Macro Theme:

Key dates ahead:

- 2/3: JOLTS

- 2/4: ISM

- 2/6: NFP

- 2/11: CPI

SG Summary:

Update 2/3: Short term now appear to be subsiding (Iran, MN, etc), and correlation metrics shifted higher after last weeks spasms (Sunday night futures traded to 6,875 before rallying to 7k). Further, we’ve uncovered a signal wherein the wild intraday swings vs overnight stability suggests positive SPX returns on a 3 to 5 day forward window. Given this, and the close back above 6,950, we will be long of stocks and looking to sell intraday calls against that position. Further, on the single stock side, we see TSLA has a IV Rank near 1, and so we will look to get into some longer dated TSLA calls for upside exposure. A break back <6,950 flips us back to risk-off.

1/30: Yesterday’s vol spasm (1.7% intraday decline) proved the instability of this market, and yet that spasm didn’t appear to improve the dyanmics. Given this, we remain on high alert as long as the SPX is <6,950. If/when the dynamics improve, we will adjust. For now, tread lightly.

1/28: Traders are pricing in just 40bps of range for today’s FOMC, and are leaning bullish into Mag 7 earnings. We also note major lows in bond implied vols, and the dollar having made ~3 year lows. All this suggests stocks are “priced for perfection”. It wouldn’t take much to create a big jump in vol. Expressing both upside & downside is interesting now given the low index IV’s (SPY IV Rank = 7%), and so we want to position in short-dated call spreads in the QQQ (stock replacement), and also add a tranche of SPY put spreads in the 2-3 month to expiration tenor.

Key SG levels for the SPX are:

- Resistance: 7,000, 7,020

- Pivot: 6,950 (bearish <, bullish >) UPDATED 1/28

- Support: 6,950, 6,900

Founder’s Note:

Futures are flat with JOLTS at 8:30AM ET.

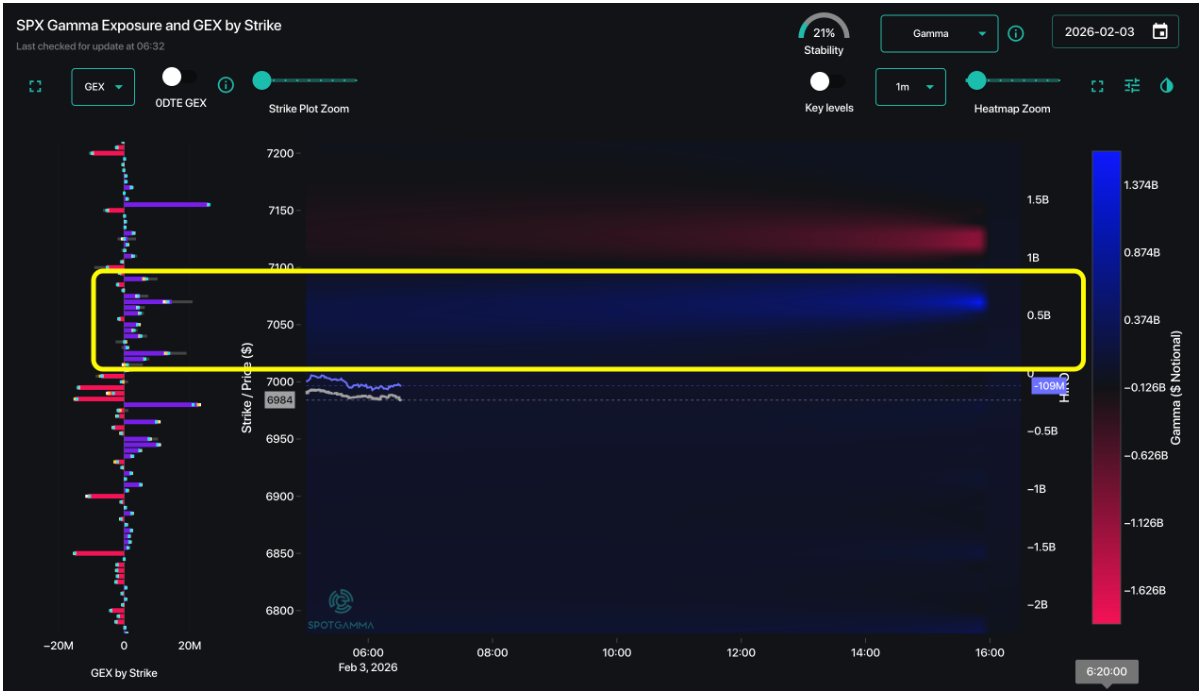

There is now a fair amount of gamma >7,000, and that is not all 0DTE. This suggests 7k will take some time to digest, and so we look for low volatility and resistance into this strike. It also implies market support. The same can be said for <7k, as we see positive gamma from 6,950 to 6,975. Given this, we’d be looking to scalp dips into that area, and sell rips into 7k. Should the SPX lose <6,950, we’d flip back to risk-off.

As the SPX rallied back into the 7k strike yesterday we noted a slight contraction in vols of 1/3 to 1/2 a vol point across the surface. That’s not terribly exciting, and suggests vol contraction (vanna) was not so much of a driver in yesterday’s recovery. Vol contraction would be a hallmark of forward stock stability. While the last few days say big intraday vol, the 5-day realized vol (based on close to close) is only 5%, with 1-month at 10%. Thats quiet.

Those realized vol metrics cloak intraday vol, and yesterdays rally was big: at least 1.6% from overnight lows. We’ve seen similar daily swings over recent days – which feels weird.

No one likes feelings around here, so we turned to data. Here we have a 5-day rolling comparison of SPX close-to-close vol vs intraday range vol (high-low/open). What we see is that this metric is currently negative, and that is telling us the intraday swings are anomalous.

The forward returns from these events are actually positive (5-yeas of data, n=76 negative days). For 1-day forward returns we see fairly flat outcomes, but the 3-day return histograms look strongly positive – and we’d note the 5-day looks even a bit better (that one nasty left tail was Feb of ’20 (Covid)). This seems like a signal you don’t want to fight, particularly if we remain above 6,950.

©2025 TenTen Capital LLC DBA SpotGamma

All TenTen Capital LLC DBA SpotGamma materials, information, and presentations are for educational purposes only and should not be considered specific investment advice nor recommendations. Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. VIEW FULL RISK DISCLOSURE https://spotgamma.com/model-faq/disclaimer/

|

|

/ESH26 |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|---|

|

Reference Price: |

$7001.35 |

$6976 |

$691 |

$25552 |

$621 |

$2626 |

$259 |

|

SG Gamma Index™: |

|

1.119 |

-0.382 |

|

|

|

|

|

SG Implied 1-Day Move: |

|

0.64% |

0.58% |

|

|

|

|

|

SG Implied 5-Day Move: |

|

1.47% |

|

|

|

|

|

|

SG Implied 1-Day Move High: |

|

$7029.45 |

$700.23 |

|

|

|

|

|

SG Implied 1-Day Move Low: |

|

$6940.05 |

$692.15 |

|

|

|

|

|

SG Volatility Trigger™: |

$6985.35 |

$6960 |

$692 |

$25540 |

$625 |

$2630 |

$263 |

|

Absolute Gamma Strike: |

$7025.35 |

$7000 |

$690 |

$25550 |

$620 |

$2600 |

$250 |

|

Call Wall: |

$7125.35 |

$7100 |

$700 |

$25550 |

$640 |

$2800 |

$270 |

|

Put Wall: |

$6825.35 |

$6800 |

$680 |

$24000 |

$600 |

$2600 |

$250 |

|

Zero Gamma Level: |

$6961.35 |

$6936 |

$695 |

$25296 |

$625 |

$2680 |

$271 |

|

Key Support & Resistance Strikes |

|---|

|

SPX Levels: [7000, 6900, 6950, 6000] |

|

SPY Levels: [690, 680, 670, 695] |

|

NDX Levels: [25550, 26000, 25000, 25800] |

|

QQQ Levels: [620, 600, 625, 610] |

|

SPX Combos: [(7297,93.25), (7276,73.25), (7249,92.99), (7228,79.33), (7207,73.30), (7200,98.52), (7193,75.01), (7172,87.54), (7158,94.25), (7151,95.90), (7137,77.28), (7130,75.50), (7123,90.47), (7109,84.59), (7102,99.48), (7088,90.40), (7081,81.21), (7074,94.77), (7067,91.79), (7060,92.18), (7053,99.29), (7046,86.36), (7039,85.99), (7032,95.98), (7025,98.04), (7018,98.57), (7011,96.38), (7004,99.26), (6997,99.98), (6990,99.87), (6983,100.00), (6976,99.99), (6969,99.96), (6962,99.95), (6956,94.47), (6949,97.32), (6942,93.51), (6935,87.42), (6928,97.68), (6921,78.68), (6914,72.26), (6907,92.35), (6900,94.78), (6893,86.31), (6886,69.29), (6879,78.99), (6872,91.64), (6858,92.66), (6851,91.96), (6837,80.88), (6823,83.55), (6802,98.41), (6788,73.87), (6774,74.88), (6767,71.57), (6753,94.98), (6732,66.80), (6725,76.79), (6697,95.17), (6676,72.48), (6656,70.88), (6649,82.92)] |

|

SPY Combos: [696.75, 702.3, 707.16, 677.31] |

|

NDX Combos: [24658, 25552, 25067, 26498] |

|

QQQ Combos: [619.92, 599.78, 621.18, 629.99] |

|

|

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Gamma Tilt: |

1.12 |

0.654 |

1.089 |

0.703 |

0.530 |

0.418 |

|

Gamma Notional (MM): |

$347.782M |

‑$720.204M |

$3.008M |

‑$428.893M |

‑$51.766M |

‑$1.06B |

|

25 Delta Risk Reversal: |

-0.056 |

-0.044 |

-0.072 |

-0.057 |

-0.045 |

-0.03 |

|

Call Volume: |

580.157K |

1.409M |

13.913K |

936.979K |

19.788K |

289.567K |

|

Put Volume: |

856.288K |

2.169M |

18.564K |

1.231M |

68.342K |

1.14M |

|

Call Open Interest: |

7.223M |

4.48M |

54.823K |

3.222M |

221.376K |

2.75M |

|

Put Open Interest: |

11.937M |

10.559M |

95.992K |

5.174M |

419.035K |

7.076M |

0 comentarios