Informe Option Levels

What’s Happening in the Market Today was one of the largest selloffs since 8/5, with the SPX closing -2.1% to 5,530. As per our AM note, “Below 5,590 we think the scales tilt toward the downside, with a large support zone at 5,550 – 5,440. ” So while...

Informe Option Levels

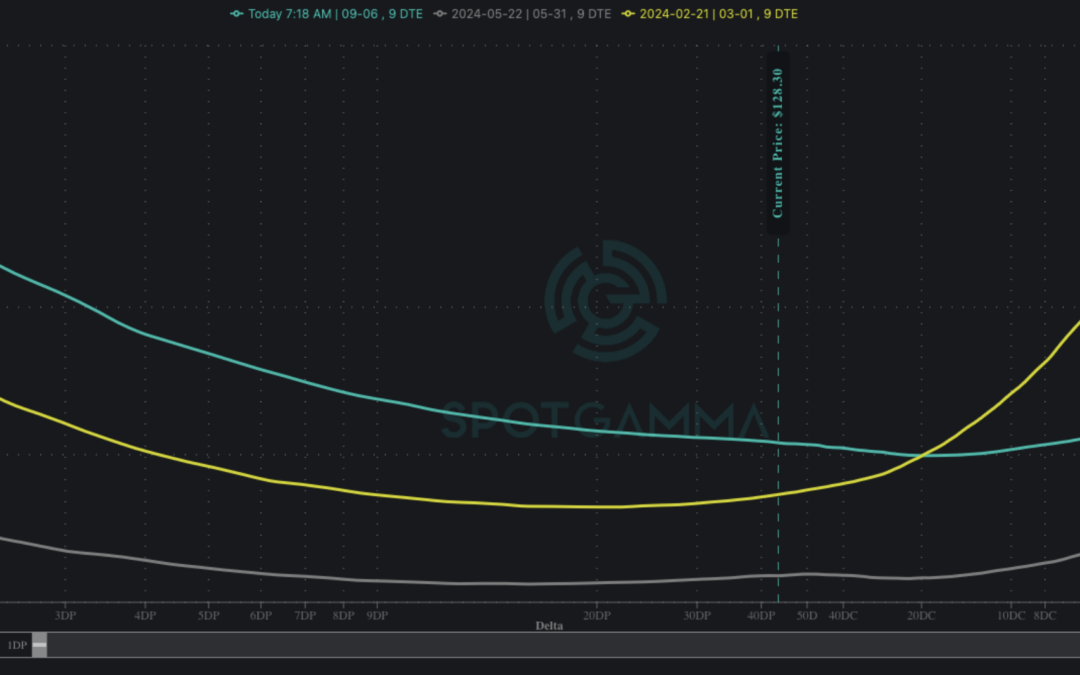

Macro Theme: Key dates ahead: 8/30 PCE 9/18 FOMC 9/20 OPEX Large short term SPX support at 5,550, which may limit downside into 9/3. There is a pocket of negative gamma >5,650, which implies quick upside into 5,700. Key SG levels for the SPX are: Support:...

Informe Option Levels

Macro Theme: Key dates ahead: 8/30 PCE 9/18 FOMC 9/20 OPEX Large short term SPX support at 5,550, which may limit downside into 9/3. There is a pocket of negative gamma >5,650, which implies quick upside into 5,700. Key SG levels for the SPX are: Support:...