Futures have pushed higher to 4015, and the VIX has dropped to 23. Key SG levels are unchanged, with 4000 serving as major resistance. 3950 is support. We believe yesterday’s rally, which has extended this AM, is related to tomorrows 9AM ET VIX expiration (see yesterdays note).

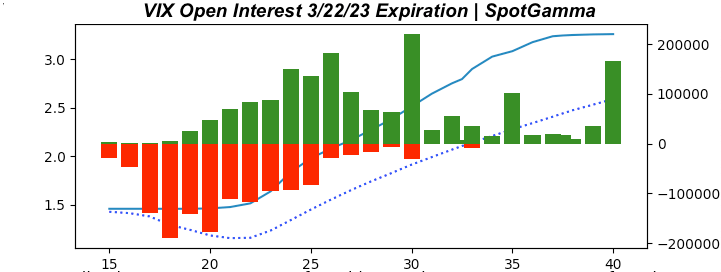

Here is the updated VIX open interest for 3/22, with the largest call interest holding >=24. We continue to think traders are incentivized to keep the VIX under this level into tomorrow AM’s OPEX.

Additionally, this rally has served to drag the VIX term structure into contango just ahead of tomorrows 2pm ET FOMC. One would generally not anticipate a vol crush heading into a large event, and we believe the move will start to lose steam (both in IV and ES) if markets push to 4000. This does not imply we see markets selling off sharply this afternoon – but more tight, rangebound trade.

Looking forward out of the FOMC, shown below is the implied probability distribution for SPX. This is derived from SPX options, and you can see that the distribution widens out due to FOMC. Normally you would anticipate seeing more of a bell shaped curve, but in this case there is a very long left tail, and traders seem to be pricing much lower odds of a move>4100. This syncs with our view that 4065 will be the resistance/pinning area into 3/31 OPEX.

Into that 4065 resistance, we are bullish of the SPX >4000. 3900-4000 is a neutral zone, and trade back below 3900 is bearish. The Put Wall remains at 3800, which is our maximum, interim low.

| SpotGamma Proprietary SPX Levels | Latest Data | SPX Previous | SPY | NDX | QQQ |

|---|---|---|---|---|---|

| Reference Price: | 3951 | 3952 | 393 | 12558 | 305 |

| SG Implied 1-Day Move: | 1.24%, | (±pts): 49.0 | VIX 1 Day Impl. Move:1.52% | ||

| SG Implied 5-Day Move: | 2.16% | 3916 (Monday Reference Price) | Range: 3832.0 | 4001.0 | ||

| SpotGamma Gamma Index™: | -0.59 | -0.98 | -0.30 | 0.02 | -0.01 |

| Volatility Trigger™: | 3955 | 3950 | 395 | 11975 | 304 |

| SpotGamma Absolute Gamma Strike: | 4000 | 4000 | 390 | 12525 | 300 |

| Gamma Notional (MM): | -305.0 | -280.0 | -1530.0 | 4.0 | -56.0 |

| Call Wall: | 4065 | 4065 | 402 | 12525 | 310 |

| Put Wall: | 3800 | 3800 | 390 | 11000 | 285 |

| Additional Key Levels | Latest Data | Previous | SPY | NDX | QQQ |

|---|---|---|---|---|---|

| Zero Gamma Level: | 4028 | 4029 | 405.0 | 11571.0 | 345 |

| Gamma Tilt: | 0.83 | 0.84 | 0.6 | 1.5 | 0.96 |

| Delta Neutral Px: | 3978 | ||||

| Net Delta (MM): | $1,200,751 | $1,245,333 | $178,091 | $41,524 | $93,817 |

| 25 Day Risk Reversal: | -0.06 | -0.06 | -0.06 | -0.06 | -0.06 |

| Call Volume: | 507,147 | 529,838 | 1,726,419 | 9,451 | 645,645 |

| Put Volume: | 929,982 | 1,040,418 | 2,652,934 | 7,199 | 894,516 |

| Call Open Interest: | 5,144,935 | 5,146,961 | 5,976,826 | 47,695 | 4,362,122 |

| Put Open Interest: | 9,909,172 | 9,759,522 | 12,351,110 | 50,498 | 7,638,319 |

| Key Support & Resistance Strikes: |

|---|

| SPX: [4100, 4000, 3950, 3900] |

| SPY: [400, 395, 390, 385] |

| QQQ: [310, 305, 300, 290] |

| NDX: [13000, 12525, 12000, 11000] |

| SPX Combo (Strike, Percentile): [(4102.0, 84.52), (4074.0, 83.61), (4066.0, 92.2), (4050.0, 84.71), (4031.0, 84.75), (4027.0, 80.85), (3952.0, 87.97), (3916.0, 86.11), (3900.0, 94.64), (3876.0, 77.4), (3865.0, 82.41), (3849.0, 94.49), (3825.0, 83.86), (3813.0, 83.14), (3801.0, 97.29), (3774.0, 83.51), (3766.0, 78.45)] |

| SPY Combo: [378.71, 388.55, 383.43, 405.09, 393.67] |

| NDX Combo: [12521.0, 12721.0, 13136.0, 12935.0] |