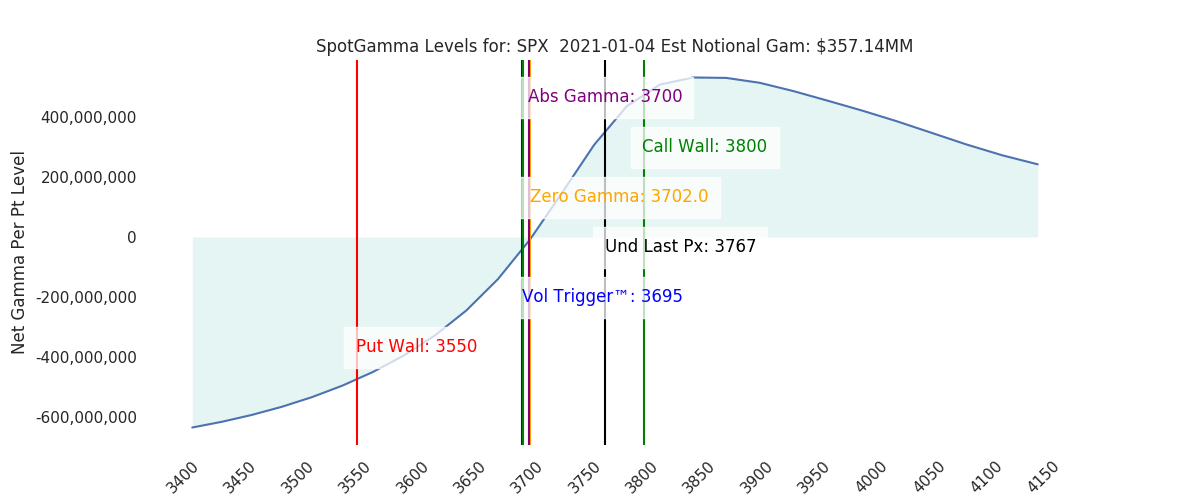

Futures have pushed higher to start the New Year, currently 3765. The Call Wall did shift higher to 3800 which is a function of both a reduction in gamma at 3750 and calls added to 3800. Despite this shift higher the VIX appears to be holding steady at 23. We generally look for a drop in implied volatility to start the new year, and this may be held in check by the political events the next few days (GA elections, electoral college). Ideally we see VIX decline to support the prospects of a sustained rally. Regardless 3800 is the current upside target, and we think that could be achieved driven by an implied volatility drop into the end of the week (post “the politics”).

Total gamma levels did decline after the 12/31 expiration but are still materially positive in the S&P. We look for support at 3750, but think the trend higher is still intact unless we break the gamma flip area of 3700.

Macro Note:

3750-3800 Jan Exp Range.

| Signal Name | Latest Data | Previous | SPY | NDX | QQQ | ||

|---|---|---|---|---|---|---|---|

| Ref Price: | 3767 | 3748 | 376 | 12946 | 313 | ||

| VIX Ref: | 23.06 | 22.75 | |||||

| SG Gamma Index™: | 0.82 | 0.82 | 0.06 | 0.02 | -0.03 | ||

| Gamma Notional(MM): | $357.00 | $256.00 | $658.00 | $3.00 | $-166.00 | ||

| SGI Imp. 1 Day Move: | 0.89%, | 34.0 pts | Range: 3733.0 | 3801.0 | ||||

| SGI Imp. 5 Day Move: | 3767 | 2.38% | Range: 3678.0 | 3857.0 | ||||

| Zero Gamma Level(ES Px): | 3702 | 3683 | — | 0 | |||

| Vol Trigger™(ES Px): | 3695 | 3695 | 372 | 12680 | 310 | ||

| SG Abs. Gamma Strike: | 3700 | 3700 | 380 | 12800 | 300 | ||

| Put Wall Support: | 3550 | 3550 | 360 | 10500 | 278 | ||

| Call Wall Strike: | 3800 | 3800 | 380 | 12725 | 320 | ||

| CP Gam Tilt: | 1.47 | 1.25 | 1.31 | 1.44 | 0.81 | ||

| Delta Neutral Px: | 3556 | ||||||

| Net Delta(MM): | $1,001,067.00 | $996,019.00 | $152,922.00 | $31,916.00 | $59,174.00 | ||

| 25D Risk Reversal | -0.08 | -0.08 | -0.07 | -0.05 | -0.09 | ||

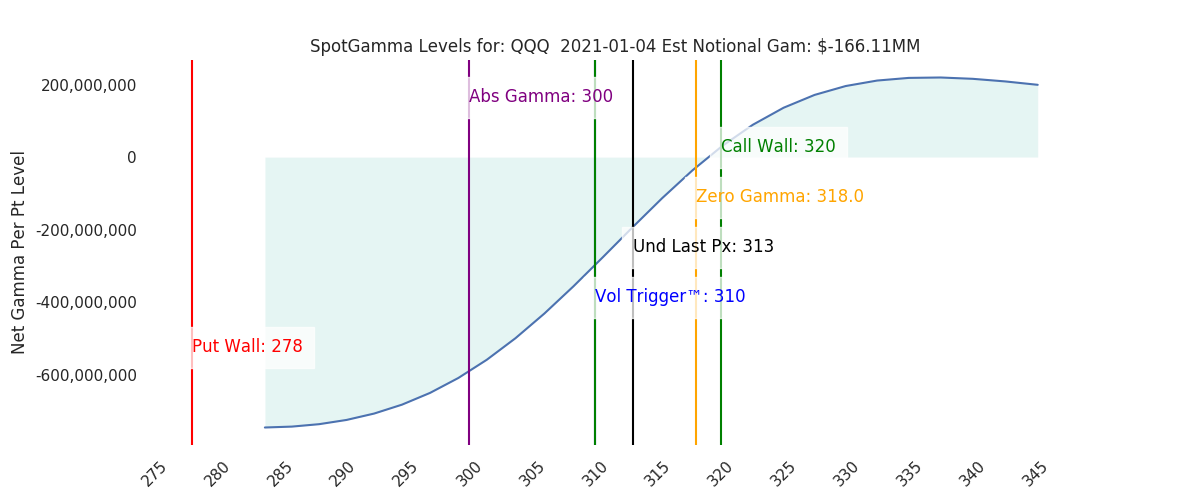

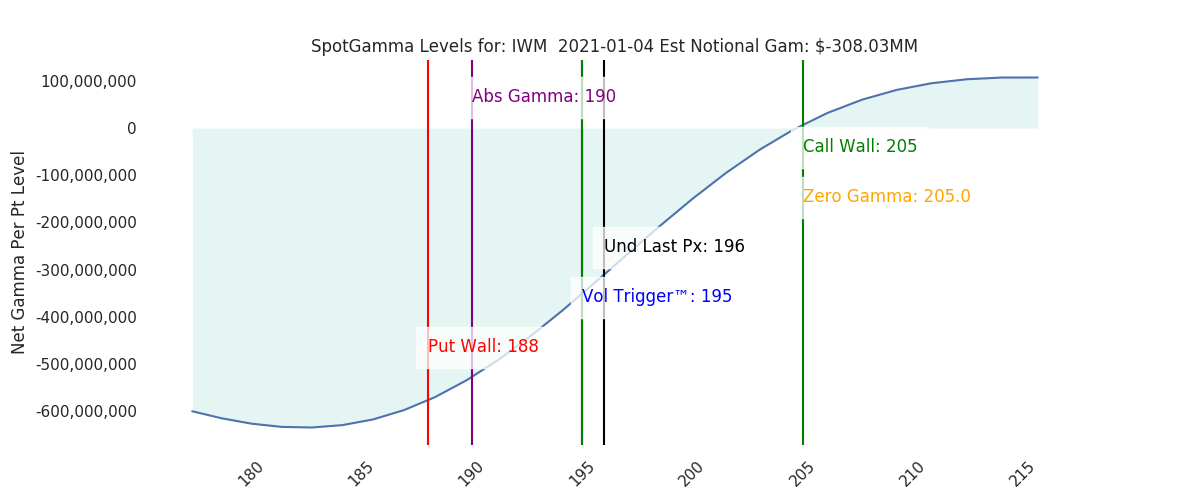

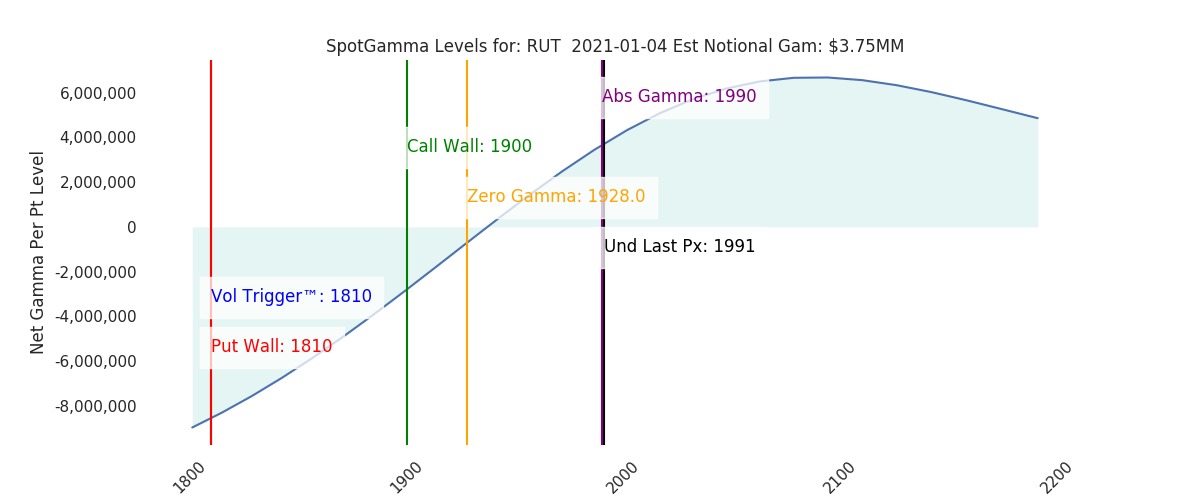

| Top Absolute Gamma Strikes: SPX: [3750, 3725, 3700, 3650] SPY: [380, 375, 372, 370] QQQ: [320, 315, 310, 300] NDX:[13000, 12800, 12725, 12600] SPX Combo: [3811.0, 3758.0, 3784.0, 3833.0, 3709.0] NDX Combo: [12768.0, 12988.0] SPX resistance is: 3800. Support is: 3700 .Reference ‘Intraday Support’ levels for support areas. The total gamma has moved has moved UP: $357.00MM from: $256.00MM Gamma is tilted towards Puts, may indicate puts are expensive Positive gamma is moderate which should lead to smaller market moves. |

0 comentarios