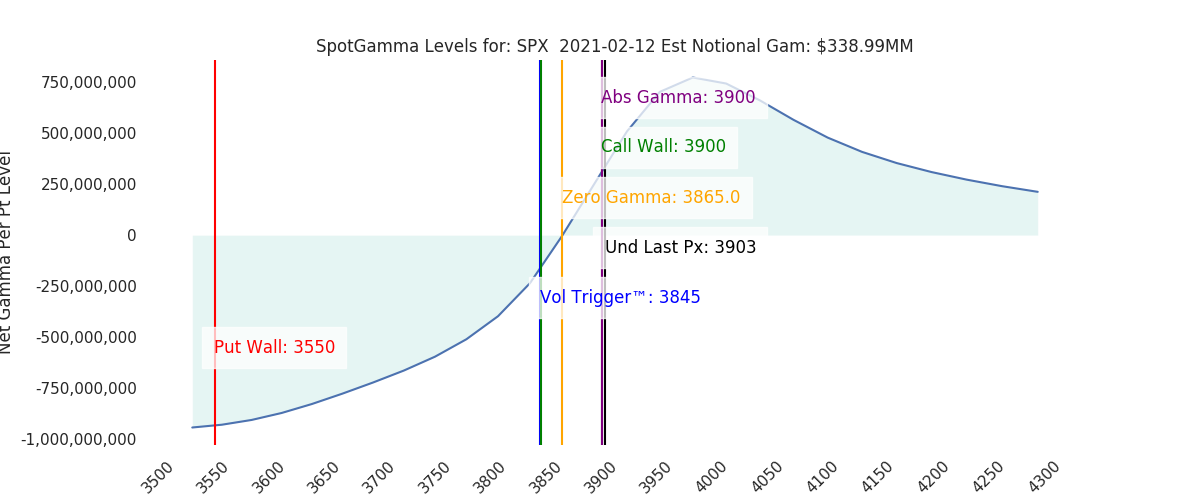

Futures are again flat, with major SG levels unchanged. Today’s expiration is fairly light, reinforcing that the bulk of SPX open interest (and the 3900 pin) holds into late next week. Once again we do not anticipate a move away from 3900 today, with these being the largest intraday levels: 3986, 3912 and 3936.

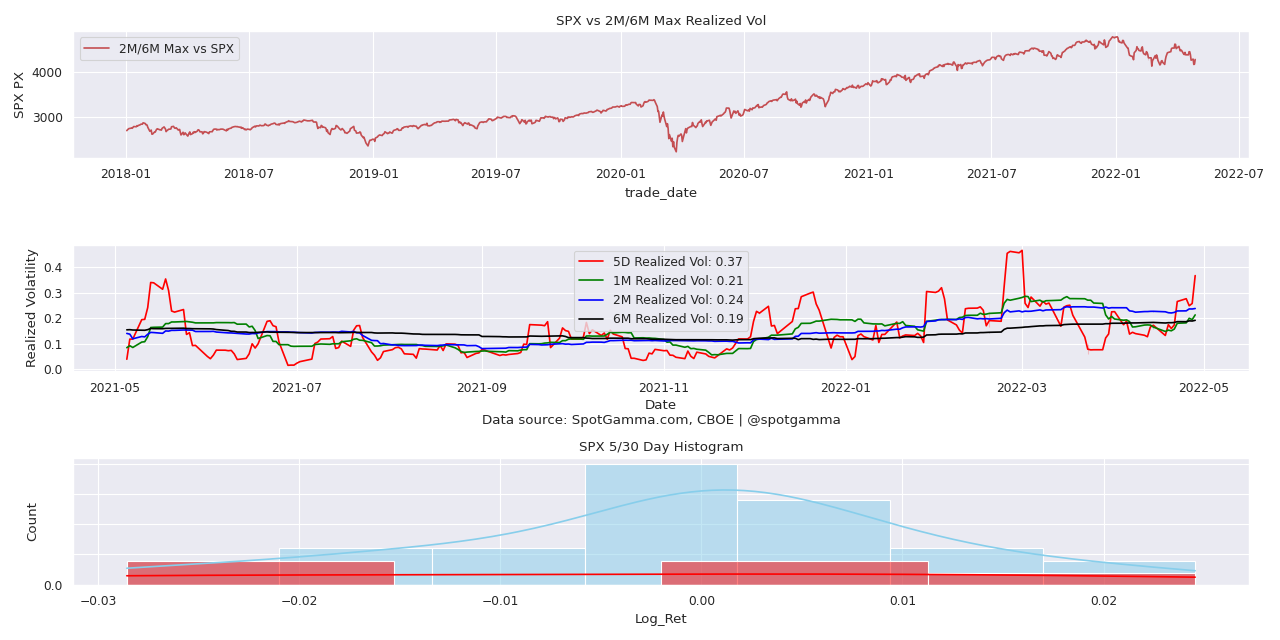

You can see that as a result of the 3900 pin realized volatility has tanked, and is essentially back to “pre-covid crash” levels.

Compare this to the VIX which is still ~10% above December lows, and well above “pre-covid crash” levels:

This seems to reinforce this new VIX/Implied Vol dynamic, and this idea that the “volatility of volatility” will be higher going forward. We will be watching this carefully into next week, as our models suggest lower volatility next week (OPEX week) and then the “pin” (aka a jump in “volatility of volatility”) is pulled into 2/22.

Macro Note:

3900-3950 into Feb OPEX

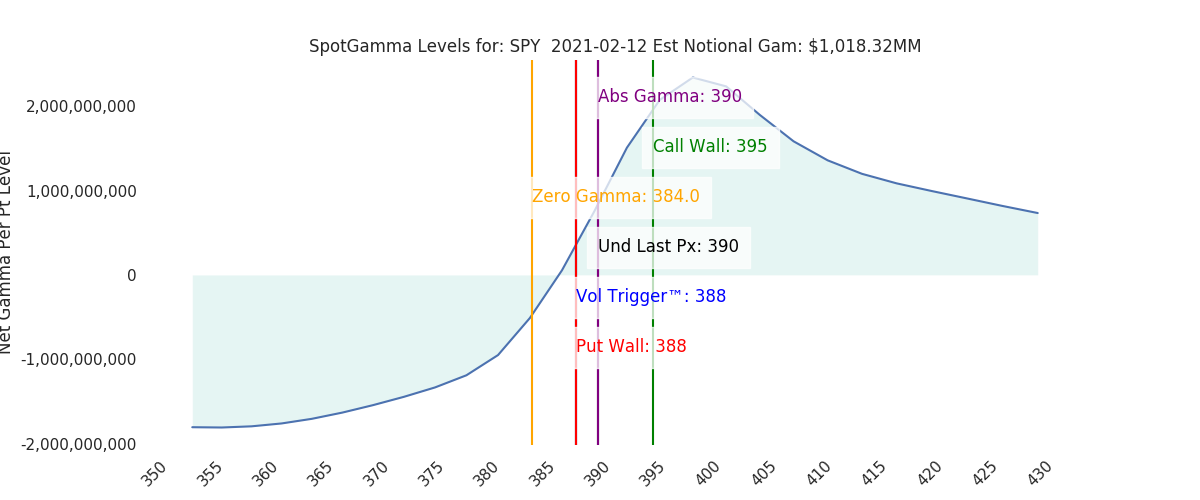

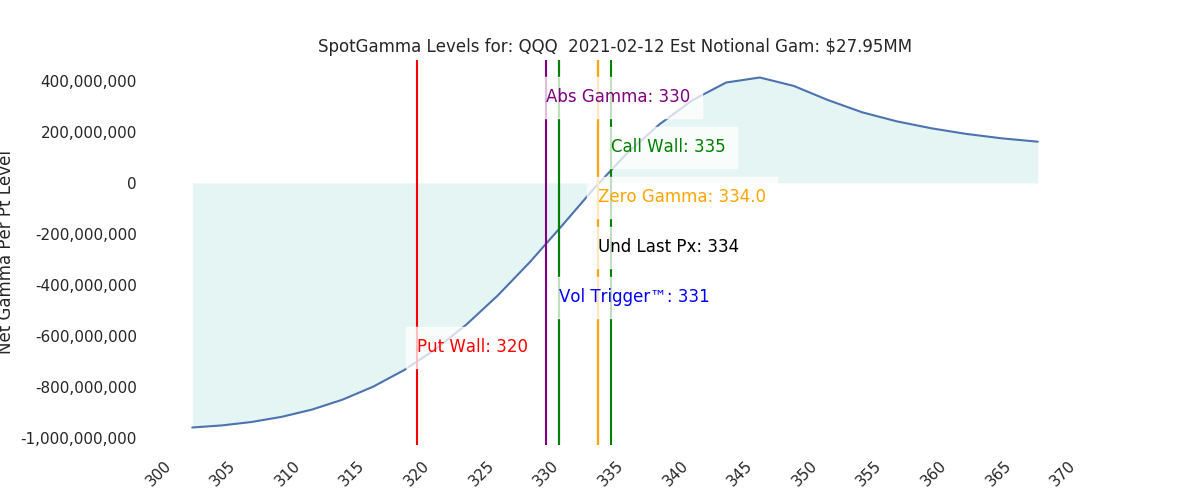

| Signal Name | Latest Data | Previous | SPY | NDX | QQQ | ||

|---|---|---|---|---|---|---|---|

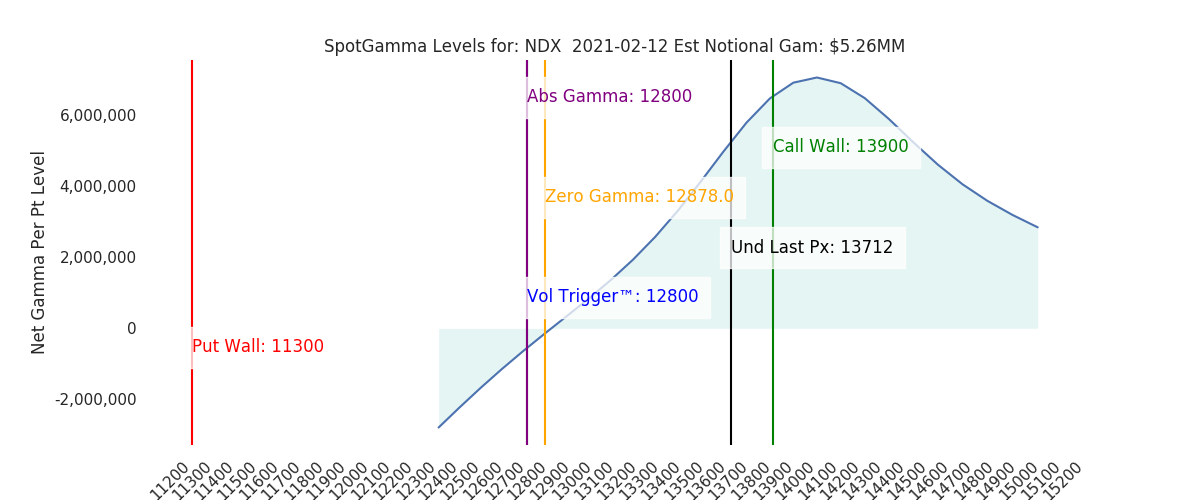

| Ref Price: | 3903 | 3907 | 390 | 13712 | 334 | ||

| VIX Ref: | 21.25 | 21.25 | |||||

| SG Gamma Index™: | 1.30 | 1.11 | 0.21 | 0.04 | 0.01 | ||

| Gamma Notional(MM): | $339 | $387 | $1,018 | $5 | $28 | ||

| SGI Imp. 1 Day Move: | 0.78%, | 30.0 pts | Range: 3873.0 | 3933.0 | ||||

| SGI Imp. 5 Day Move: | 3899 | 2.06% | Range: 3819.0 | 3979.0 | ||||

| Zero Gamma Level(ES Px): | 3865 | 3840 | — | 0 | |||

| Vol Trigger™(ES Px): | 3845 | 3820 | 388 | 12800 | 331 | ||

| SG Abs. Gamma Strike: | 3900 | 3900 | 390 | 12800 | 330 | ||

| Put Wall Support: | 3550 | 3700 | 388 | 11300 | 320 | ||

| Call Wall Strike: | 3900 | 4000 | 395 | 13950 | 335 | ||

| CP Gam Tilt: | 1.55 | 1.3 | 1.32 | 1.74 | 1.03 | ||

| Delta Neutral Px: | 3712 | ||||||

| Net Delta(MM): | $1,269,840 | $1,274,099 | $210,195 | $42,387 | $75,929 | ||

| 25D Risk Reversal | -0.09 | -0.08 | -0.07 | -0.08 | -0.08 | ||

| Top Absolute Gamma Strikes: SPX: [3925, 3900, 3850, 3800] SPY: [395, 390, 385, 380] QQQ: [335, 333, 330, 315] NDX:[13950, 13500, 12800, 12500] SPX Combo: [3888.0, 3986.0, 3939.0, 3912.0, 3947.0] NDX Combo: [13722.0, 13928.0, 13763.0, 13804.0] The Volatility Trigger has moved UP: 3845 from: 3820 The PutWall has moved to: 3550 from: 3700 The Call Wall has moved to: 3900 from: 4000 SPX is above the Volatility Trigger™, resistance is: 3900 Support is: 3900 The total gamma has moved DOWN: $339MM from: $387.00MM Positive gamma is moderate which should lead to smaller market moves. Average Range on day is 1.5% |

0 comentarios