Informe Option Levels

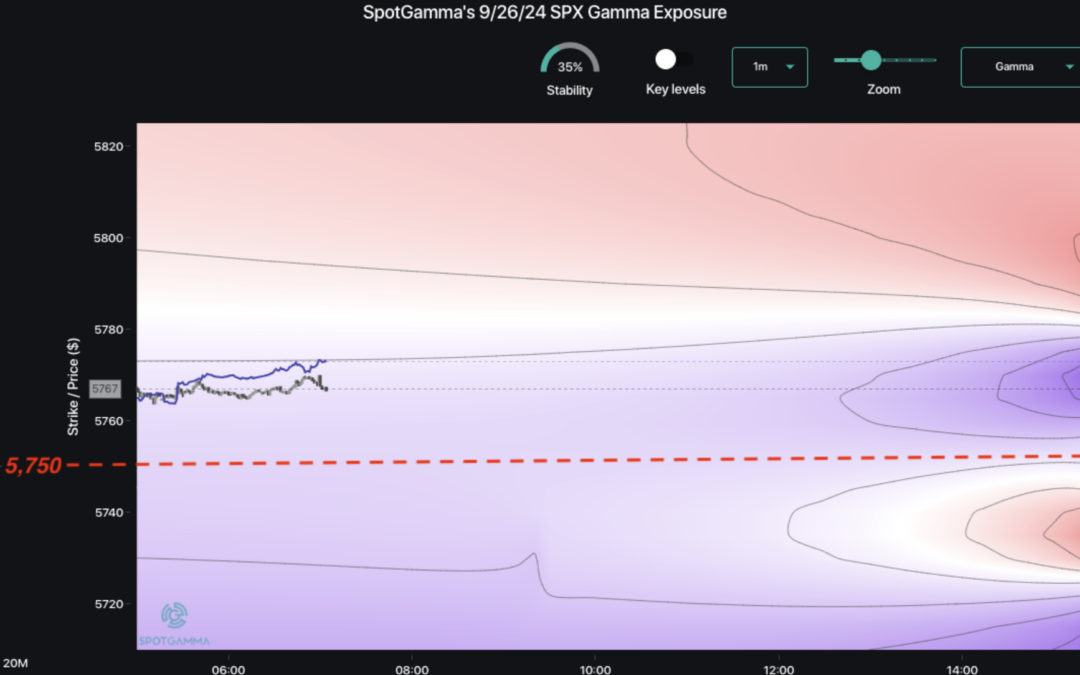

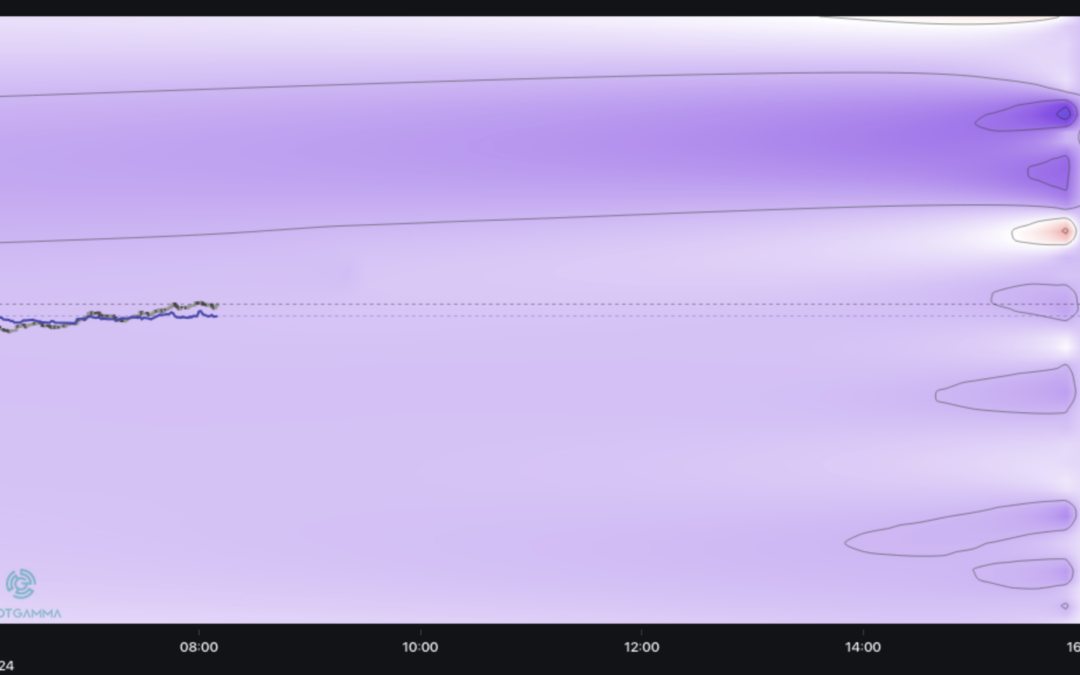

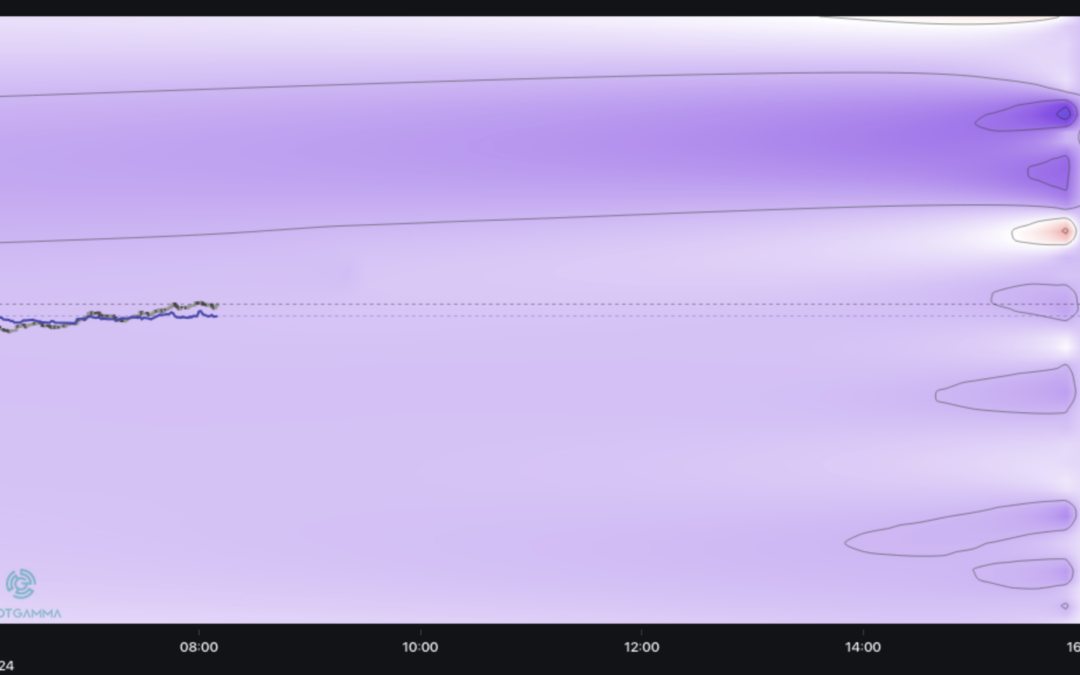

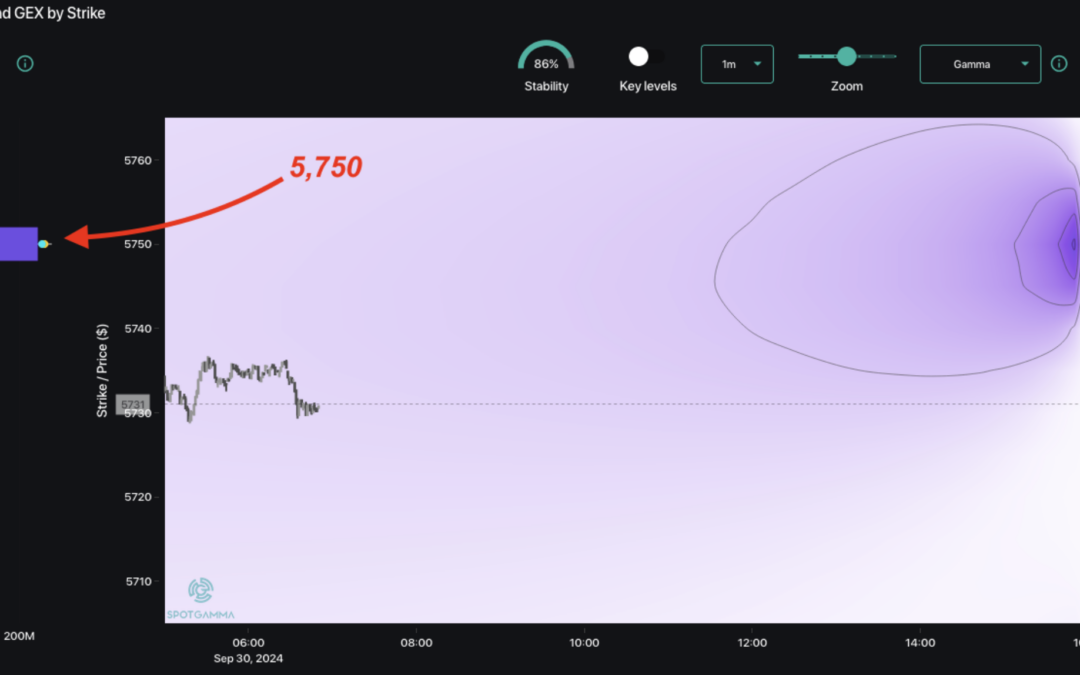

Macro Theme: Key dates ahead: 9/30 Quarter End OPEX Key SG levels for the SPX are: Support: 5,700 Resistance: 5,750, 5,800 As of 9/30/24: We remain long >5,700 We position flat equities <5,700 Risk-off on a break <5,650 QQQ: Support: 487, 485, 480...

Informe Option Levels

Macro Theme: Key dates ahead: 9/30 Quarter End OPEX Key SG levels for the SPX are: Support: 5,700 Resistance: 5,750, 5,800 As of 9/30/24: We remain long >5,700 We position flat equities <5,700 Risk-off on a break <5,650 QQQ: Support: 487, 485,...

Informe Option Levels

Macro Theme: Key dates ahead: 9/27 Core PCE 8:30AM 9/30 Quarter End OPEX TLDR: We continue to maintain long positions >5,700, and would flip to neutral if the SPX goes <5,700. We expect more chop today, with eyes remaining on time & price: 5,750 &...