by Responsyble | Jun 12, 2024 | Informe Option Levels

Macro Theme: Short Term SPX Resistance: 5,410 Short Term SPX Support: 5,300 SPX Risk Pivot Level: 5,300 Major SPX Range High/Resistance: 5,410 Major SPX Range Low/Support: 5,000 NVDA 10-1 split Friday night has the potential for relative top the week of 6/10...

by Responsyble | Jun 11, 2024 | Informe Option Levels

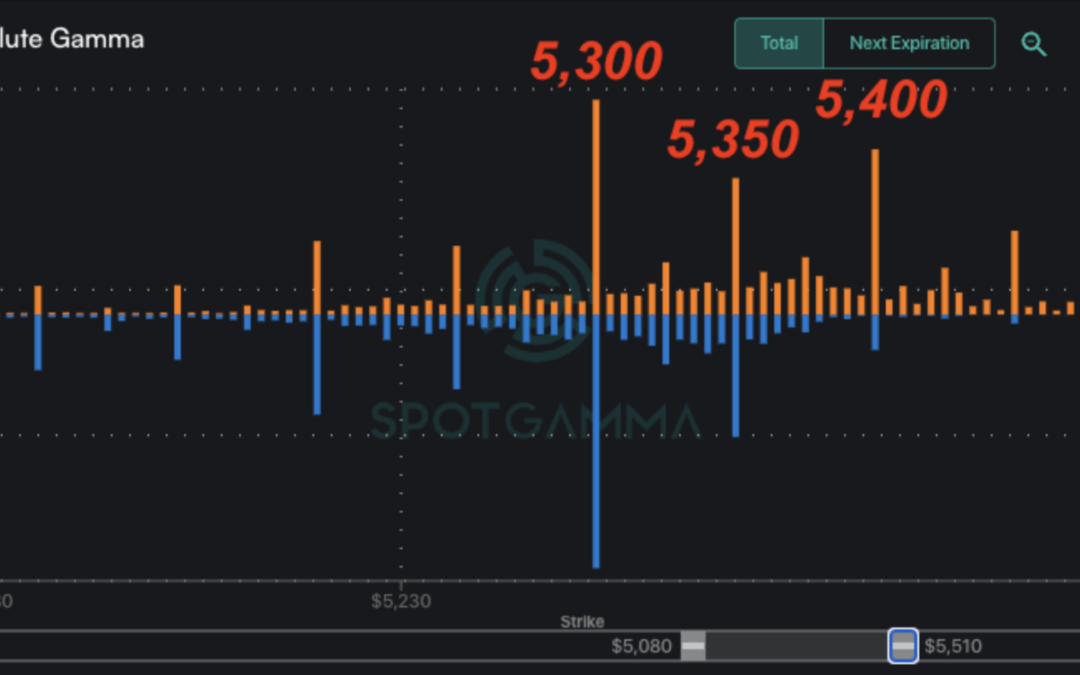

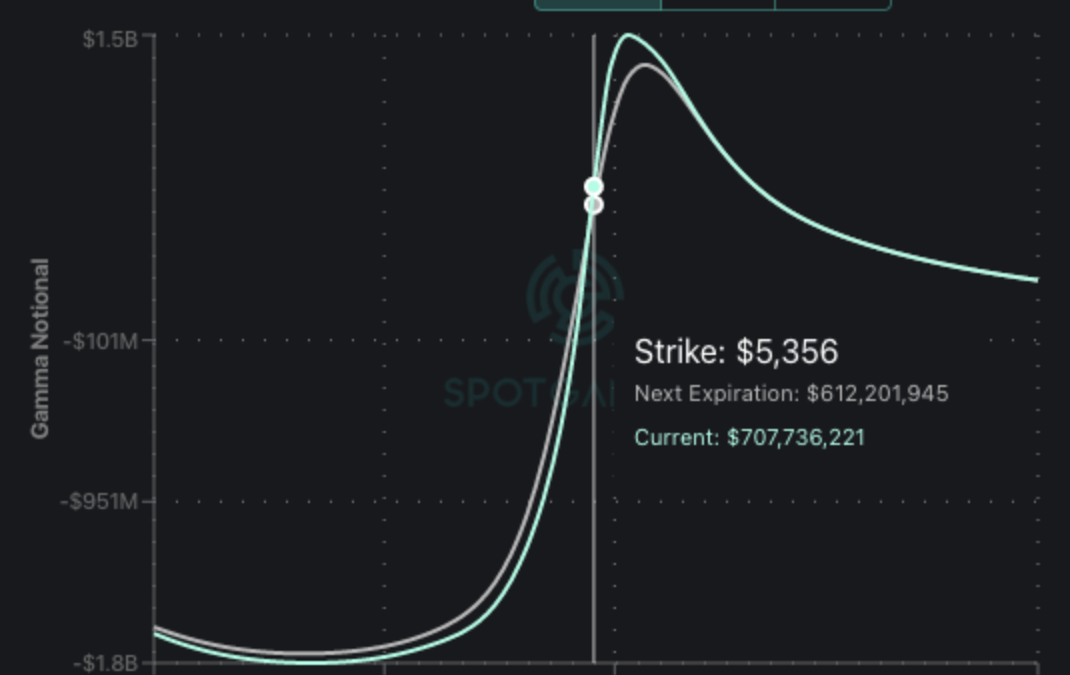

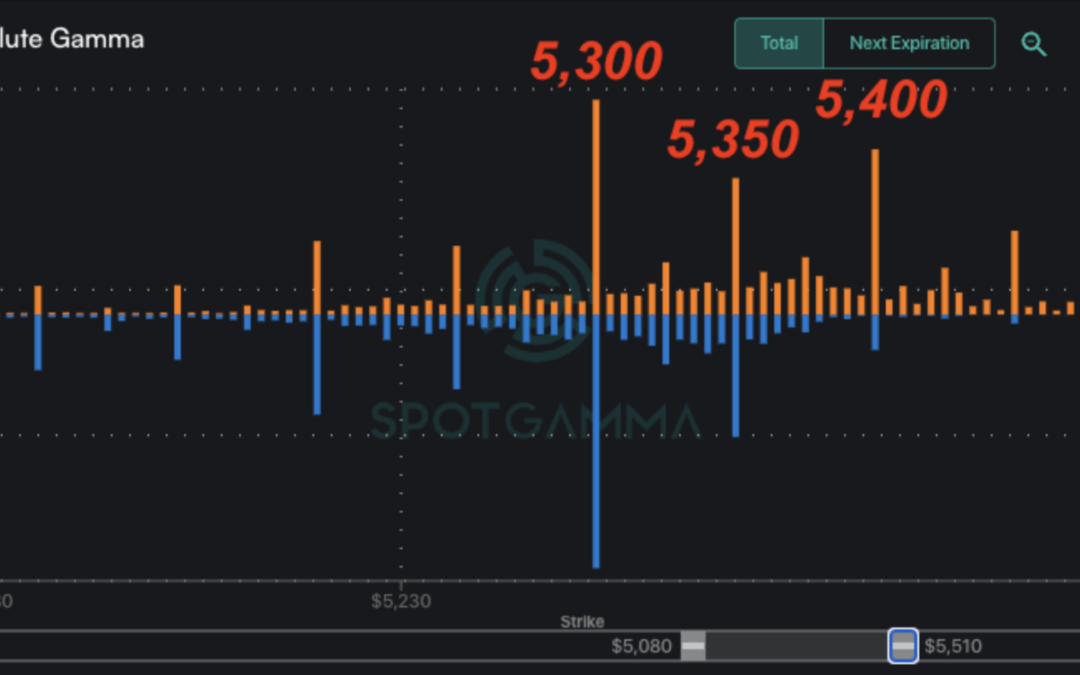

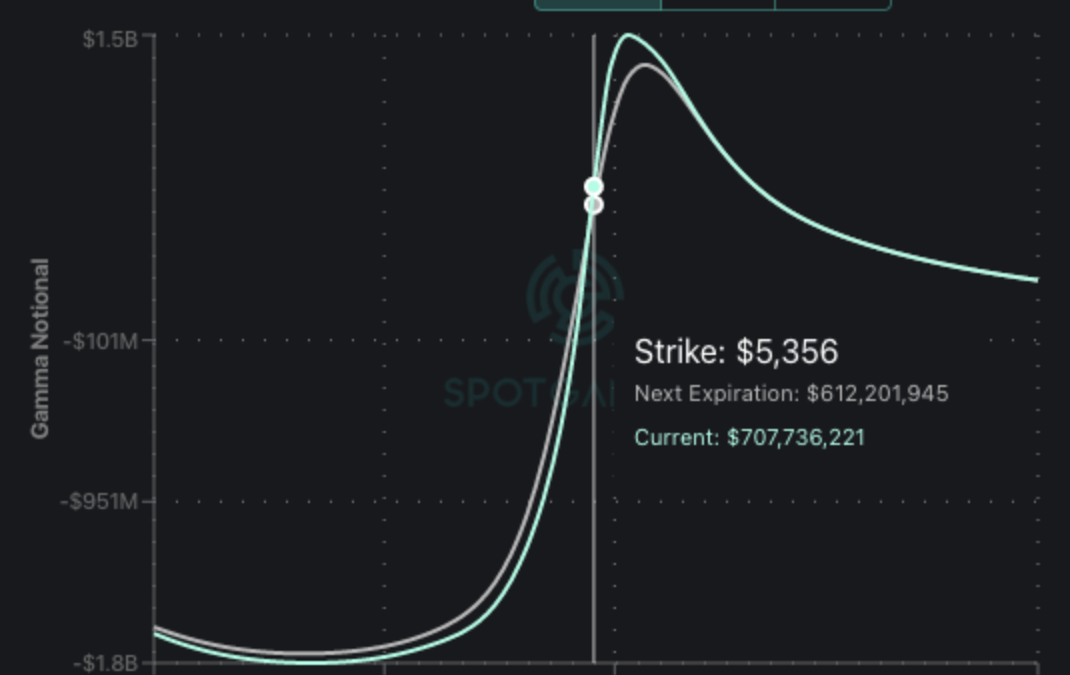

Macro Theme: Short Term SPX Resistance: 5,400 Short Term SPX Support: 5,300 SPX Risk Pivot Level: 5,312 Major SPX Range High/Resistance: 5,312 Major SPX Range Low/Support: 5,000 NVDA 10-1 split Friday night has the potential for a blow-off top into early next...

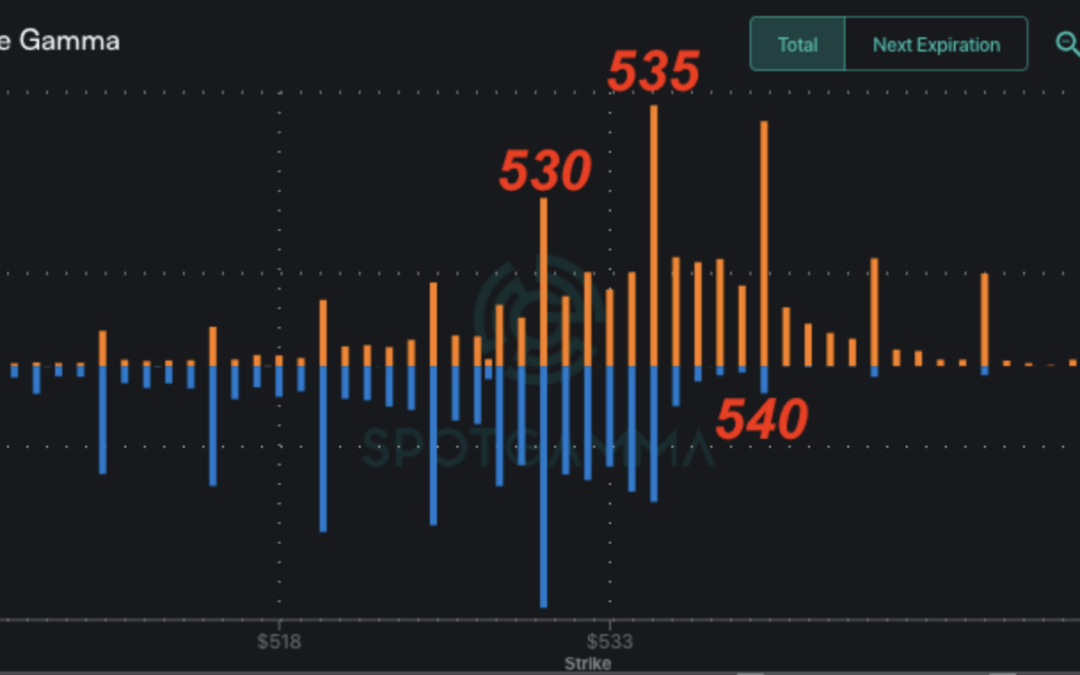

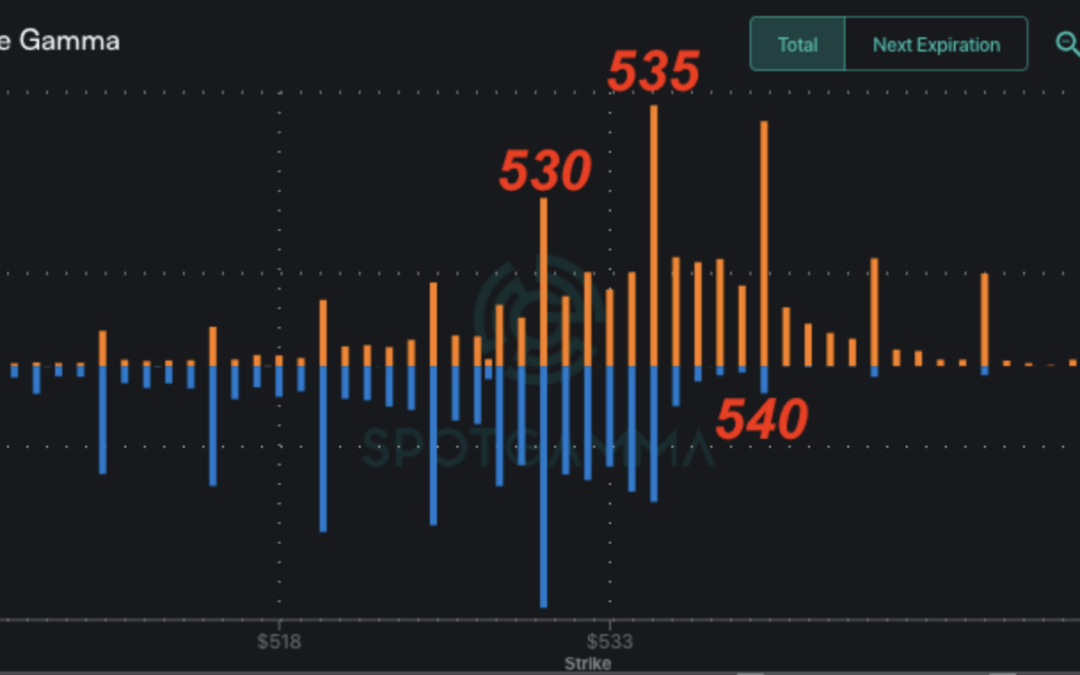

by Responsyble | Jun 10, 2024 | Informe Option Levels

Macro Theme: Short Term SPX Resistance: 5,400 Short Term SPX Support: 5,300 SPX Risk Pivot Level: 5,312 Major SPX Range High/Resistance: 5,312 Major SPX Range Low/Support: 5,000 NVDA 10-1 split Friday night has the potential for a blow-off top into early next...

by Responsyble | Jun 7, 2024 | Informe Option Levels

Macro Theme: Short Term SPX Resistance: 5,400 Short Term SPX Support: 5,300 SPX Risk Pivot Level: 5,312 Major SPX Range High/Resistance: 5,312 Major SPX Range Low/Support: 5,000 NVDA 10-1 split Friday night has the potential for a blow-off top into early next...

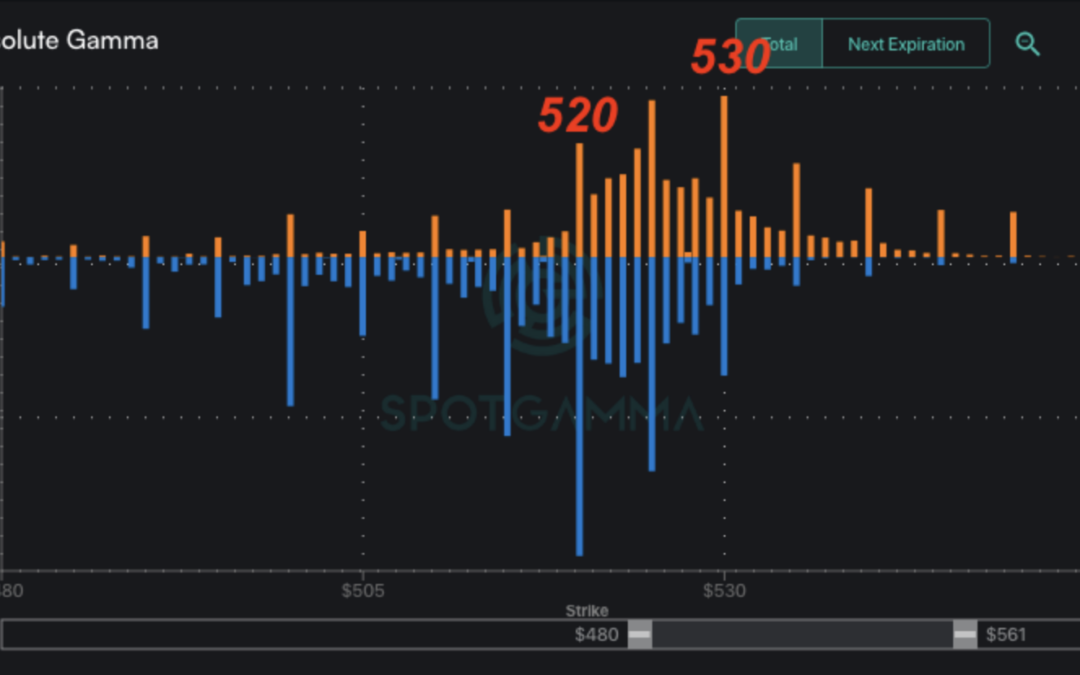

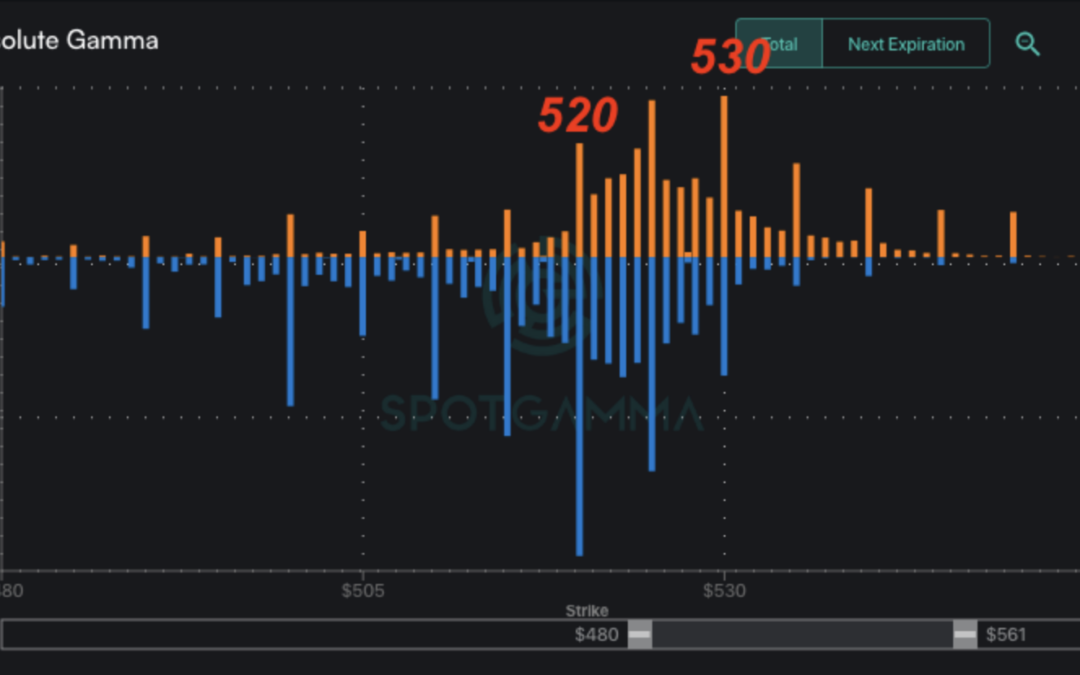

by Responsyble | Jun 3, 2024 | Informe Option Levels

Macro Theme: Short Term SPX Resistance: 5,311 Short Term SPX Support: 5,250 SPX Risk Pivot Level: 5,311 Major SPX Range High/Resistance: 5,311 Major SPX Range Low/Support: 5,000 Starting on 5/31 Core PCE traders are likely to focus on rate narratives into early...