Macro Theme:

Major Resistance: 4,400 – 4,410 (SPY 440 Call Wall)

Pivot Level: 4,400

Interim Support: 4,320

Range High: 4,410

Range Low: 4,000 Put Wall

‣ We are neutral on the SPX, and looking for a window of weakness post 6/14 FOMC & 6/16 OPEX with a target of 4,320. A break of 4,400 flips our stance back to bullish SPX

‣ We favor QQQ & megacap tech longs based on recent, lower relative call IV’s

Last chance >> Register for our Trading AI Stocks Mini Bootcamp. Wednesday, June 28th, 10am – 12pm EST. Hosted by SpotGamma founder Brent Kochuba and pro trader Doug Pless. Two trade studies on Nvidia and Google in two power packed hours. Registration closes at 11:59pm Monday June 26th, sign up HERE.

Founders Note:

Futures are slightly lower to 4,382. Key SG levels remain largely unchanged, with support at 4,360 (SPY 435) – 4,350, then 4,320 (JPM call strike). We continue to see 4,300 as major support for the week. Overhead we note 4,400 – 4,410 (SPY 440 Call Wall) as the major resistance range.

A quick note on the SPX Call Wall – it has shifted to 4,320 as a result of the JPM collar. We are therefore monitoring the SPY 400 Call Wall/SPX 4,400 large gamma strikes as the top of our range and a major resistance level. Should the SPY or SPX Call Wall roll >4,400 we would see further upside.

In QQQ resistance is at 365, with support at 360. The 370 Call Wall remains the high end of our range.

Our core view has been that the S&P was due for consolidation into 4,300, with the 4,300-4,320 (6/30 JPM collar 4,320 call strike) area providing strong support. Counter to this S&P downside, we’ve been seeing signs of “re-basing” in the tech leaders, and are therefore of the view that those top names may now resume their Q2 rallies.

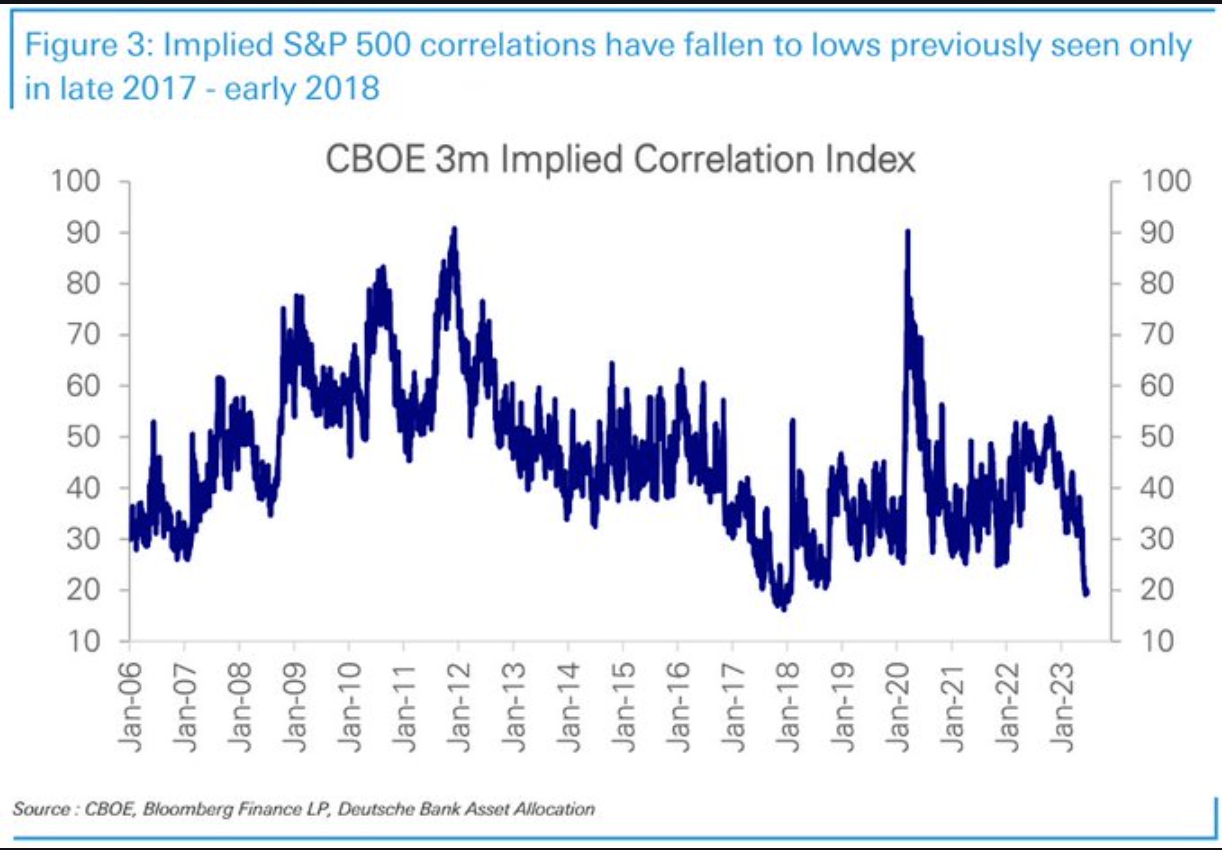

Along these lines, we’ve seen a few of these implied correlation charts making the rounds (h/t @GunjanJS). The CBOE correlation index calculates the spread between SPX IV’s and the combined IV of the basket of stocks in the S&P500 Index. As you can see below, S&P IV is quite low relative to single stocks as traders hyper-focus on “AI”.

As we’ve discussed in previous notes, when the market is fearful correlation typically spikes higher as traders sell all equities (see March ’20).

The implied trade here is a dispersion strategy in which traders may sell SPX index volatility to fund long volatility in single stock positions. This fits in a bit with the idea of narrow market breadth – or just a few stocks driving the market. If there was major concern of a macro event (or if one triggers) then this strategy could suffer as correlation spikes.

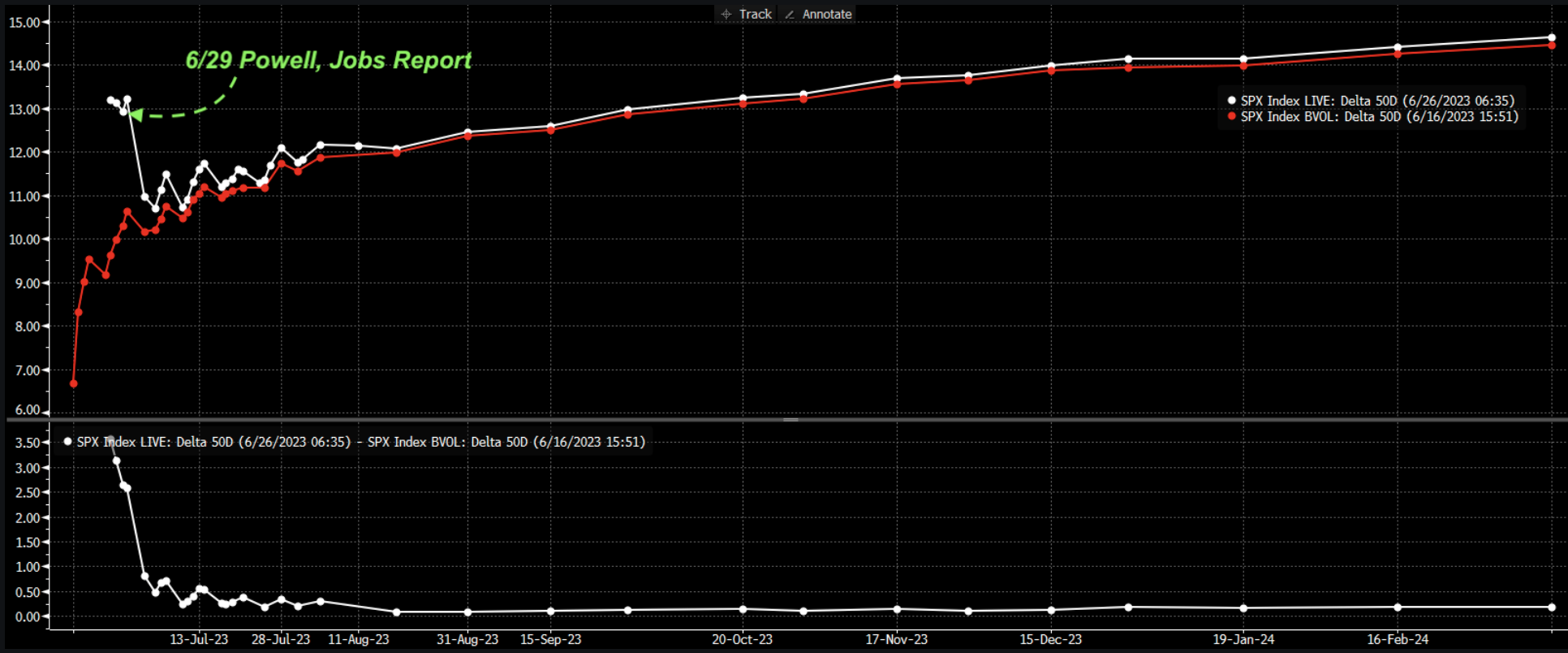

We’re not entirely sure just how large these strategies are, and therefore how much of an index volatility suppressant they are. Regardless, the current state of S&P options IV is somewhere between asleep and apathetic as reflected in the term structure below. There is a slight elevation to IV’s due to the 6/29 Powell discussion and quarter end – but its all reads as traders seeing a rather riskless environment. With at-the-money S&P IV around 11%, traders are looking for ~70bps maximum SPX daily moves.

While there arguably isn’t a catalyst to shift the market out of that tight range over the next 1-2 sessions, the clearing of the $100bn of SPX Index delta on 6/30 + large equity quarter end flows could be enough to get things moving again (both higher and/or lower). This would in turn suggest that IV may be a bit too cheap here as traders reposition for Q3.

For this week we continue to hold the same market view from last week, with support, again, in the 4,300 area. Should the S&P break back above 4,400 we would resume our bullish stance.

|

SpotGamma Proprietary Levels |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Reference Price: |

$4348 |

$433 |

$14891 |

$362 |

$1821 |

$180 |

|

SpotGamma Implied 1-Day Move: |

0.83% |

0.83% |

|

|

|

|

|

SpotGamma Implied 5-Day Move: |

2.22% |

|

|

|

|

|

|

SpotGamma Volatility Trigger™: |

$4315 |

$434 |

$14800 |

$362 |

$1850 |

$183 |

|

Absolute Gamma Strike: |

$4400 |

$430 |

$15200 |

$360 |

$1800 |

$180 |

|

SpotGamma Call Wall: |

$4320 |

$440 |

$15200 |

$370 |

$1880 |

$190 |

|

SpotGamma Put Wall: |

$4000 |

$430 |

$14475 |

$355 |

$1780 |

$170 |

|

Additional Key Levels |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Zero Gamma Level: |

$4323 |

$435 |

$13880 |

$364 |

$1873 |

$186 |

|

Gamma Tilt: |

1.151 |

0.692 |

2.298 |

0.783 |

0.671 |

0.604 |

|

SpotGamma Gamma Index™: |

0.732 |

-0.328 |

0.079 |

-0.082 |

-0.024 |

-0.069 |

|

Gamma Notional (MM): |

$259.985M |

‑$1.32B |

$9.26M |

‑$411.621M |

‑$22.352M |

‑$708.789M |

|

25 Day Risk Reversal: |

-0.044 |

-0.024 |

-0.029 |

-0.025 |

-0.028 |

-0.035 |

|

Call Volume: |

482.412K |

1.708M |

6.042K |

594.359K |

19.922K |

298.217K |

|

Put Volume: |

909.843K |

2.141M |

6.978K |

974.277K |

50.332K |

568.199K |

|

Call Open Interest: |

5.442M |

6.108M |

54.883K |

4.157M |

183.75K |

3.432M |

|

Put Open Interest: |

11.781M |

12.85M |

59.623K |

8.935M |

332.891K |

7.13M |

|

Key Support & Resistance Strikes |

|---|

|

SPX Levels: [4400, 4350, 4320, 4300] |

|

SPY Levels: [435, 434, 433, 430] |

|

NDX Levels: [15200, 15150, 15125, 15000] |

|

QQQ Levels: [365, 360, 355, 350] |

|

SPX Combos: [(4544,92.11), (4518,93.43), (4496,98.50), (4470,91.83), (4444,96.36), (4435,83.69), (4427,80.59), (4422,92.99), (4414,89.40), (4405,79.80), (4396,99.22), (4383,77.63), (4370,98.27), (4366,79.04), (4361,79.60), (4357,76.01), (4335,92.81), (4322,84.85), (4314,96.85), (4296,90.09), (4292,85.84), (4283,77.64), (4279,83.57), (4270,78.32), (4266,81.41), (4244,93.38), (4214,87.75), (4196,95.42), (4166,75.17), (4144,89.35)] |

|

SPY Combos: [434.93, 444.9, 440.13, 432.33] |

|

NDX Combos: [15189, 14579, 15204, 14370] |

|

QQQ Combos: [366.68, 364.87, 371.76, 351.8] |