Markets were weak overnight, putting in a 3765 low before catching a small bid back up to 3775. This places markets in a weak position, going into a post OPEX timeframe that is historically associated with volatility. There was again very large trading at the 3800 strike yesterday which should add to its pull, but it appears that the options structure <3800 has materially weakened.

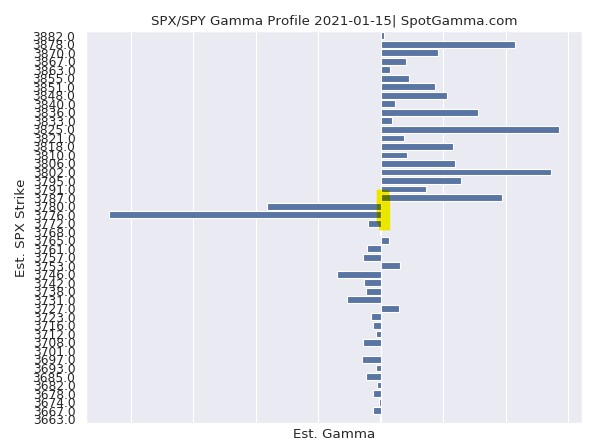

You can see that position change in the combo charts, note the two large negative gamma bars around 3775. This could provide a “punch down” should markets push through that level.

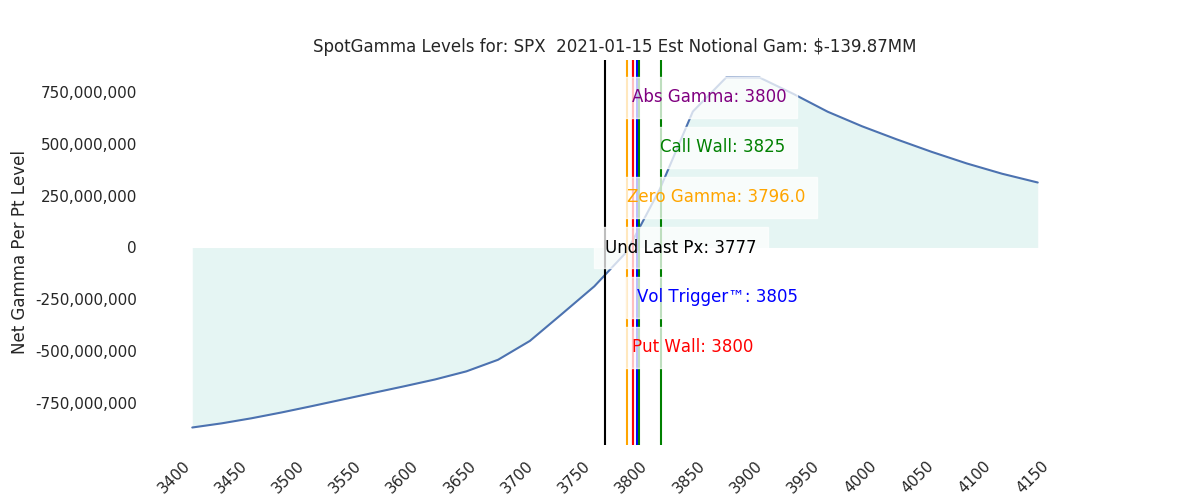

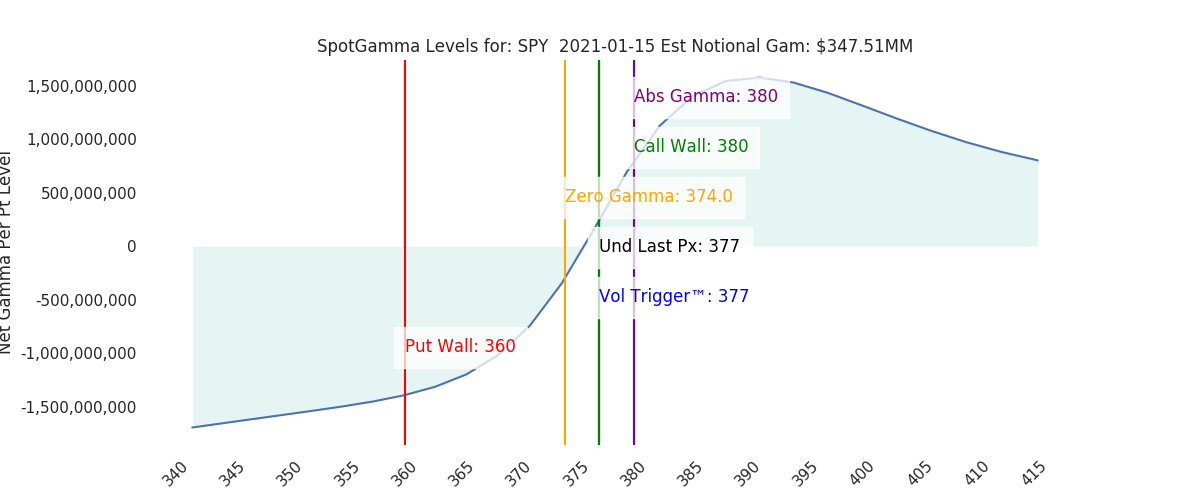

The Vol Trigger & gamma flip line has also jumped up quite a bit to ~3800, which reiterates little dealer support for markets <=3800. The challenging dynamic here is that 3800 is such a large gamma strike, and we still think it has some pull into todays OPEX. Of course a lot of this position rolls off at 9:30 AM EST when SPX expires, however 380 in SPY holds until the 4pm EST close.

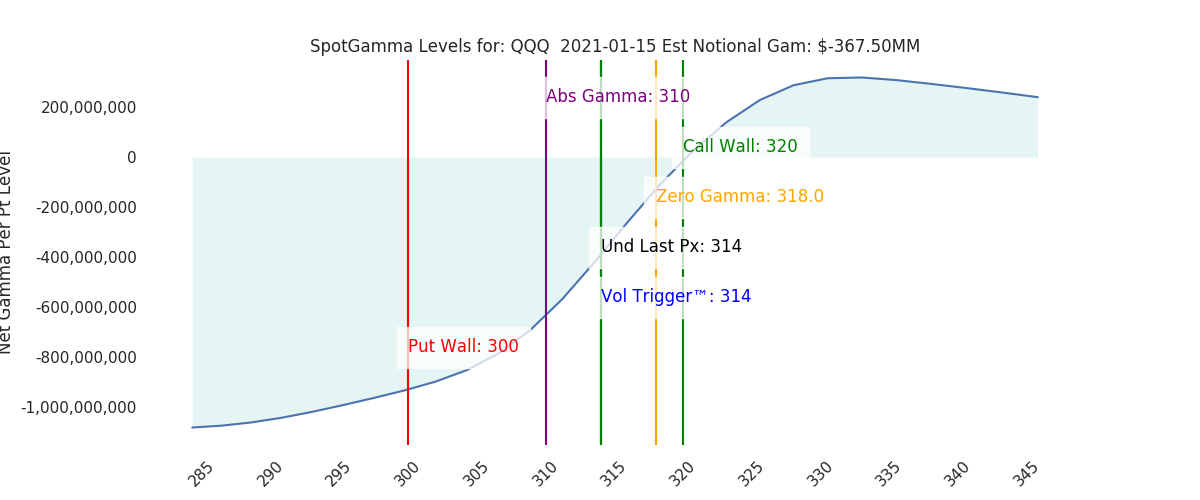

We estimate 20-25% of SPX gamma is set to expire today which is a large amount. Single stocks show about 50% of total gamma rolling off at 4pm. This could therefore lead to a lot of hedging shifts in names with large options positions.

The bottom line is this: 3800 is still the large magnet, but as you know the farther from a magnet you get the less pull it has. 3775 is the critical risk line. We give edge to weak flows on Tuesday (Monday markets are closed) and so an opening in negative gamma territory with OPEX related selling could spiral quickly. Therefore a strong move below 3775, and certainly a closing beneath there is a very strong “risk off” signal.

Macro Note:

New range set next week post Jan OPEX.

| Signal Name | Latest Data | Previous | SPY | NDX | QQQ | ||

|---|---|---|---|---|---|---|---|

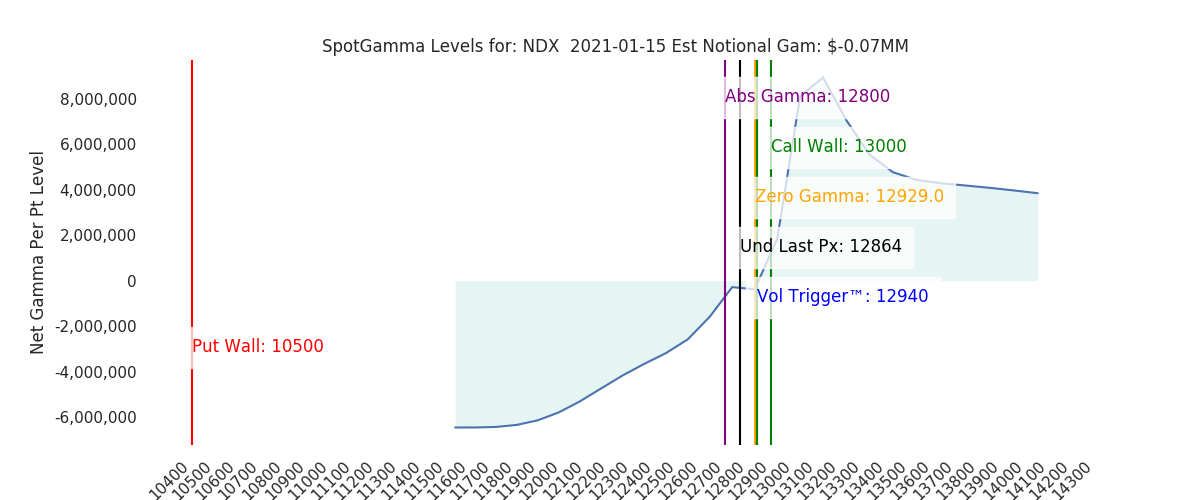

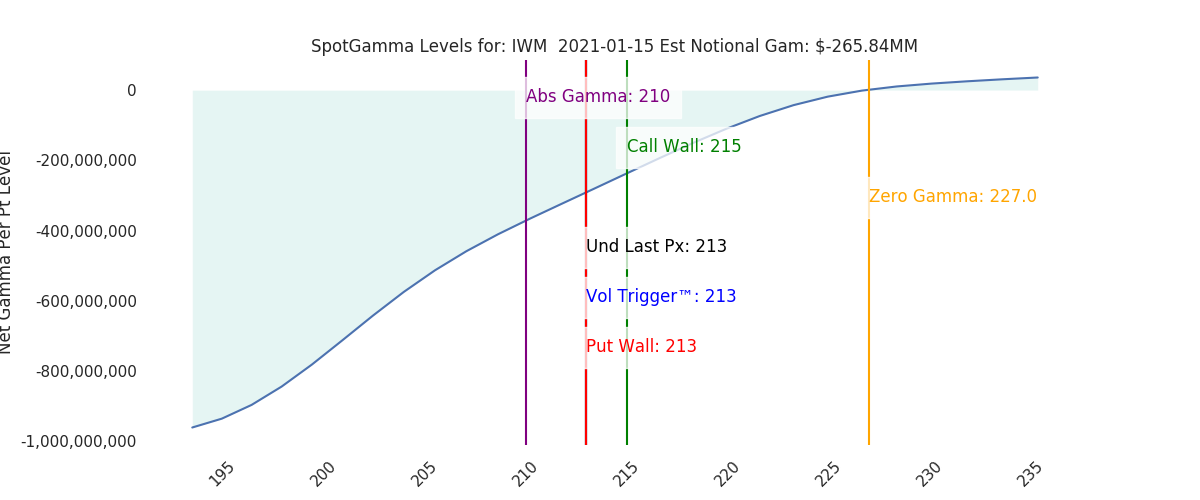

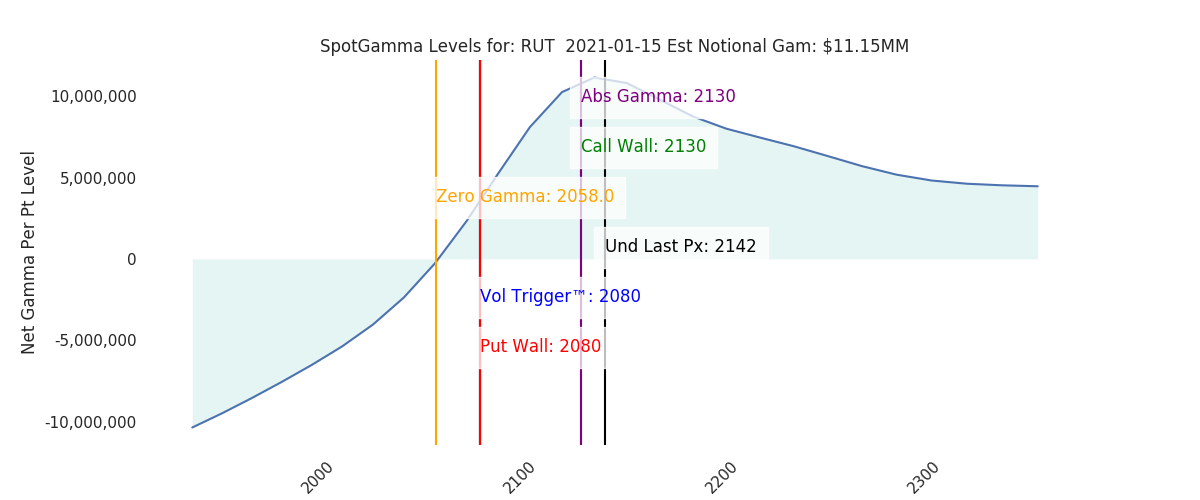

| Ref Price: | 3777 | 3771 | 377 | 12864 | 314 | ||

| VIX Ref: | 23.79 | 23.25 | |||||

| SG Gamma Index™: | 0.12 | 0.12 | 0.14 | 0.00 | -0.05 | ||

| Gamma Notional(MM): | $-140 | $-169 | $348 | $0 | $-368 | ||

| SGI Imp. 1 Day Move: | 1.45%, | 55.0 pts | Range: 3722.0 | 3832.0 | ||||

| SGI Imp. 5 Day Move: | 3793 | 2.05% | Range: 3715.0 | 3871.0 | ||||

| Zero Gamma Level(ES Px): | 3796 | 3790 | — | 0 | |||

| Vol Trigger™(ES Px): | 3805 | 3805 | 377 | 12940 | 314 | ||

| SG Abs. Gamma Strike: | 3800 | 3800 | 380 | 12800 | 310 | ||

| Put Wall Support: | 3800 | 3800 | 360 | 10500 | 300 | ||

| Call Wall Strike: | 3825 | 3825 | 380 | 13000 | 320 | ||

| CP Gam Tilt: | 1.04 | 0.91 | 1.11 | 0.99 | 0.74 | ||

| Delta Neutral Px: | 3619 | ||||||

| Net Delta(MM): | $1,195,425 | $1,193,605 | $182,779 | $34,486 | $71,344 | ||

| 25D Risk Reversal | -0.08 | -0.08 | -0.09 | -0.08 | -0.09 | ||

| Top Absolute Gamma Strikes: SPX: [3800, 3775, 3750, 3700] SPY: [380, 378, 375, 370] QQQ: [320, 315, 310, 300] NDX:[13000, 12950, 12900, 12800] SPX Combo: [3782.0, 3831.0, 3808.0, 3884.0, 3793.0] NDX Combo: [13123.0, 12994.0, 13084.0, 12633.0, 12710.0] SPX is below the Volatility Trigger™. The 3796.0 level is first level of resistance and is critical as its the negative gamma threshold. The trigger level of: 3805 will act as overhead resistance. Watching VIX is key, if volatility comes in dealers will start to buy back shares as their short puts lose value. This could start a rally. The total gamma has moved has moved UP: $-140MM from: $-169.00MM Gamma is tilted towards Puts, may indicate puts are expensive Negative gamma is moderate favoring further swings in the market |

0 comentarios