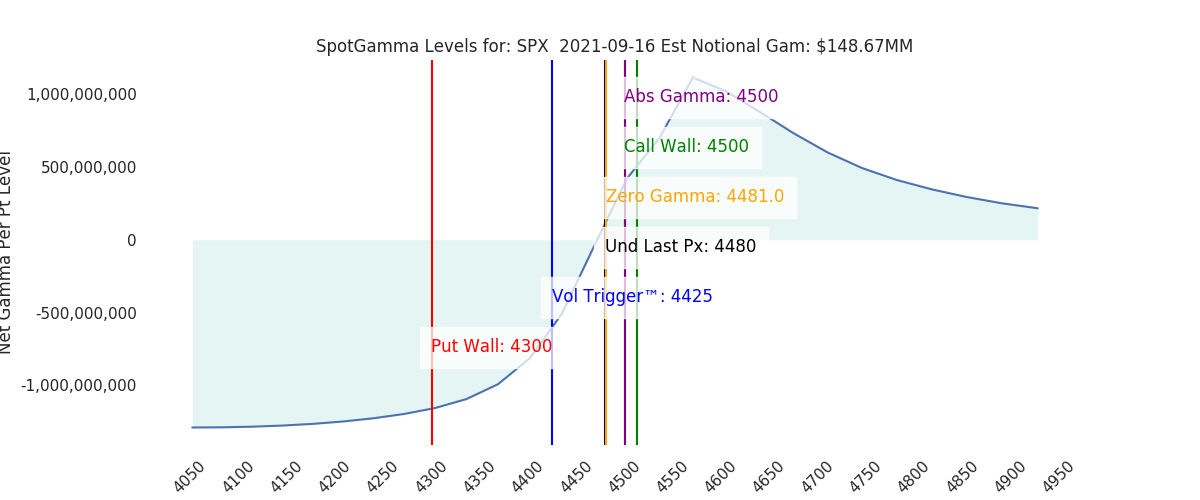

Little happening in futures overnight which are at 4466. There was a pretty decent shift in gamma with yesterdays 85bps market move, which means we forecast less volatility today (SG implied S&P500 move = 87bps). 4500 remains heavy resistance, with 4400 support. We see a major inflection point “fair value” as 4465-4475 (discussed below).

As we touched on in last nights note there was very heavy SPX volume yesterday (2mm contracts) and implied volatility was hit hard (VIX -1.5pts). This means volatility sellers were out in force, and they likely concentrated on 9/17 expiration contracts. Our view is that this stock pop higher likely creates something of an air pocket underneath.

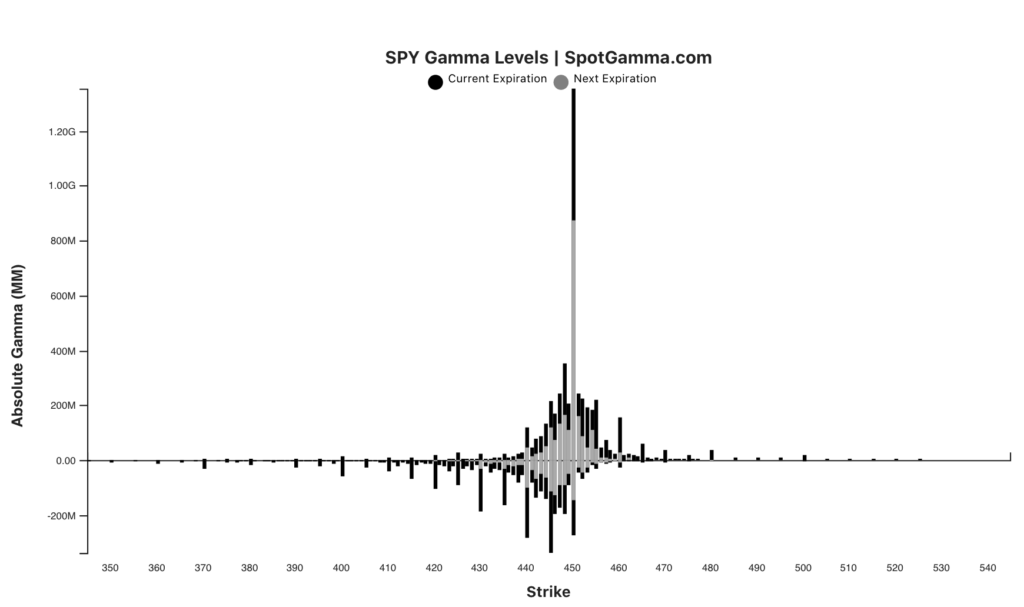

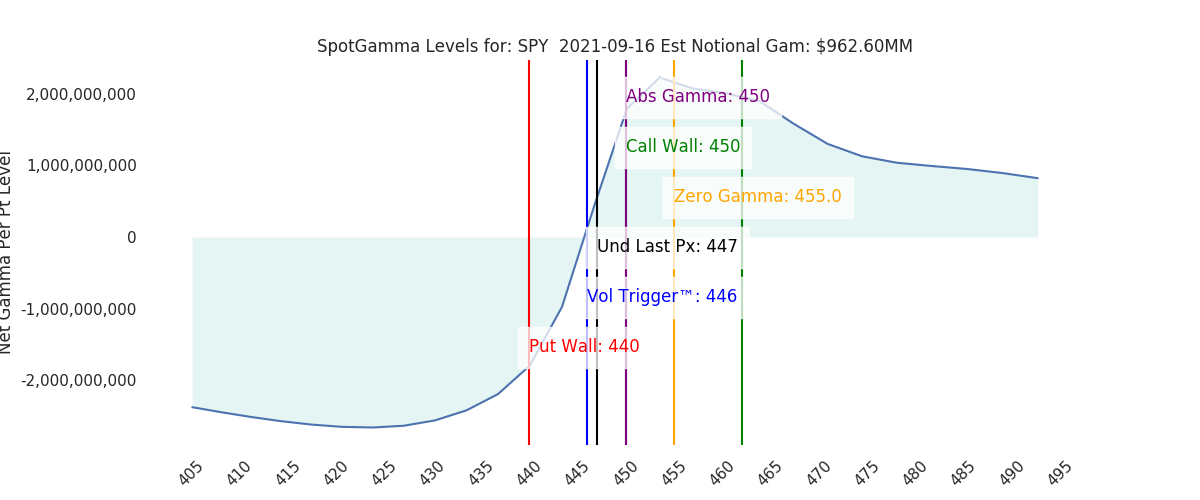

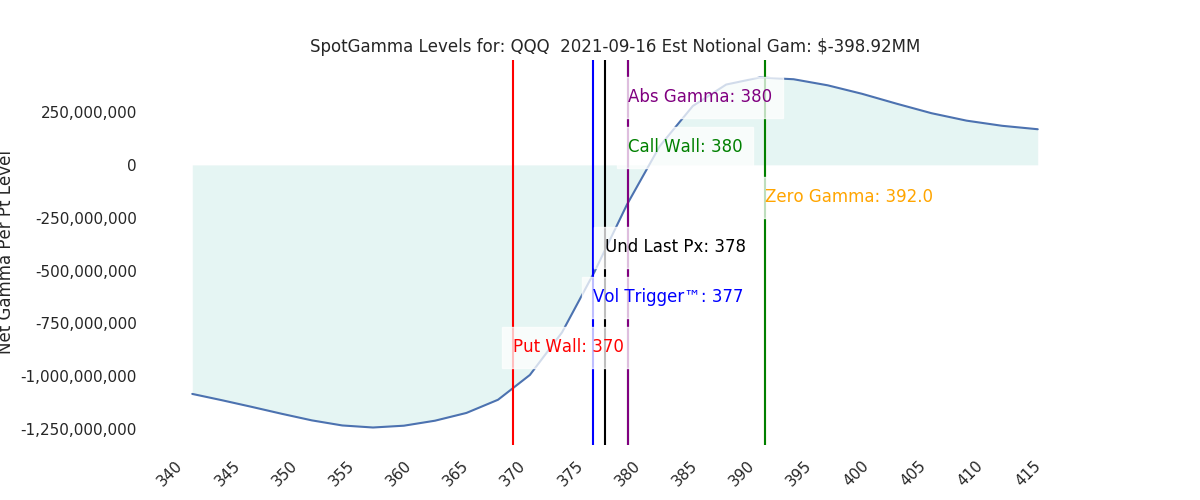

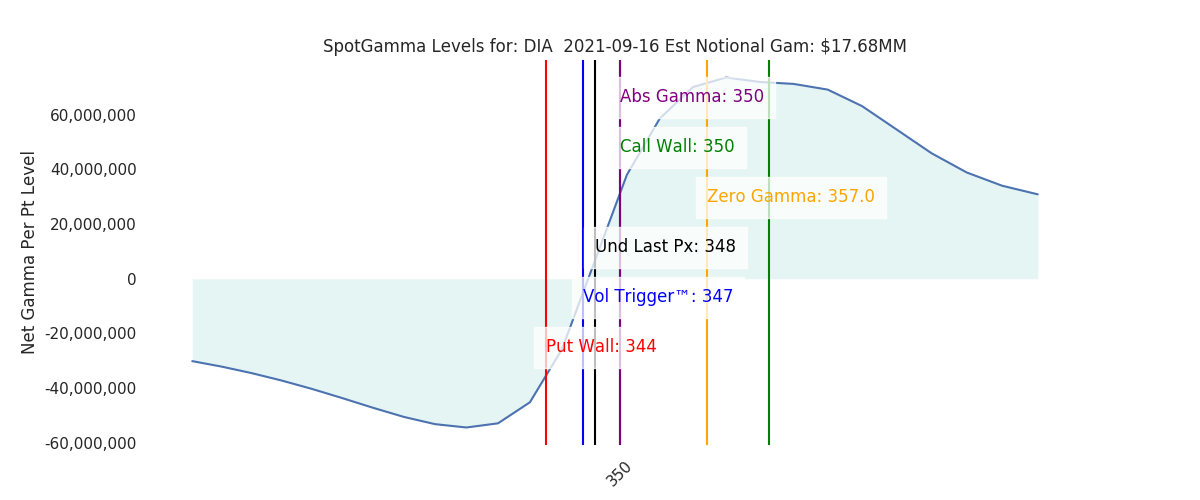

Backing this idea is the updated open interest figures, which now show 35% of SPX, 50% SPY, and 35% of QQQ gamma expiring tomorrow (vs ~20% y’day). Of particular note is this chart of SPY which depicts a massive gamma bar at 450, indicating large calls expiring tomorrow at that strike. We’re of the opinion those calls were sold yesterday, based on our negative HIRO (intraday options indicator) and the VIX/implied volatility crush. We can’t recall having seen such a single strike call concentration before.

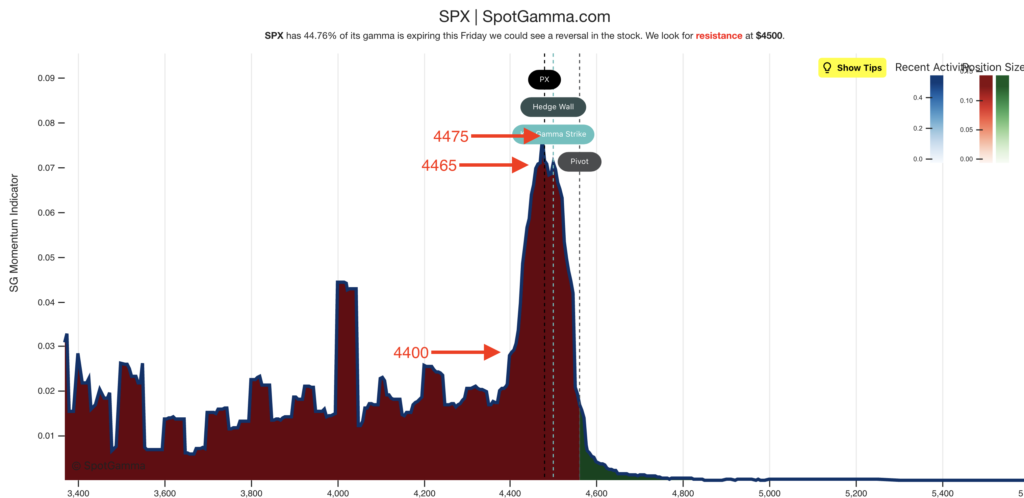

Regarding the 4465/75 “fair value”, this comes from our EquityHub model. Many of you may recall how this model showed 4440 as a key inflection point for some time. That was the major low for the markets in the last several days, and exactly where the market bounced yesterday.

As you can see below we now have 4465/75 as a “pin point” which a sharp drop in the SG Momentum down to 4400. What this essentially says is that we can anticipate high volatility on a break of 4465, with 4400 now the major support marker (detailed EquityHub talk here).

The bottom line is this: if we get a push up to 4500/450 then that could be very sticky due to large gamma at that line (ie limited upside). Beneath there we see high volatility, with the potential for major swings aka “no mans land”. Because of the large gamma expiring volatility should continue into Monday.

Model Overview:

4500 resistance & high volatility into 9/17 OPEX. OPEX opens a window of weakness into 9/22 FOMC.

| SpotGamma Proprietary Levels | Latest Data | Previous | SPY | NDX | QQQ |

|---|---|---|---|---|---|

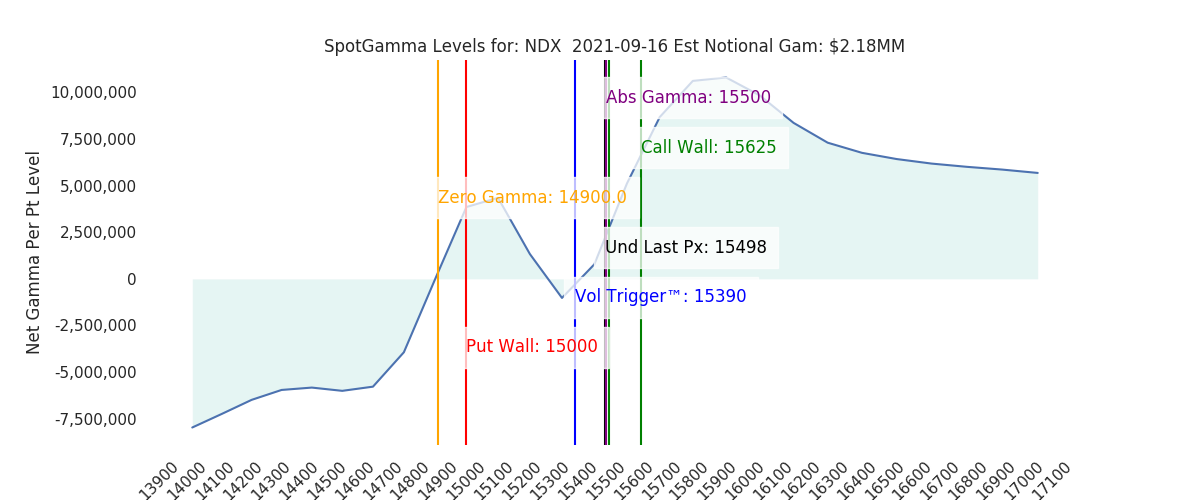

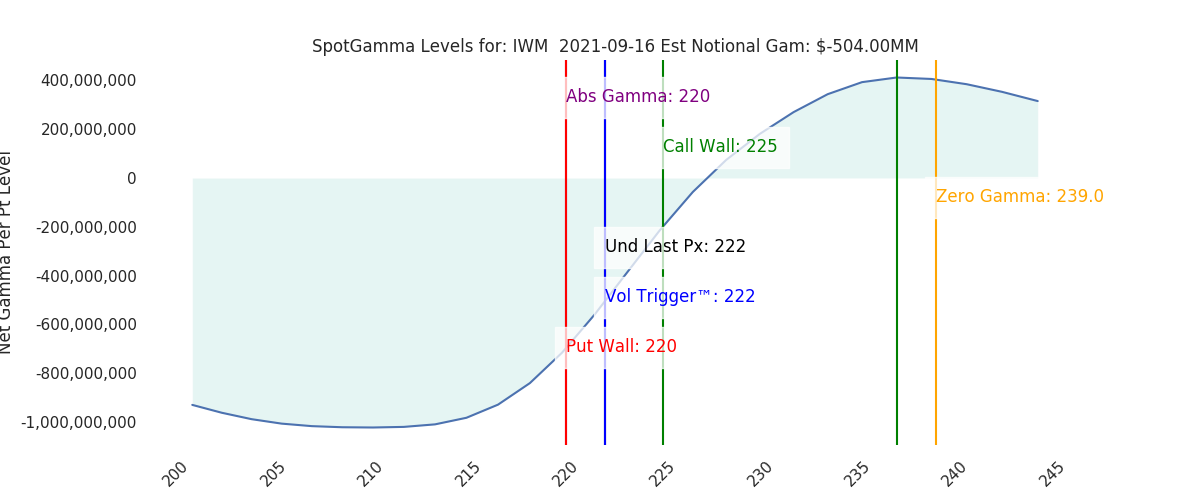

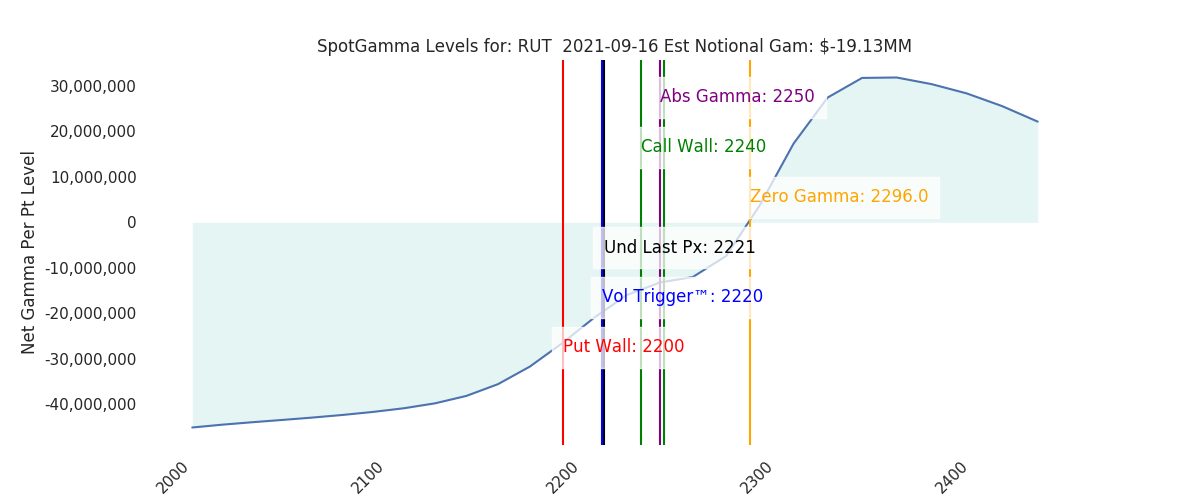

| Ref Price: | 4480 | 4484 | 447 | 15498 | 378 |

| SpotGamma Imp. 1 Day Move: | 0.87%, | 39.0 pts | Range: 4441.0 | 4519.0 | ||

| SpotGamma Imp. 5 Day Move: | 4.55% | 4472 (Monday Ref Px) | Range: 4269.0 | 4676.0 | ||

| SpotGamma Gamma Index™: | 0.79 | -0.31 | 0.22 | 0.03 | -0.07 |

| Volatility Trigger™: | 4425 | 4465 | 446 | 15390 | 377 |

| SpotGamma Absolute Gamma Strike: | 4500 | 4400 | 450 | 15500 | 380 |

| Gamma Notional(MM): | $149 | $356 | $963 | $2 | $-399 |

| Additional Key Levels | Latest Data | Previous | SPY | NDX | QQQ |

|---|---|---|---|---|---|

| Zero Gamma Level: | 4481 | 4451 | 0 | 0 | 0 |

| Put Wall Support: | 4300 | 4400 | 440 | 15000 | 370 |

| Call Wall Strike: | 4500 | 4500 | 450 | 15625 | 380 |

| CP Gam Tilt: | 1.16 | 1.15 | 1.23 | 1.12 | 0.8 |

| Delta Neutral Px: | 4325 | ||||

| Net Delta(MM): | $1,728,021 | $1,665,805 | $211,049 | $56,341 | $99,222 |

| 25D Risk Reversal | -0.06 | -0.06 | -0.08 | -0.07 | -0.08 |

| Top Absolute Gamma Strikes: |

|---|

| SPX: [4525, 4500, 4475, 4450] |

| SPY: [450, 448, 447, 445] |

| QQQ: [380, 378, 375, 370] |

| NDX:[15625, 15600, 15575, 15500] |

| SPX Combo: [4500.0, 4495.0, 4522.0, 4545.0, 4598.0] |

| SPY Combo: [450.12, 449.67, 452.36, 454.6, 459.97] |

| NDX Combo: [15556.0, 15153.0, 15757.0, 15633.0, 15602.0] |

0 comentarios