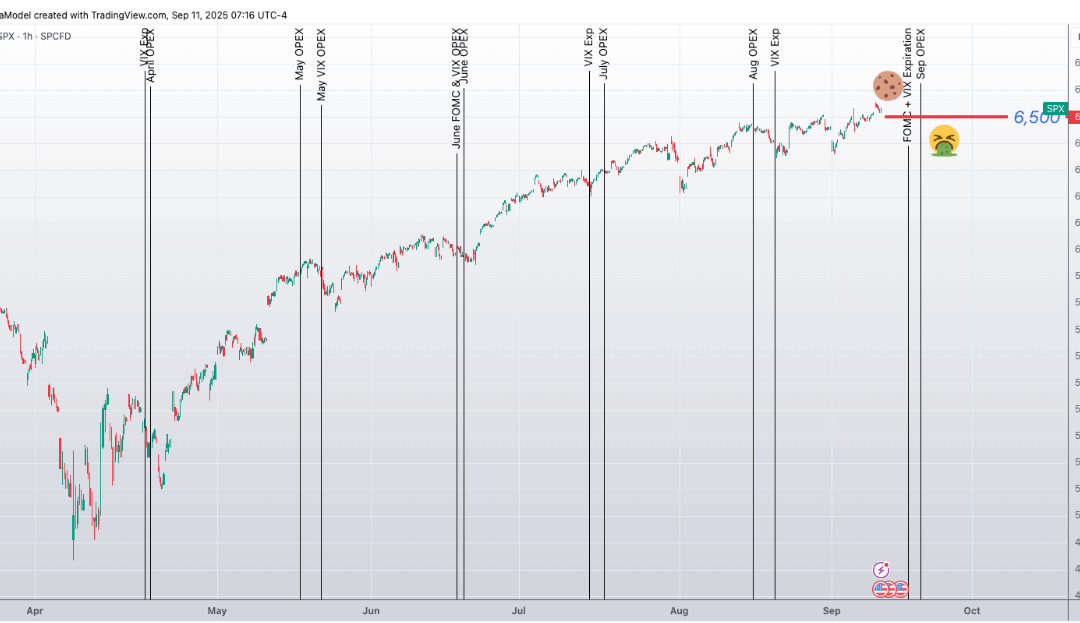

Macro Theme: Key dates ahead: 9/11: CPI 9/17: VIX Exp, FOMC 9/19: OPEX Update: 9/11: Our key pivot is now 6,500. While SPX is >6,500, we favor of test of 6,600 into 9/17. <6,500, pre or post 9/17, we will flip to risk off. 9/3: We move back to a bullish stance...

by Melida Montemayor | Sep 10, 2025 | Informe Option Levels

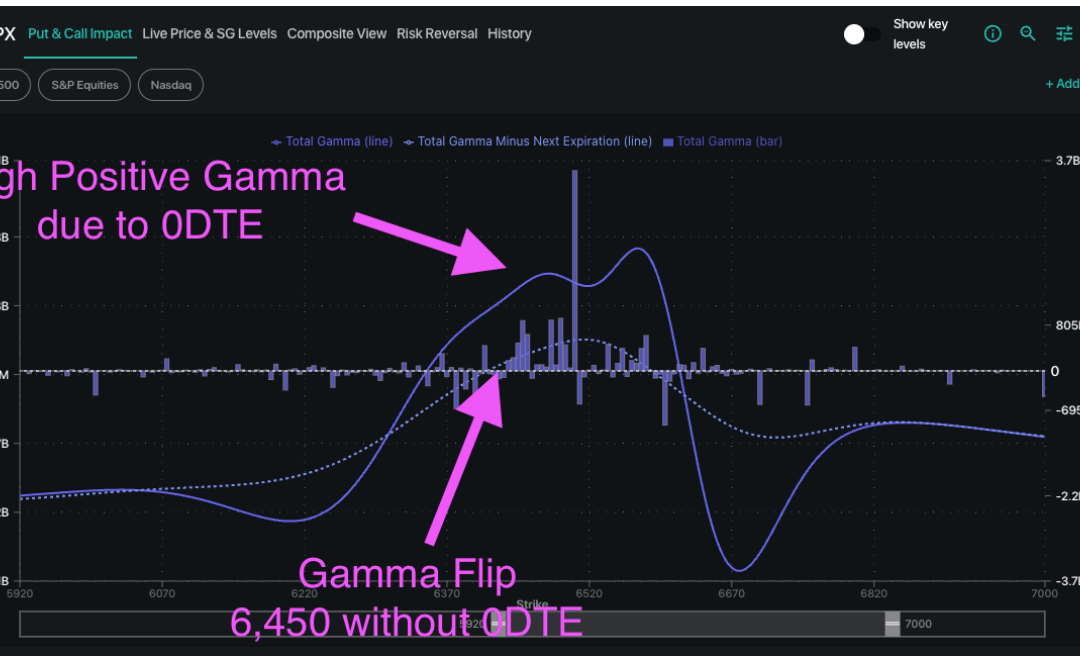

Macro Theme: Key dates ahead: 9/10: PPI 9/11: CPI 9/17: VIX Exp, FOMC 9/19: OPEX Update 9/3: We move back to a bullish stance if the SPX is >6,400, and look to enter calls in SPY/QQQ/IWM playing for >=2% upside into Sep 19th OPEX as a way to express upside....

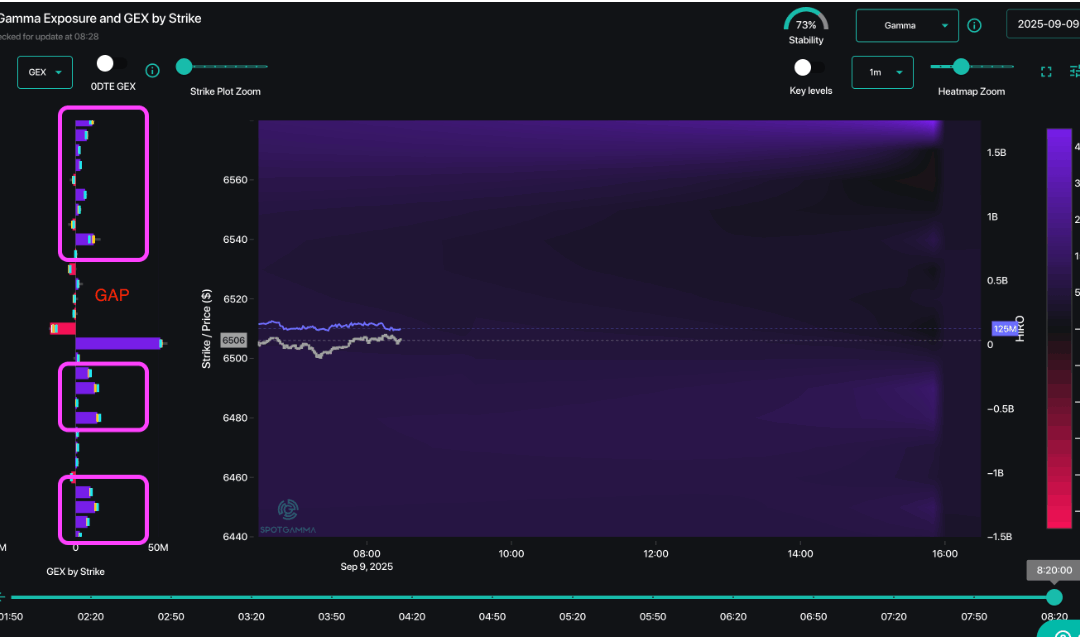

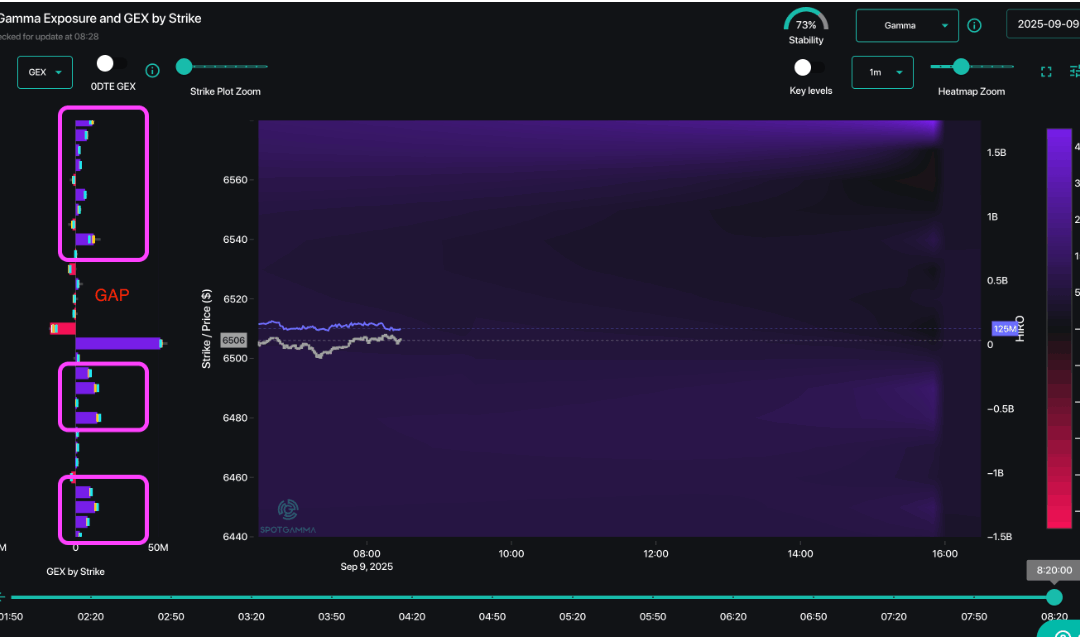

by Melida Montemayor | Sep 9, 2025 | Informe Option Levels

Macro Theme: Key dates ahead: 9/10: PPI 9/11: CPI 9/17: VIX Exp, FOMC 9/19: OPEX Update 9/3: We move back to a bullish stance if the SPX is >6,400, and look to enter calls in SPY/QQQ/IWM playing for >=2% upside into Sep 19th OPEX as a way to express upside....