Protegido: Documentos gamma scalping

Protegido con contraseña

Introduce a continuación la contraseña para ver este artículo protegido:

Informe Option Levels

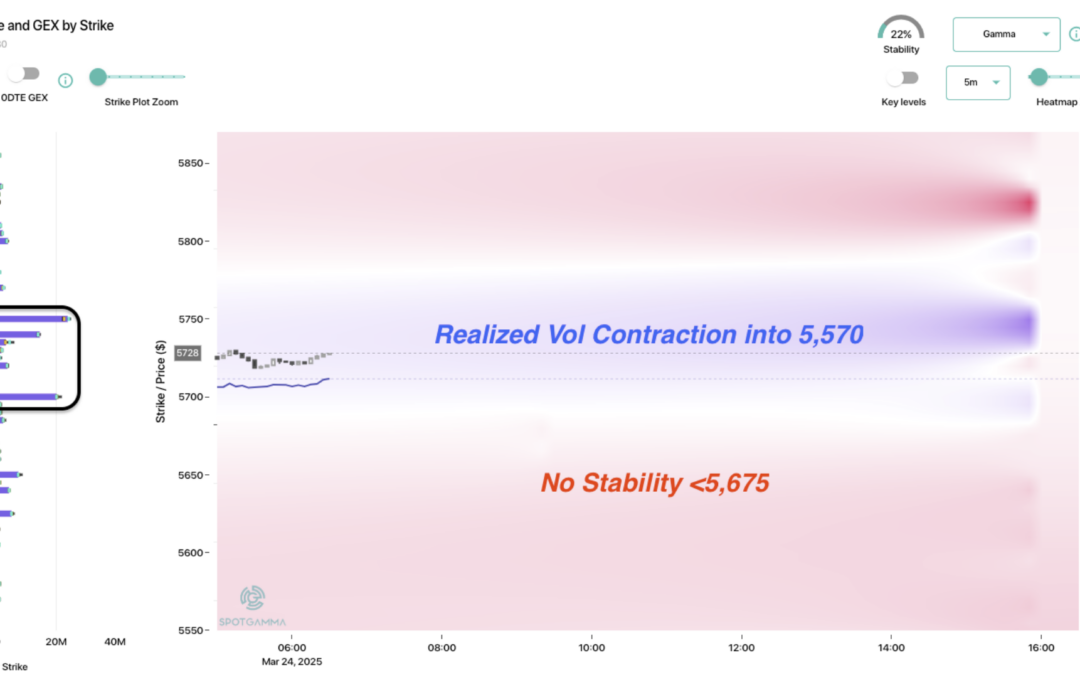

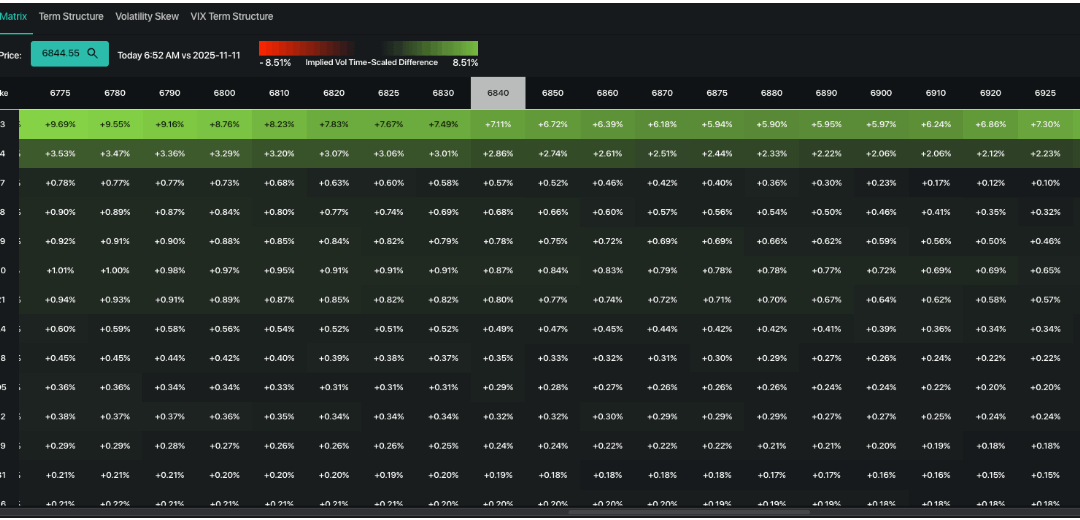

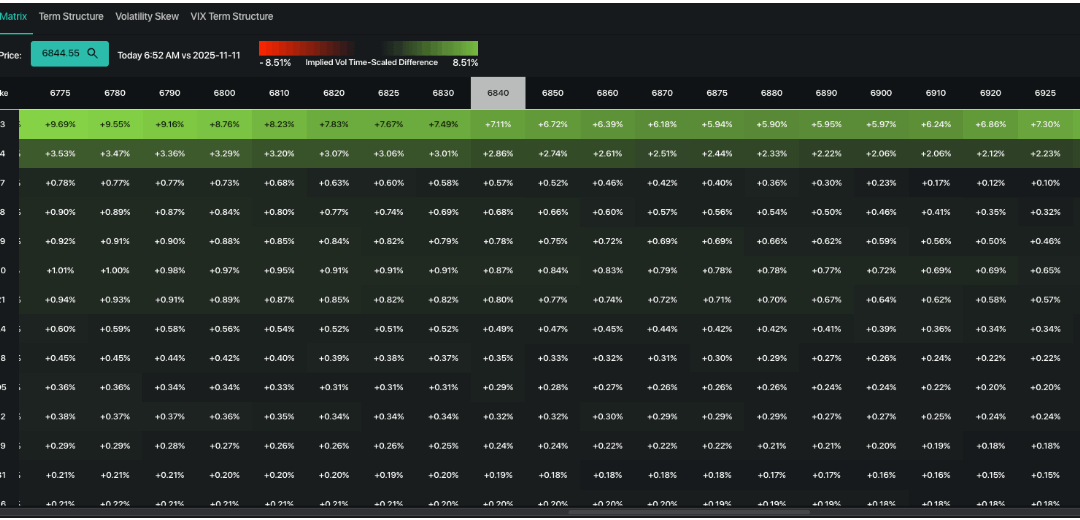

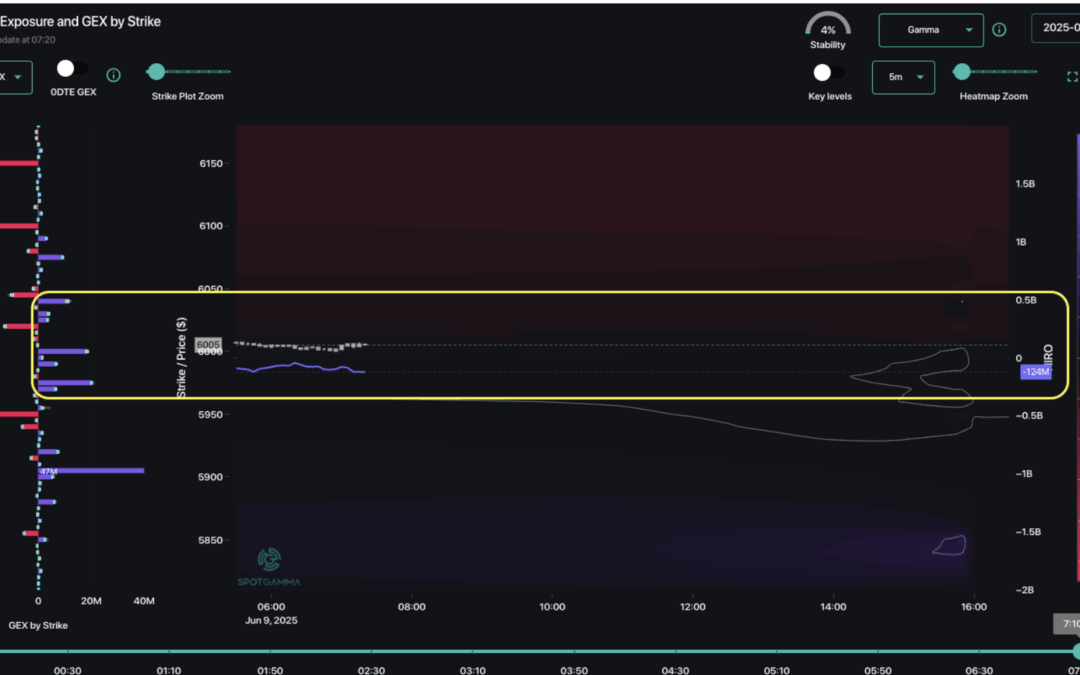

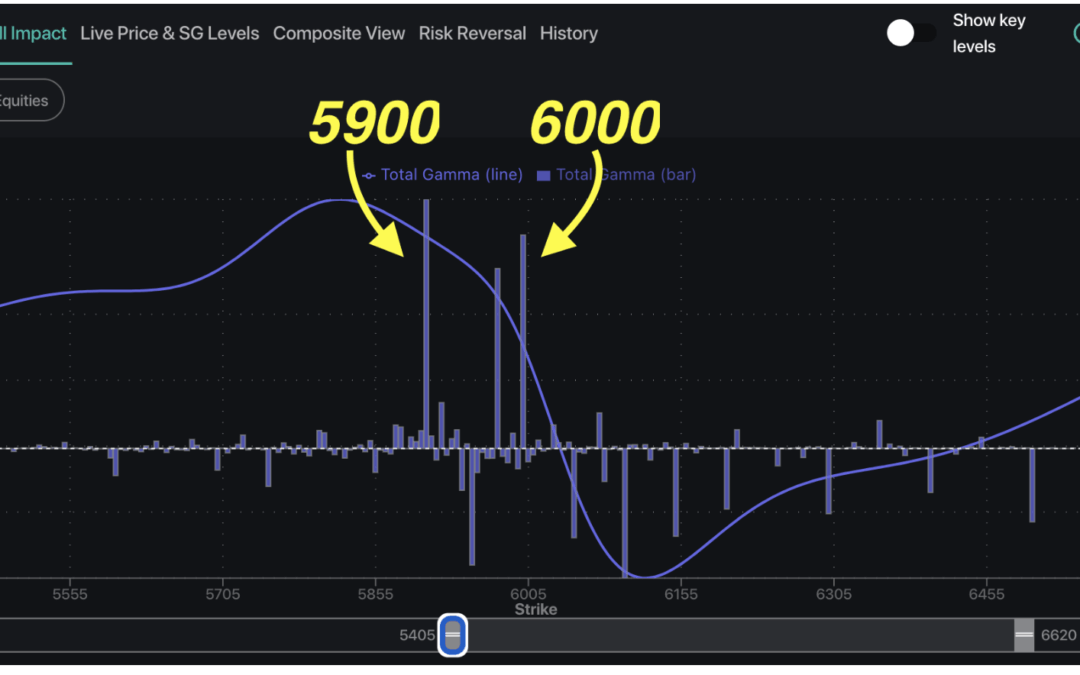

Macro Theme: Key dates ahead: 6/5 Jobless Claims 6/6 NFP 6/11 CPI 6/4: In line with the update from 5/27 – As the SPX has held >=5,900 we continue to favor upside equity plays, which syncs with looking for vol contraction into June monthly OPEX (6/20)....

Informe Option Levels

Macro Theme: Key dates ahead: 6/4 ISM PMI 6/5 Jobless Claims 6/6 NFP 6/11 CPI 6/4: In line with the update from 5/27 – As the SPX has held >=5,900 we continue to favor upside equity plays, which syncs with looking for vol contraction into June monthly...