Informe Option Levels

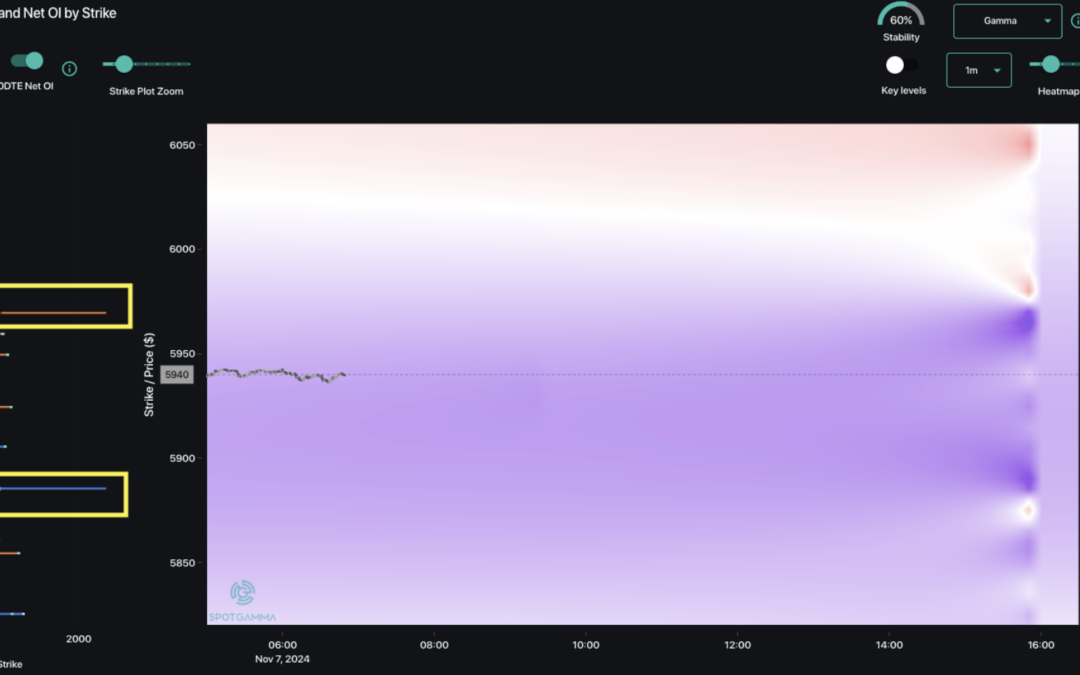

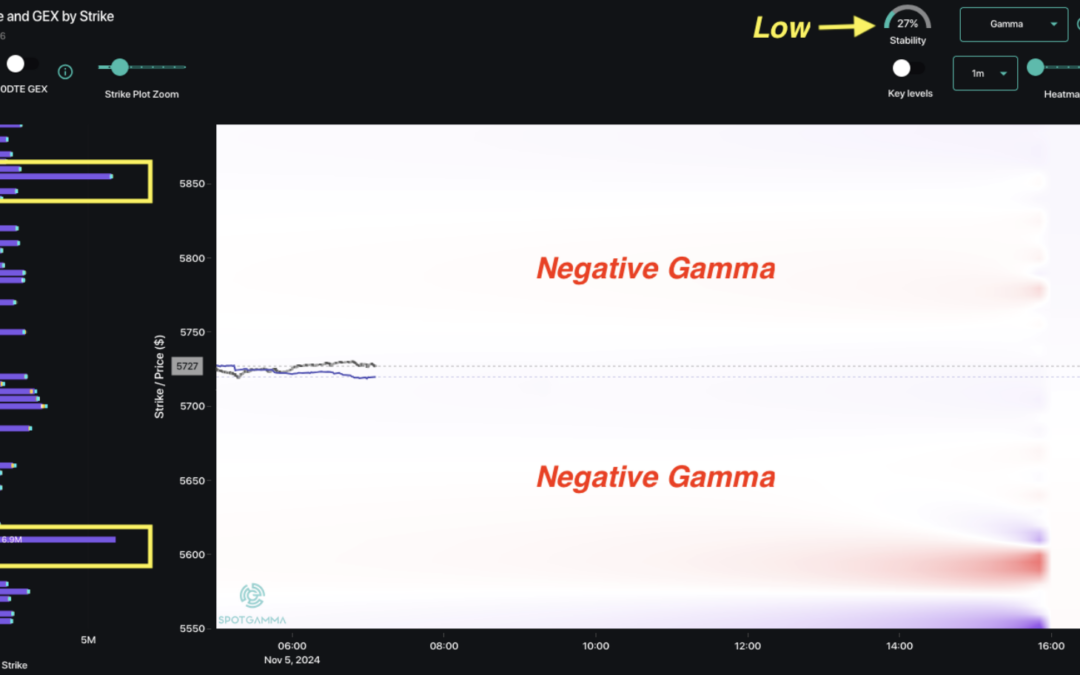

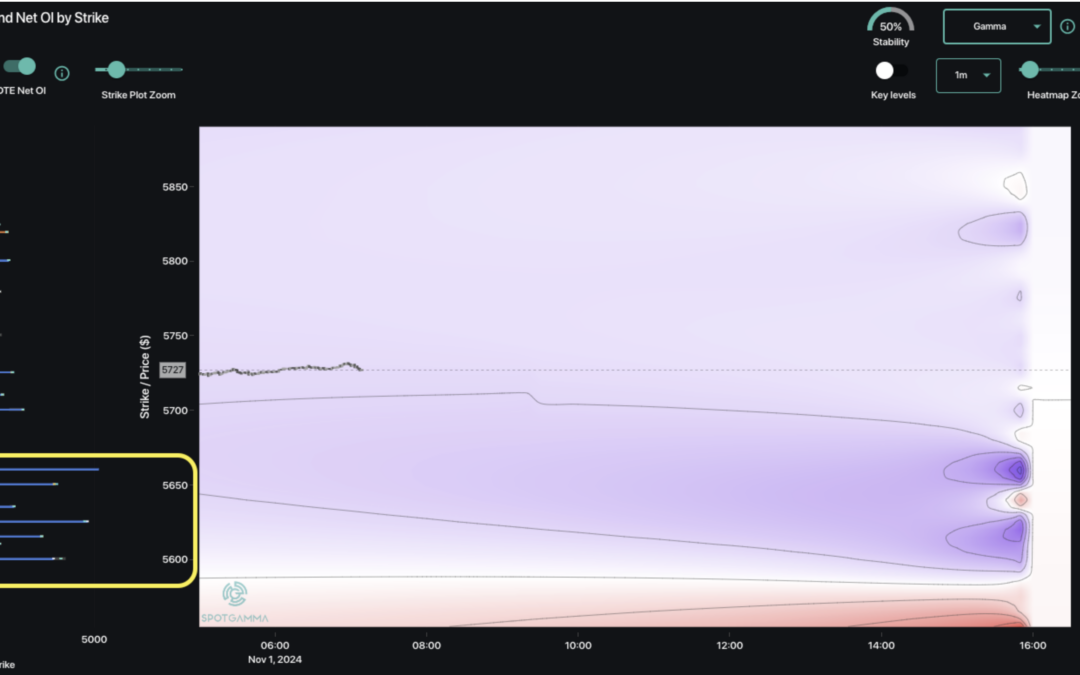

Macro Theme: Key dates ahead: 11/5 – 11/6 Election 11/7 FOMC We are currently neutral of equities until/unless SPX recovers >=5,800, and short of equities if SPX <5,700. 5,850 is pre-election resistance. Jan NVDA and/or QQQ calls are our preferred...

Informe Option Levels

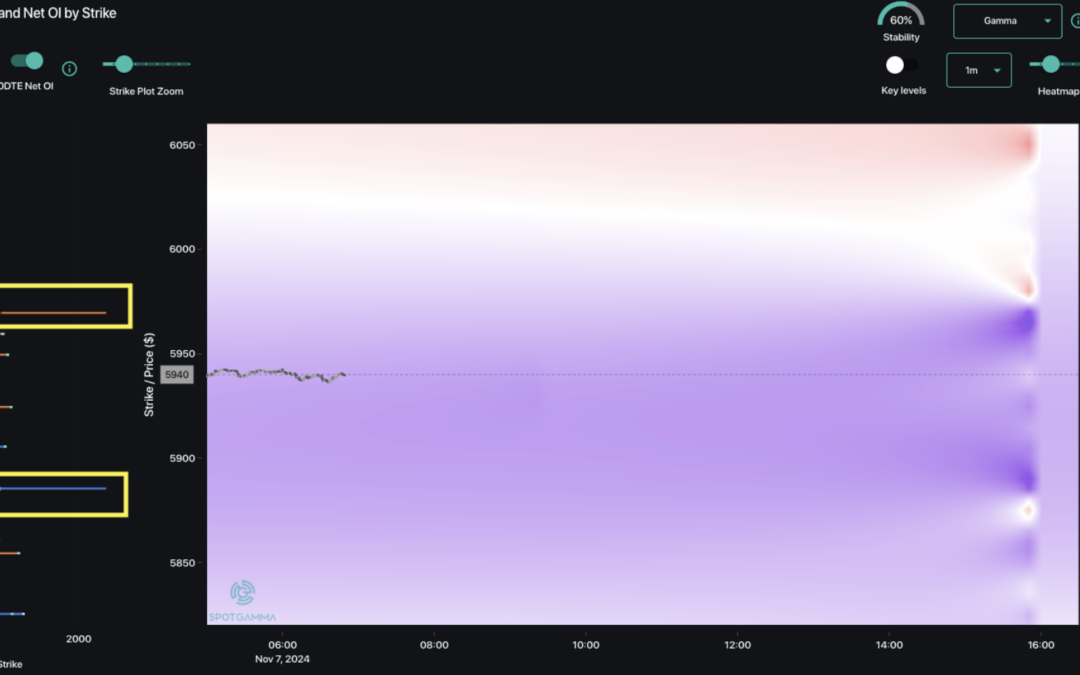

Macro Theme: Key dates ahead: 11/5 – 11/6 Election 11/7 FOMC We are currently neutral of equities until/unless SPX recovers >=5,800 5,850 is pre-election resistance. Jan NVDA and/or QQQ calls are our preferred way to hedge the election/FOMC right tail,...

Informe Option Levels

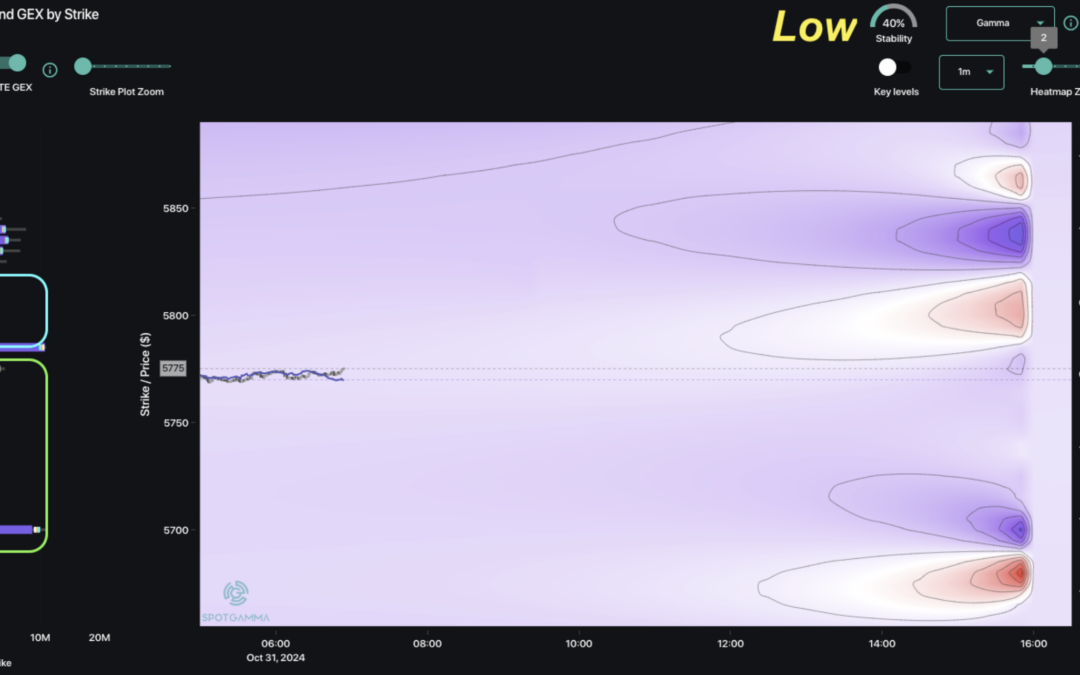

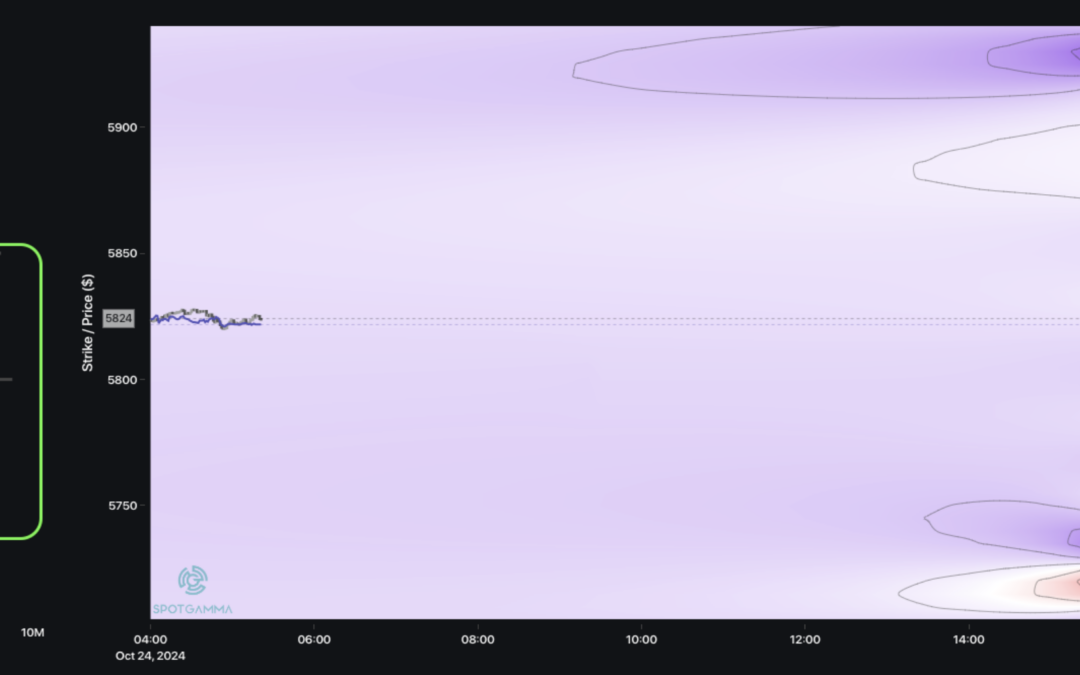

Macro Theme: Key dates ahead: 10/31 CORE PCE 11/1 PMI 11/6 Election 11/7 FOMC We remain long of equities while SPX >5,800, and neutral <5,800. Currently we do note see a material negative gamma SPX position until <5,700, suggesting a lack of strong...