Macro Theme:

Key dates ahead:

- 1/30: PPI

SG Summary:

Update 1/30: Yesterday’s vol spasm (1.7% intraday decline) proved the instability of this market, and yet that spasm didn’t appear to improve the dyanmics. Given this, we remain on high alert as long as the SPX is <6,950. If/when the dynamics improve, we will adjust. For now, tread lightly.

1/28: Traders are pricing in just 40bps of range for today’s FOMC, and are leaning bullish into Mag 7 earnings. We also note major lows in bond implied vols, and the dollar having made ~3 year lows. All this suggests stocks are “priced for perfection”. It wouldn’t take much to create a big jump in vol. Expressing both upside & downside is interesting now given the low index IV’s (SPY IV Rank = 7%), and so we want to position in short-dated call spreads in the QQQ (stock replacement), and also add a tranche of SPY put spreads in the 2-3 month to expiration tenor.

Key SG levels for the SPX are:

- Resistance: 6,960, 7,000, 7,020

- Pivot: 6,950 (bearish <, bullish >) UPDATED 1/28

- Support: 6,900, 6,800

Founder’s Note:

Futures are off 28bps – which is a strong recovery from overnight lows near SPX 6,900.

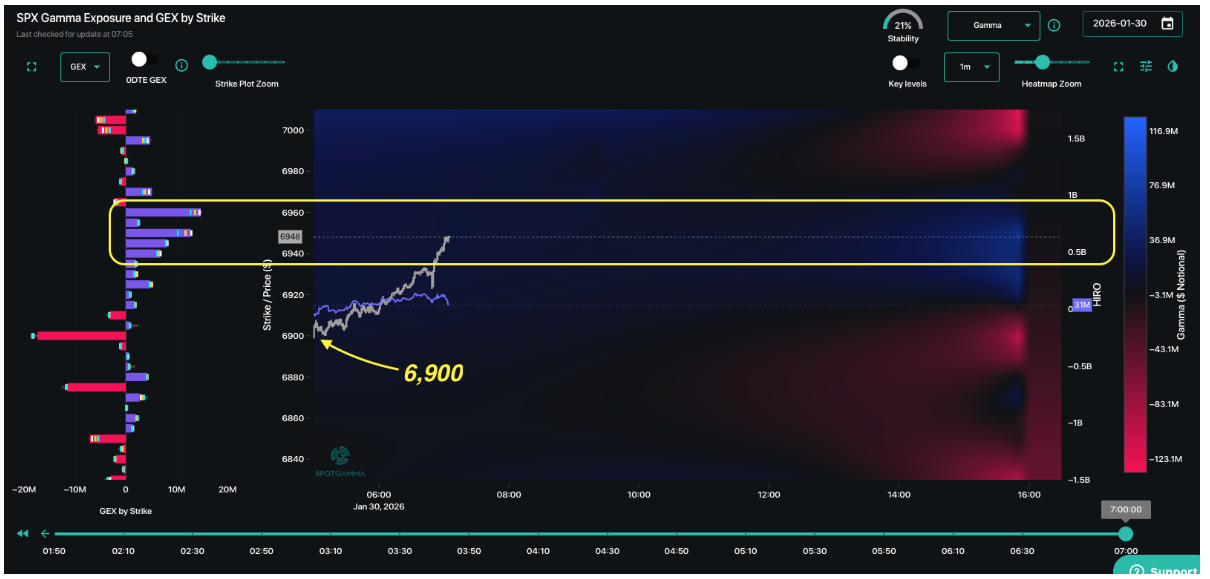

TLDR: Resistance is in the 6,940 to 6,960 positive gamma band (yellow box). With the SPX below the 6,950 Risk Pivot, we remain on the lookout for spasm-y downside a la yesterday. Not only did the dynamics that drove yesterday’s spasm not improve – they seemed to have gotten worse. Further, no one is on to these dynamics (see below), and so we think that the next spasm may not have such big mean reversion. And if you as an SG sub was questioning what happened yesterday then please tender your resignation!

We yesterday moved our Risk Pivot to 6,950 on account of the chunky buyside long puts at ~6,900 and below (shows as dealer short, red bars). We also went into today being one of the only voices out there hand-waving about the potential for volatility spasms into the low correlation/low 0DTE IV environment. We don’t bring up this review to be self-congratulatory, but instead to note:

- There are now bigger dealer short puts below – that suggests faster downside due to more negative gamma <=6,900

- Today’s 0DTE straddle is pricing in just $42/60 bps of movement for today. To quote Mugatu: “I feel like im taking crazy pills!” So…the SPX yesterday dropped 1.7% intraday before rallying back 1.4%, and futures were down 1.15% before rallying back 0.75%…and your pricing in 40 bps? With PPI on deck at 8:30?

Before we move on we need to be clear on what may saved the markets yesterday: 0DTE puts (light blue), with about $7bn notional of them being sold (see y’days great PM note). Those puts get sold, helping to put the floor in, triggering traders into other mean reversion positions “buy the stock dip” and “sell the 20 VIX”. What you don’t see in HIRO was long dated calls being bought… There was one bank suggesting massive dealer S&P500 positive gamma as a reason for the mean reversion. We don’t see that….the gamma thats in play is largely 0DTE and subject to getting blown out quickly, making that implied support quite transient (see here).

Looking ahead, if there was one small change/improvement to the dynamic its that single stock calls suddenly went from bid up to “yours”, as shown in Compass. Most stocks were middle right on the Compass yesterday (leaning in to calls), and now have dispersed to the left (in favor of puts).

This is a small improvement, but note what COR1M (blue) did yesterday during the spasm – it spiked. COR1M read as back in the “risky 8’s” by the close, but that is likely to shift when the single stock options market opens. We also want to flag something else: the VIX is in green. Both COR1M & VIX tracked perfectly into that intraday drop which saw the VIX go to 20. Remember: VIX measures ~1-month to exp SPX options, and COR1M measures ~1-month single stock vol vs SPX vol. There is an intrinsic link there, obviously, but we think of COR1M as a vol turbocharger because it highlights dispersion trade unwinds: sell single stock vol (which is usually bid up on the call side) and buy index vol.

What’s the point? The underbelly of this market is very soft, and we are very concerned about the next spasm being one that sticks. Tread lightly.

©2025 TenTen Capital LLC DBA SpotGamma

All TenTen Capital LLC DBA SpotGamma materials, information, and presentations are for educational purposes only and should not be considered specific investment advice nor recommendations. Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. VIEW FULL RISK DISCLOSURE https://spotgamma.com/model-faq/disclaimer/

|

|

/ESH26 |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|---|

|

Reference Price: |

$6997.4 |

$6969 |

$693 |

$25884 |

$629 |

$2654 |

$263 |

|

SG Gamma Index™: |

|

0.486 |

-0.318 |

|

|

|

|

|

SG Implied 1-Day Move: |

|

0.58% |

0.58% |

|

|

|

|

|

SG Implied 5-Day Move: |

|

1.48% |

|

|

|

|

|

|

SG Implied 1-Day Move High: |

|

After open |

After open |

|

|

|

|

|

SG Implied 1-Day Move Low: |

|

After open |

After open |

|

|

|

|

|

SG Volatility Trigger™: |

$6968.4 |

$6940 |

$691 |

$25540 |

$625 |

$2645 |

$263 |

|

Absolute Gamma Strike: |

$7028.4 |

$7000 |

$690 |

$25550 |

$620 |

$2600 |

$260 |

|

Call Wall: |

$7128.4 |

$7100 |

$700 |

$25550 |

$640 |

$2800 |

$270 |

|

Put Wall: |

$6828.4 |

$6800 |

$680 |

$24000 |

$620 |

$2600 |

$250 |

|

Zero Gamma Level: |

$6956.4 |

$6928 |

$692 |

$25432 |

$628 |

$2668 |

$269 |

|

Key Support & Resistance Strikes |

|---|

|

SPX Levels: [7000, 6900, 6950, 6000] |

|

SPY Levels: [690, 680, 695, 685] |

|

NDX Levels: [25550, 26000, 25800, 25000] |

|

QQQ Levels: [620, 630, 625, 600] |

|

SPX Combos: [(7297,92.64), (7276,69.04), (7248,92.35), (7227,76.88), (7199,98.02), (7192,73.29), (7178,88.46), (7157,92.38), (7150,95.56), (7143,67.61), (7129,76.53), (7122,88.88), (7108,84.51), (7101,99.07), (7087,82.68), (7081,80.24), (7074,91.43), (7067,84.93), (7060,86.42), (7053,99.20), (7046,72.65), (7039,81.44), (7032,95.02), (7025,95.57), (7018,96.96), (7011,92.10), (7004,81.58), (6997,99.37), (6990,83.51), (6983,93.45), (6976,92.69), (6969,84.64), (6948,89.91), (6941,67.29), (6927,93.65), (6920,76.68), (6913,75.79), (6906,75.11), (6899,98.07), (6892,86.57), (6878,96.88), (6871,71.01), (6858,87.51), (6851,94.24), (6837,82.70), (6830,90.04), (6823,87.20), (6809,72.29), (6802,98.19), (6788,84.49), (6781,89.15), (6774,78.68), (6767,67.10), (6760,68.51), (6753,91.01), (6732,68.40), (6725,90.53), (6697,96.29), (6676,79.62), (6648,87.29), (6628,85.90)] |

|

SPY Combos: [702.38, 707.25, 700.3, 712.82] |

|

NDX Combos: [25496, 24668, 25548, 25910] |

|

QQQ Combos: [639.97, 645.04, 621.62, 619.72] |

|

|

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Gamma Tilt: |

1.05 |

0.737 |

1.456 |

0.886 |

0.723 |

0.514 |

|

Gamma Notional (MM): |

$441.655M |

‑$435.145M |

$14.184M |

$41.944M |

‑$25.517M |

‑$737.228M |

|

25 Delta Risk Reversal: |

-0.057 |

-0.041 |

-0.068 |

-0.052 |

-0.04 |

-0.025 |

|

Call Volume: |

793.633K |

1.902M |

11.318K |

1.391M |

15.442K |

272.798K |

|

Put Volume: |

1.014M |

2.824M |

15.675K |

1.581M |

27.673K |

1.208M |

|

Call Open Interest: |

7.252M |

4.725M |

57.219K |

3.396M |

230.113K |

2.847M |

|

Put Open Interest: |

12.115M |

11.723M |

90.746K |

5.53M |

423.04K |

7.095M |

0 comentarios