by Responsyble | Jul 29, 2024 | Informe Option Levels

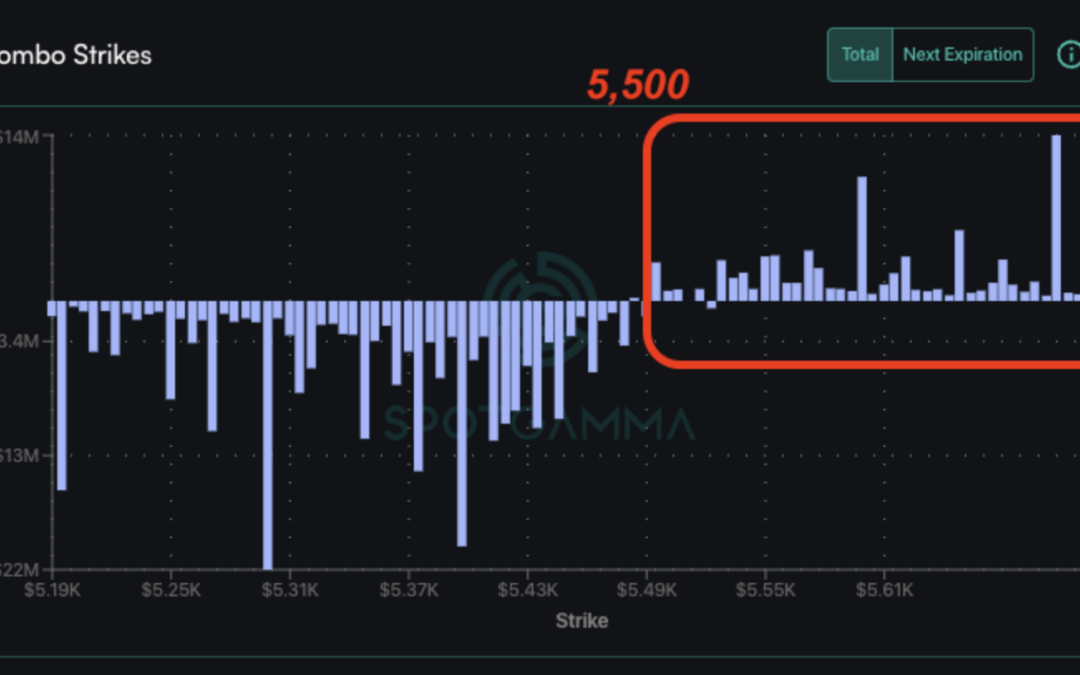

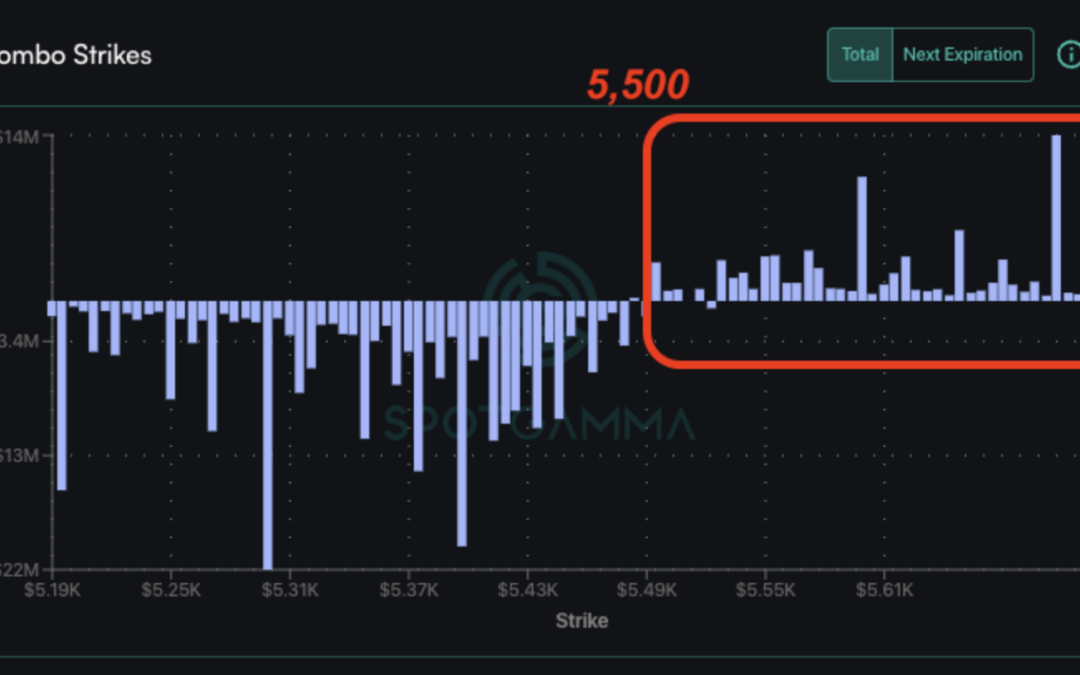

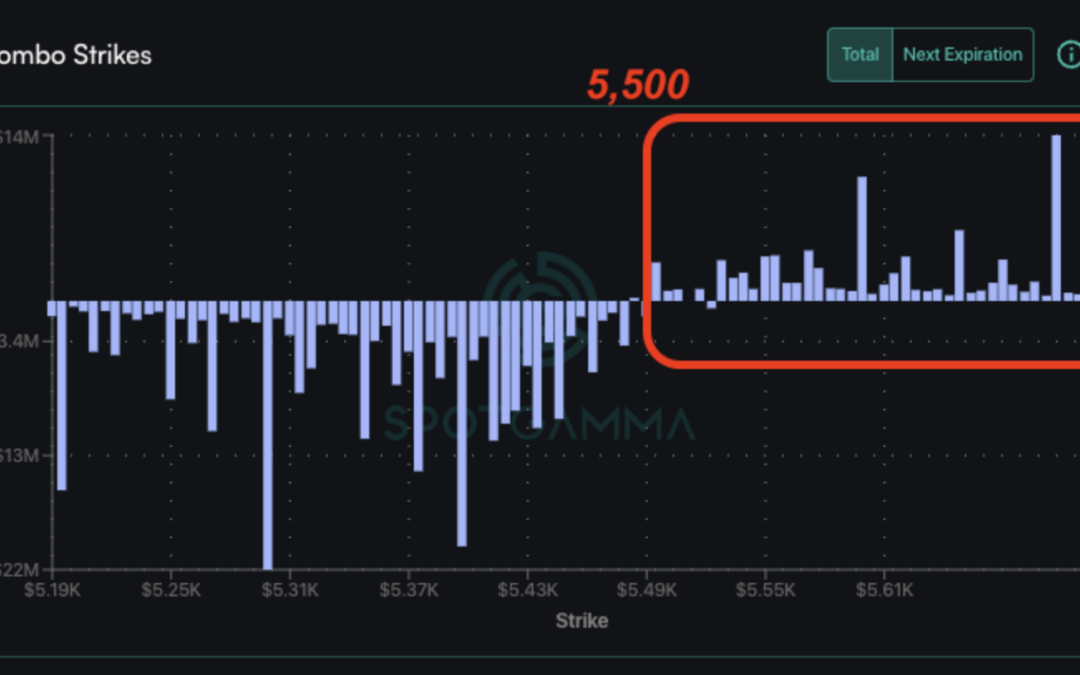

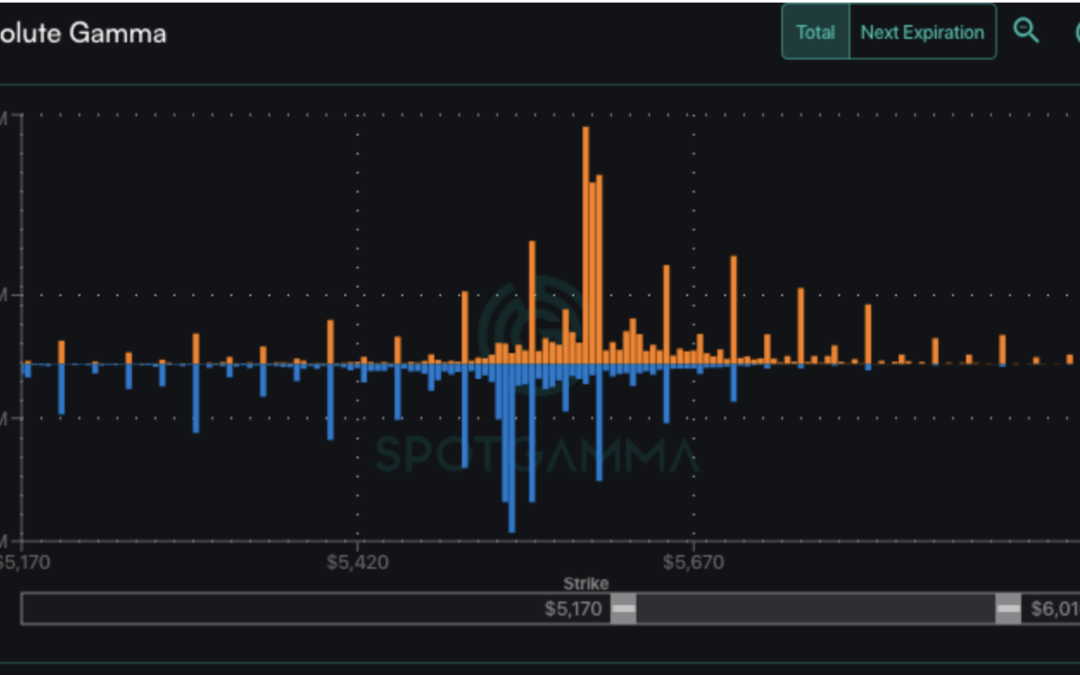

Macro Theme: Short Term SPX Resistance: 5,500 Short Term SPX Support: 5,400 SPX Risk Pivot Level: 5,515 Major SPX Range High/Resistance: 5,600 Major SPX Range Low/Support: 5,300 Next week (7/29) is critical both on the earnings front (MSFT, AAPL, AMZN, AMD,...

by Responsyble | Jul 26, 2024 | Informe Option Levels

Macro Theme: Short Term SPX Resistance: 5,500 Short Term SPX Support: 5,400 SPX Risk Pivot Level: 5,515 Major SPX Range High/Resistance: 5,600 Major SPX Range Low/Support: 5,300 Next week (7/29) is critical both on the earnings front (MSFT, AAPL, AMZN, AMD,...

by Responsyble | Jul 24, 2024 | Informe Option Levels

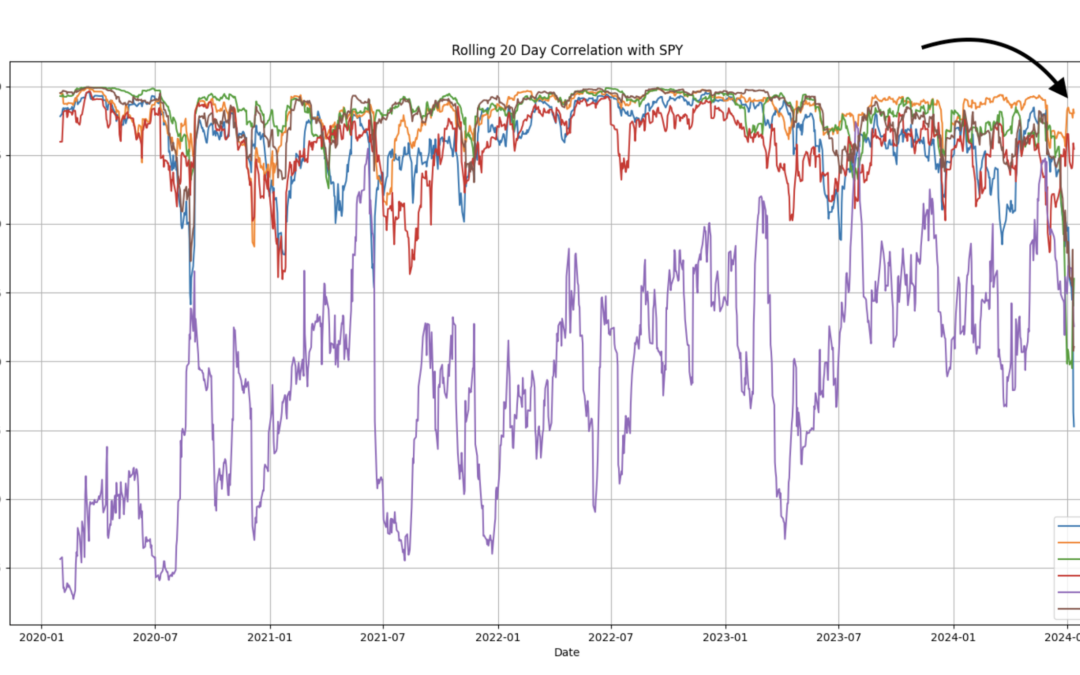

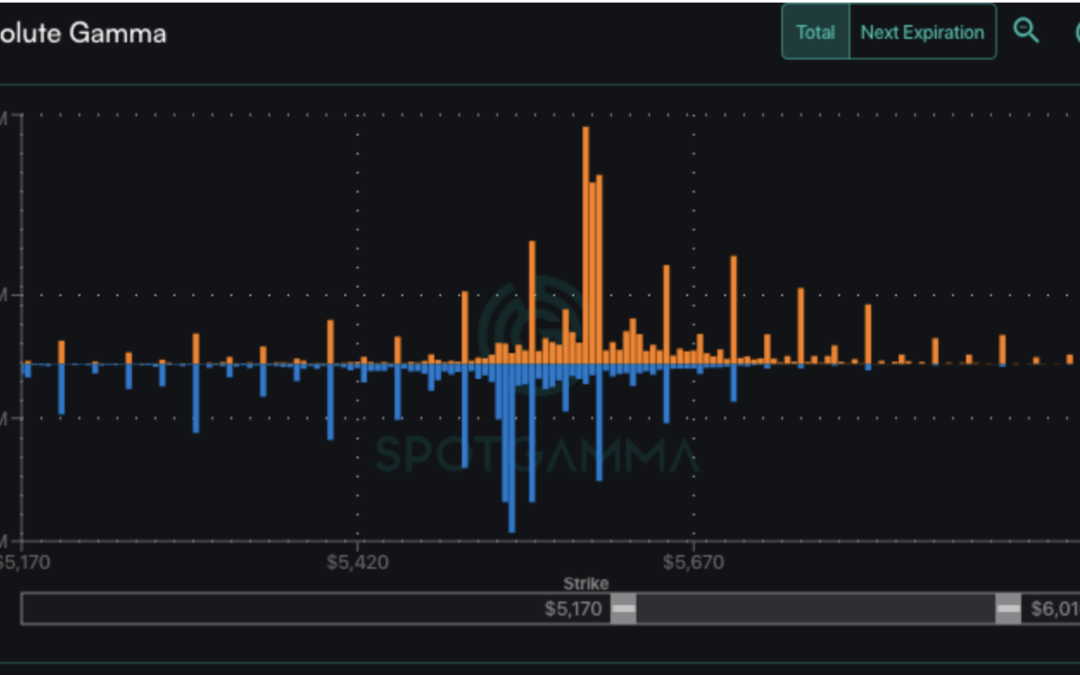

Macro Theme: Short Term SPX Resistance: 5,560 Short Term SPX Support: 5,500 SPX Risk Pivot Level: 5,620 Major SPX Range High/Resistance: 5,700 Major SPX Range Low/Support: 5,500 We are looking to 7/31 FOMC to trigger a directional move into August OPEX. Upside...

by Responsyble | Jul 23, 2024 | Informe Option Levels

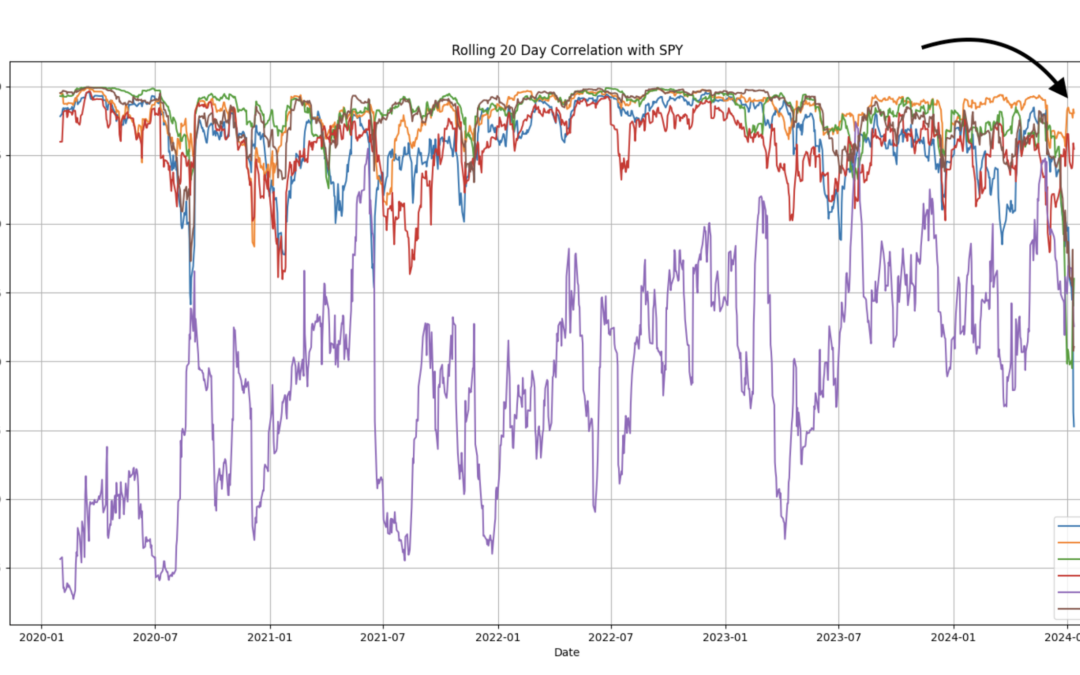

Macro Theme: Short Term SPX Resistance: 5,600 Short Term SPX Support: 5,500 SPX Risk Pivot Level: 5,620 Major SPX Range High/Resistance: 5,700 Major SPX Range Low/Support: 5,500 We look for a relief rally out of 7/19 OPEX, with a contraction in elevated...

by Responsyble | Jul 22, 2024 | Informe Option Levels

Macro Theme: Short Term SPX Resistance: 5,600 Short Term SPX Support: 5,500 SPX Risk Pivot Level: 5,620 Major SPX Range High/Resistance: 5,700 Major SPX Range Low/Support: 5,500 We look for a relief rally out of 7/19 OPEX, with a contraction in elevated...