by Melida Montemayor | Sep 5, 2025 | Informe Option Levels

Macro Theme: Key dates ahead: 9/5: NFP Update 9/3: We move back to a bullish stance if the SPX is >6,400, and look to enter calls in SPY/QQQ/IWM playing for >=2% upside into Sep 19th OPEX as a way to express upside. Should the SPX break back below 6,400, we...

by Melida Montemayor | Sep 2, 2025 | Informe Option Levels

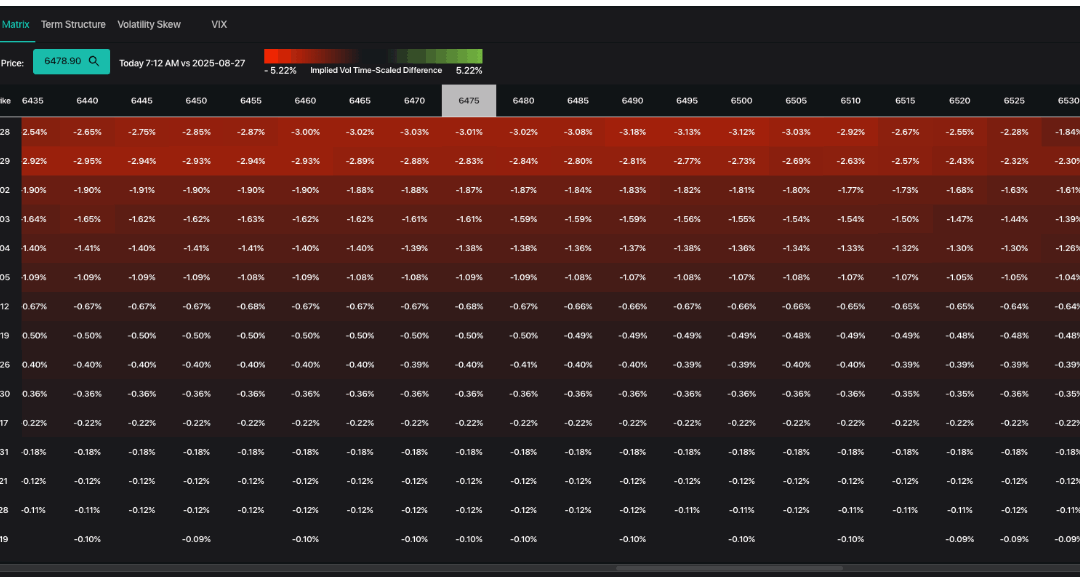

Macro Theme: Key dates ahead: 9/2: ISM 9/3: JOLTS 9/4: Jobless Claims/PMI 9/5: NFP Update 8/28: Post NVDA earnings the key upside target remains 6,500-6,525. We update our key “risk off” pivot level to 6,450. A break below there infers a test of 6,400....

by Melida Montemayor | Ago 29, 2025 | Informe Option Levels

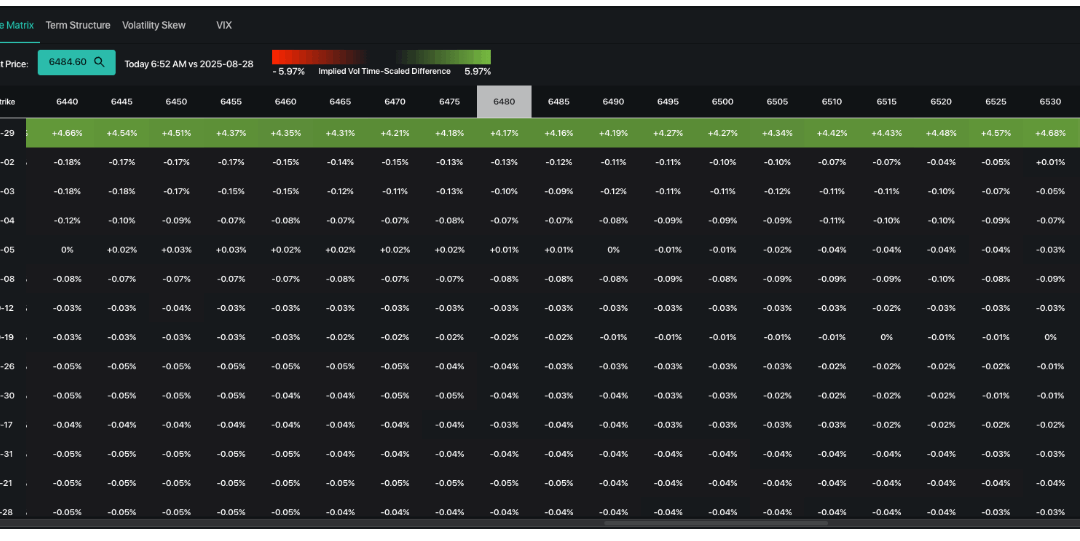

Macro Theme: Key dates ahead: 8/29: PCE 9/1: Market Closed (Labor Day) Update 8/28: Post NVDA earnings the key upside target remains 6,500-6,525. We update our key “risk off” pivot level to 6,450. A break below there infers a test of 6,400. <6,400...

by Melida Montemayor | Ago 28, 2025 | Informe Option Levels

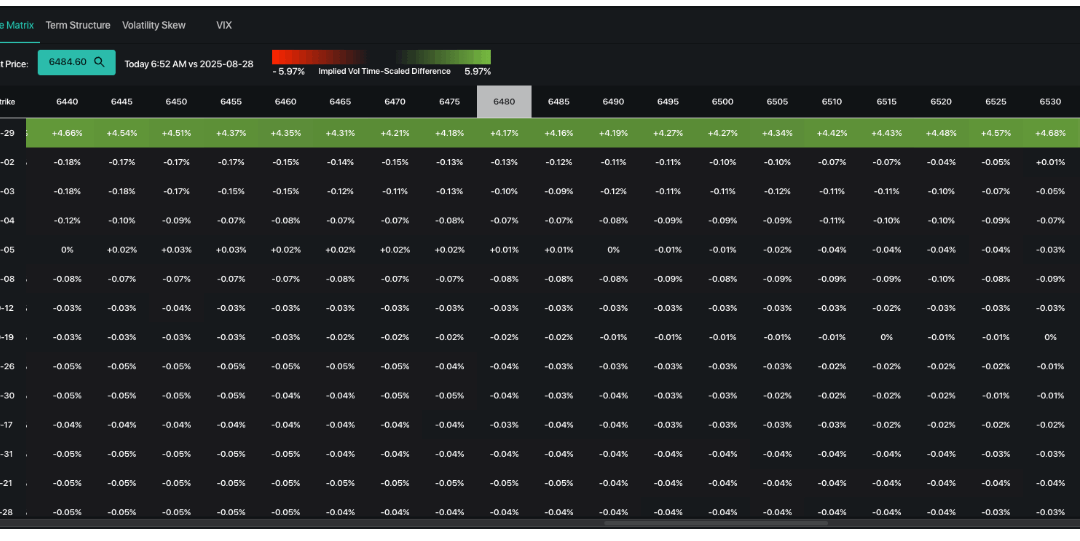

Macro Theme: Key dates ahead: 8/28: GDP/Jobless Claims 8/29: PCE 9/1: Market Closed (Labor Day) Update 8/28: Post NVDA earnings the key upside target remains 6,500-6,525. We update our key “risk off” pivot level to 6,450. A break below there infers a test...

by Melida Montemayor | Ago 27, 2025 | Informe Option Levels

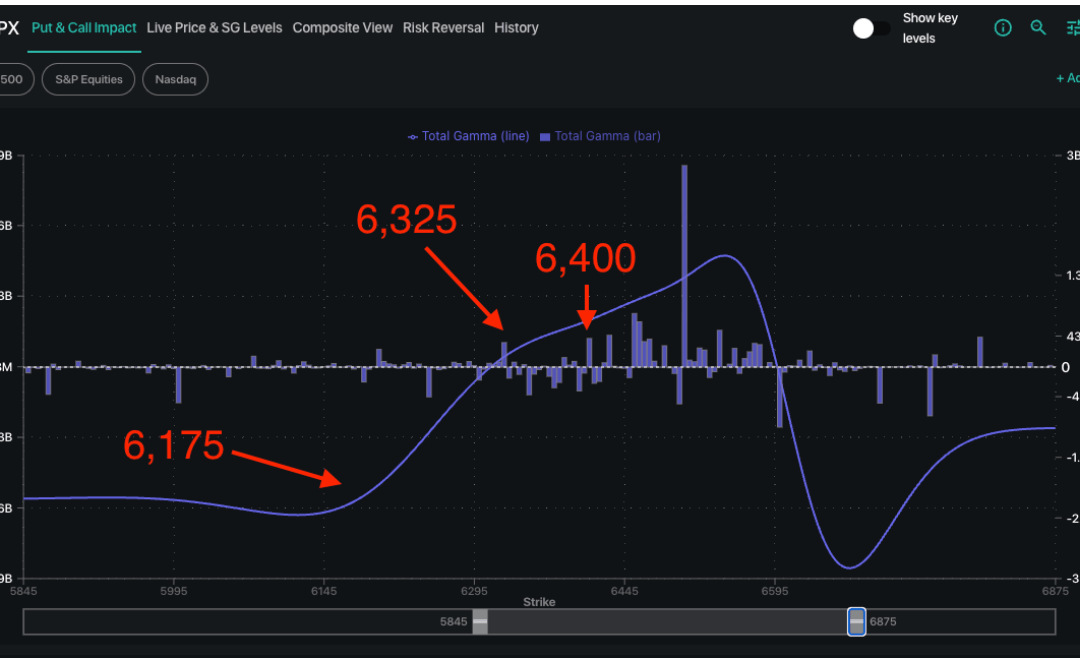

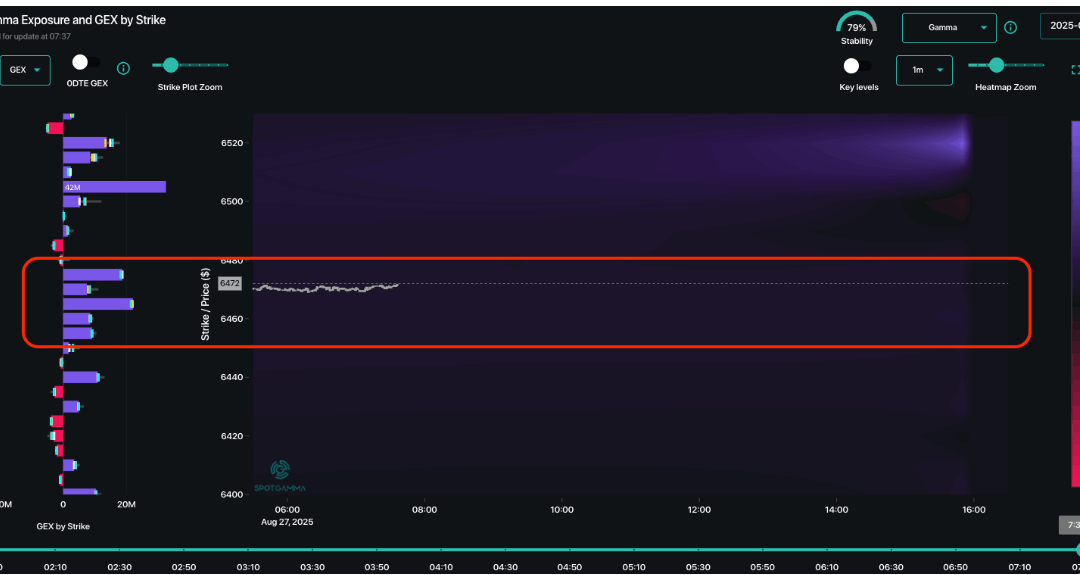

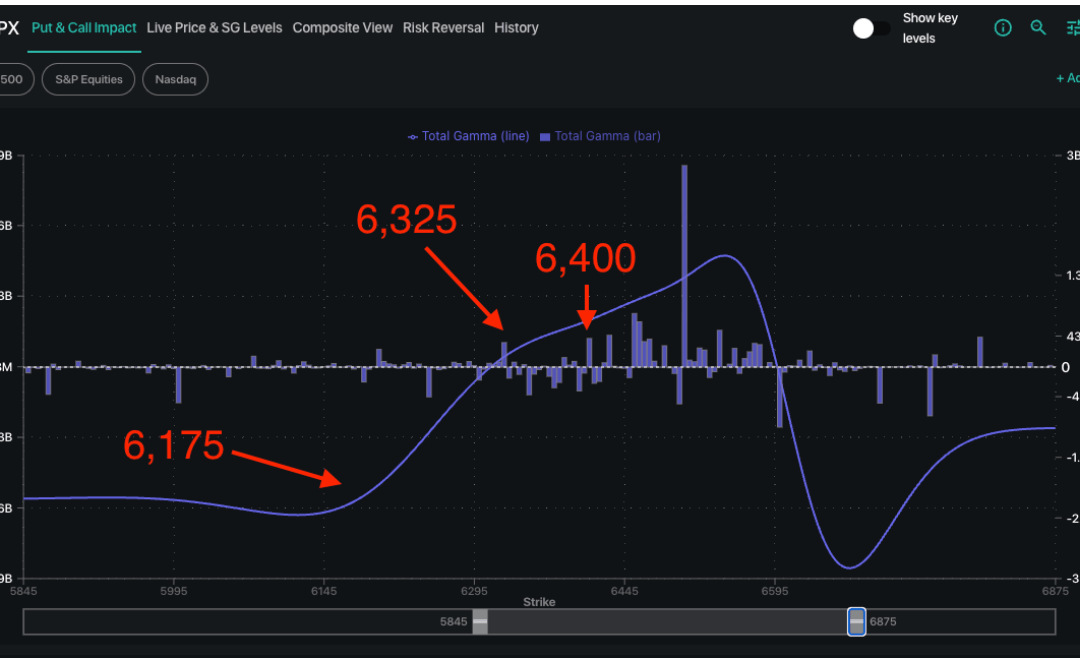

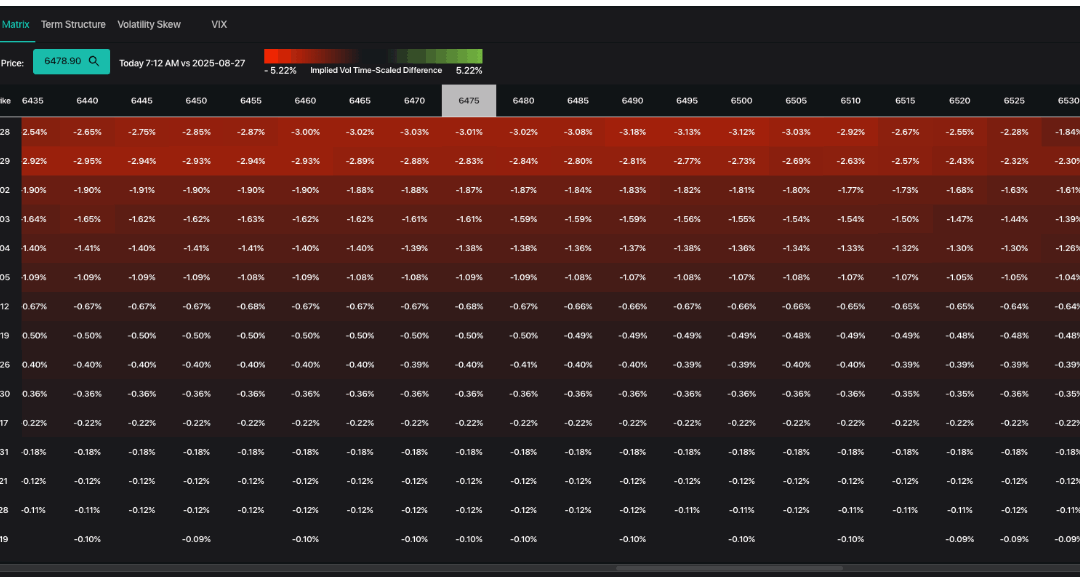

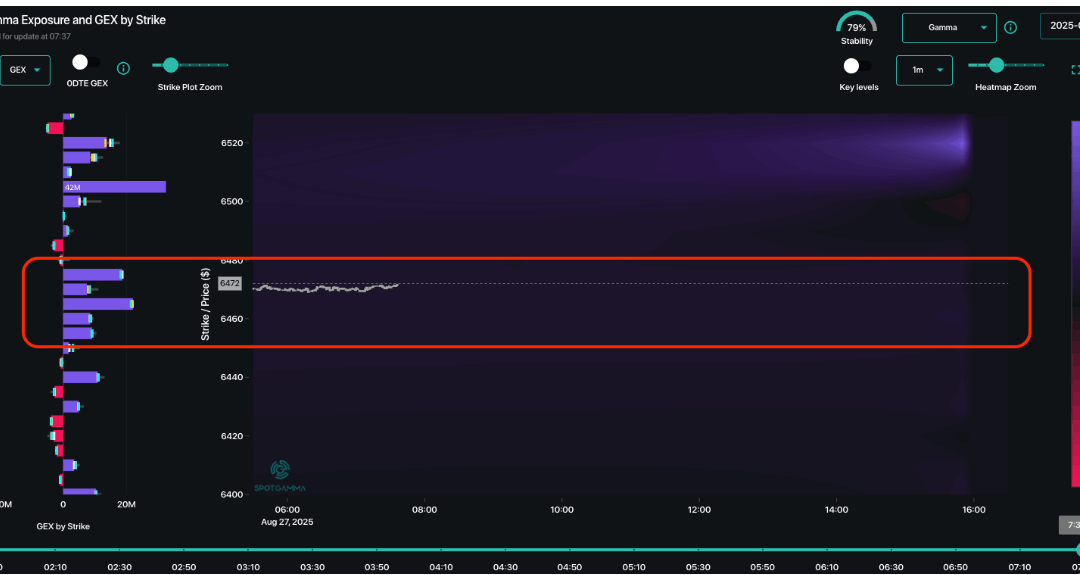

Macro Theme: Key dates ahead: 8/27: NVDA ER 8/28: Jobless Claims 8/29: PCE 8/25: Post JHOLE: At any point moving forward should SPX break under 6,400 this market could get pretty nasty, as that is where negative gamma comes in. Further, that downside action would...