Informe Option Levels

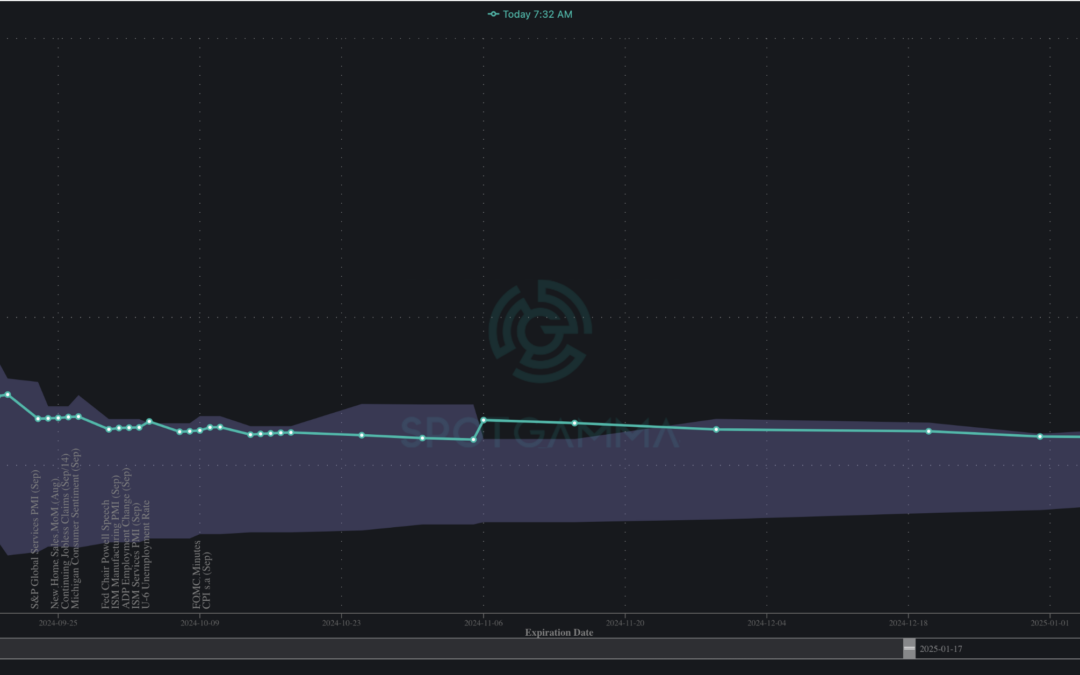

Macro Theme: Key dates ahead: 9/18 FOMC/VIX Exp 9/20 Huge Quarterly OPEX 9/18 – 9/20 is a major inflection point for equities, due to VIX Exp & FOMC (9/18), followed by Triple-Witching-OPEX. Key SG levels for the SPX are: Support: 5,620, 5,600...

Informe Option Levels

Macro Theme: Key dates ahead: 9/18 FOMC/VIX Exp 9/20 Huge Quarterly OPEX 9/18 – 9/20 is a major inflection point for equities, due to VIX Exp & FOMC (9/18), followed by Triple-Witching-OPEX. Key SG levels for the SPX are: Support: 5,600, 5,550...

Informe Option Levels

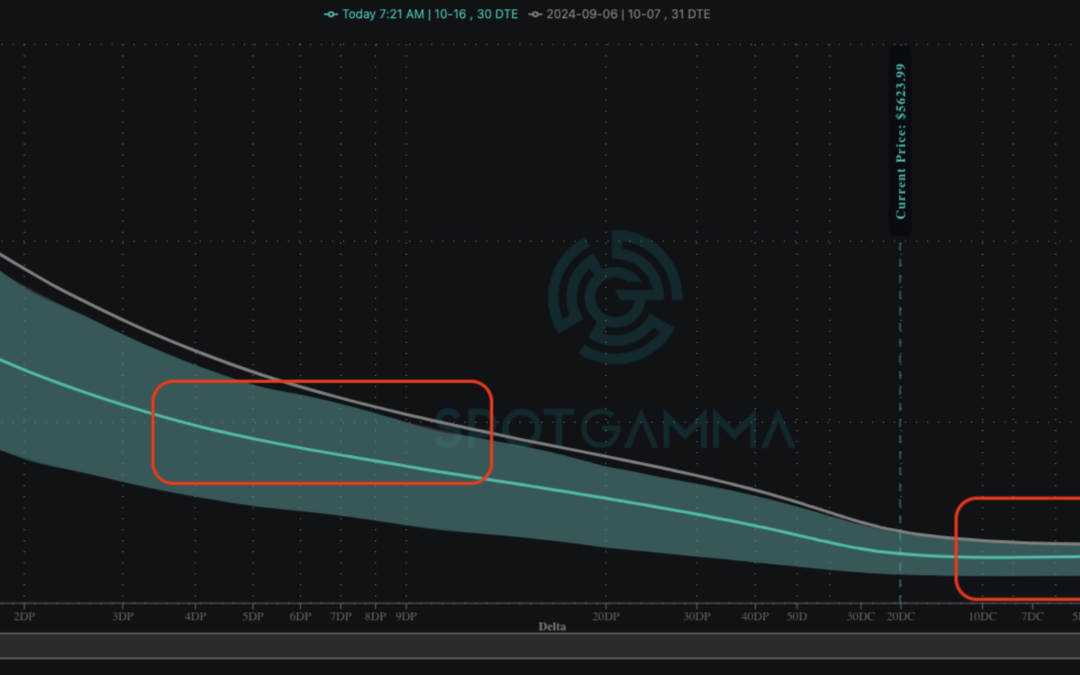

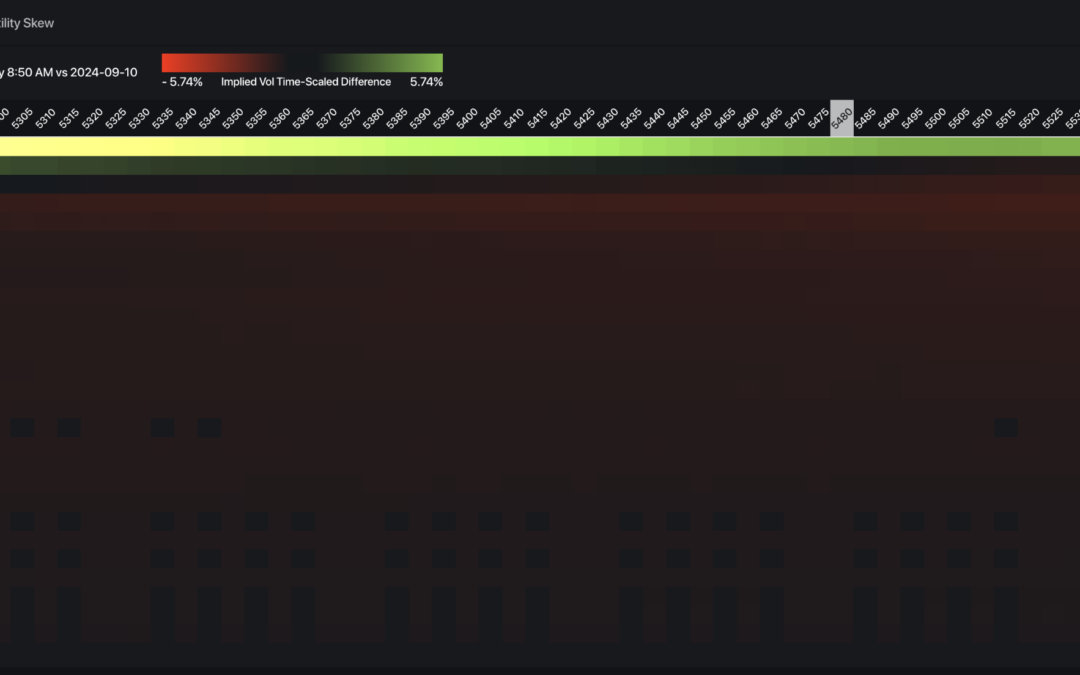

Macro Theme: Key dates ahead: 9/11 CPI 9/18 FOMC/VIX Exp 9/20 Huge Quarterly OPEX Key SG levels for the SPX are: Support: 5,400, 5,340 Resistance: 5,500, 5,520 As of 9/09/24: Models are now risk-neutral in the 5,400-5,500 range, due to the SPX testing 5,400 on...