Futures are holding near 3900 after overnight lows of 3870. 3900 is the largest gamma level (pinning area) and a large combo strike support at 3885. Our negative gamma flip point is at 3850. While SPY/SPX hold a moderate positive gamma position, QQQ remains negative and so we look for continued tech volatility.

We mentioned that there would be some hedging resistance over 3900 and it appears that was enough to hold markets in place. There is also less implied volatility/vanna fuel here due to the market recovery yesterday.

Bulls have a weak case until and unless the SPX can hold and base over 3900. Its not until 3950 that positive gamma and strong “mean reverting” dealer flows kick in.

A one day measure of intraday volatility is shown below. Its quite interesting to note the amount of volatility seen in markets, but little directional movement being made. We think this is likely a reflection of high leverage and poor liquidity, and so smaller position shifts can cause violent moves. We’ve remarked in the past that hedging flows remain light, and equity call buyers continue to push on. If this paradigm shifts even slightly it could cause some major turbulence.

Macro Note:

March range 3900-4000

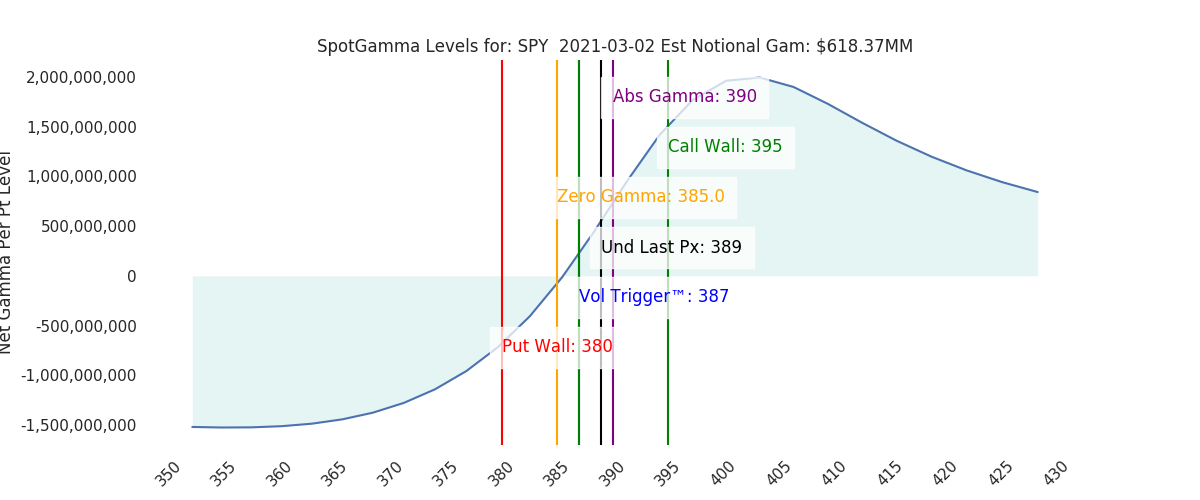

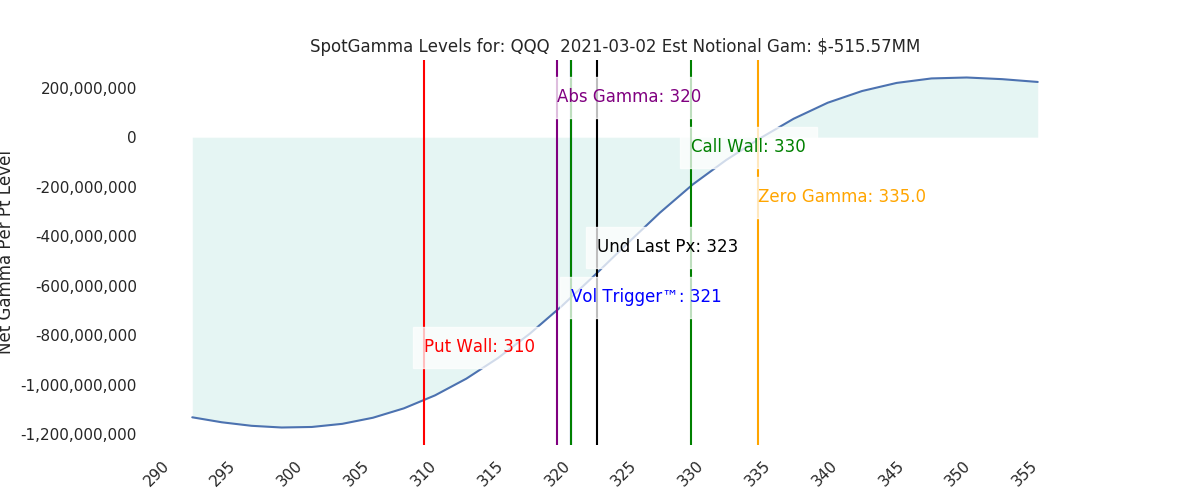

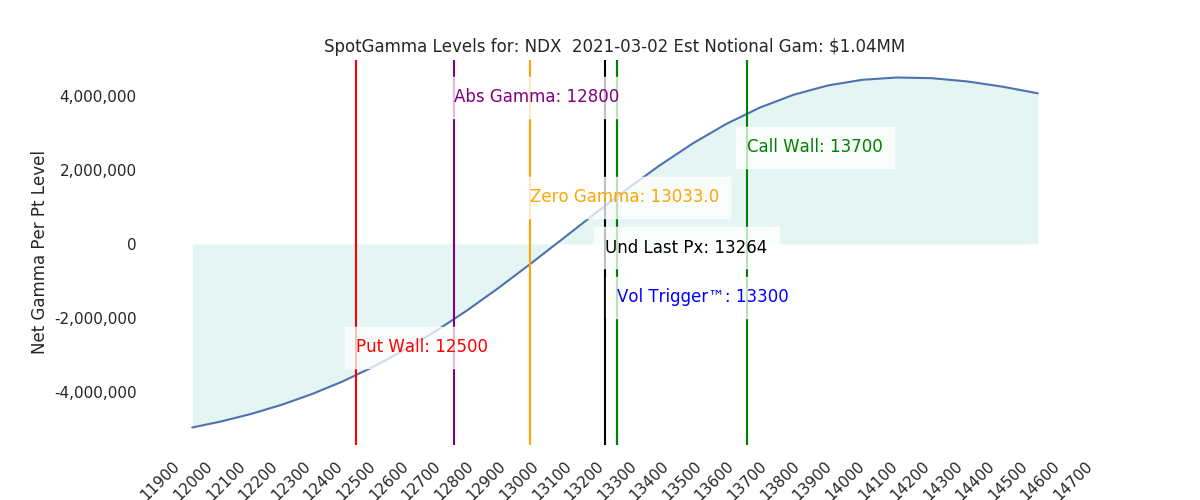

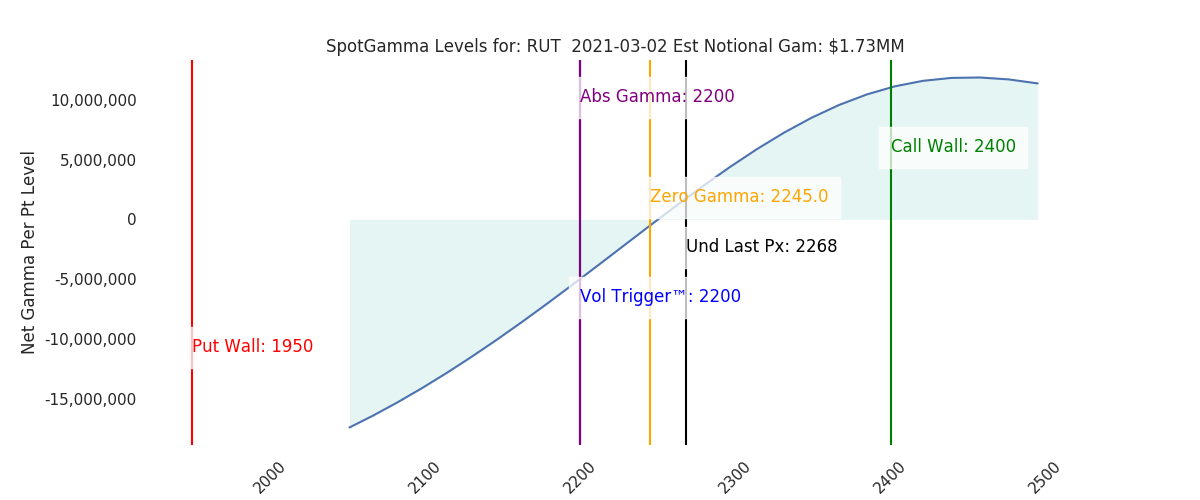

| Signal Name | Latest Data | Previous | SPY | NDX | QQQ | ||

|---|---|---|---|---|---|---|---|

| Ref Price: | 3896 | 3881 | 389 | 13264 | 323 | ||

| VIX Ref: | 22.88 | 23.35 | |||||

| SG Gamma Index™: | 0.61 | 0.60 | 0.11 | 0.01 | -0.08 | ||

| Gamma Notional(MM): | $144 | $52 | $618 | $1 | $-516 | ||

| SGI Imp. 1 Day Move: | 1.25%, | 49.0 pts | Range: 3847.0 | 3945.0 | ||||

| SGI Imp. 5 Day Move: | 3835 | 5.28% | Range: 3633.0 | 4038.0 | ||||

| Zero Gamma Level(ES Px): | 3857 | 3860 | — | 0 | |||

| Vol Trigger™(ES Px): | 3855 | 3855 | 387 | 13300 | 321 | ||

| SG Abs. Gamma Strike: | 3900 | 3900 | 390 | 12800 | 320 | ||

| Put Wall Support: | 3700 | 3700 | 380 | 12500 | 310 | ||

| Call Wall Strike: | 4000 | 4000 | 395 | 13700 | 330 | ||

| CP Gam Tilt: | 1.22 | 1.03 | 1.22 | 1.1 | 0.64 | ||

| Delta Neutral Px: | 3733 | ||||||

| Net Delta(MM): | $1,258,533 | $1,253,768 | $203,341 | $38,420 | $77,457 | ||

| 25D Risk Reversal | -0.09 | -0.09 | -0.09 | -0.09 | -0.09 | ||

| Model Forecast: |

|---|

| Top Absolute Gamma Strikes: SPX: [4000, 3900, 3850, 3800] SPY: [400, 395, 390, 385] QQQ: [330, 320, 315, 310] NDX:[13700, 13000, 12800, 12500] SPX Combo: [3990.0, 3940.0, 3967.0, 3893.0, 3885.0] NDX Combo: [13120.0, 12908.0, 13532.0] SPX resistance is: 3900 .Reference ‘Intraday Support’ levels for support areas. The total gamma has moved has moved UP: $143MM from: $52.00MM Gamma is tilted towards Puts, may indicate puts are expensive Positive gamma is moderate which should lead to smaller market moves. Average Range on day is 1.5%       |

0 comentarios