Informe Option levels

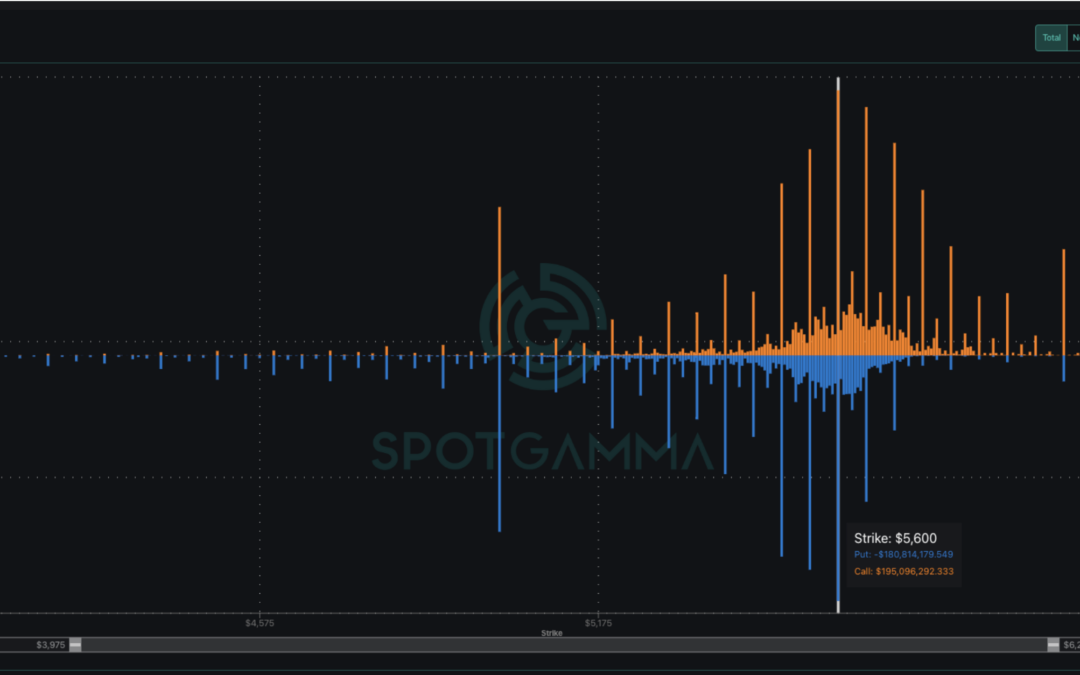

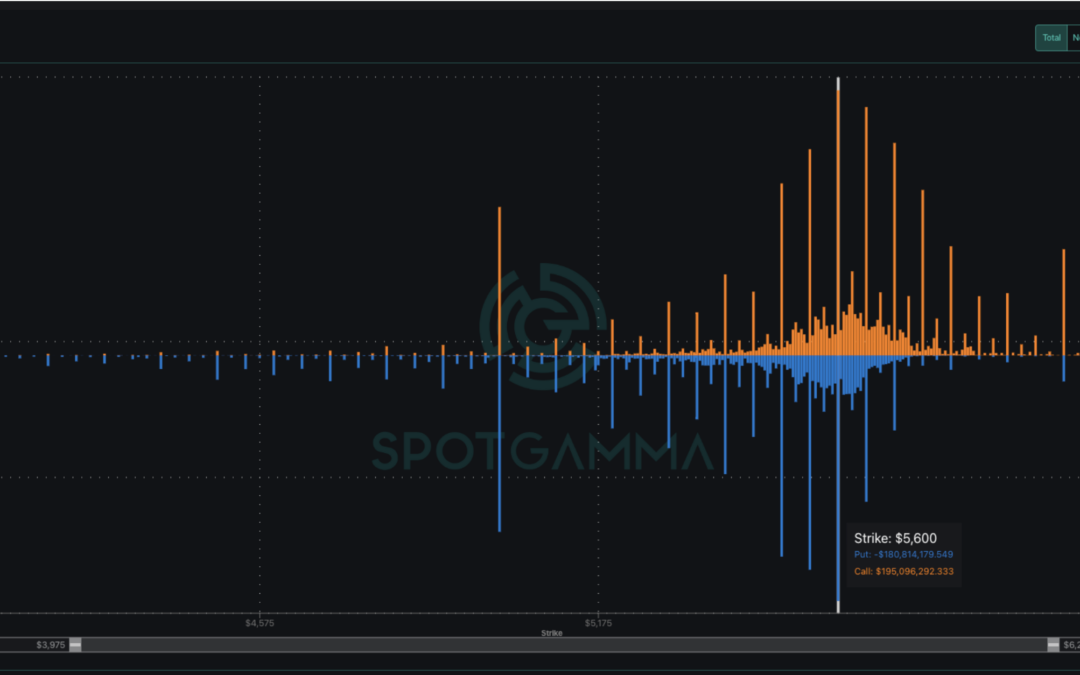

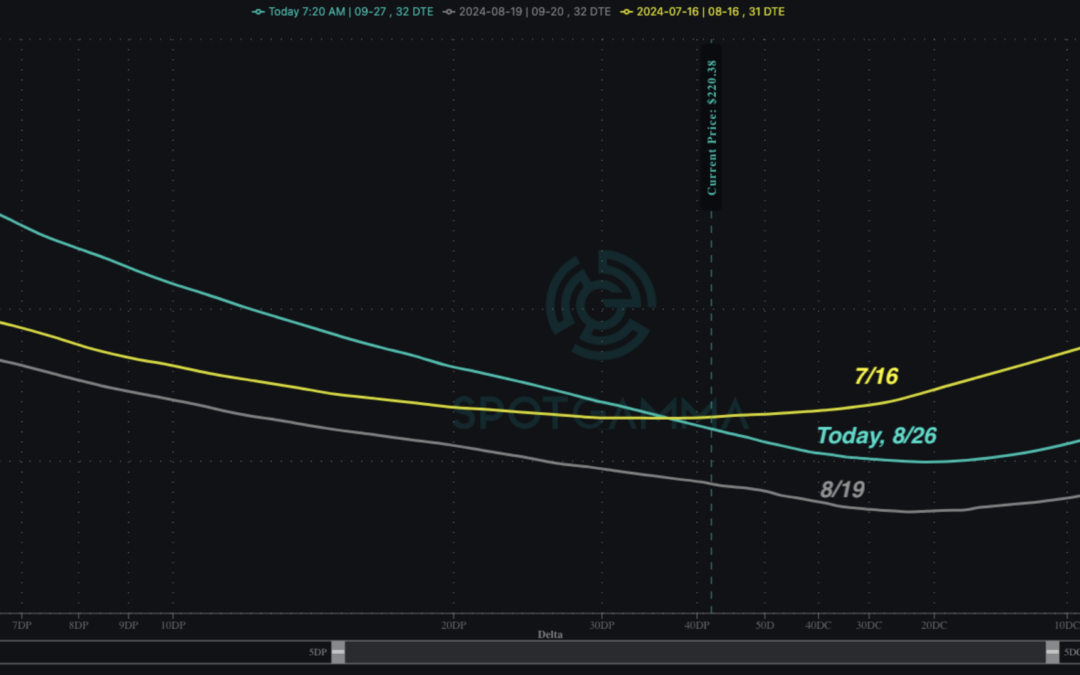

Macro Theme: Short Term SPX Resistance: 5,665 Short Term SPX Support: 5,600 SPX Risk Pivot Level: 5,600 Major SPX Range High/Resistance: 5,700 Major SPX Range Low/Support: 5,400 Key dates ahead: 8/28 NVDA earnings Upside scenario: 5,665 is major short term...

Informe Option Levels

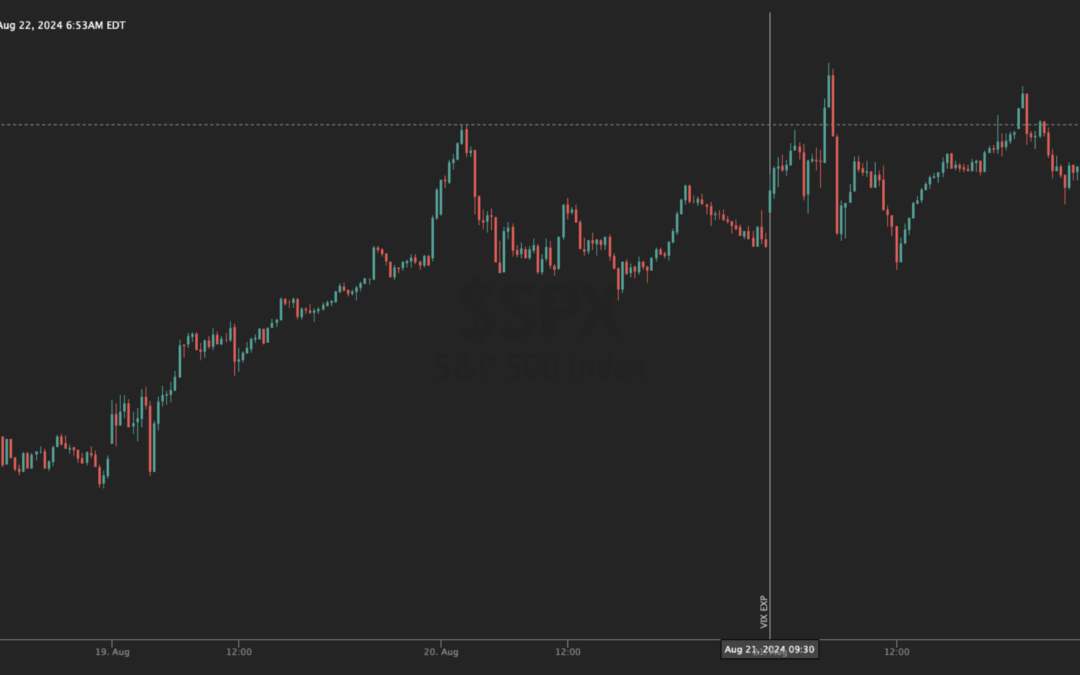

Macro Theme: Short Term SPX Resistance: 5,665 Short Term SPX Support: 5,550 SPX Risk Pivot Level: 5,600 Major SPX Range High/Resistance: 5,700 Major SPX Range Low/Support: 5,000 Key dates ahead: 8/23 Jackson Hole, 8/28 NVDA earnings Upside scenario: 5,665 is...

Informe Option Levels

Macro Theme: Short Term SPX Resistance: 5,665 Short Term SPX Support: 5,600 SPX Risk Pivot Level: 5,500 Major SPX Range High/Resistance: 5,700 Major SPX Range Low/Support: 5,000 Key dates ahead: 8/22-8/24 Jackson Hole, 8/28 NVDA earnings Upside scenario:...