Macro Theme:

Key dates ahead:

- 9/23: Home Sales, Powell Speaking

- 9/30: Quarterly OPEX

Update 9/19: We remain bullish with SPX >6,600, but we will be adding put spreads and/or put flies for expirations near 9/30, playing a potential move to the massive 6,505 JPM strike.

9/18: We look for the rally to continue into Friday OPEX, and then look for a correction next week. 9/30 is circled as potentially a more destabilizing expiration.

Key SG levels for the SPX are:

- Resistance: 6,700, 6,740

- Pivot: 6,600 (bearish <, bullish >)

- Support: 6,670, 6,650, 6,600, 6,500

Opt-in to receive FlowPatrol™ — our daily AM report detailing the most significant options trades and their impact on the stock market

Founder’s Note:

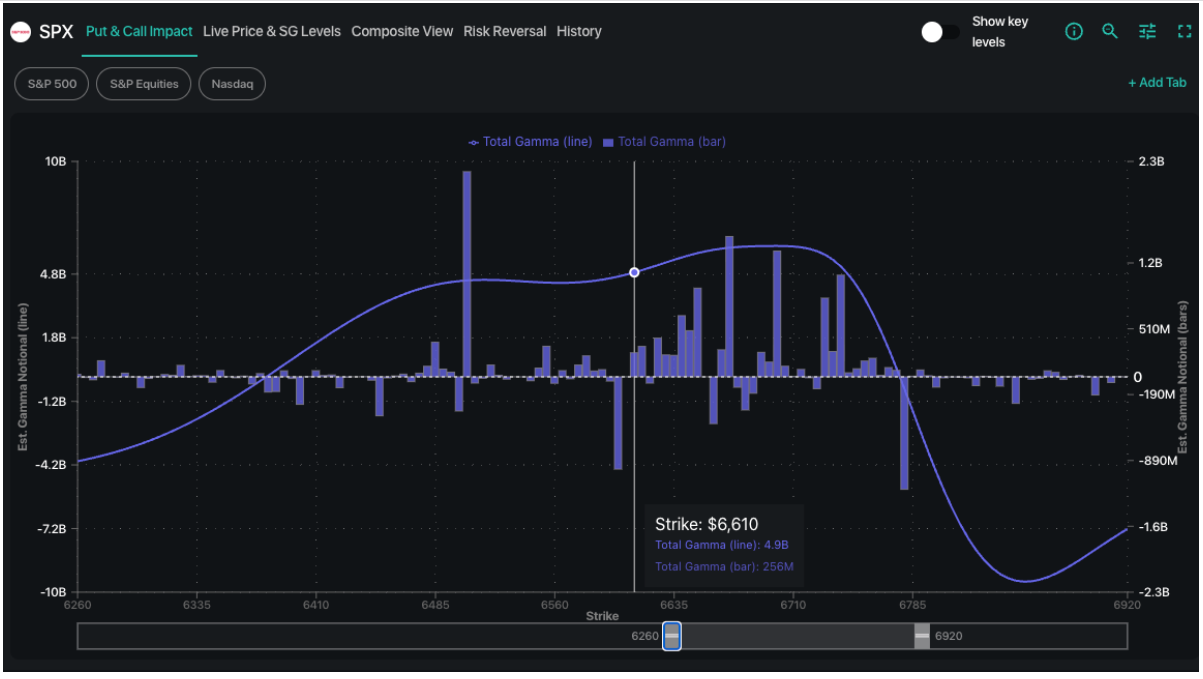

Large gamma strikes

at 6,700 then 6,740 are key resistance points. Support is at 6,670 then 6,650.

Gamma remains high all the way through to 6,500, with a particularly strong cluster >6,610. This speaks to market support, even if it seems like we’re due for some digestion of gains today into tomorrow.

As we discussed last night, SPX is up as is vol (i.e. VIX) at the same time. You can see this in the comparison of 1-month skew from today (teal) vs that of Friday night (gray). This is unusual, and speaks to to the frothy nature of this rally, with the SPX now up +3.5% this month.

We did some quick looks into the forward returns of “SPX up, VIX up” on the day, and the TLDR here is that it flags a one day pause in markets, with mixed results over 5 days. However, the signal seems quick bullish for SPX over a 10 day period (bottom chart). Looking back to gamma positioning, it too speaks of keeping stocks in a somewhat tight range and some possible gain-digestion today/tomorrow, with some upside available into 6,740 over the next week (i.e. we’re not overbought >6,700).

In the single stock space, call IV’s are approaching absurdity, and we think it’ll be hard to profit from buying single calls at these levels (i.e. stocks can still go up but you lose money on your calls because they are pricing in more massive upside). You can see this via all stocks clustered to the bottom right quadrant. ORCL in particular is flagging to be quite rich. We’d note that sector ETF calls are much more reasonable.

|

|

/ESZ25 |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|---|

|

Reference Price: |

$6750.52 |

$6693 |

$666 |

$24761 |

$602 |

$2463 |

$244 |

|

SG Gamma Index™: |

|

3.119 |

-0.112 |

|

|

|

|

|

SG Implied 1-Day Move: |

|

0.63% |

0.63% |

|

|

|

|

|

SG Implied 5-Day Move: |

|

1.81% |

|

|

|

|

|

|

SG Implied 1-Day Move High: |

|

After open |

After open |

|

|

|

|

|

SG Implied 1-Day Move Low: |

|

After open |

After open |

|

|

|

|

|

SG Volatility Trigger™: |

$6677.52 |

$6620 |

$664 |

$24620 |

$599 |

$2410 |

$241 |

|

Absolute Gamma Strike: |

$6757.52 |

$6700 |

$665 |

$24860 |

$600 |

$2500 |

$245 |

|

Call Wall: |

$6757.52 |

$6700 |

$670 |

$24860 |

$605 |

$2500 |

$250 |

|

Put Wall: |

$6557.52 |

$6500 |

$650 |

$24590 |

$560 |

$2390 |

$238 |

|

Zero Gamma Level: |

$6662.52 |

$6605 |

$665 |

$23965 |

$601 |

$2439 |

$244 |

|

|

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Gamma Tilt: |

1.475 |

0.904 |

1.884 |

0.967 |

1.129 |

0.885 |

|

Gamma Notional (MM): |

$933.576M |

‑$117.045M |

$31.901M |

$33.329M |

$11.072M |

‑$67.259M |

|

25 Delta Risk Reversal: |

-0.042 |

0.00 |

-0.044 |

0.00 |

0.00 |

-0.001 |

|

Call Volume: |

695.152K |

1.149M |

10.368K |

705.804K |

18.727K |

292.15K |

|

Put Volume: |

1.015M |

2.323M |

10.089K |

1.445M |

33.109K |

317.501K |

|

Call Open Interest: |

6.918M |

4.78M |

63.291K |

3.222M |

241.578K |

3.164M |

|

Put Open Interest: |

12.486M |

12.248M |

78.778K |

5.618M |

424.362K |

7.505M |

|

Key Support & Resistance Strikes |

|---|

|

SPX Levels: [6700, 6000, 6600, 6650] |

|

SPY Levels: [665, 660, 666, 670] |

|

NDX Levels: [24860, 24870, 24600, 24590] |

|

QQQ Levels: [600, 590, 595, 610] |

|

SPX Combos: [(7002,98.35), (6975,74.34), (6948,87.55), (6928,81.55), (6901,96.90), (6874,85.85), (6848,96.57), (6828,96.23), (6821,74.24), (6808,75.69), (6801,99.55), (6787,86.67), (6781,93.83), (6774,95.60), (6767,90.81), (6761,91.97), (6754,80.38), (6747,99.70), (6741,99.45), (6734,88.47), (6727,99.72), (6721,93.56), (6714,95.64), (6707,99.49), (6700,99.77), (6694,87.18), (6687,81.77), (6680,75.09), (6674,90.25), (6613,69.63), (6607,80.83), (6580,70.04), (6573,82.09), (6526,86.28), (6506,88.05), (6500,88.24), (6473,75.03), (6453,76.44), (6426,83.18), (6399,86.07)] |

|

SPY Combos: [667.68, 677.64, 669.67, 672.33] |

|

NDX Combos: [24860, 24588, 24513, 25009] |

|

QQQ Combos: [599.95, 596.95, 598.75, 604.74] |

0 comentarios