Futures are near last nights close, but did test 3225 earlier overnight. As mentioned last night we think the default move here is lower based on the negative gamma position and likely addition of election hedges. The selling here (despite whatever the prevailing narrative is) is very mechanical and appears to correspond with what our models suggested. This flow can of course be counteracted by call buying and additional short volatility plays, but we’d note the reaction to big tech earnings suggests bulls are holding back.

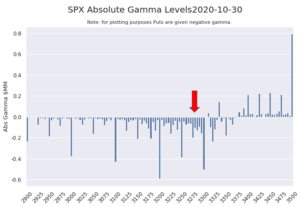

If you review the positional gamma chart you can see we are embedded in negative gamma strikes, which infers high volatility. Remember that “volatility” is bidirectional, but its tilted to the downside here by tech selling and or the addition of new puts. New puts invite delta hedging (short futures) which is compounded by the negative gamma hedging (more short futures).

For today we again we recommend watching the VIX as its trend likely signals the action in the SPX. 3300 is overhead resistance with 3200 support.

Macro Note:3500 resistance, 3400 Zero Gamma line into 11/3 expiration

| SIGNAL NAME | LATEST DATA | PREVIOUS | SPY | NDX | QQQ | ||

|---|---|---|---|---|---|---|---|

| Ref Price: | 3230 | 3303 | 324 | 11047 | 276 | ||

| VIX Ref: | 37.59 | 37.59 | |||||

| SG Gamma Index™: | -0.35 | -0.47 | -0.07 | 0.00 | -0.05 | ||

| Gamma Notional(MM): | $-594.00 | $-282.00 | $-1,097.00 | $-2.00 | $-434.00 | ||

| SGI Imp. 1 Day Move: | 1.89%, | 61.0 pts | Range: 3169.0 | 3291.0 | ||||

| SGI Imp. 5 Day Move: | 3429 | 2.24% | Range: 3352.0 | 3506.0 | ||||

| Zero Gamma Level(ES Px): | 3346 | 3346 | — | 0 | |||

| Vol Trigger™(ES Px): | 3370 | 3375 | 335 | 11450 | 280 | ||

| SG Abs. Gamma Strike: | 3300 | 3300 | 330 | 10900 | 280 | ||

| Put Wall Support: | 3200 | 3200 | 320 | 9500 | 272 | ||

| Call Wall Strike: | 3500 | 3500 | 350 | 12000 | 300 | ||

| CP Gam Tilt: | 0.84 | 0.79 | 0.63 | 0.81 | 0.62 | ||

| Delta Neutral Px: | 3287 | ||||||

| Net Delta(MM): | $10,933.00 | $11,578.00 | $1,849.00 | $338.00 | $664.00 | ||

| 25D Risk Reversal | -0.12 | -0.12 | -0.12 | -0.1 | -0.1 | ||

| Top Absolute Gamma Strikes: SPX: [3500, 3400, 3350, 3300] SPY: [340, 335, 330, 320] QQQ: [282, 280, 277, 275] NDX:[12000, 11200, 11000, 10900] SPX Combo: [3208.0] NDX Combo: [] The Volatility Trigger has moved DOWN: 3370 from: 3375 SPX is below the Volatility Trigger™. The 3346.0 level is first level of resistance and is critical as its the negative gamma threshold. The trigger level of: 3370 will act as overhead resistance. Watching VIX is key, if volatility comes in dealers will start to buy back shares as their short puts lose value. This could start a rally. The total gamma has moved DOWN: $-594.23MM from: $-283.00MM Gamma is tilted towards Puts, may indicate puts are expensive Negative gamma is moderate favoring further swings in the market |

0 comentarios