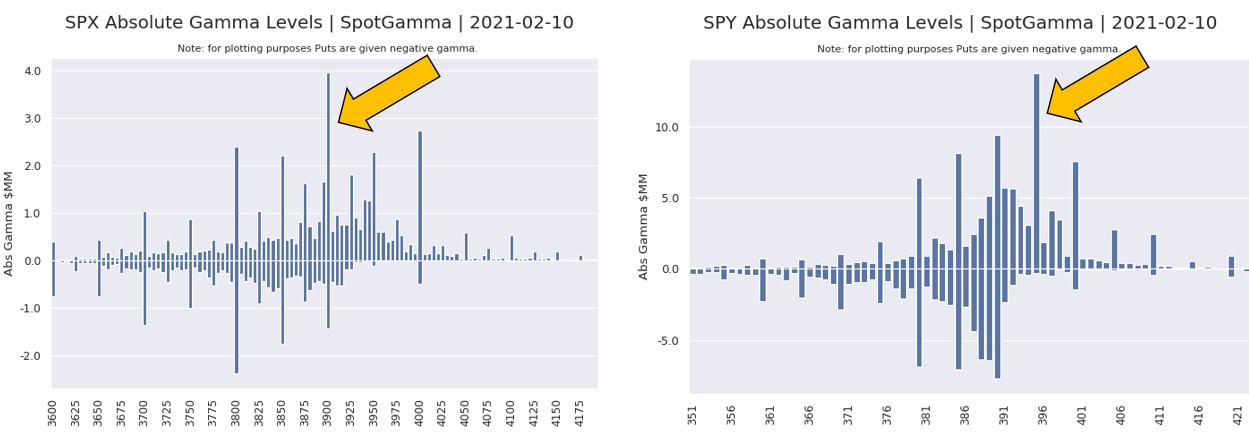

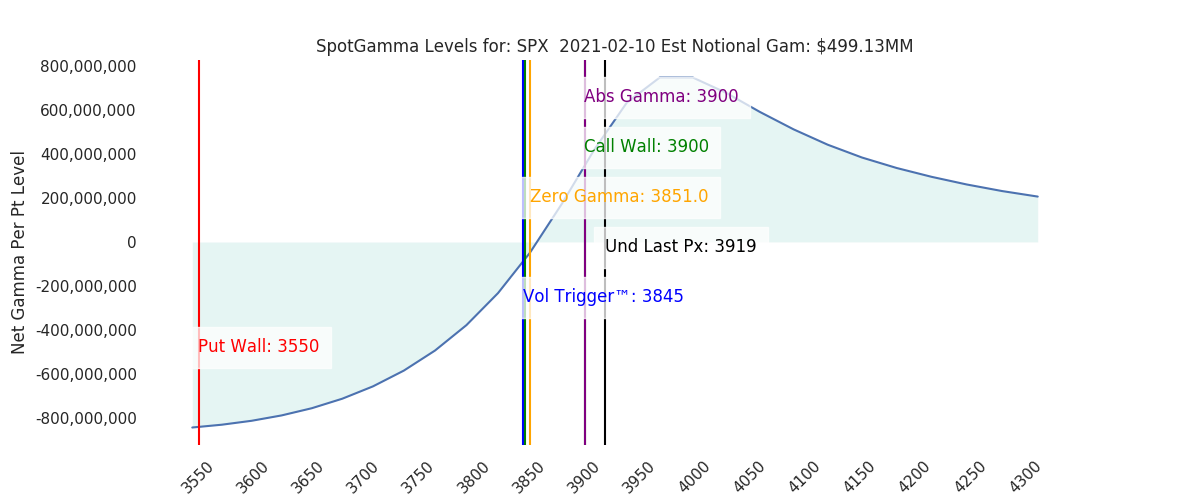

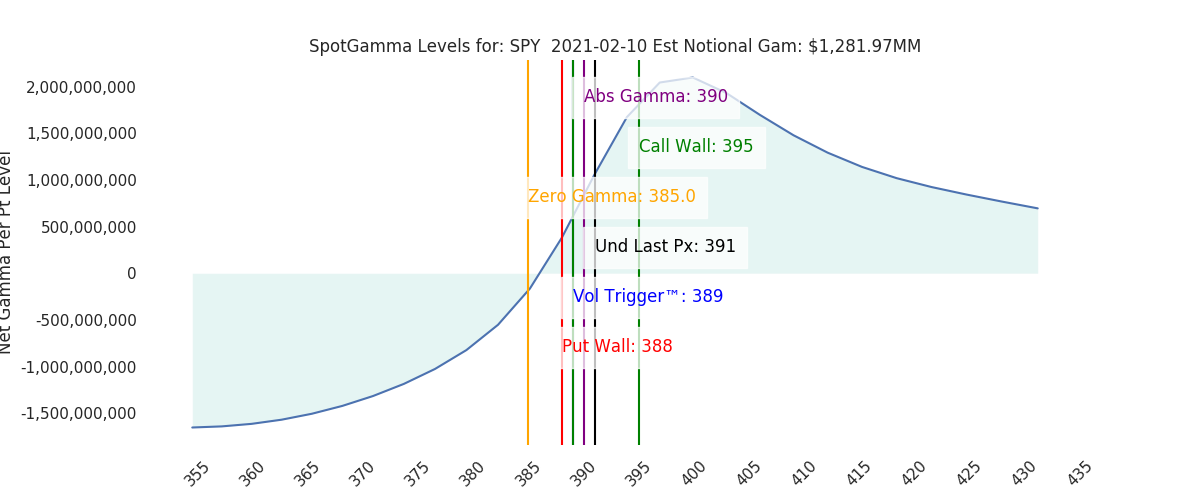

Futures are higher to 3920, with an interesting Call Wall “divergence” appearing overnight. The SPX wall remains at 3900, but the SPY wall now appears at 395. SPY total gamma is nearly 2.5x larger than SPX gamma which indicates that the 395 SPY pull is a real force and gives some validation to higher SPX prices. The large size of 3900 (SPX, left) and 395 (SPY, right) relative to other strikes is shown below. The Call Wall strike is the largest positive gamma bar, and you can see that these respective levels are nearly 2x larger than any other strike. To shift the walls new calls must be added, and or the SPX must be materially higher.

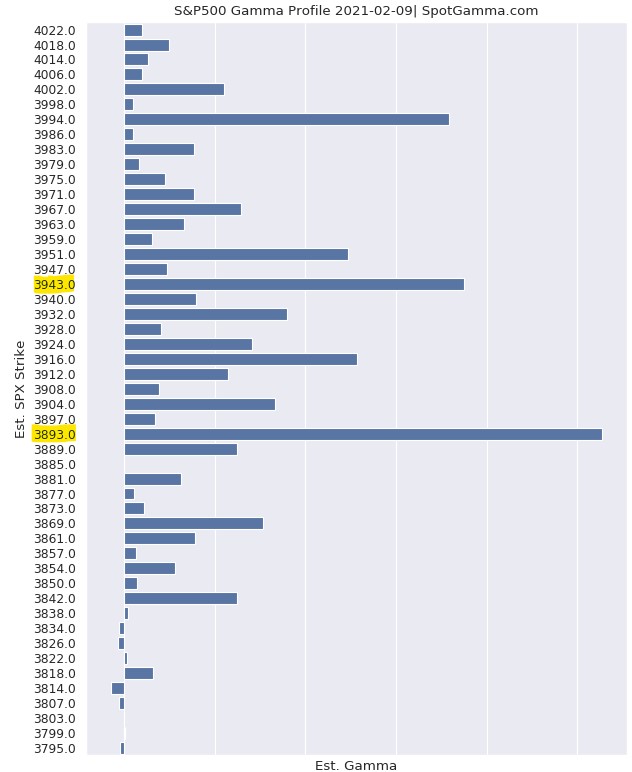

The net of all this is best shown in the S&P combined gamma profile below, wherein the 3900 area still shows as the largest level, but the 3943 produces a large overhead gamma strike. This is a “sticky range” which should continue to produce low volatility and tight trading ranges.

While there has been a quiet but consistent roll from strikes <3900 up to 4000, we also see put interest filling in from <=3900. This call roll and new put interest has shifted the Zero Gamma levels up into the 3850 area, and we expect to see that ZeroGamma risk line hit 3900 by 2/19 OPEX. Things continue to align for “volatility” (ie lots of movement) into 2/19.

Macro Note:

3700-3900 into Feb OPEX

| Signal Name | Latest Data | Previous | SPY | NDX | QQQ | ||

|---|---|---|---|---|---|---|---|

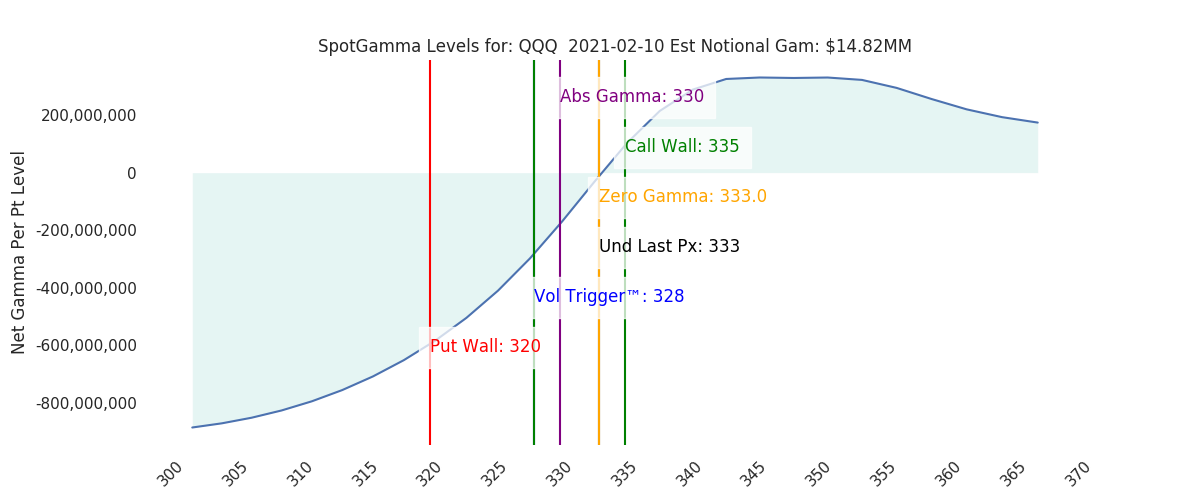

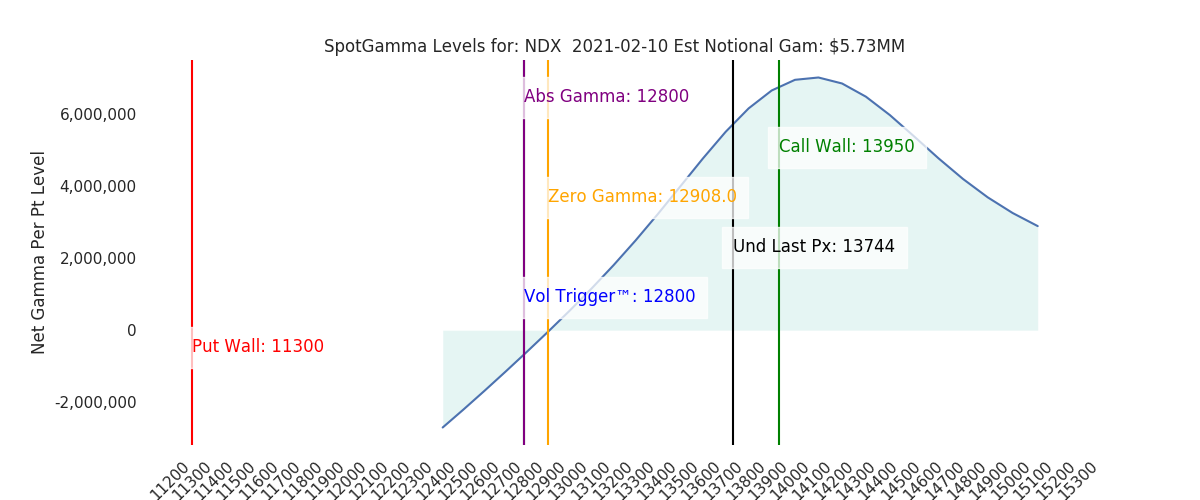

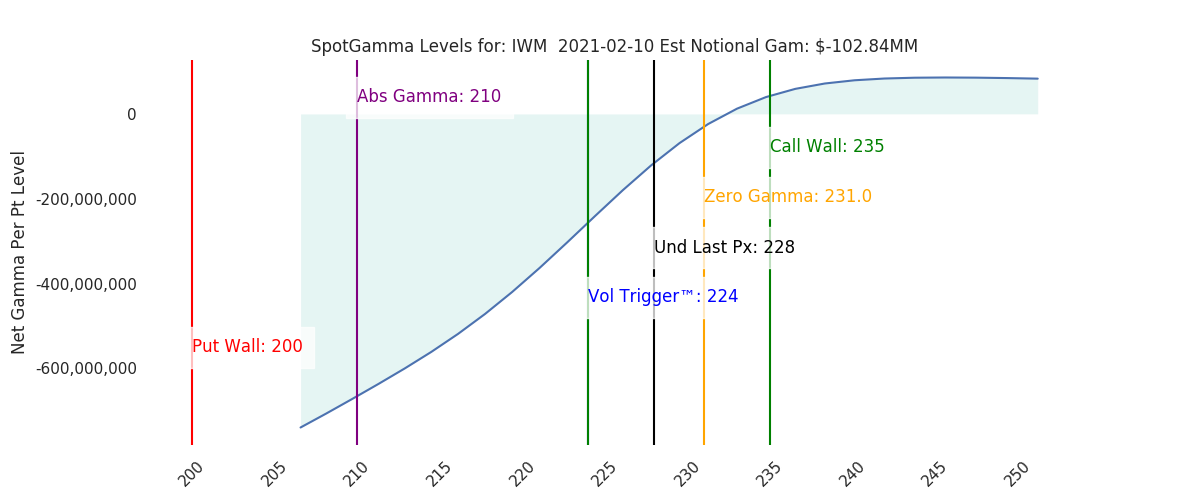

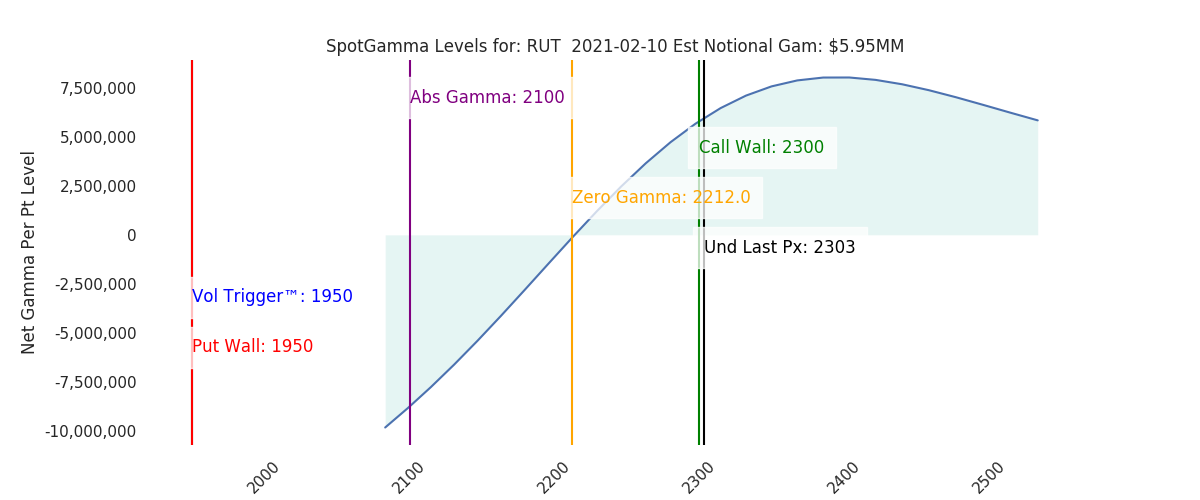

| Ref Price: | 3919 | 3909 | 391 | 13744 | 333 | ||

| VIX Ref: | 21.63 | 21.63 | |||||

| SG Gamma Index™: | 1.20 | 1.45 | 0.17 | 0.03 | 0.00 | ||

| Gamma Notional(MM): | $499 | $531 | $1,282 | $6 | $15 | ||

| SGI Imp. 1 Day Move: | 0.8%, | 31.0 pts | Range: 3888.0 | 3950.0 | ||||

| SGI Imp. 5 Day Move: | 3899 | 2.06% | Range: 3819.0 | 3979.0 | ||||

| Zero Gamma Level(ES Px): | 3851 | 3812 | — | 0 | |||

| Vol Trigger™(ES Px): | 3845 | 3820 | 389 | 12800 | 328 | ||

| SG Abs. Gamma Strike: | 3900 | 3900 | 390 | 12800 | 330 | ||

| Put Wall Support: | 3550 | 3550 | 388 | 11300 | 320 | ||

| Call Wall Strike: | 3900 | 3900 | 395 | 13950 | 335 | ||

| CP Gam Tilt: | 1.53 | 1.47 | 1.47 | 1.9 | 1.01 | ||

| Delta Neutral Px: | 3699 | ||||||

| Net Delta(MM): | $1,260,906 | $1,240,129 | $207,673 | $41,615 | $74,335 | ||

| 25D Risk Reversal | -0.08 | -0.08 | -0.07 | -0.07 | -0.07 | ||

| Top Absolute Gamma Strikes: SPX: [4000, 3900, 3850, 3800] SPY: [395, 390, 385, 380] QQQ: [330, 325, 320, 315] NDX:[13950, 13500, 13000, 12800] SPX Combo: [3907.0, 4009.0, 3958.0, 3934.0, 3966.0] NDX Combo: [14003.0, 13796.0, 13961.0] The Volatility Trigger has moved UP: 3845 from: 3820 SPX is above the Volatility Trigger™, resistance is: 3900 Support is: 3900 The total gamma has moved DOWN: $499MM from: $530.00MM Positive gamma is moderate which should lead to smaller market moves. Average Range on day is 1.5% |

0 comentarios