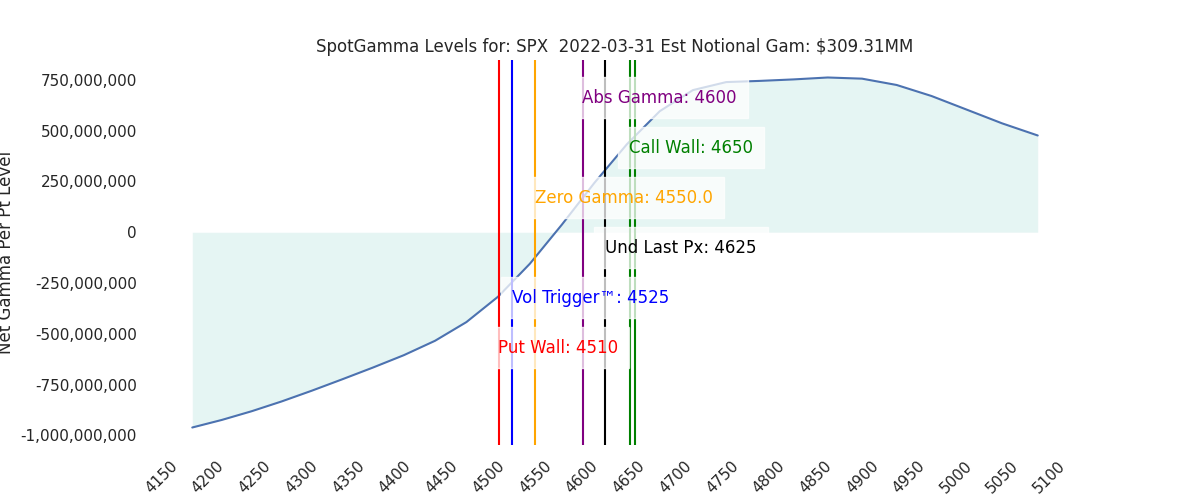

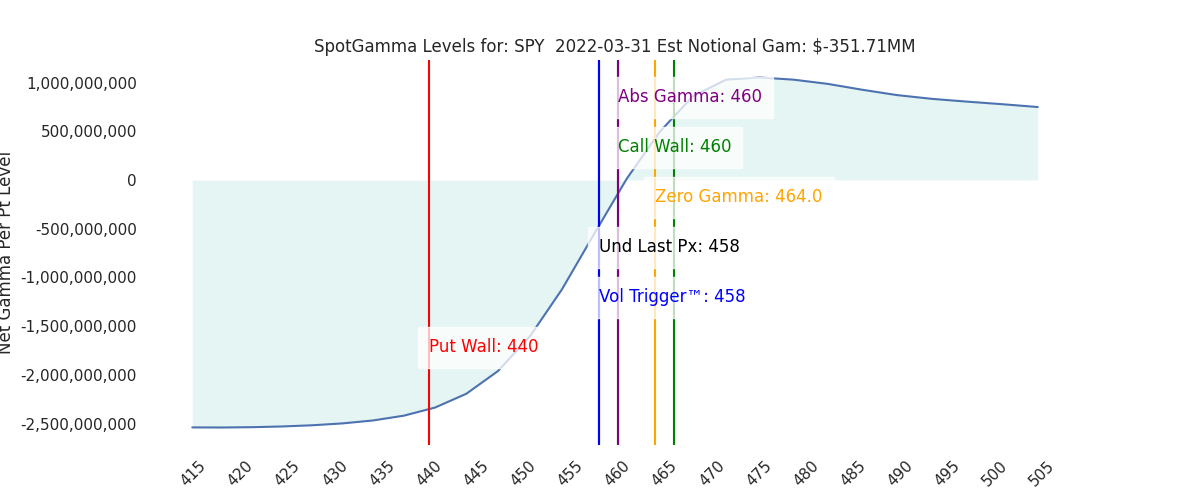

Futures were quiet overnight, holding near 4610. Our volatility estimate remains at 0.6% with little change in net gamma. 460SPY/4600SPX remain the key level(s) today, which should function as a support zone. Critically, the SPX Call Wall has shifted to 4650 (from 4600) which is the new top end of our range. In addition to strong 4600 support, there is light support at 4575.

The main focus for today will likely be around the JPM collar trade which should lead to some large SPX prints. We don’t anticipate any net market impact today as hedgers position to mitigate impact. Look for some large SPX prints in the morning, and then another set of large SPX prints later in the afternoon as they adjust strikes.

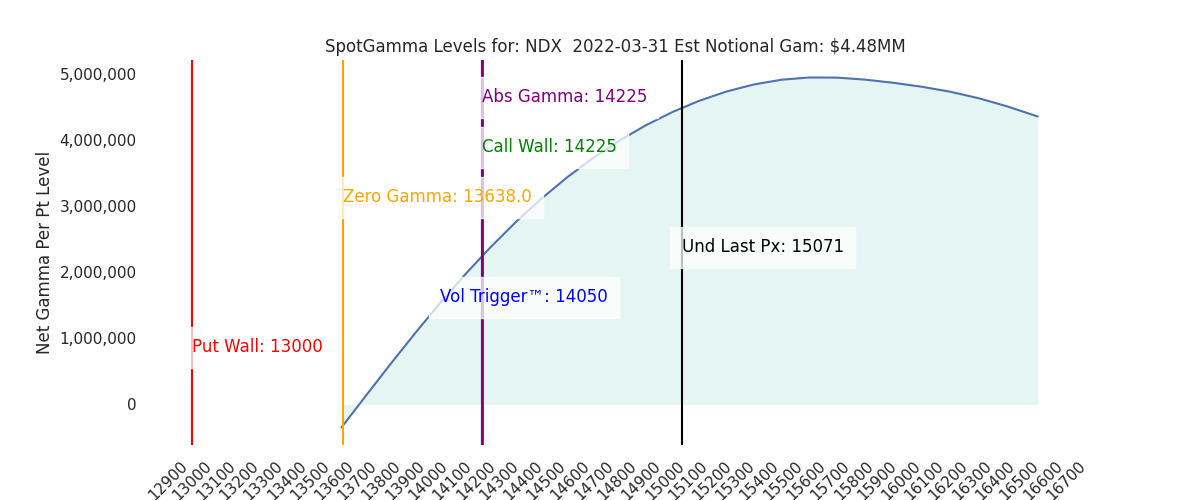

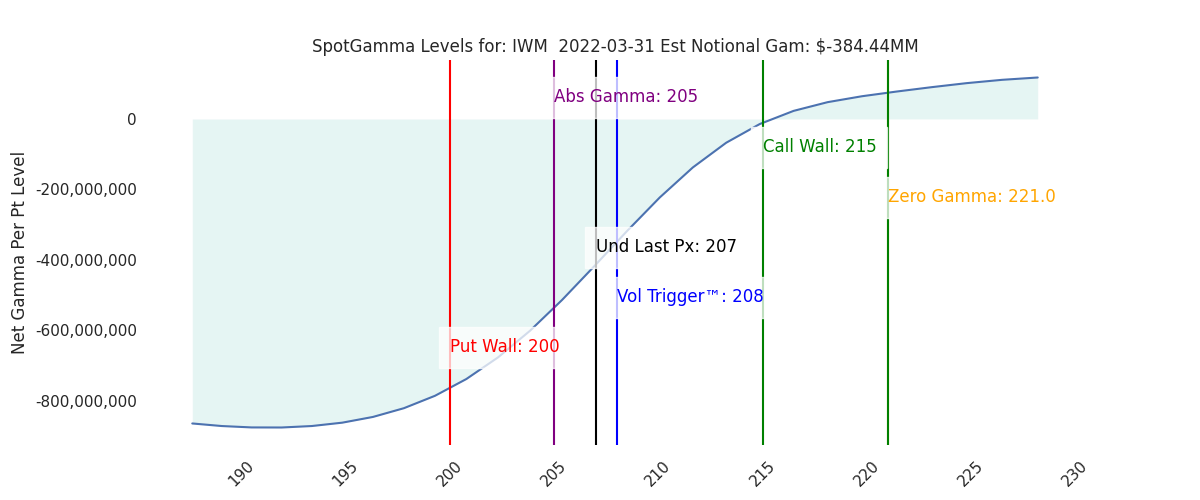

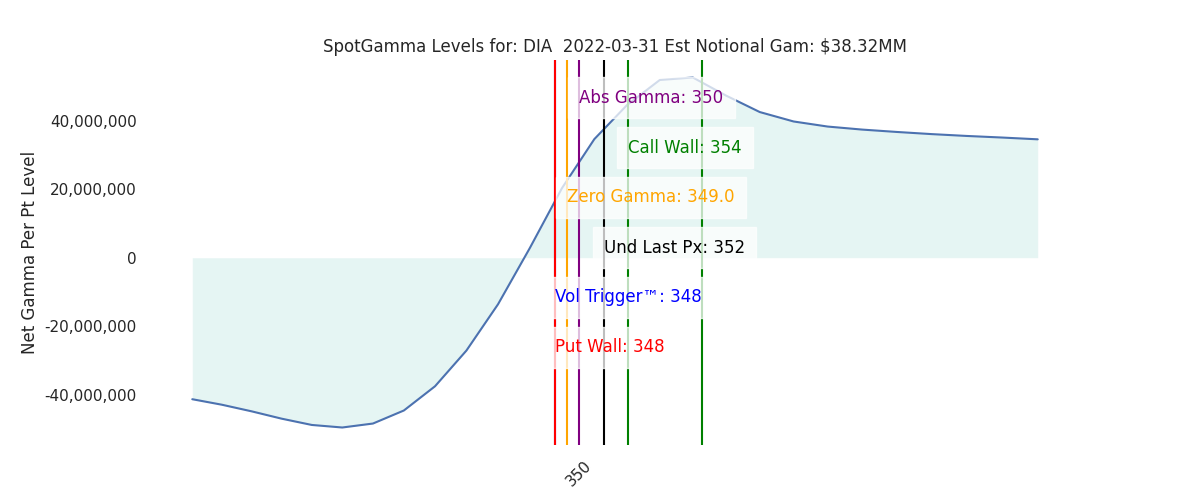

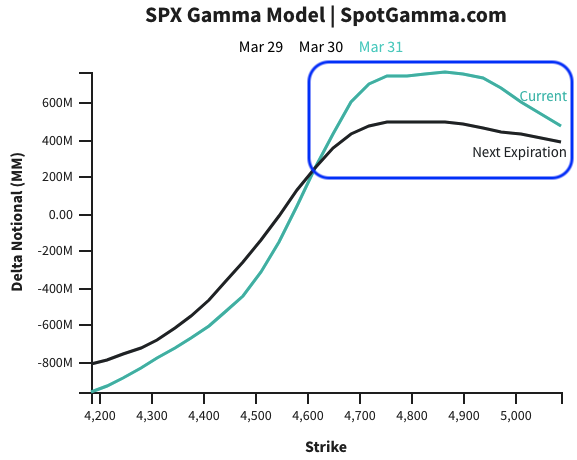

More interestingly these new JPM positions should shift the gamma profile going forward. As you can see below, today’s expiration will roll off a great deal of gamma overhead, which in theory allows for more market movement into next week.

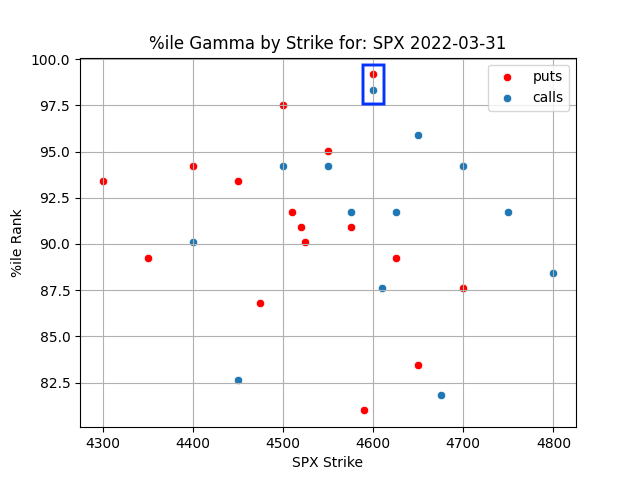

Placed in a more historical context, these SPX gamma levels are unimpressive. Shown below is the percentile rank (vs 1 year of data), and you can see the put & call strikes at 4600 are the largest, but the size around that remains small. The point here is that this expiration is going to net reduce the (already small) gamma & therefore drain the hedging flows pinning the market to this area.

While is tough to assign a directional edge here, we do think that the market makes a move over the next few days. As you can see below the market has been tied to 4600 over the last few sessions, which syncs with our tight daily volatility estimates of ~0.6%. Coming off of today’s expiration we should have expanded volatility and a wider trading range. 4650 makes sense if you are a bull and 4525 is the downside support area.

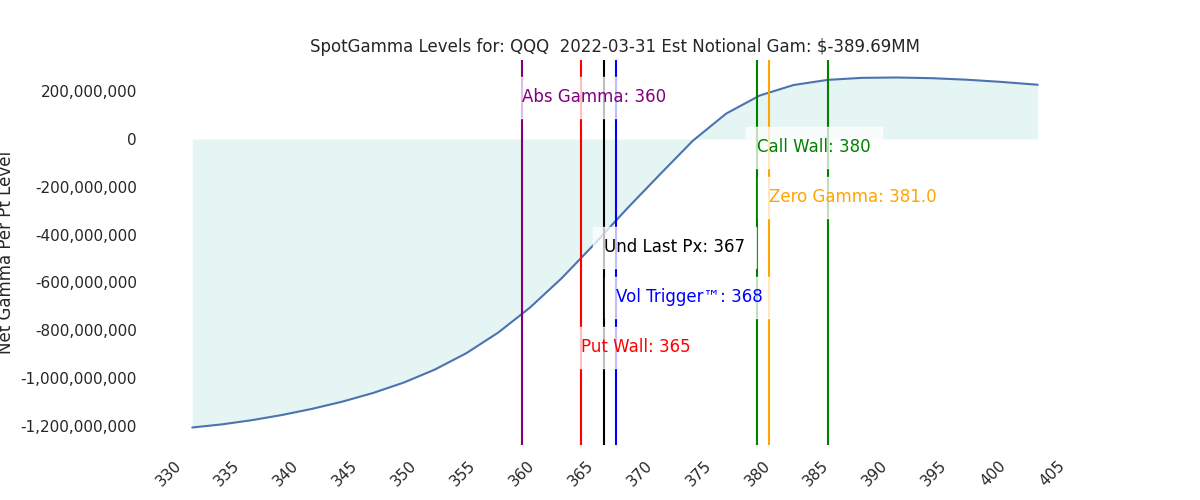

| SpotGamma Proprietary Levels | Latest Data | Previous | SPY | NDX | QQQ |

|---|---|---|---|---|---|

| Ref Price: | 4625 | 4625 | 458 | 15071 | 367 |

| SpotGamma Imp. 1 Day Move: Est 1 StdDev Open to Close Range |

0.61%, | (±pts): 28.0 | VIX 1 Day Impl. Move:1.23% | ||

| SpotGamma Imp. 5 Day Move: | 2.26% | 4543 (Monday Ref Px) | Range: 4440.0 | 4646.0 | ||

| SpotGamma Gamma Index™: | 0.80 | 0.8 | -0.05 | 0.04 | -0.07 |

| Volatility Trigger™: | 4525 | 4525 | 458 | 14050 | 368 |

| SpotGamma Absolute Gamma Strike: | 4600 | 4600 | 460 | 14225 | 360 |

| Gamma Notional(MM): | 309.0 | 309.30 | -352.0 | 4.0 | -390.0 |

| Additional Key Levels | Latest Data | Previous | SPY | NDX | QQQ |

|---|---|---|---|---|---|

| Zero Gamma Level: | 4550 | 4550 | 0 | 0 | 0 |

| Put Wall Support: | 4510 | 4510 | 440 | 13000 | 365 |

| Call Wall Strike: | 4650 | 4600 | 460 | 14225 | 380 |

| CP Gam Tilt: | 1.28 | 1.24 | 0.89 | 1.6 | 0.75 |

| Delta Neutral Px: | 4465 | ||||

| Net Delta(MM): | $1,435,642 | $1,435,642 | $169,914 | $45,596 | $101,583 |

| 25D Risk Reversal | -0.07 | -0.07 | -0.06 | -0.01 | -0.06 |

| Key Support & Resistance Strikes: |

|---|

| SPX: [4650, 4600, 4550, 4500] |

| SPY: [462, 460, 455, 450] |

| QQQ: [370, 365, 360, 350] |

| NDX:[16000, 15500, 15000, 14225] |

| SPX Combo (strike, %ile): [4677.0, 4626.0, 4727.0, 4653.0, 4538.0] |

| SPY Combo: [463.29, 458.24, 468.33, 460.99, 449.53] |

| NDX Combo: [14981.0, 15403.0] |