Informe Option Levels

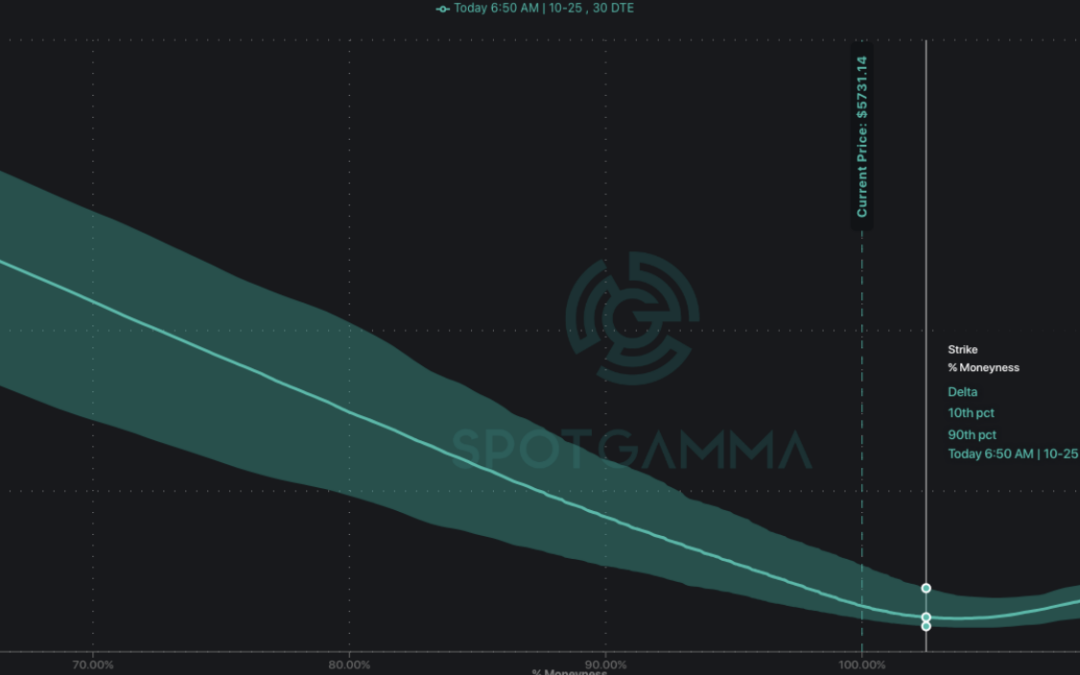

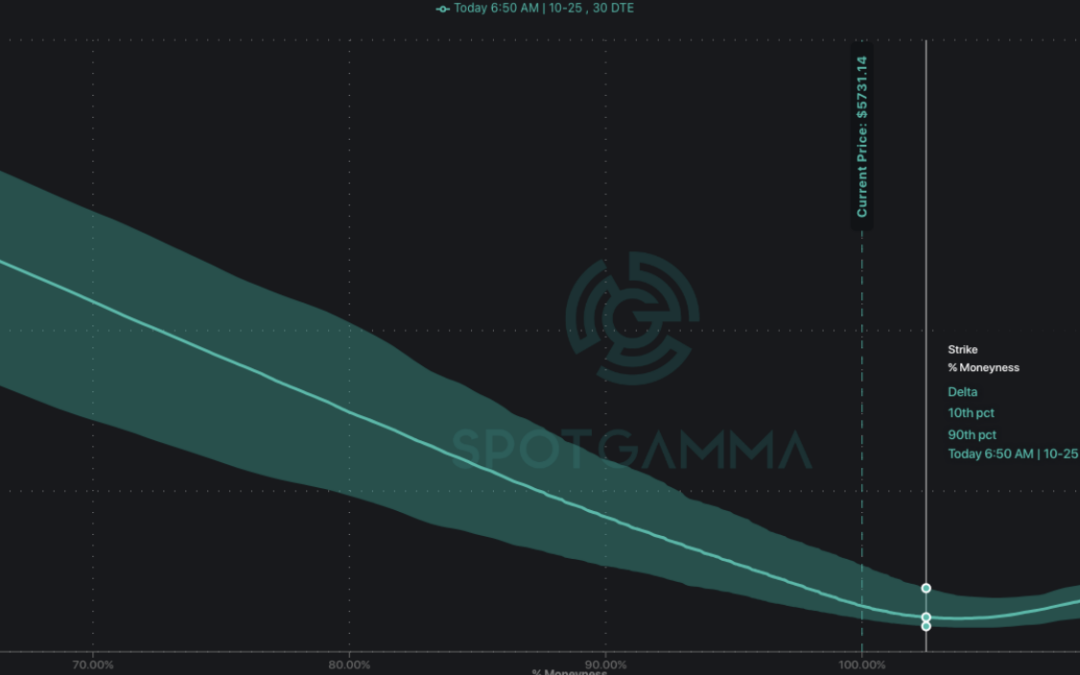

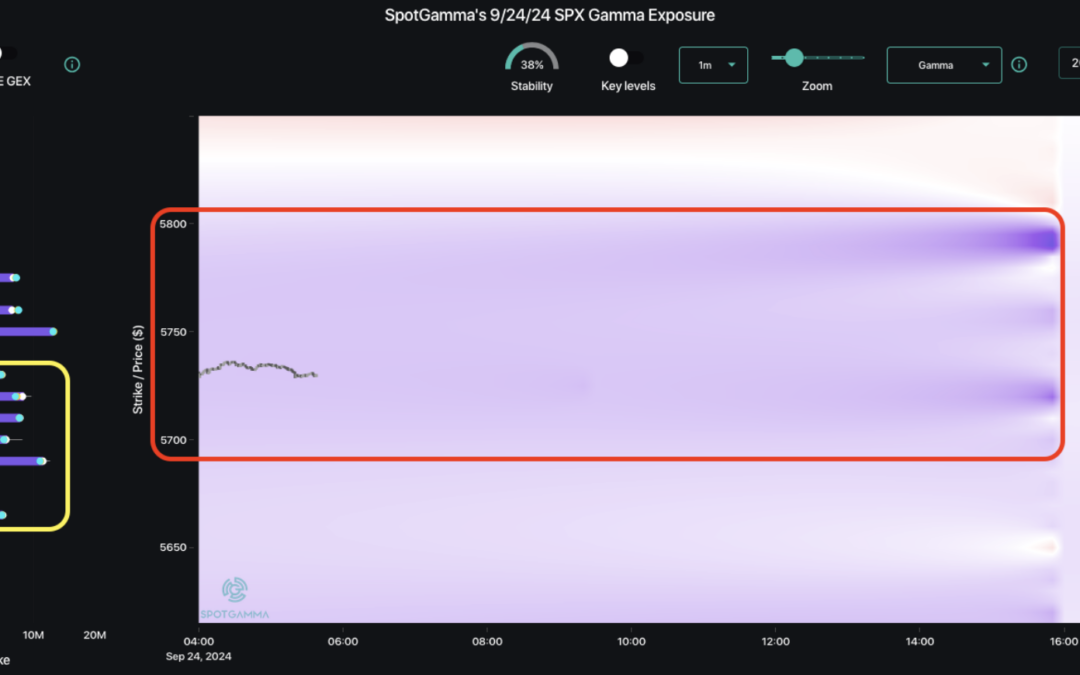

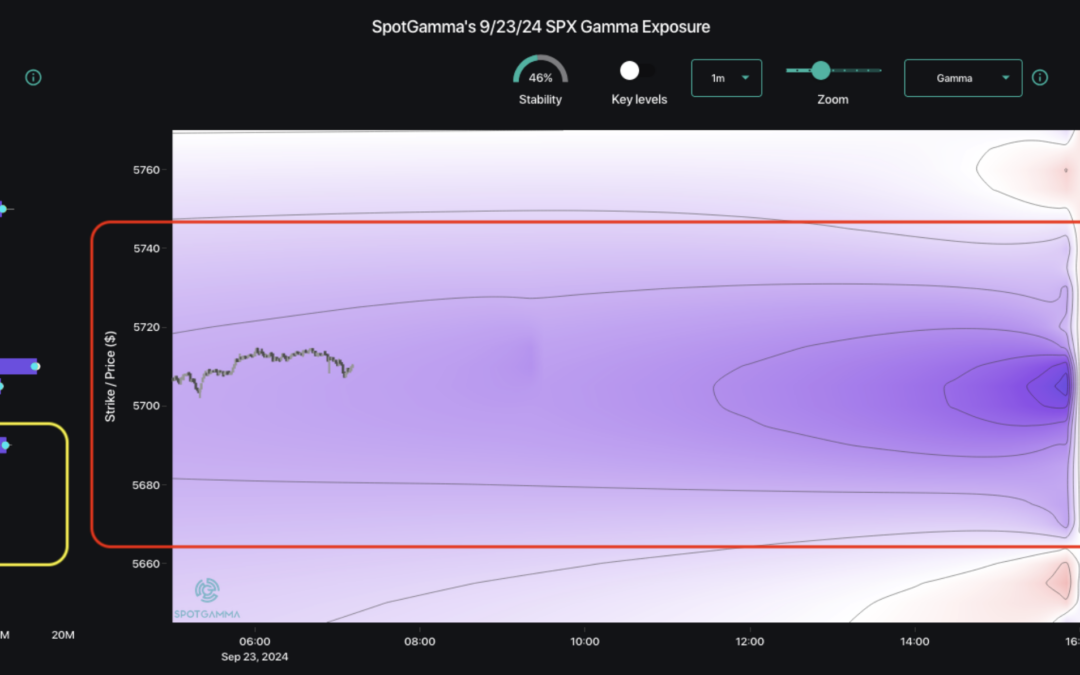

Macro Theme: Key dates ahead: 9/26 GDP & Powell Speaking 9/30 Quarter End OPEX We’re looking for OPEX-related price consolidation as call-heavy positions adjust, which could extend into Monday. <5,700 we flip from net long to neutral. <5,650 we...

Informe Option Levels

Macro Theme: Key dates ahead: 9/26 GDP 9/30 Quarter End OPEX We’re looking for OPEX-related price consolidation as call-heavy positions adjust, which could extend into Monday. <5,700 we flip from net long to neutral. <5,650 we flip from neutral to...

Informe Option Levels

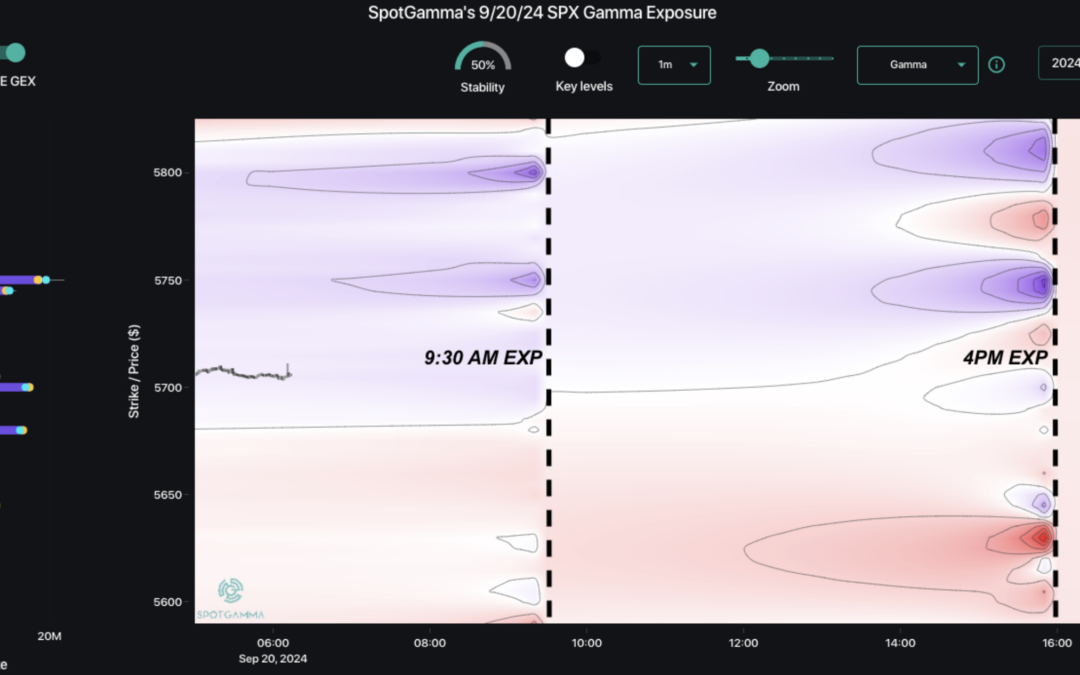

Macro Theme: Key dates ahead: 9/20 Huge Quarterly OPEX Following FOMC, we see equities in a negative gamma stance, which implies upside volatility may remain. SPX 5,750 & IWM 230 are the major upside levels into 9/20 OPEX. Into Friday/Monday OPEX may...