Macro Theme:

Key dates ahead:

- 1/21: VIX Exp, Trump Davos

- 1/22: GDP, PCE

- 1/28: FOMC

SG Summary:

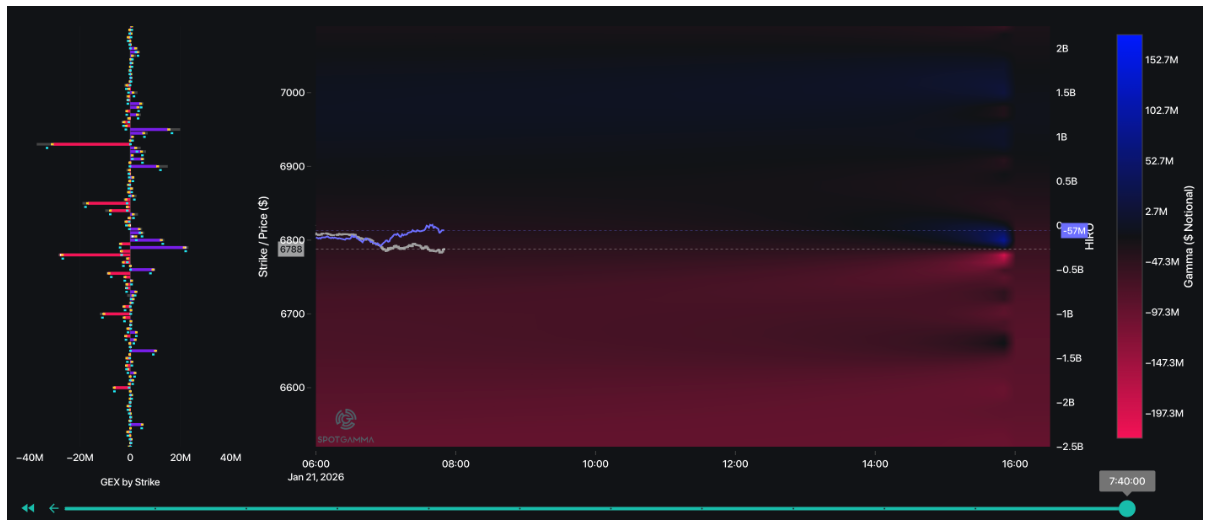

Update 1/20: Based on current positioning (1/20 AM), we eye 6,700 as a negative gamma “troughing” low. Until then, we are concerned that elevated volatility premium keeps markets unstable at least through 1/28 FOMC. Given this, we hold the Risk-Pivot at 6,890, but we actively look to shift that lower if the positioning and sentiment improves.

1/7: While we now look for a move to 7k in the coming days, with COR1M at ~8.3 we have elected to add a small number of Feb/March index puts. <6,900 we would increase short positions. See the 1/7 note for details.

Key SG levels for the SPX are:

- Resistance: 6,800, 6,900

- Pivot: 6,890 (bearish <, bullish >) UPDATED 12/26

- Support: 6,700

Founder’s Note:

Futures are flat after yesterday’s 2% rout. Trump’s Davos speech is at 8:30AM ET.

TLDR: At 6,800, we’re not interested in stocks. The renewed tariff situation is in play, and equity upside may be limited due to FOMC next week. FOMC likely prevents a full clearing of volatility premium (lower vols lift stocks). At 6,700 we’d start to get more interested in dip buying, with negative gamma likely subsiding <6,700. A test of 6,700 likely also syncs with VIX in the 25-30 area which is signal of pretty large vol premiums.

We see negative gamma across the board, with no material strike-driven support level below, however we do still mark 6,700 as a possible low due to the reduction of negative gamma. Before then, support is likely more driven by removal of event-risk – in this case the geopolitical/tariff rhetoric.

To the upside we eye 6,800 & 6,900 as resistance.

On the vol front, we yesterday AM marked a ~2 vol pt gain across the SPX surface. We see SPX term structure in backwardation, with ATM IV’s near 16%. 16% is nothing to write home about, and leaves room both for an “easy jump” in IV’s, as well as some contraction.

It’s likely that Trump’s 8:30 Davos speech drives short term price & vol movement. He could double down on rhetoric, which likely creates a sharp vol jump pushing those ATM IV’s to 20 & VIX 25. This would likely coincide with SPX to 6,700 for today. To the upside, 6,900 is the equilibrium point, and IV’s could contract 1-2 vol points, but we do not see much more than that due to FOMC next week.

On the single stock side, positions have obviously skewed towards puts (red box). You may recall that just a week ago top stocks were all skewing towards calls (dashed red box). The key thing to note here is that many of these names start reporting earnings in the next 1-2 weeks, and so their IV’s are likely to hold at relatively higher levels. This may allow for higher relative volatility, too.

©2025 TenTen Capital LLC DBA SpotGamma

All TenTen Capital LLC DBA SpotGamma materials, information, and presentations are for educational purposes only and should not be considered specific investment advice nor recommendations. Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. VIEW FULL RISK DISCLOSURE https://spotgamma.com/model-faq/disclaimer/

|

|

/ESH26 |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|---|

|

Reference Price: |

$6829.15 |

$6796 |

$677 |

$24987 |

$608 |

$2645 |

$262 |

|

SG Gamma Index™: |

|

-3.18 |

-0.694 |

|

|

|

|

|

SG Implied 1-Day Move: |

|

0.64% |

0.64% |

|

|

|

|

|

SG Implied 5-Day Move: |

|

1.48% |

|

|

|

|

|

|

SG Implied 1-Day Move High: |

|

$6863.09 |

$684.09 |

|

|

|

|

|

SG Implied 1-Day Move Low: |

|

$6775.81 |

$675.39 |

|

|

|

|

|

SG Volatility Trigger™: |

$6958.15 |

$6925 |

$685 |

$25130 |

$621 |

$2630 |

$264 |

|

Absolute Gamma Strike: |

$7033.15 |

$7000 |

$680 |

$25550 |

$600 |

$2600 |

$260 |

|

Call Wall: |

$7133.15 |

$7100 |

$695 |

$25550 |

$630 |

$2700 |

$270 |

|

Put Wall: |

$6833.15 |

$6800 |

$670 |

$24000 |

$600 |

$2600 |

$250 |

|

Zero Gamma Level: |

$6892.15 |

$6859 |

$686 |

$24924 |

$620 |

$2639 |

$266 |

|

Key Support & Resistance Strikes |

|---|

|

SPX Levels: [7000, 6000, 6900, 6800] |

|

SPY Levels: [680, 670, 685, 675] |

|

NDX Levels: [25550, 25000, 25200, 25500] |

|

QQQ Levels: [600, 610, 620, 615] |

|

SPX Combos: [(7123,71.73), (7103,95.48), (7076,71.43), (7048,91.34), (7028,81.64), (7001,91.79), (6974,74.82), (6953,88.34), (6899,89.24), (6872,67.72), (6851,94.17), (6838,90.78), (6831,74.85), (6824,94.05), (6817,82.53), (6810,81.13), (6797,99.35), (6790,93.44), (6783,96.71), (6776,92.19), (6770,92.65), (6763,94.73), (6756,76.61), (6749,96.72), (6742,87.60), (6736,70.47), (6729,83.28), (6722,98.30), (6715,70.38), (6709,69.85), (6702,98.92), (6695,68.14), (6688,84.92), (6681,67.38), (6675,84.52), (6668,92.57), (6647,95.86), (6641,73.61), (6627,86.73), (6620,82.73), (6600,95.45), (6573,88.27), (6552,86.08), (6518,86.54), (6498,95.79), (6477,89.71), (6471,69.79)] |

|

SPY Combos: [697.95, 687.57, 707.63, 717.31] |

|

NDX Combos: [24663, 25562, 24238, 24863] |

|

QQQ Combos: [621.88, 615.05, 620.02, 600.14] |

|

|

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Gamma Tilt: |

0.678 |

0.464 |

0.834 |

0.590 |

0.912 |

0.670 |

|

Gamma Notional (MM): |

‑$886.629M |

‑$1.821B |

‑$3.794M |

‑$641.323M |

‑$6.676M |

‑$333.665M |

|

25 Delta Risk Reversal: |

-0.071 |

0.00 |

-0.059 |

-0.059 |

-0.056 |

-0.041 |

|

Call Volume: |

703.346K |

1.948M |

12.984K |

963.492K |

23.878K |

315.112K |

|

Put Volume: |

1.14M |

2.866M |

12.412K |

1.326M |

39.701K |

822.933K |

|

Call Open Interest: |

6.742M |

4.523M |

51.367K |

3.015M |

216.791K |

2.553M |

|

Put Open Interest: |

11.335M |

10.333M |

88.632K |

4.819M |

388.66K |

6.083M |

0 comentarios