Macro Theme:

Key dates ahead:

- 1/28: FOMC. Earnings: META, TSLA, MSFT, LRCX

- 1/29: Jobless Claims. Earnings: AAPL, SNDK

- 1/30: PPI

SG Summary:

Update 1/23: It seems likely that SPX is now stuck back in its 6,900-6,950 box – likely until 1/28 FOMC. Having said that, some of our risk metrics are signaling “troubles ahead”, and so we will likely look to add some VIX call spreads and/or SPX put spreads into Monday or Tuesday of next week.

Key SG levels for the SPX are:

- Resistance: 6,980, 7,000

- Pivot: 6,890 (bearish <, bullish >) UPDATED 12/26

- Support: 6,950, 6,920, 6,900, 6,800

Founder’s Note:

Futures are 25bps higher with no major data on tap.

We were marking 6,950 as a likely high into FOMC, and SPX pushed through that level intraday yesterday before end-of-day selling brought a close of 6,950. We today see futures indicating an open near 6,970, buoyed by memory chips after the MSFT/SK Hynix deal.

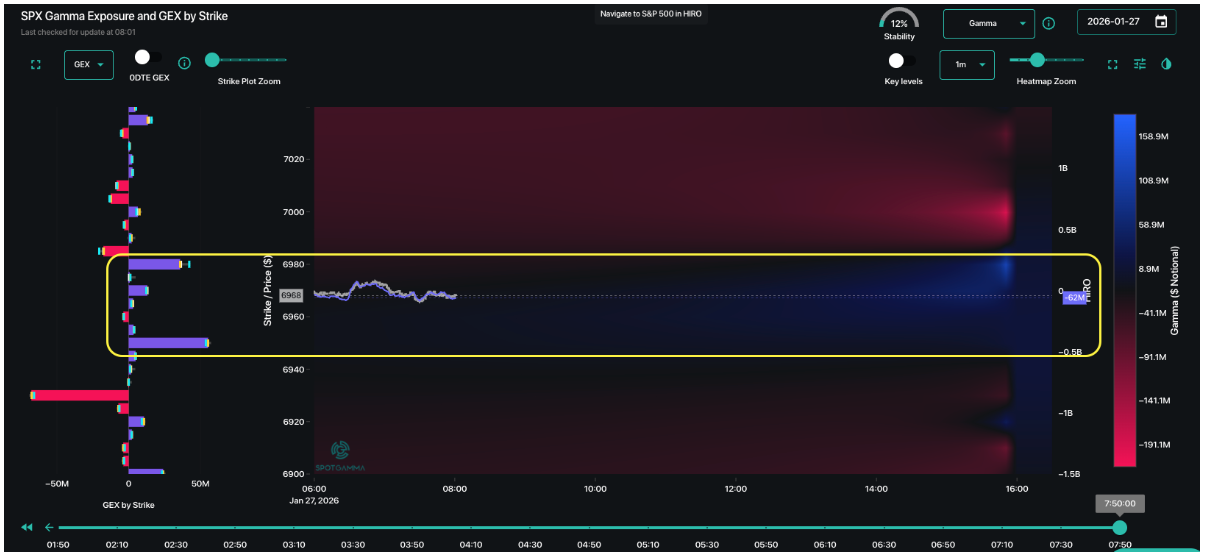

The early prevailing trading range is framed by the positive gamma from 6,950 to 6,980 – and while that range may seem tight, the 0DTE straddle is $21/30 bps with an IV of 12.46% (ref 6,970). Futures are up 25bps overnight – so the straddle is barely accounting for the realized move over the last several hours!

We cannot recall ever having seen a full-session 0DTE straddle this cheap, and given this we strongly caution against selling 0DTE options.

What catches our eye here is that outside of the 6,950-6,980 (yellow box) we see negative gamma, which implies volatility….and even a 50bps move is nearly 2x the straddle price!

This low volatility obviously signals the market has 0 expectations of volatility today, and sees no major data triggers. The problem with this is that the market is priced for absolute perfection. Any headline or even decently sized flow can force options sellers (who are short IV at bottom-basement levels) to close, which can in turn cause jumps in volatility. Adding to this, tomorrow’s 6,970 straddle is just 57bps…remember tomorrow is FOMC!

Couple this very low SPX vol with equity correlation (COR1M), which is resting below our risk-off level of 8. While nothing is guaranteed, COR1M <8 has been an excellent metric to forecast short term market corrections.

Ultimately we have to remain leaning long with SPX is above the Risk Pivot at 6,890, but we are really struggling to feel comfortable with this setup, and will be looking to add to some ~2 month S&P put protection/VIX call spreads.

©2025 TenTen Capital LLC DBA SpotGamma

All TenTen Capital LLC DBA SpotGamma materials, information, and presentations are for educational purposes only and should not be considered specific investment advice nor recommendations. Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. VIEW FULL RISK DISCLOSURE https://spotgamma.com/model-faq/disclaimer/

|

| /ESH26 | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $6980.45 | $6950 | $692 | $25713 | $625 | $2659 | $263 |

| SG Gamma Index™: |

| 1.617 | -0.237 |

|

|

|

|

| SG Implied 1-Day Move: |

| 0.62% | 0.62% |

|

|

|

|

| SG Implied 5-Day Move: |

| 1.48% |

|

|

|

|

|

| SG Implied 1-Day Move High: |

| After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: |

| After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $6970.45 | $6940 | $693 | $25540 | $625 | $2660 | $265 |

| Absolute Gamma Strike: | $7030.45 | $7000 | $690 | $25550 | $620 | $2600 | $260 |

| Call Wall: | $7030.45 | $7000 | $700 | $25550 | $630 | $2800 | $270 |

| Put Wall: | $6930.45 | $6900 | $675 | $24000 | $600 | $2600 | $250 |

| Zero Gamma Level: | $6939.45 | $6909 | $691 | $25264 | $624 | $2673 | $269 |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [7000, 6950, 6900, 6000] |

| SPY Levels: [690, 693, 692, 695] |

| NDX Levels: [25550, 25800, 26000, 25500] |

| QQQ Levels: [620, 625, 630, 623] |

| SPX Combos: [(7277,79.43), (7249,91.38), (7228,74.35), (7200,97.91), (7193,68.64), (7173,89.51), (7152,98.61), (7124,85.86), (7117,68.62), (7103,99.06), (7082,86.11), (7075,94.61), (7068,88.05), (7061,91.83), (7054,78.74), (7048,99.22), (7041,85.88), (7034,84.58), (7027,99.52), (7020,87.44), (7013,97.32), (7006,93.70), (6999,99.54), (6992,98.43), (6985,97.06), (6978,99.48), (6971,93.82), (6964,87.30), (6957,88.18), (6950,94.02), (6943,75.32), (6936,82.76), (6922,92.23), (6909,66.64), (6902,98.55), (6895,79.53), (6888,76.96), (6881,84.16), (6874,85.41), (6867,78.80), (6860,73.50), (6853,96.86), (6832,80.35), (6825,88.73), (6818,82.58), (6811,73.68), (6797,97.92), (6790,80.76), (6783,67.42), (6776,72.72), (6770,87.66), (6763,76.32), (6749,88.70), (6742,67.31), (6728,81.90), (6721,78.84), (6700,95.00), (6672,84.64), (6651,84.11), (6624,83.47)] |

| SPY Combos: [697.45, 677.46, 707.79, 702.27] |

| NDX Combos: [25893, 25482, 24659, 25559] |

| QQQ Combos: [621.53, 599.74, 615.31, 630.25] |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.174 | 0.800 | 1.604 | 0.892 | 0.780 | 0.589 |

| Gamma Notional (MM): | $303.594M | ‑$726.193M | $11.246M | ‑$221.803M | ‑$25.119M | ‑$623.413M |

| 25 Delta Risk Reversal: | -0.049 | -0.033 | -0.056 | -0.042 | -0.036 | -0.019 |

| Call Volume: | 506.914K | 1.001M | 10.191K | 625.973K | 15.125K | 221.593K |

| Put Volume: | 725.459K | 2.03M | 10.674K | 980.667K | 25.205K | 517.826K |

| Call Open Interest: | 7.072M | 4.47M | 54.104K | 3.09M | 225.507K | 2.756M |

| Put Open Interest: | 11.724M | 10.978M | 82.98K | 5.13M | 416.577K | 6.808M |

0 comentarios