Macro Theme:

Key dates ahead:

- 1/28: FOMC. Earnings: META, TSLA, MSFT, LRCX

- 1/29: Jobless Claims. Earnings: AAPL, SNDK

- 1/30: PPI

SG Summary:

Update 1/23: It seems likely that SPX is now stuck back in its 6,900-6,950 box – likely until 1/28 FOMC. Having said that, some of our risk metrics are signaling “troubles ahead”, and so we will likely look to add some VIX call spreads and/or SPX put spreads into Monday or Tuesday of next week.

1/20: Based on current positioning (1/20 AM), we eye 6,700 as a negative gamma “troughing” low. Until then, we are concerned that elevated volatility premium keeps markets unstable at least through 1/28 FOMC. Given this, we hold the Risk-Pivot at 6,890, but we actively look to shift that lower if the positioning and sentiment improves.

Key SG levels for the SPX are:

- Resistance: 6,920, 6,950

- Pivot: 6,890 (bearish <, bullish >) UPDATED 12/26

- Support: 6,800, 6,700

Founder’s Note:

Futures are flat after having tested our Risk Pivot of 6,890.

TLDR: We remain favoring longs while the SPX is >6,890. That being said, COR1M flagged a risk signal on Thursday/Friday (see here), and so we will look to add some lotto SPX puts and/or VIX call spreads today & tomorrow. For the upside, 6,950 is the major level into FOMC on 1/28. We think another upside leg in equities is unlikely until after FOMC.

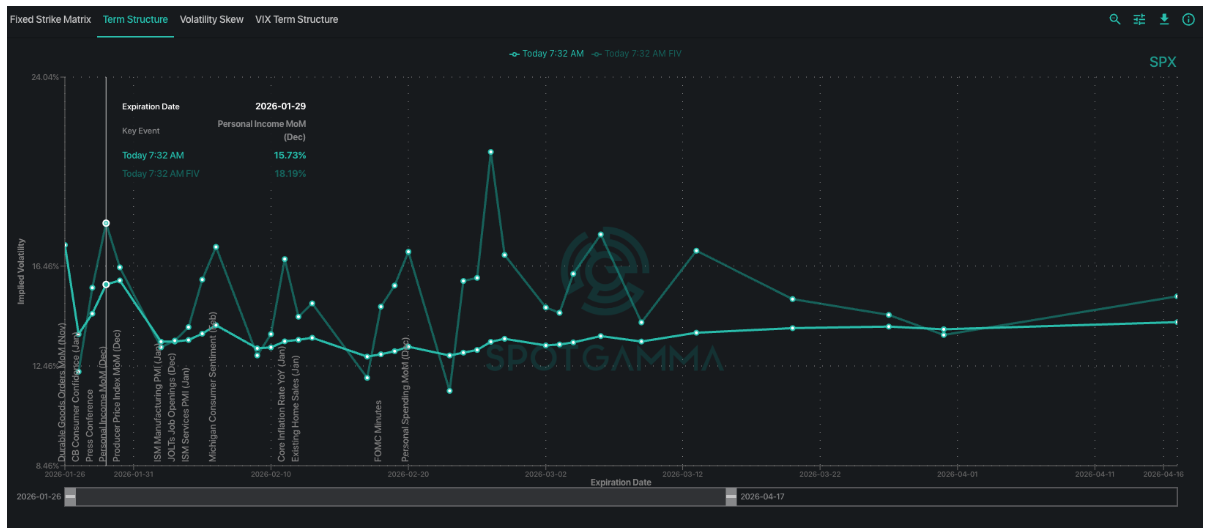

Starting with vol, we have been noting that forward implied vols (FIV) showed risk associated with the upcoming FOMC (FIV > term structure (TS)). Here we see that the SPX TS is now peaking not on FOMC (1/28), but on 1/29 – 1/30. This appears to be due to the fact that big earnings start on 1/28: MSFT, TSLA, META, LRCX then Jobless Claims, AAPL & SNDK ER, and some delayed econ Dec data fall on 1/29, and PPI on 1/30. The takeaway from the FIV > TS is that SPX vols are likely to be held higher, which reduces declining IV/vanna as a factor to push stocks higher. Coming out of this week there could be a sharp vol contraction/positive vanna boost if earnings are good, and FOMC is benign.

We note equity vols in the memory names have been screaming, and LRCX reports 1/28, with SNDK on 1/29. Given the extreme vol & sentiment, these are arguably more interesting names for market movement than the Mag 7’s.

Ultimately all is quiet in the equity index vol space, as SPY/DIA/IWM/QQQ all show average skews and low IV’s (yellow box). Also, interestingly into FOMC, we see the major bond ETF’s as put-skewed (left side of chart), but also showing very low IV. There is however a lot of dispersion with commodities/metals/energy (“stuff”) all call-weighted and/or showing higher relative vol. Then we also note bullish positions in housing/real estate, defense and industrials. This all speaks to rotation both inside of equities &/or into “stuff” but it signals there are certainly pockets of risk-on against a backdrop of boring index movement.

What’s the takeaway from this? The bullish stuff is not tech/Mag 7, and so there is room to come out of this week with tech re-bid & a squeeze of vol premium which would push SPX back up to 7,000. Conversely, we could easily lose that 6,890 SPX level and see correlations spike and equities drop across the board. Further, we can make an argument here the energy/commodity related stocks are now offering an equity tailwind, and if there is some reversal there it dents the equity stability.

While we are going to precariously walk into macro-land, imagine if the dollar (below) catches a bid. Is that enough to reverse the “stuff” trade? Normally we wouldn’t opine/care about such things, but with FOMC & big econ data this week maybe that causes a dollar reversal and/or rate vol picks up and commods come down. While we can’t pick the details of this apart, we feel like such developments would upset the bullish equity stance.

©2025 TenTen Capital LLC DBA SpotGamma

All TenTen Capital LLC DBA SpotGamma materials, information, and presentations are for educational purposes only and should not be considered specific investment advice nor recommendations. Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. VIEW FULL RISK DISCLOSURE https://spotgamma.com/model-faq/disclaimer/

|

|

/ESH26 |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|---|

|

Reference Price: |

$6946.95 |

$6915 |

$689 |

$25605 |

$622 |

$2669 |

$264 |

|

SG Gamma Index™: |

|

-0.301 |

-0.355 |

|

|

|

|

|

SG Implied 1-Day Move: |

|

0.60% |

0.60% |

|

|

|

|

|

SG Implied 5-Day Move: |

|

1.48% |

|

|

|

|

|

|

SG Implied 1-Day Move High: |

|

After open |

After open |

|

|

|

|

|

SG Implied 1-Day Move Low: |

|

After open |

After open |

|

|

|

|

|

SG Volatility Trigger™: |

$6956.95 |

$6925 |

$689 |

$25480 |

$622 |

$2675 |

$265 |

|

Absolute Gamma Strike: |

$7031.95 |

$7000 |

$690 |

$25550 |

$620 |

$2600 |

$260 |

|

Call Wall: |

$7031.95 |

$7000 |

$695 |

$25550 |

$630 |

$2800 |

$270 |

|

Put Wall: |

$6831.95 |

$6800 |

$675 |

$24000 |

$600 |

$2600 |

$255 |

|

Zero Gamma Level: |

$6906.95 |

$6875 |

$687 |

$25158 |

$621 |

$2682 |

$268 |

|

Key Support & Resistance Strikes |

|---|

|

SPX Levels: [7000, 6900, 6950, 6000] |

|

SPY Levels: [690, 680, 685, 695] |

|

NDX Levels: [25550, 25500, 25700, 25600] |

|

QQQ Levels: [620, 625, 630, 615] |

|

SPX Combos: [(7248,89.39), (7227,76.99), (7199,97.19), (7192,69.93), (7178,79.34), (7158,91.16), (7151,93.39), (7123,85.08), (7102,98.32), (7082,76.56), (7075,90.84), (7068,74.23), (7061,75.62), (7054,67.08), (7047,98.29), (7040,67.28), (7033,91.27), (7026,95.82), (7019,77.18), (7012,88.43), (7006,80.17), (6999,98.79), (6992,90.93), (6985,90.04), (6978,96.44), (6971,93.32), (6964,82.92), (6957,93.50), (6950,97.57), (6943,90.41), (6936,68.37), (6923,86.32), (6909,66.49), (6902,97.52), (6895,79.28), (6888,81.52), (6881,89.55), (6874,90.02), (6867,84.03), (6860,81.29), (6853,98.15), (6846,74.53), (6840,92.28), (6833,85.97), (6826,91.99), (6819,84.34), (6812,84.55), (6798,98.69), (6791,86.75), (6777,88.04), (6770,90.81), (6763,74.67), (6757,83.47), (6750,93.08), (6743,72.81), (6729,67.17), (6722,93.16), (6701,96.65), (6687,67.72), (6674,85.24), (6653,88.89), (6625,86.75), (6597,93.56), (6577,68.04)] |

|

SPY Combos: [697.94, 692.42, 677.96, 682.78] |

|

NDX Combos: [25554, 24658, 25298, 25913] |

|

QQQ Combos: [621.41, 600.3, 615.2, 630.1] |

|

|

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Gamma Tilt: |

0.969 |

0.702 |

1.48 |

0.792 |

0.842 |

0.624 |

|

Gamma Notional (MM): |

‑$27.236M |

‑$781.592M |

$11.254M |

‑$282.401M |

‑$15.091M |

‑$521.279M |

|

25 Delta Risk Reversal: |

-0.049 |

0.00 |

-0.057 |

0.00 |

-0.035 |

0.00 |

|

Call Volume: |

515.007K |

1.143M |

8.524K |

747.804K |

18.323K |

328.119K |

|

Put Volume: |

765.905K |

1.798M |

8.41K |

1.131M |

52.597K |

978.267K |

|

Call Open Interest: |

7.009M |

4.438M |

52.561K |

3.034M |

224.847K |

2.758M |

|

Put Open Interest: |

11.652M |

10.426M |

80.543K |

5.042M |

412.642K |

6.757M |

0 comentarios