Futures were steady overnight, and are currently near 4440. Fridays expiration brought a substantial reduction in negative gamma, which suggests a reduction in market volatility (SG est 0.82% SPX move for today). For today we see support at 4400 with resistance at 4471.

With expiration comes the release of “max puts”. You can see below in the Delta Tilt readings that we’re now up off of the recent put-heavy readings. We’ve felt for some time that large put values were a signal that the market was well hedged, which in turned supported equities.

Further, despite the major bounce in equities the large gamma strikes are still predominantly put positions. Below is a percentile rank by strike for SPY gamma, and you can see that puts still rank highest. Its above 440SPY/4400SPX wherein the gamma at call strikes starts to increase, but those call positions need to increase markedly to offer market support. Data from last week suggests that call buying was rather anemic.

One of the other things on our radar is implied volatility[IV] (i.e. VIX). As you can see below the VIX has dropped sharply from highs, which implies the vanna trade was in full force during the recent rally. We now view IV as hitting a lower bound which suggests that vanna fuel is now reduced.

This view is based off of the fact that 1 month realized volatility is a high 25 (this may tether IV) and markets must retain some “event-vol” due to geopolitical unrest. Its unlikely you want large short put exposure before there is peace.

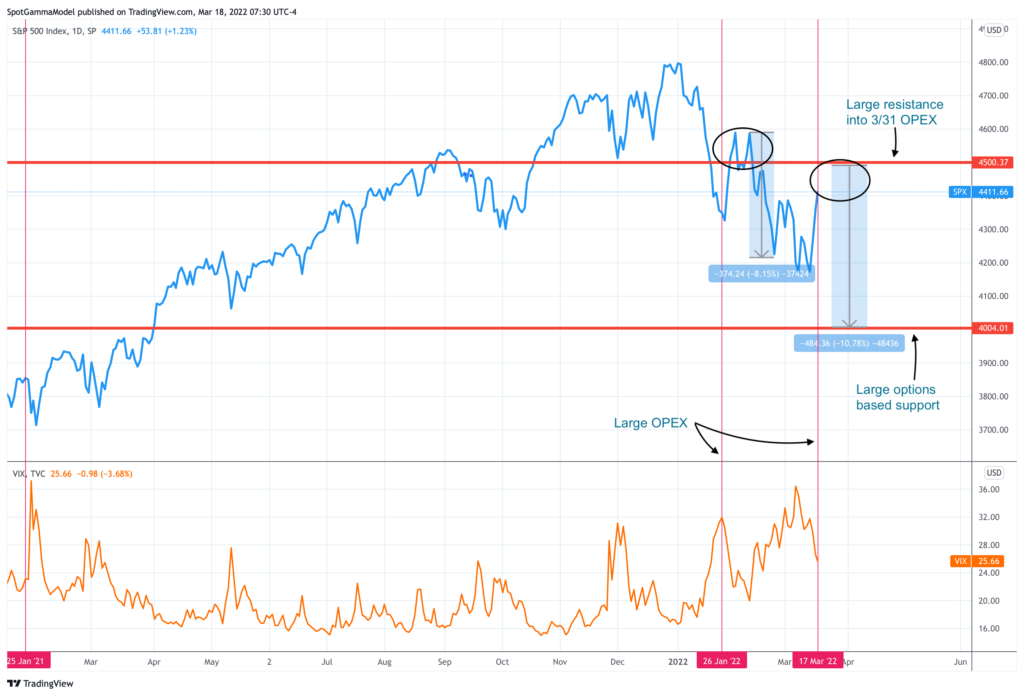

We are still watching the scenario laid out below, which we posted last week. The current market position seems to line up with that of January ’22. Both windows saw short rallies off of large options expirations and FOMC meetings.

As in late January, we think the fast short cover rally has now lost most of its fuel. 4500 remains a large overhead resistance point into 3/31 expiration. If the market holds 4400 we anticipate short dated options positions filling in, which can offer some support via volatility reduction.

However, a break of 4400 may bring new put buyers and a quick test of 4300 due to increasing negative gamma and spikes in IV. Because of the put reduction at expiration we believe that markets are now open to fresh ’22 lows.

| SpotGamma Proprietary Levels | Latest Data | Previous | SPY | NDX | QQQ |

|---|---|---|---|---|---|

| Ref Price: | 4438 | 4400 | 444 | 14333 | 351 |

| SpotGamma Imp. 1 Day Move: | 0.82%, | Est 1 StdDev Open to Close Range (±pts): 36.0 | |||

| SpotGamma Imp. 5 Day Move: | 2.26% | 4438 (Monday Ref Px) | Range: 4338.0 | 4539.0 | ||

| SpotGamma Gamma Index™: | 0.05 | 0.17 | -0.07 | 0.03 | -0.05 |

| Volatility Trigger™: | 4395 | 4380 | 440 | 14050 | 348 |

| SpotGamma Absolute Gamma Strike: | 4400 | 4400 | 440 | 14225 | 350 |

| Gamma Notional(MM): | $-143 | $-538 | $-385 | $3 | $-260 |

| Additional Key Levels | Latest Data | Previous | SPY | NDX | QQQ |

|---|---|---|---|---|---|

| Zero Gamma Level: | 4472 | 4468 | 0 | 0 | 0 |

| Put Wall Support: | 4100 | 4350 | 430 | 13000 | 320 |

| Call Wall Strike: | 4500 | 4400 | 450 | 14225 | 360 |

| CP Gam Tilt: | 1.02 | 0.79 | 0.83 | 1.51 | 0.79 |

| Delta Neutral Px: | 4416 | ||||

| Net Delta(MM): | $1,294,736 | $1,709,342 | $141,250 | $35,886 | $88,768 |

| 25D Risk Reversal | -0.06 | -0.08 | -0.06 | -0.07 | -0.08 |

| Key Support & Resistance Strikes: |

|---|

| SPX: [4500, 4450, 4400, 4300] |

| SPY: [450, 445, 440, 435] |

| QQQ: [350, 340, 330, 325] |

| NDX:[15000, 14500, 14225, 14000] |

| SPX Combo (strike, %ile): [(4520.0, 86.97), (4471.0, 92.21), (4449.0, 80.54), (4423.0, 88.48)] |

| SPY Combo: [448.08, 449.41, 443.19, 452.97, 445.85] |

| NDX Combo: [14134.0, 14679.0, 14478.0] |