Informe Option Levels

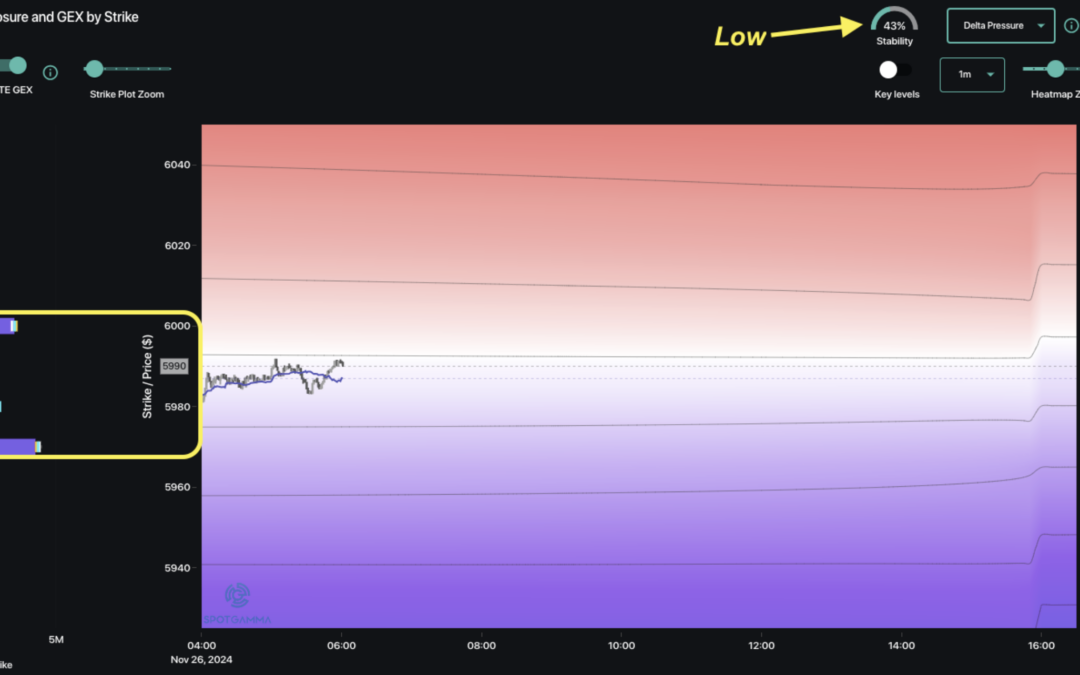

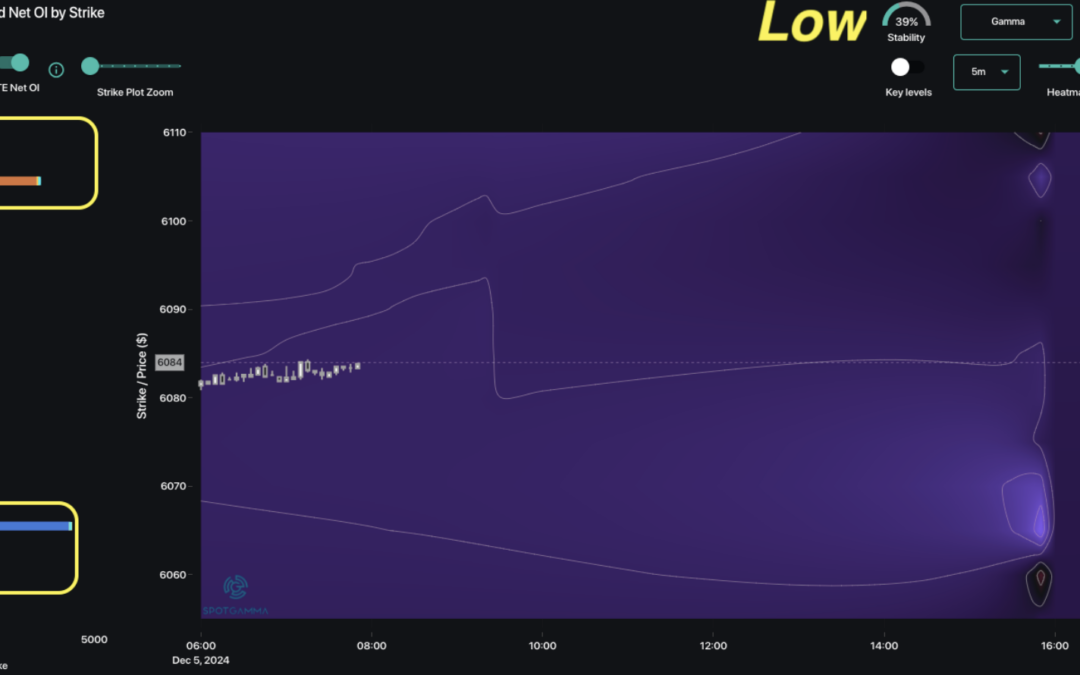

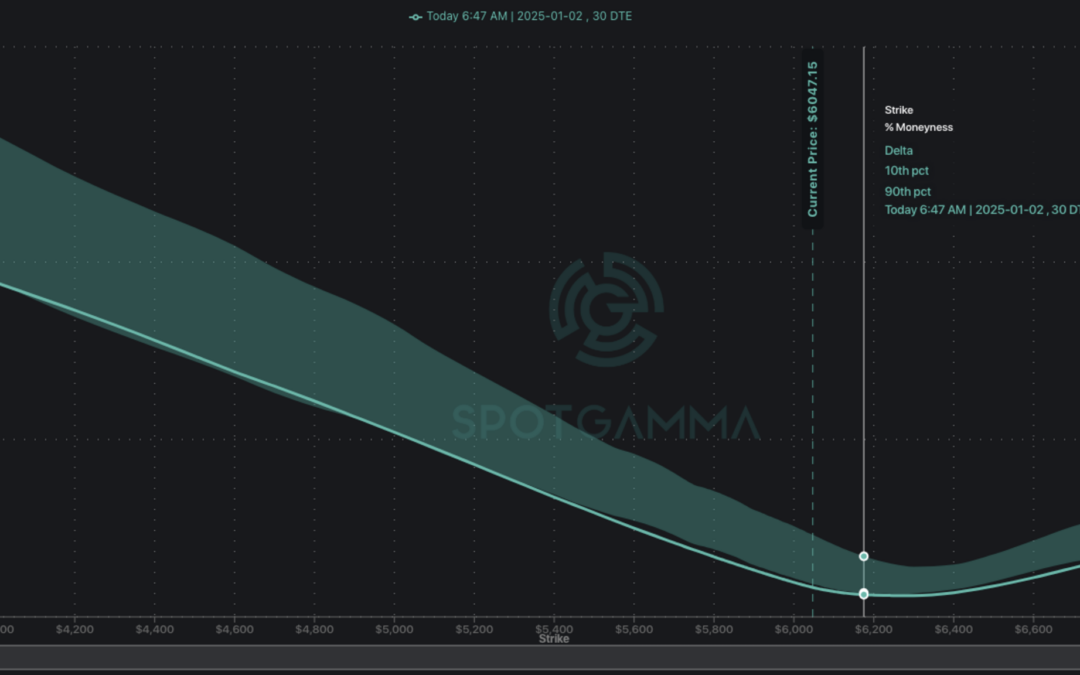

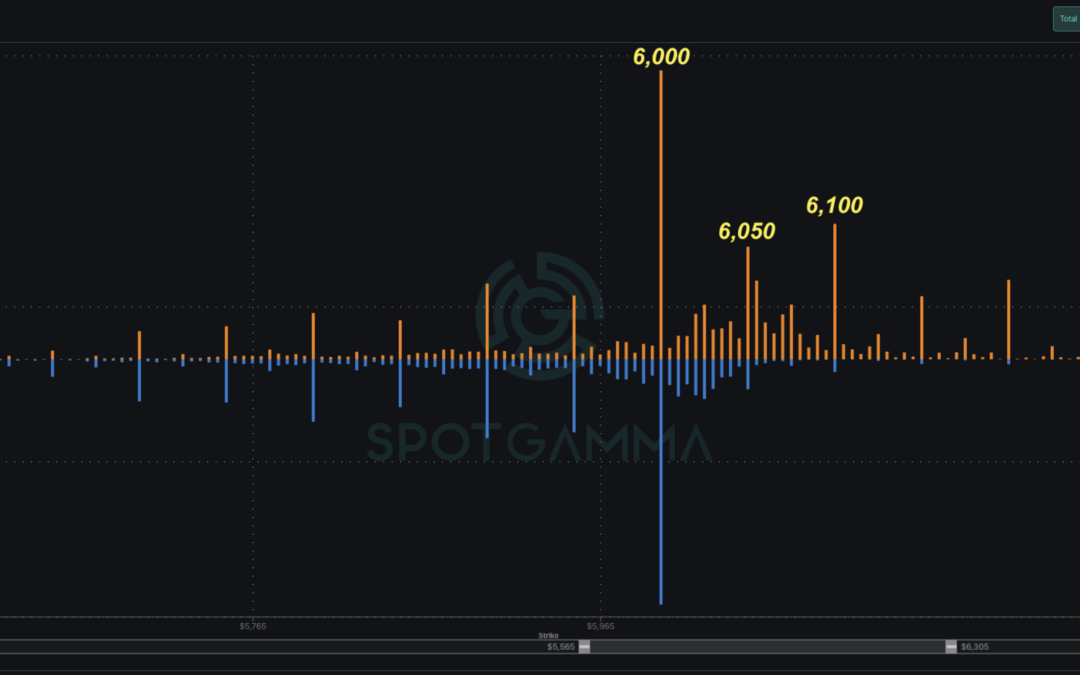

Macro Theme: Key dates ahead: 12/6 NFP 12/11 CPI Our primary risk metric signals being long of equities while SPX >6,000 with an upside target 6,100. <6,000 we flip to risk-off. Through to 12/20 OPEX we plan to operate in “buy the dip mode”...

Informe Option Levels

Macro Theme: Key dates ahead: 12/4 ISM Servives PMI, Powell 12/5 Jobless Claims 12/6 NFP 12/11 CPI Our primary risk signals signal long of equities while SPX >6,000 with an upside target of 6,050, then 6,100. We are neutral 5,900-6,000& <5,900 we flip...

Informe Option Levels

Macro Theme: Key dates ahead: 12/2 ISM Manufacturing PMI 12/4 ISM Servives PMI, Powell 12/5 Jobless Claims 12/6 NFP 12/11 CPI Our primary risk signals signal long of equities while SPX >6,000 with an upside target of 6,050. We are neutral 5,900-6,000&...