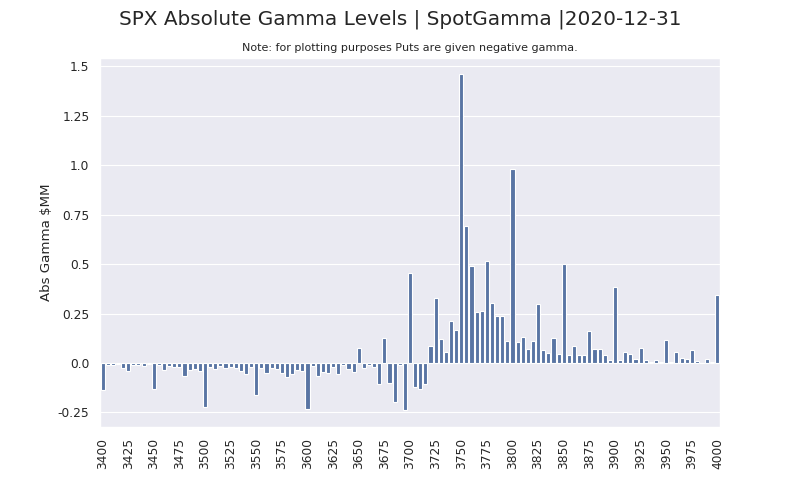

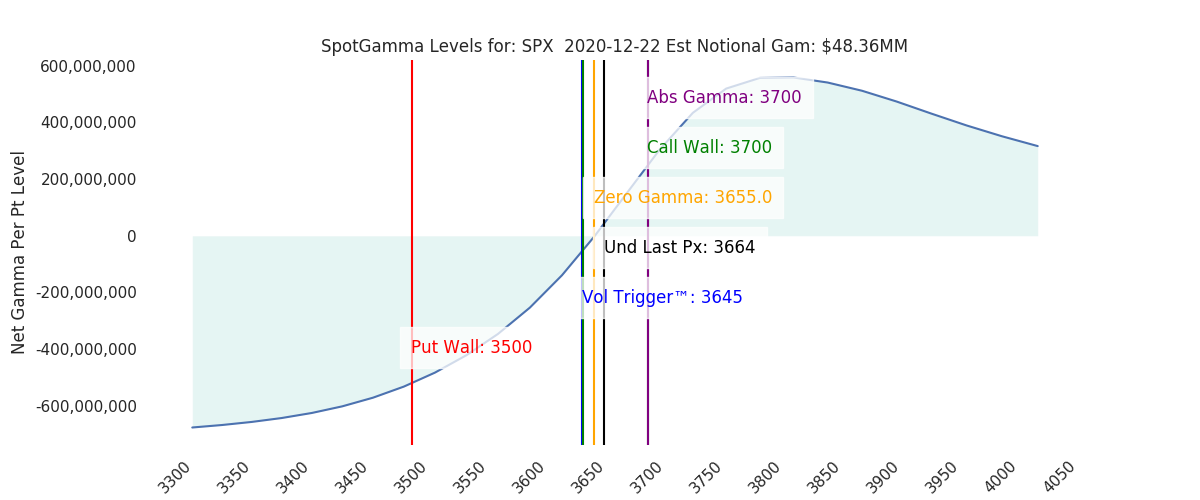

Futures are near 3685 after a fairly quiet overnight session. Its clear that yesterdays dip brought call buyers and thats reflected in the data (note the Tilt charts). Our gamma flip levels have consolidated at 3650 which again forms as the key downside risk level. 3700 remains the largest gamma strike on the board (pivot area) with 3750 the Call Wall & upside target. This is essentially the setup we saw last week, just with much less S&P positive gamma (~$0mm vs $2bn).

You can see below the overall setup, wherein there is not much in the way of ATM calls, but OTM calls sit above 3700. This infers that into the 3700’s markets could find more stability for a push higher.

Downside risks still remain elevated due to low gamma levels, but bears have had several chances to take their shot. For now traders are still treating dips as buying opportunities, and we must give bulls the benefit of the doubt as long as markets sit above the Zero Gamma level.

Macro Note:

New Jan range setup this week.

| SIGNAL NAME | LATEST DATA | PREVIOUS | SPY | NDX | QQQ | ||

|---|---|---|---|---|---|---|---|

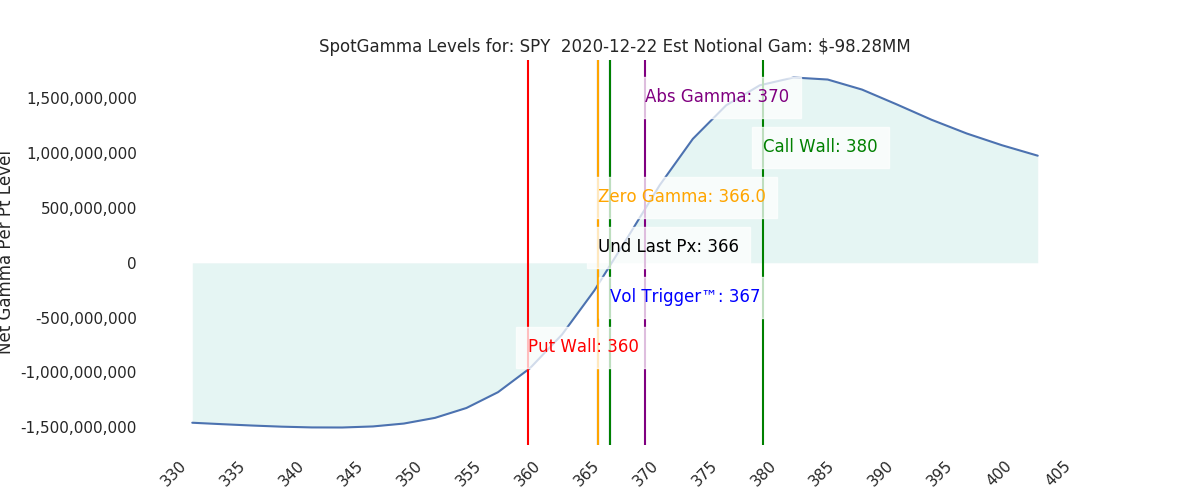

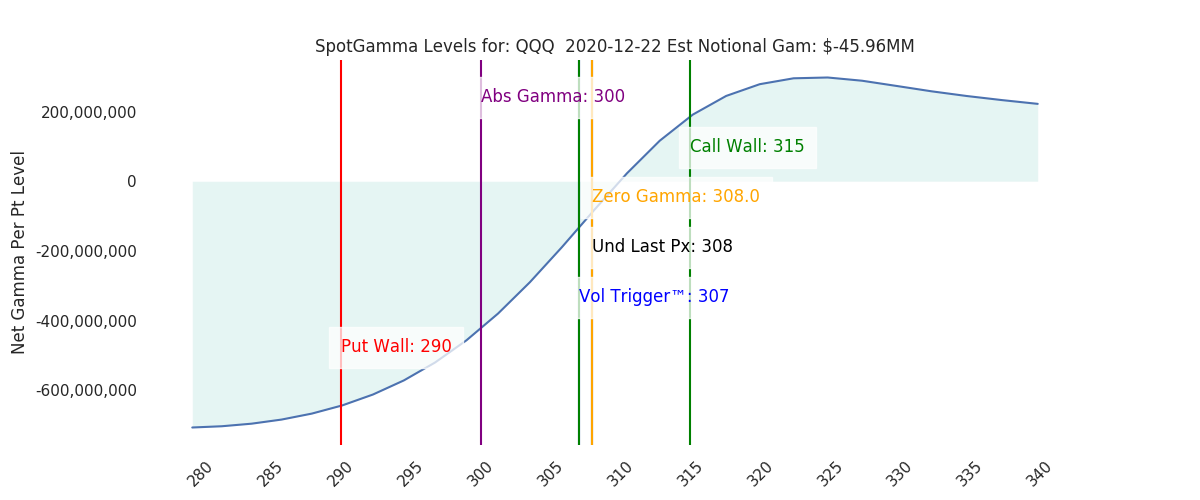

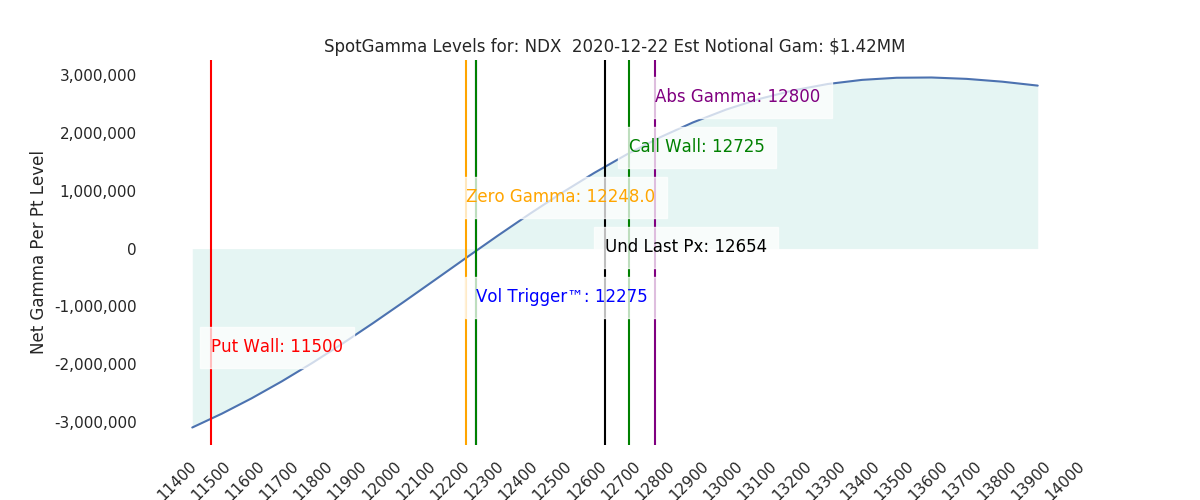

| Ref Price: | 3664 | 3681 | 366 | 12654 | 308 | ||

| VIX Ref: | 25.16 | 25.16 | |||||

| SG Gamma Index™: | 0.59 | 0.59 | -0.00 | 0.01 | -0.01 | ||

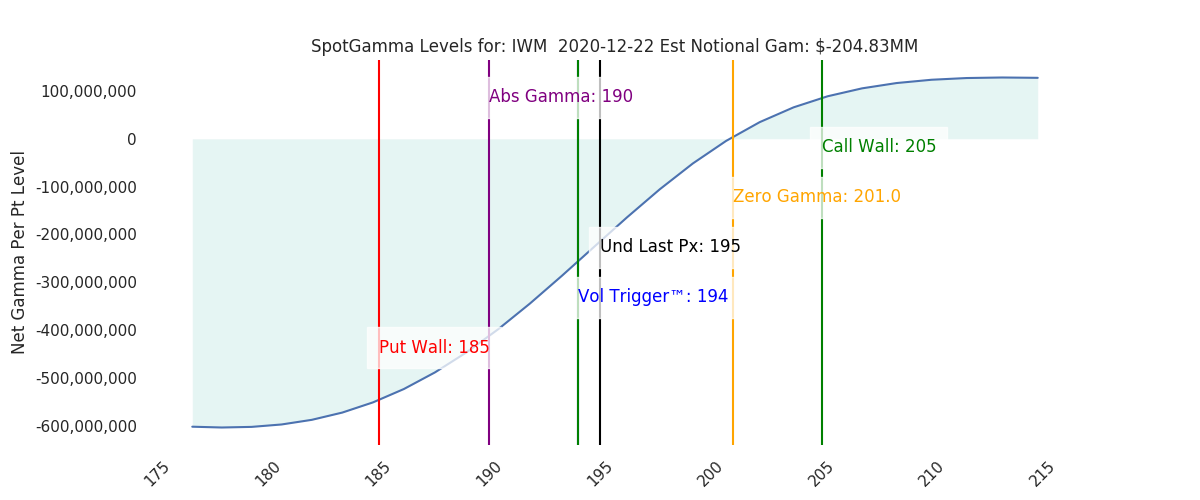

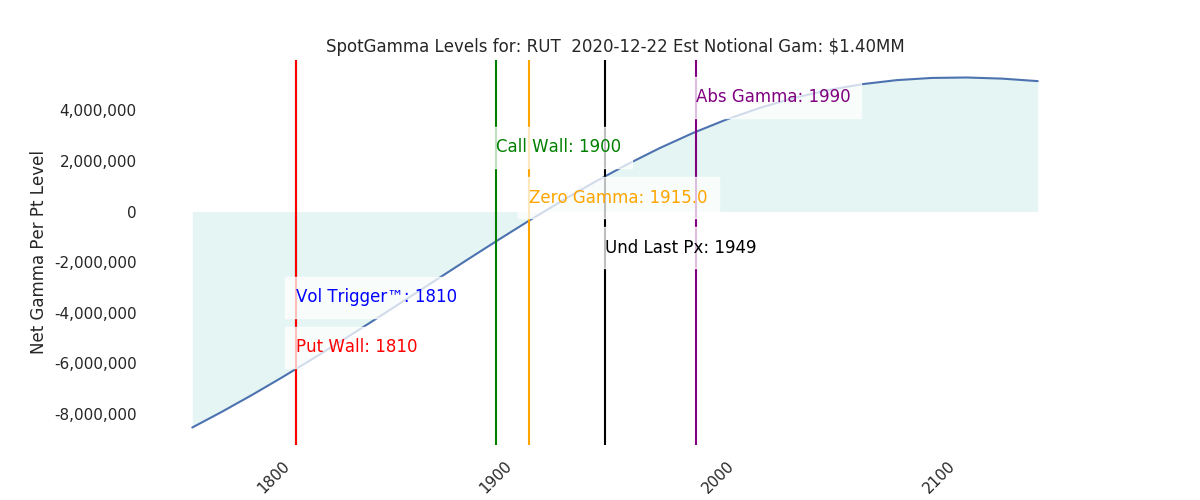

| Gamma Notional(MM): | $48.00 | $41.00 | $-98.00 | $1.00 | $-46.00 | ||

| SGI Imp. 1 Day Move: | 0.88%, | 32.0 pts | Range: 3632.0 | 3696.0 | ||||

| SGI Imp. 5 Day Move: | 3647 | 2.05% | Range: 3573.0 | 3722.0 | ||||

| Zero Gamma Level(ES Px): | 3655 | 3672 | — | 0 | |||

| Vol Trigger™(ES Px): | 3645 | 3695 | 367 | 12275 | 307 | ||

| SG Abs. Gamma Strike: | 3700 | 3700 | 370 | 12800 | 300 | ||

| Put Wall Support: | 3500 | 3500 | 360 | 11500 | 290 | ||

| Call Wall Strike: | 3700 | 3750 | 380 | 12725 | 315 | ||

| CP Gam Tilt: | 1.34 | 1.04 | 0.96 | 1.24 | 0.95 | ||

| Delta Neutral Px: | 3511 | ||||||

| Net Delta(MM): | $940,367.00 | $939,181.00 | $138,204.00 | $28,785.00 | $56,393.00 | ||

| 25D Risk Reversal | -0.09 | -0.06 | -0.07 | -0.09 | -0.08 | ||

| Top Absolute Gamma Strikes: SPX: [3700, 3675, 3650, 3600] SPY: [380, 370, 365, 360] QQQ: [320, 310, 300, 290] NDX:[13000, 12800, 12725, 11500] SPX Combo: [3724.0, 3672.0, 3698.0, 3650.0, 3713.0] NDX Combo: [12696.0, 12823.0] The Volatility Trigger has moved DOWN: 3645 from: 3695 The Call Wall has moved to: 3700 from: 3750 SPX resistance is: 3700 .Reference ‘Intraday Support’ levels for support areas. The total gamma has moved has moved UP: $48.00MM from: $40.00MM Gamma is tilted towards Puts, may indicate puts are expensive Positive gamma is moderate which should lead to smaller market moves. Average Range on day is 1.5% |

0 comentarios