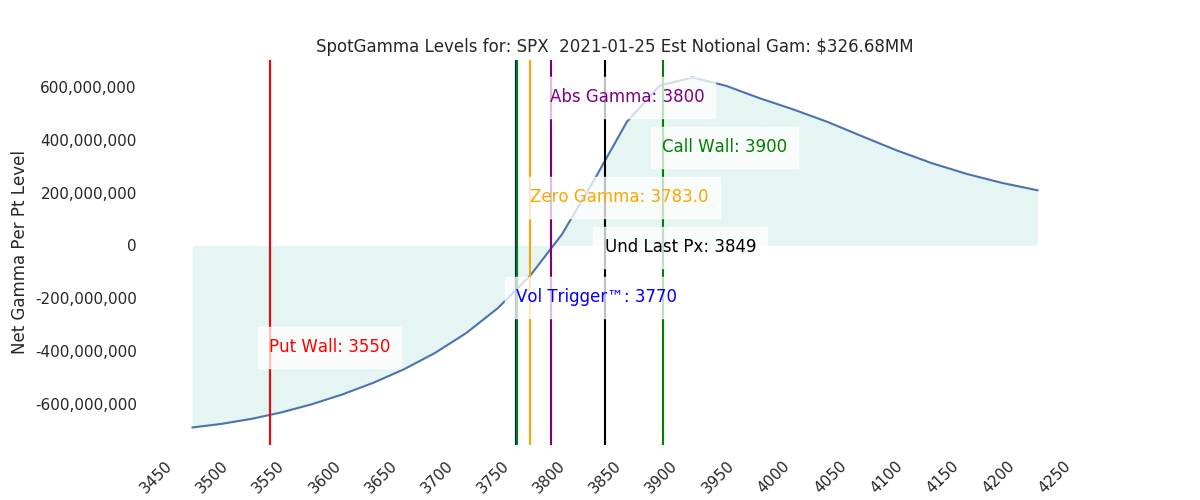

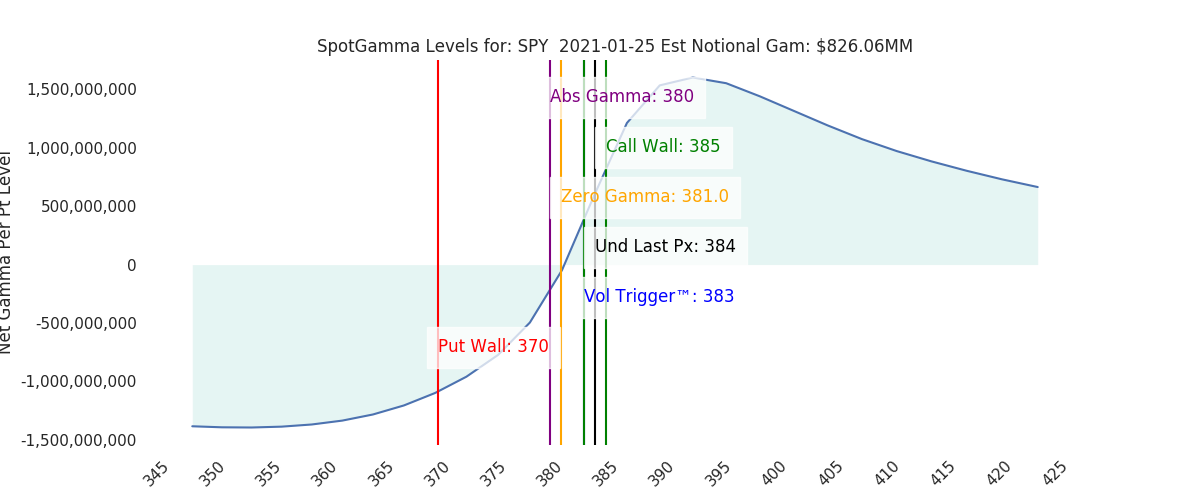

Futures are pulling back to 3840 after touching 3852 in the overnight session. The Call Wall shifts (by the slightest of margins) to 3900 in SPX, but holds at 385 in SPY. The major risk level is 3775, with 3800 being the largest options strike and major support. The largest Combo line resistance is 3857.

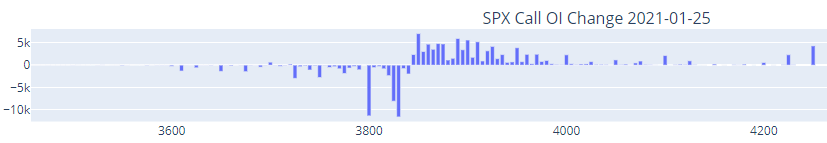

Friday saw a lot of call closures <=3850 in both SPX and SPY which reduced overall gamma levels in the S&P.

We view this as risk reduction into this weeks FOMC meetings, and anticipate markets holding the 3800-3850 range into the Wed rate announcement.

We have been talking about the instability embedded in markets due to record long calls, net long short put positions, and a focus on chasing excessive returns. Our view is that the reddit/wallstreetbets phenomenon is likely serving to reduce short selling, too.

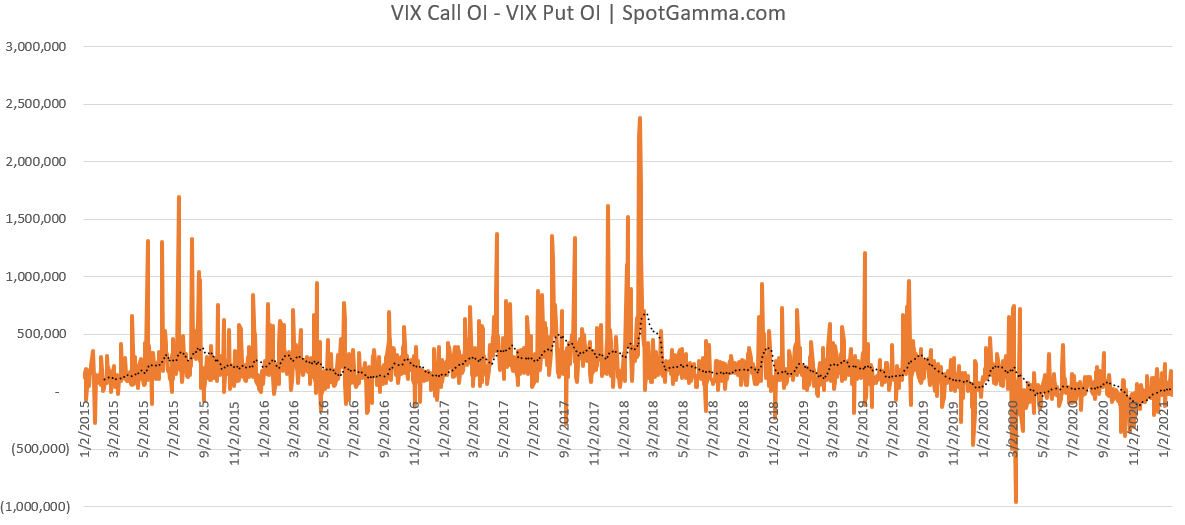

We have another data point to add to this mix, and that is the focus on VIX puts. The chart below shows VIX Call open interest against VIX put interest. As you can see that metric has been oscillating around zero which shows the lowest net VIX call demand since at least 2015.

Everyone is on one side of the boat so to speak, and have thrown the life jackets overboard. This of course does not mean that markets top in the short term, but warrants respecting the elevated risk of a violent downside move signaled by any break of the Zero Gamma level.

Macro Note:

Feb Range 3750-3850

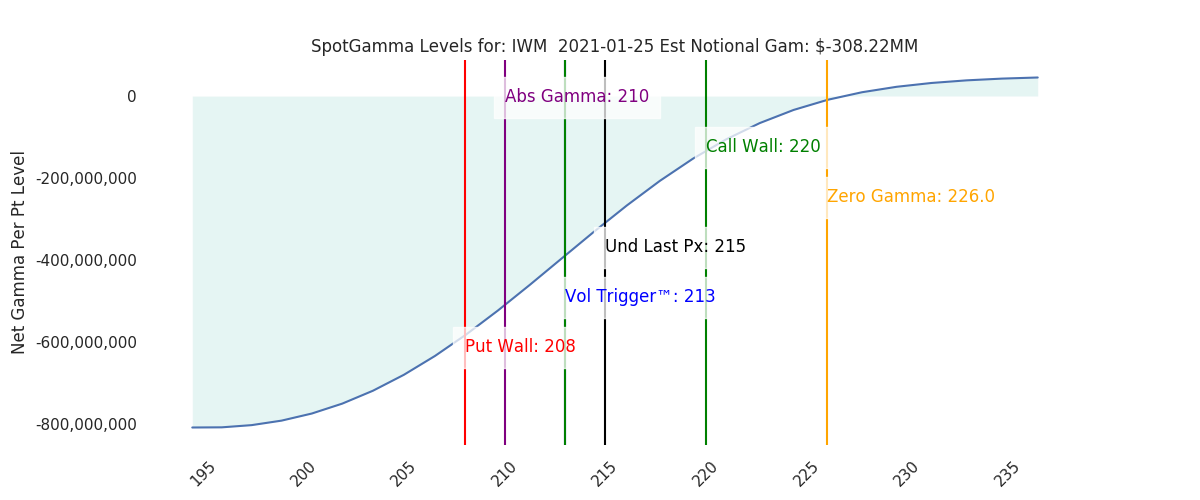

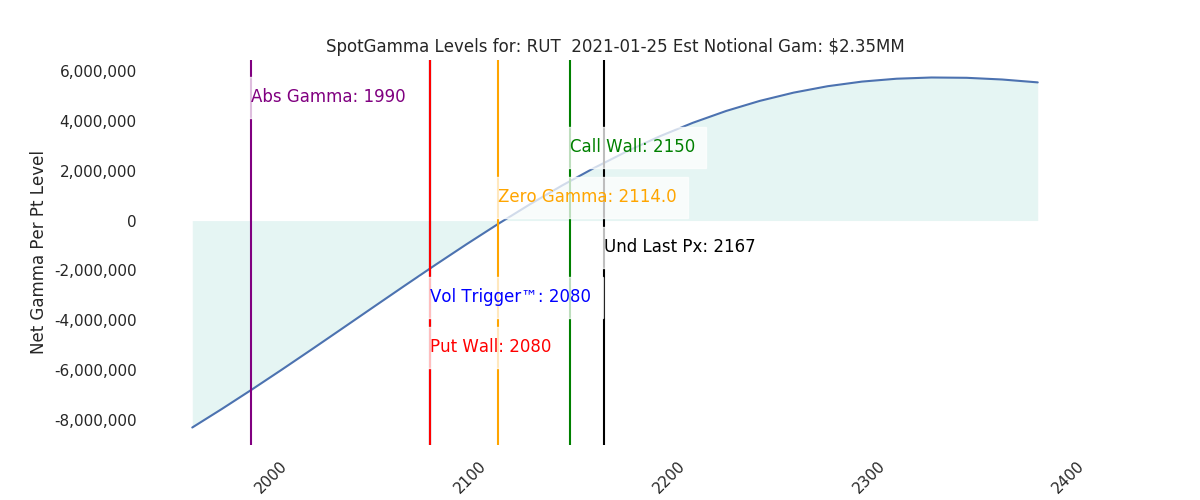

| Signal Name | Latest Data | Previous | SPY | NDX | QQQ | ||

|---|---|---|---|---|---|---|---|

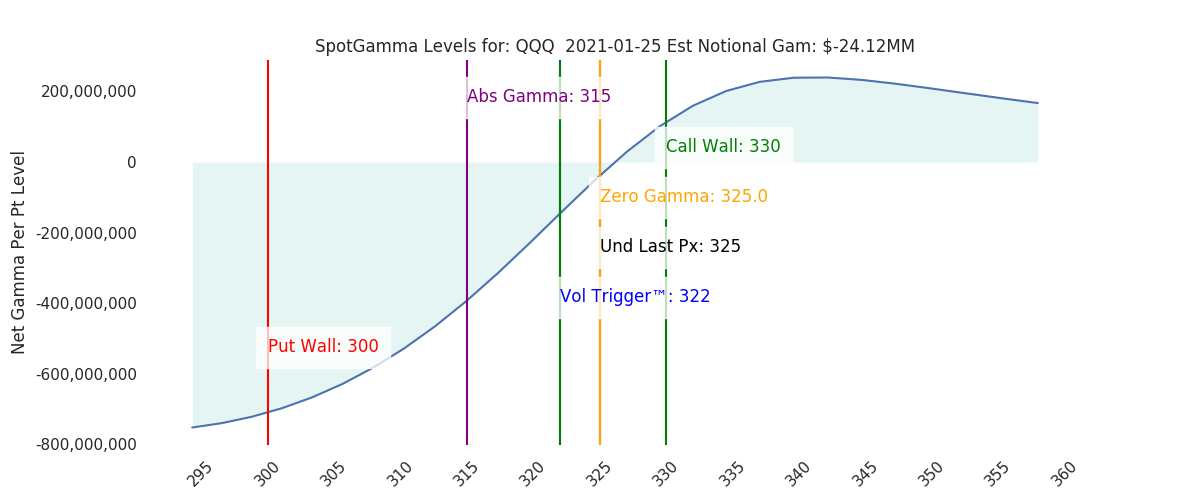

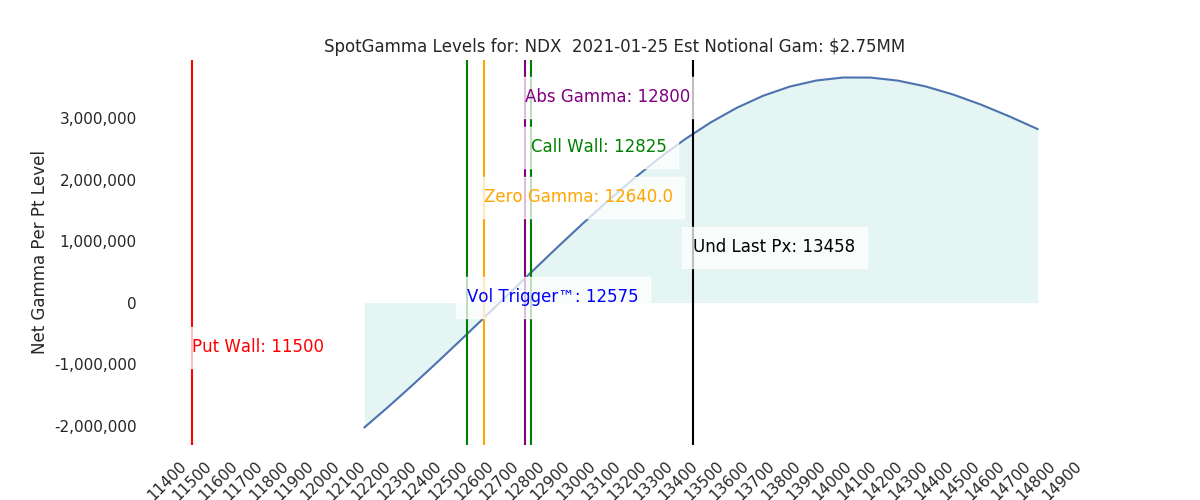

| Ref Price: | 3849 | 3830 | 384 | 13458 | 325 | ||

| VIX Ref: | 14 | 21.91 | |||||

| SG Gamma Index™: | 0.78 | 1.21 | 0.06 | 0.02 | -0.00 | ||

| Gamma Notional(MM): | $327 | $157 | $826 | $3 | $-24 | ||

| SGI Imp. 1 Day Move: | 0.95%, | 37.0 pts | Range: 3812.0 | 3886.0 | ||||

| SGI Imp. 5 Day Move: | 3849 | 2.0% | Range: 3773.0 | 3927.0 | ||||

| Zero Gamma Level(ES Px): | 3783 | 3792 | — | 0 | |||

| Vol Trigger™(ES Px): | 3770 | 3820 | 383 | 12575 | 322 | ||

| SG Abs. Gamma Strike: | 3800 | 3850 | 380 | 12800 | 315 | ||

| Put Wall Support: | 3550 | 3550 | 370 | 11500 | 300 | ||

| Call Wall Strike: | 3900 | 3850 | 385 | 12825 | 330 | ||

| CP Gam Tilt: | 1.4 | 1.12 | 1.35 | 1.48 | 0.97 | ||

| Delta Neutral Px: | 3634 | ||||||

| Net Delta(MM): | $1,055,079 | $1,072,424 | $167,828 | $34,908 | $62,648 | ||

| 25D Risk Reversal | -0.09 | -0.06 | -0.08 | -0.08 | -0.08 | ||

| Top Absolute Gamma Strikes: SPX: [3900, 3850, 3800, 3700] SPY: [390, 385, 383, 380] QQQ: [330, 325, 320, 315] NDX:[13000, 12825, 12800, 12600] SPX Combo: [3907.0, 3857.0, 3884.0, 3903.0, 3873.0] NDX Combo: [13645.0, 13443.0] The Volatility Trigger has moved DOWN: 3770 from: 3820 The Call Wall has moved to: 3900 from: 3850 SPX resistance is: 3900. Support is: 3800 .Reference ‘Intraday Support’ levels for support areas. The total gamma has moved has moved UP: $326MM from: $157.00MM Gamma is tilted towards Puts, may indicate puts are expensive Positive gamma is moderate which should lead to smaller market moves. Average Range on day is 1.5% |

0 comentarios