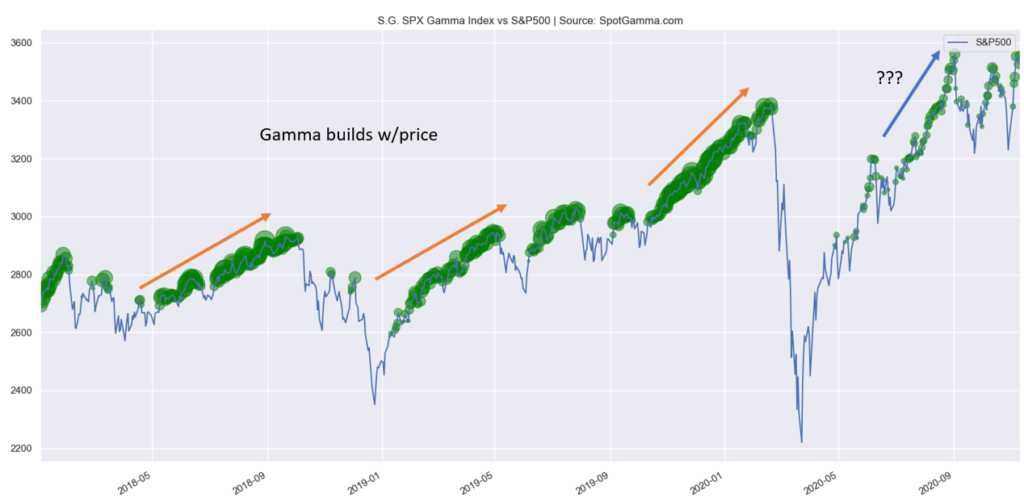

Little change in both futures and SG levels overnight. This is an interesting point in markets because as SPX price is at the previous Sept record high gamma has seemed to stalled at its previous highs, too. You can this reflected in the gamma returns scatter but also this bubble plot seen below.

It leaves us wondering if this is a reflection of call demand at these prices, or if its something more structural to the post-covid-crash SPX flows.

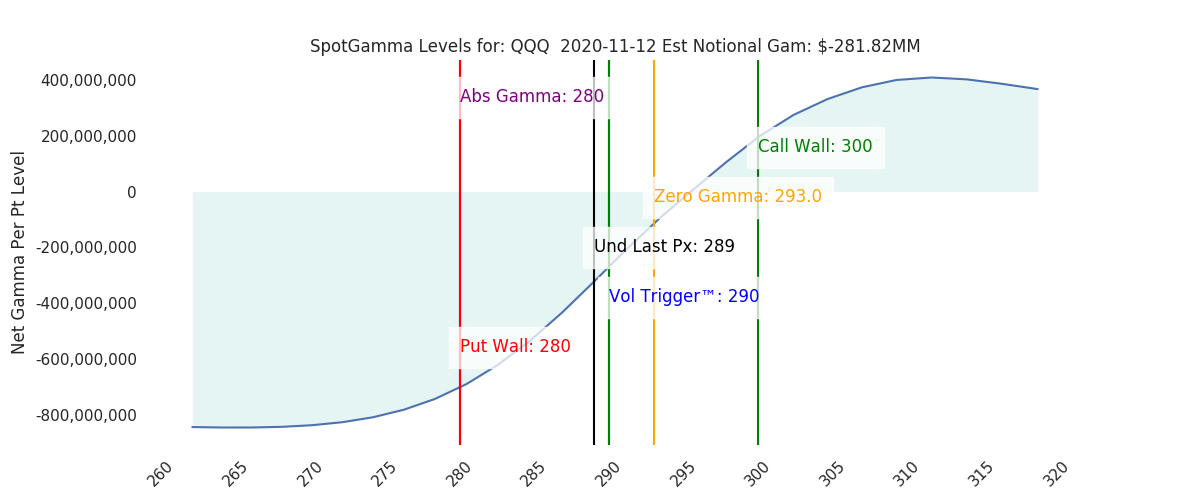

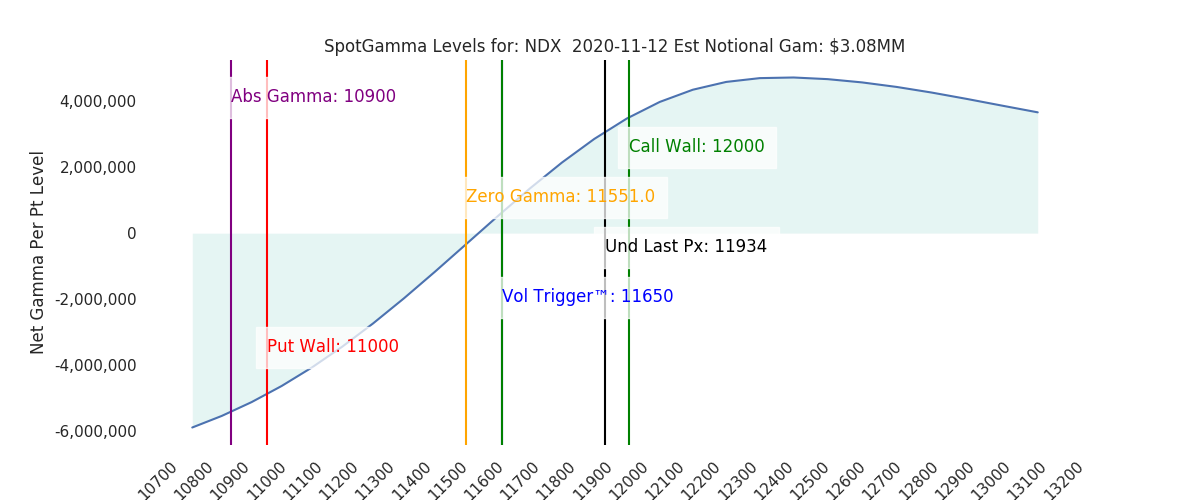

To this point we’d note that while SPX gamma seems to have stalled at $500mm, SPY is much larger at $1.3bn with NDX gamma still negative but shifting higher. From this perspective the markets appear to be accepting these higher prices – at least for the moment.

In reviewing many single stock names we are still struck by the amount of volume in many names. We’ve mentioned CCL and DIS before, but there are many others. Traders were likely burned not only on the price gap higher but also by purchasing lots of calls much higher. We think these calls likely weighed on markets the last several days as the volatility premium decreased and dealers unwound some long stock hedges.

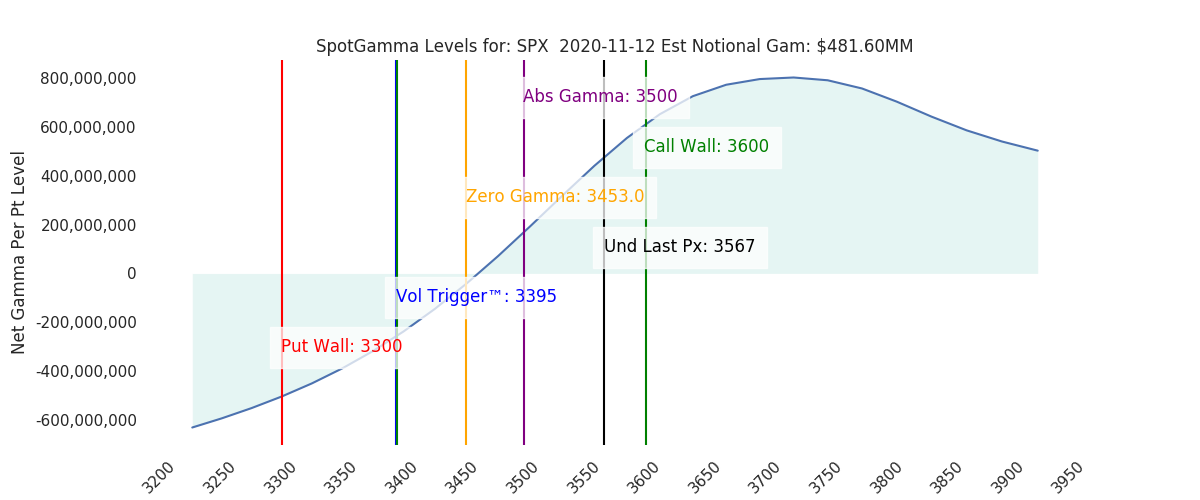

For today we see a bit wider of a range on the SPX (~80bps) with 3550 support and 3600 resistance.

Macro Note:

3500 – 3600 NOV OPEX range.

| SIGNAL NAME | LATEST DATA | PREVIOUS | SPY | NDX | QQQ | ||

|---|---|---|---|---|---|---|---|

| Ref Price: | 3567 | 3566 | 356 | 11934 | 289 | ||

| VIX Ref: | 23.64 | 23.45 | |||||

| SG Gamma Index™: | 1.17 | 1.22 | 0.23 | 0.02 | -0.04 | ||

| Gamma Notional(MM): | $482.00 | $507.00 | $1,314.00 | $3.00 | $-282.00 | ||

| SGI Imp. 1 Day Move: | 0.88%, | 31.0 pts | Range: 3534.0 | 3596.0 | ||||

| SGI Imp. 5 Day Move: | 3632 | 2.23% | Range: 3551.0 | 3713.0 | ||||

| Zero Gamma Level(ES Px): | 3453 | 3426 | — | 0 | |||

| Vol Trigger™(ES Px): | 3395 | 3370 | 342 | 11650 | 290 | ||

| SG Abs. Gamma Strike: | 3500 | 3500 | 350 | 10900 | 280 | ||

| Put Wall Support: | 3300 | 3300 | 320 | 11000 | 280 | ||

| Call Wall Strike: | 3600 | 3600 | 360 | 12000 | 300 | ||

| CP Gam Tilt: | 1.67 | 1.48 | 1.57 | 1.34 | 0.78 | ||

| Delta Neutral Px: | 3292 | ||||||

| Net Delta(MM): | $13,159.00 | $12,951.00 | $2,176.00 | $400.00 | $718.00 | ||

| 25D Risk Reversal | -0.06 | -0.06 | -0.06 | -0.07 | -0.06 | ||

| Top Absolute Gamma Strikes: SPX: [3600, 3550, 3500, 3450] SPY: [360, 355, 350, 340] QQQ: [290, 287, 285, 280] NDX:[12000, 11800, 11000, 10900] SPX Combo: [3619.0, 3519.0, 3569.0, 3594.0, 3626.0] NDX Combo: [11896.0, 11591.0, 11661.0] The Volatility Trigger has moved UP: 3395 from: 3370 SPX resistance is: 3600. Support is: 3500 .Reference ‘Intraday Support’ levels for support areas. The total gamma has moved DOWN: $481.60MM from: $506.00MM Positive gamma is moderate which should lead to smaller market moves. Average Range on day is 1.5% |

0 comentarios