Futures are holding steady at 4010, which implies the SPX is set to open at the very large 4000 gamma strike. Key SG levels are largely unchanged, with 4000 now as our pivot and 4050 overhead resistance. Key levels below are 3950, then 3900. Our eyes continue to be on this possible liquidity hole <4k, wherein vanna + gamma serve to pull markets lower.

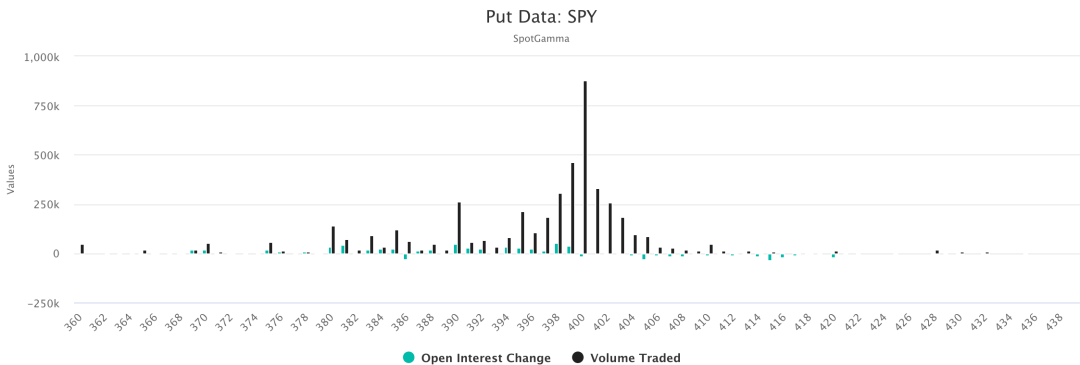

The volume yesterday at the 400SPY & 4000SPX put strikes was remarkable. There were over 800k SPY puts & 150k SPX puts traded at that strike, which led to a -17k SPY and +15k SPX change in OI at those levels. In other words – that strike was the main focus of 0DTE/daytraders in yesterdays session.

While there was a decent amount of open interest increases at longer dated expirations, implied volatility at longer dated expirations was fairly muted. This suggests that yesterdays selling was “controlled consolidation” ahead of key data points the next few days. When fear strikes (and/or if traders shift to a “higher for longer” rate view) we’d anticipate longer dated IV to initially shift materially higher as traders reset to lower equity valuations. Additionally, a break of 4000 here may draw hedging flows that pressure volatility higher.

Looking at IV through SPX term structure, it’s interesting to compare today vs 2/13 which was the day prior to the CPI print. Traders had a higher volatility expectation for the CPI print vs todays FOMC minutes, however term structure has elevated since last week. This makes sense as markets have lost the embrace of that pre-OPEX gamma, and are now ~3% lower.

However, we think that because of the loss of OPEX positioning, elevated IV (vanna is a bigger deal), and ATM gamma dynamics (i.e. gamma poised to drive vol) – the potential for volatility today is higher than for the 2/14 CPI. Despite this, we see that the 0DTE ATM straddle seems on the cheaper side at $32 (IV = 32%).

Having said the above, our view for today is that the SPX will make a strong push away from 4000 as traders digest the 2pm ET FOMC minutes. If the minutes prove benign, then we’d look for IV to come off rather sharply, which coincides with a relief rally to the 4050 area. We think upside is fairly limited as traders attention would immediately shift to Fridays data (GDP/Jobs/PCE), with a maximum upside of 4100 into Friday AM.

Conversely there could be more violent action to the downside. In yesterdays AM note we outlined our “bad dream” scenario for bulls, wherein step 1 was completed (a close at 4000). If the 4000 level breaks we may see a sharp rise in IV, which combines with negative gamma to likely bring a rapid test of 3950. Ultimately we would target the 3900 Put Wall into Friday, but a bad enough data print could invoke that test today.

| SpotGamma Proprietary SPX Levels | Latest Data | SPX Previous | SPY | NDX | QQQ |

|---|---|---|---|---|---|

| Ref Price: | 3997 | 4004 | 399 | 12060 | 294 |

| SG Implied 1-Day Move:: | 1.05%, | (±pts): 42.0 | VIX 1 Day Impl. Move:1.45% | ||

| SG Implied 5-Day Move: | 2.33% | 4078 (Monday Ref Price) | Range: 3984.0 | 4174.0 | ||

| SpotGamma Gamma Index™: | -0.93 | 0.08 | -0.45 | 0.03 | -0.02 |

| Volatility Trigger™: | 4025 | 4060 | 405 | 12050 | 300 |

| SpotGamma Absolute Gamma Strike: | 4000 | 4000 | 400 | 12300 | 285 |

| Gamma Notional(MM): | -637.0 | -750.0 | -2057.0 | 5.0 | -98.0 |

| Put Wall: | 3900 | 3900 | 400 | 11000 | 285 |

| Call Wall : | 4200 | 4200 | 420 | 12300 | 360 |

| Additional Key Levels | Latest Data | Previous | SPY | NDX | QQQ |

|---|---|---|---|---|---|

| Zero Gamma Level: | 4075 | 4082 | 410.0 | 11422.0 | 333 |

| CP Gam Tilt: | 0.8 | 0.69 | 0.53 | 1.42 | 0.59 |

| Delta Neutral Px: | 3994 | ||||

| Net Delta(MM): | $1,501,514 | $1,486,206 | $177,615 | $47,274 | $25,888 |

| 25D Risk Reversal | -0.06 | -0.06 | -0.06 | -0.05 | -0.06 |

| Call Volume | 622,223 | 488,122 | 2,064,924 | 7,321 | 675,890 |

| Put Volume | 936,007 | 1,047,966 | 3,079,999 | 8,167 | 1,172,657 |

| Call Open Interest | 5,819,999 | 5,689,357 | 5,982,211 | 60,687 | 1,051,281 |

| Put Open Interest | 10,554,339 | 10,524,412 | 12,138,452 | 57,286 | 2,070,351 |

| Key Support & Resistance Strikes: |

|---|

| SPX: [4100, 4000, 3950, 3900] |

| SPY: [405, 400, 395, 390] |

| QQQ: [300, 290, 285, 280] |

| NDX:[13000, 12300, 12000, 11500] |

| SPX Combo (strike, %ile): [(4173.0, 79.37), (4149.0, 87.13), (4101.0, 83.74), (4065.0, 88.41), (4005.0, 90.79), (4001.0, 93.57), (3973.0, 86.89), (3961.0, 76.32), (3957.0, 85.66), (3949.0, 96.63), (3945.0, 76.62), (3929.0, 78.4), (3925.0, 91.07), (3905.0, 89.54), (3901.0, 96.92), (3873.0, 79.73), (3849.0, 89.36), (3825.0, 76.6), (3801.0, 95.03)] |

| SPY Combo: [389.51, 394.3, 379.53, 399.49, 391.91] |

| NDX Combo: [12302.0] |