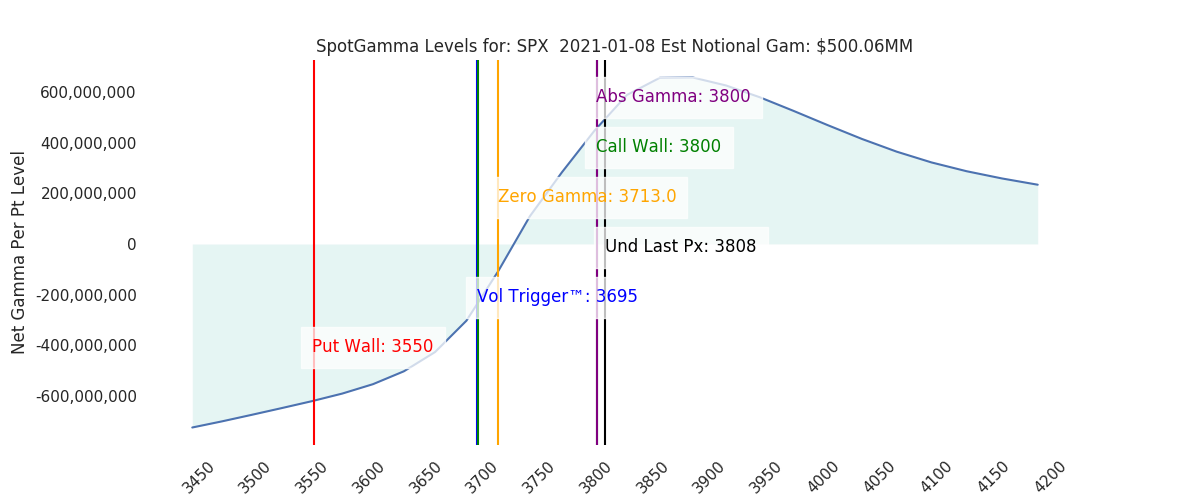

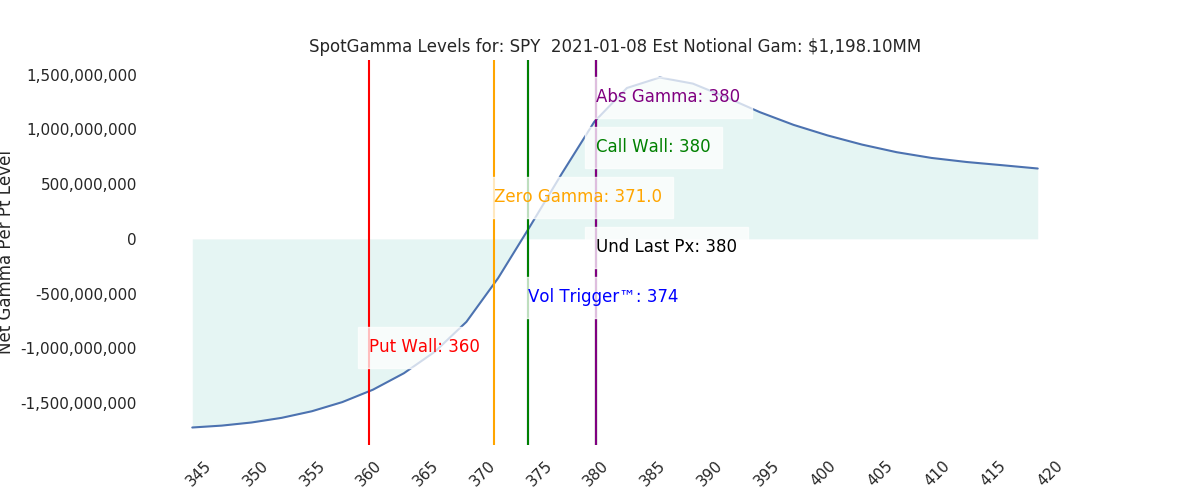

Futures are flat to last nights close to 3806, and off of overnight highs of 3817. Gamma in the S&P500 complex picked up overnight, led by SPY. Our risk levels have shifted slightly, with SPX showing 3700 but SPY indicating 374. While this is a fairly bullish setup we note that the Call Wall did not shift higher from 3800. This leads us to look for the market to consolidate today around the 3800 strike. If markets do shoot higher over the Call Wall today we’d consider the market overbought and look for mean reversion back to the 3800 strike unless/until that Call Wall strike shifts.

Much like in previous rallies the gamma ends distribution is “front loaded”, implying that we are are subject to quick jabs lower in the SPX as seen on Monday.

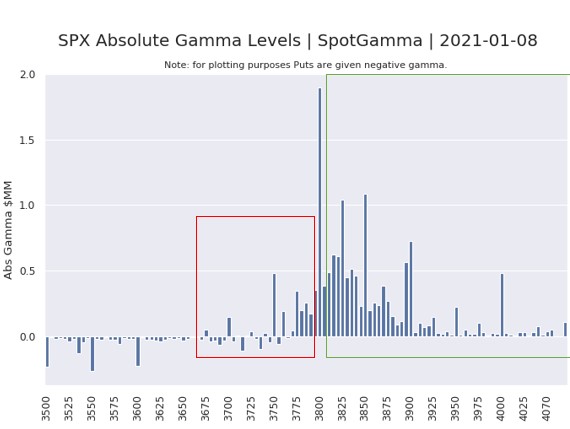

Note in the chart below how we have a large gamma strike at 3800 which we think serves as a pinning area today. At strikes above (green box) there are additional large positive gamma strikes which should serve to lower volatility/stabilize prices. At strikes below (red box) there is much less positive gamma which implies that this is a higher volatility zone.

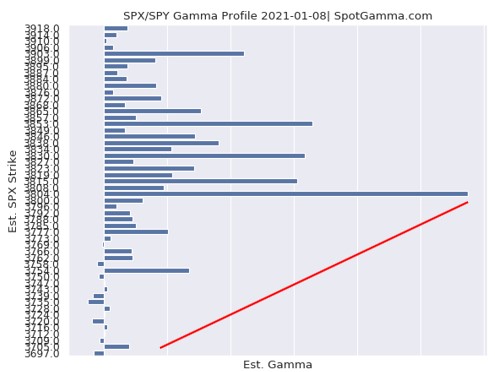

You can see that same strike gamma profile when we combine SPX & SPY gamma as shown below.

While there may be a test or two lower that comes, we don’t see a catalyst for a larger drawdown until possibly 1/15 expiration. This marks where a lot of options positions will roll/expire and we anticipate long dealer deltas unwinding after that date. Recall the brief but volatile drawdown that occurred after 12/18 OPEX.

Macro Note:

3750-3800 Jan Exp Range.

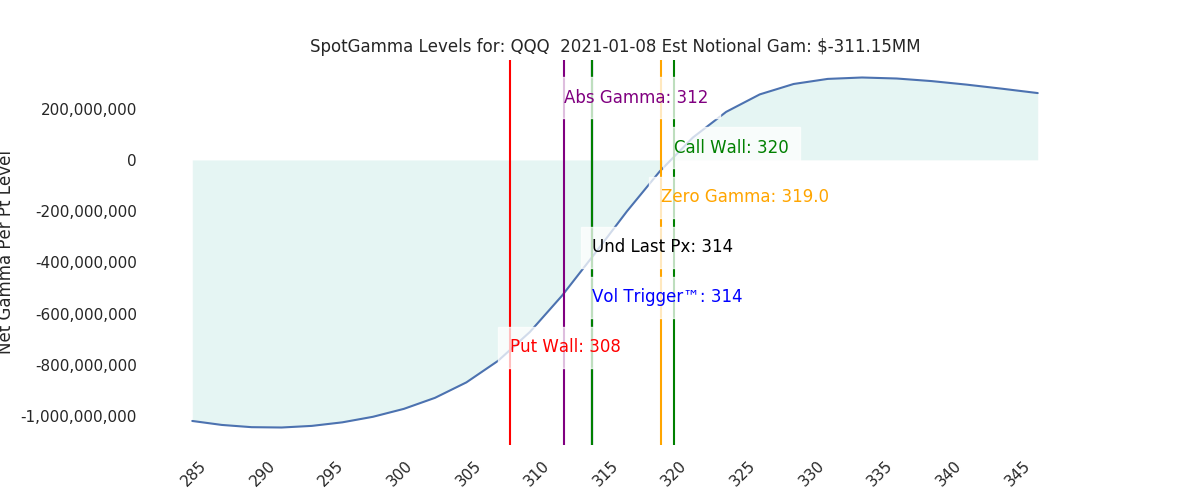

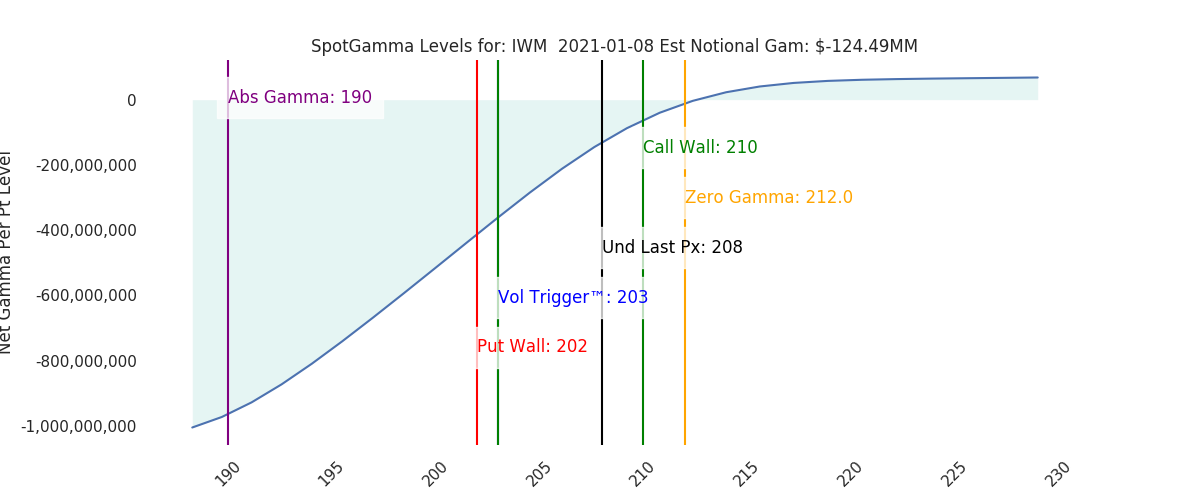

| Signal Name | Latest Data | Previous | SPY | NDX | QQQ | ||

|---|---|---|---|---|---|---|---|

| Ref Price: | 3808 | 3796 | 380 | 12989 | 314 | ||

| VIX Ref: | 22.21 | 22.37 | |||||

| SG Gamma Index™: | 1.41 | 0.58 | 0.23 | 0.02 | -0.04 | ||

| Gamma Notional(MM): | $500.00 | $408.00 | $1,177.00 | $4.00 | $-311.00 | ||

| SGI Imp. 1 Day Move: | 0.89%, | 34.0 pts | Range: 3774.0 | 3842.0 | ||||

| SGI Imp. 5 Day Move: | 3767 | 2.38% | Range: 3678.0 | 3857.0 | ||||

| Zero Gamma Level(ES Px): | 3713 | 3702 | — | 0 | |||

| Vol Trigger™(ES Px): | 3695 | 3695 | 374 | 12680 | 314 | ||

| SG Abs. Gamma Strike: | 3800 | 3700 | 380 | 12800 | 312 | ||

| Put Wall Support: | 3550 | 3600 | 360 | 10500 | 308 | ||

| Call Wall Strike: | 3800 | 3800 | 380 | 12725 | 320 | ||

| CP Gam Tilt: | 1.81 | 1.42 | 1.5 | 1.5 | 0.76 | ||

| Delta Neutral Px: | 3594 | ||||||

| Net Delta(MM): | $1,094,072.00 | $1,065,495.00 | $169,132.00 | $34,123.00 | $64,477.00 | ||

| 25D Risk Reversal | -0.08 | -0.09 | -0.07 | -0.08 | -0.08 | ||

| Top Absolute Gamma Strikes: SPX: [3850, 3800, 3750, 3700] SPY: [380, 378, 375, 370] QQQ: [320, 315, 312, 310] NDX:[13000, 12800, 12725, 12600] SPX Combo: [3804.0, 3853.0, 3830.0, 3815.0, 3903.0] NDX Combo: [13189.0, 12696.0, 12865.0, 12761.0, 12982.0] The PutWall has moved to: 3550 from: 3600 SPX is above the Volatility Trigger™, resistance is: 3800 Support is: 3800 The total gamma has moved has moved UP: $500.00MM from: $408.00MM Positive gamma is moderate which should lead to smaller market moves. Average Range on day is 1.5% |

0 comentarios