Macro Theme:

Key dates ahead:

- 10/6: OPEN AI dev day

Update 10/2: We raise our key risk off level to 6,680 (from 6,600). We prefer remaining long of stocks while above that level, with an short term upside target of 6,750-6,765. If 6,680 breaks, we would look for a test of 6,600. Of note: Single stock skews are getting objectively rich, and the CBOE COR1M at ~9 is also flagging this excess bullishness. Should that metric get sub 8 we will be sharply reducing upside exposure.

9/30: The vol complex remains odd, which we think can induce volatility. If 6,600 breaks, we would look for an initial market low of 6,500. Over 6,600 the market has potential upside to 6,740, which can happen quickly if the US avoids a shutdown and if this weeks data is benign.

Key SG levels for the SPX are:

- Resistance: 6,750, 6,765

- Pivot: 6,700 (bearish <, bullish >) Sub 6,700 implies a test of 6,600.

- Support: 6,700, 6,680, 6,600

Opt-in to receive FlowPatrol™ — our daily AM report detailing the most significant options trades and their impact on the stock market

Stay informed of how options flow evolves each day: Opt in to receive FlowPatrol daily

Founder’s Note:

ES futures +30bps, NQ +60bps.

OpenAI Dev Day today at 1PM ET.

Lots of sticky gamma around 6,700-6,760 in SPX, and we accordingly remain risk-on while SPX is >6,700. Under 6,700 we will be flipping to shorts due to the odd dynamics in this market, which we think embed an inevitable heavy risk-off period. To us, the question is not if, but when. “When” is the million dollar question, as one does not want to miss the (continuing) upside train, and this is why we now watch <6,700 closely, in addition to COR1M going <8 (see below).

Last Thursday AM we highlighted our major risk barometer in this market being CBOE Correlation (COR1M), which indexified the risk we saw in this market: a potential blow off top driven by excess call chasing. COR1M, as stated: “…tells us that single stock IV’s are quite rich to SPX IV – a signal of excessive bullishness.”

Further, we noted Compass showing increasing IV’s into a call-bid regime:

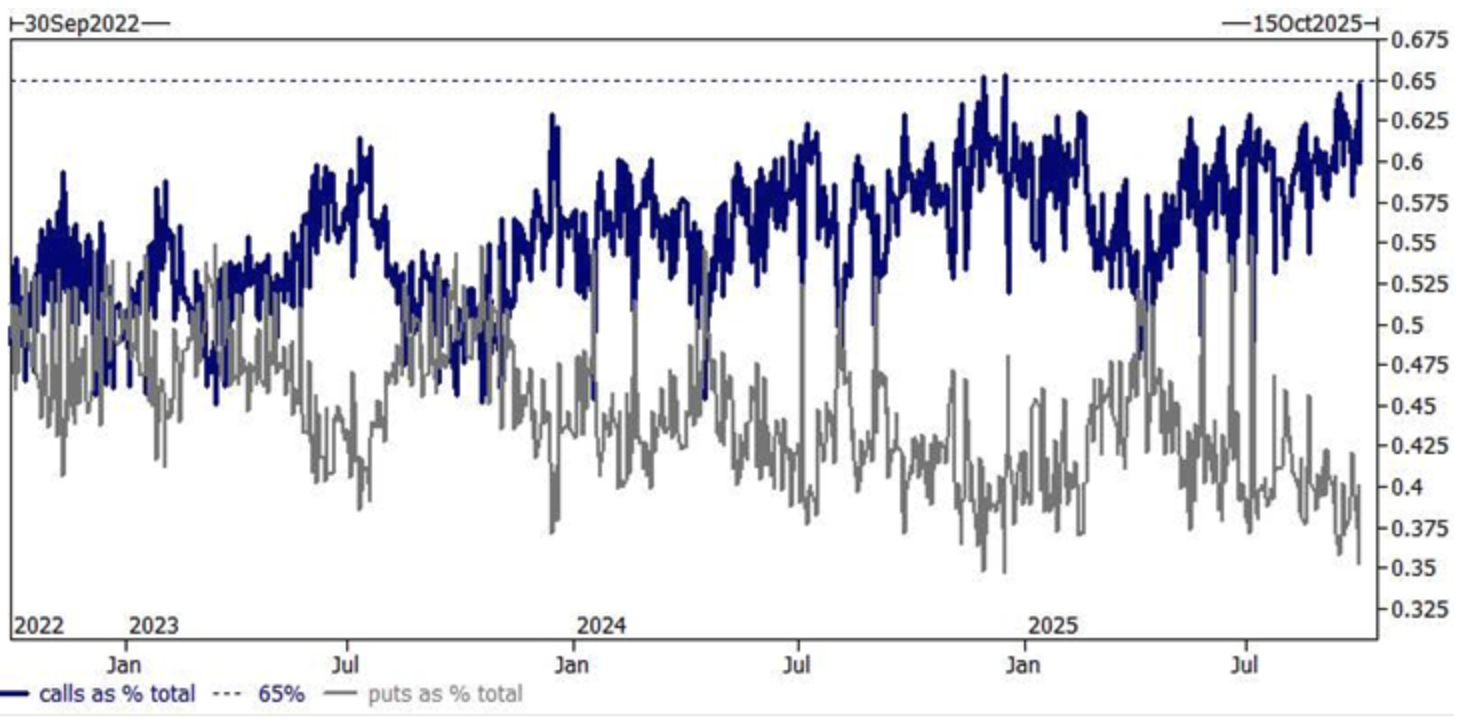

Backfilling some of these ideas from last week, (Per GS via ZH) Wednesday was 65%

call volume

across stocks which was a record:

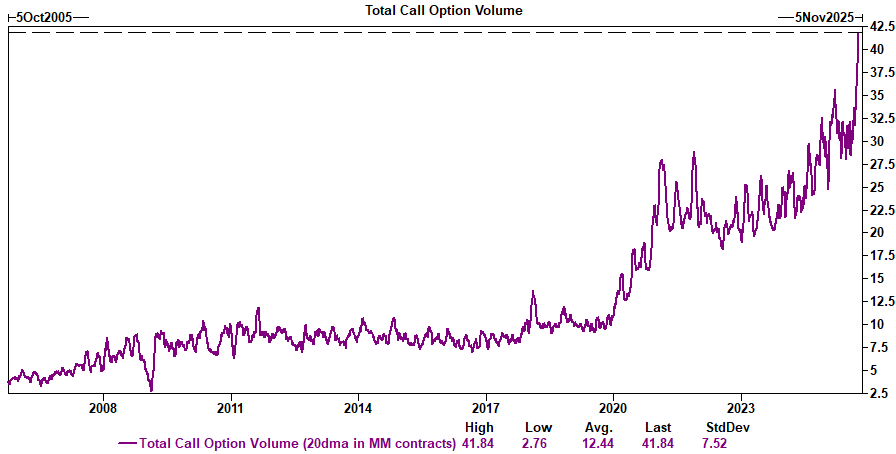

GS also pair that % figure to this chart of

call volume,

which shows an incredible breakout in single stock call volumes:

To paraphrase the impact of this, they think that this voracious all demand in single stocks is a driver of “stocks up, vol up”. That makes sense. They then suggest that this single stock call/vol demand is bleeding into index vol, which is whats creating the “SPX up, VIX up” regime of late.

We’re not sold on this explanation of single stock call demand being the driver of SPX vol. SPX IV’s, as we’ve discussed at length, are quite sticky in the 13-14% (VIX 16’s) despite the fact that SPX 1-month realized vol is ~6. This is one of the widest spreads ever (VIX vs SPX RV).

The sticky SPX vol may be the reason that the COR1M index has not yet moved into the <=8’s, which to us is a major risk signal (see Thursday’s note). COR1M measures top stock IV vs SPX IV, and on a relative basis there was more excess to this spread back in Feb ’25 (just before the DeepSeek NVDA collapse) and of course record low COR1M back in July of ’24 when NVDA/semi went parabolic. Both of those periods saw major corrections after these low COR1M readings.

So, at least as far as COR1M informs us, the spread between single stock IV and SPX IV is not stretched to recent records. Of course COR1M is only one way to view things, and its weighted to 1-month options, and maybe the reason we don’t see that <8 now on COR1M is because of this odd sticky SPX IV regime which seems to be quite different from historical standards. Further, if you look at SPX

call volumes

they are way off of highs, suggesting that there isn’t a bid to SPX IV due to call buying.

BofA had previously flagged big flows into VIX products (ex ETN’s) as a source of demand for longer dated vols, and that type of driver for these odd sticky SPX IV’s/VIX makes more sense to us vs the idea that SPX IV is being driven by single stock call demand. Giving weight to this idea is the COT reports, which have been showing large flows into VIX complex (h/t/ Barchart). In summary “VIX flows” is more the driver of SPX IV vs single stock flows.

Wrapping this up: we have all the makings of an excess blow off top in single stocks, and we want to maintain long exposure while the music is playing. Oct OPEX is the obvious time to watch for a change in this excess bull regime, but ultimately <6700 SPX we will be quick to limit our upside exposure, and COR1M <8 is where we will definitely look to add downside hedges regardless of SPX levels.

©2025 TenTen Capital LLC DBA SpotGamma

|

| /ESZ25 | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $6763.35 | $6715 | $669 | $24785 | $603 | $2476 | $245 |

| SG Gamma Index™: |

| 2.063 | -0.227 |

|

|

|

|

| SG Implied 1-Day Move: |

| 0.62% | 0.62% |

|

|

|

|

| SG Implied 5-Day Move: |

| 1.40% |

|

|

|

|

|

| SG Implied 1-Day Move High: |

| After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: |

| After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $6743.35 | $6695 | $669 | $24390 | $603 | $2455 | $244 |

| Absolute Gamma Strike: | $6748.35 | $6700 | $670 | $24525 | $600 | $2400 | $240 |

| Call Wall: | $6848.35 | $6800 | $675 | $24525 | $610 | $2500 | $250 |

| Put Wall: | $6548.35 | $6500 | $655 | $24840 | $590 | $2410 | $230 |

| Zero Gamma Level: | $6724.35 | $6676 | $667 | $24170 | $602 | $2470 | $247 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.277 | 0.800 | 1.565 | 0.829 | 0.930 | 0.815 |

| Gamma Notional (MM): | $504.727M | ‑$606.663M | $13.985M | ‑$288.74M | ‑$9.068M | ‑$186.757M |

| 25 Delta Risk Reversal: | -0.048 | 0.00 | -0.052 | 0.00 | -0.026 | -0.01 |

| Call Volume: | 659.047K | 1.154M | 10.348K | 720.479K | 20.028K | 436.275K |

| Put Volume: | 1.126M | 2.235M | 13.539K | 1.118M | 50.344K | 688.825K |

| Call Open Interest: | 7.476M | 4.855M | 66.146K | 3.355M | 244.878K | 3.202M |

| Put Open Interest: | 13.043M | 12.661M | 89.22K | 5.831M | 435.619K | 7.777M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6700, 6000, 6750, 6800] |

| SPY Levels: [670, 640, 660, 665] |

| NDX Levels: [24525, 24500, 24900, 24800] |

| QQQ Levels: [600, 605, 590, 610] |

| SPX Combos: [(7025,70.23), (6998,99.44), (6978,79.08), (6951,92.99), (6924,85.90), (6897,98.52), (6877,92.14), (6857,70.51), (6850,98.42), (6837,81.22), (6823,97.74), (6817,87.88), (6810,80.76), (6803,99.88), (6796,78.31), (6790,93.90), (6783,94.75), (6776,97.53), (6770,92.45), (6763,98.30), (6756,88.37), (6749,99.49), (6743,97.53), (6736,86.47), (6729,88.30), (6723,93.59), (6702,94.69), (6696,71.87), (6682,88.80), (6675,81.04), (6662,82.01), (6649,88.35), (6642,74.20), (6622,87.75), (6602,86.50), (6588,72.61), (6581,80.07), (6575,84.38), (6548,90.08), (6521,74.03), (6501,92.42), (6474,74.67), (6447,80.33), (6420,72.46), (6400,89.79)] |

| SPY Combos: [677.92, 672.57, 669.89, 697.33] |

| NDX Combos: [24513, 24909, 25058, 24240] |

| QQQ Combos: [596.6, 608.11, 609.93, 605.69] |

0 comentarios