Macro Theme:

Key dates ahead:

- 10/17: OPEX

- 10/22: VIX exp

- 10/24: CPI

- ~10/29: Trump/XI meeting

10/13: We see relative support in the 6,500’s due to a range of positive gamma (red box), which means we will look to play tactical bounces at major gamma strikes in that range. This main thought here is that it just doesn’t look all that ugly down below (from a positioning perspective), and so we may look to add on some short dated call spreads to play a bounce. If the SPX regains 6,700, we flip back to a longer-term risk-on. <6,500 is where more of an aggressive directional slide takes place.

Key SG levels for the SPX are:

- Resistance: 6,700

- Pivot: 6,700 (bearish <, bullish >)

- Support: 6,600, 6,500, 6,330 (our long term/worst case low)

Opt-in to receive FlowPatrol™ — our daily AM report detailing the most significant options trades and their impact on the stock market

Stay informed of how options flow evolves each day: Opt in to receive FlowPatrol daily

Founder’s Note:

Futures are +20bps, with no major economic data on the tape for today.

There are a host of region banks reporting today – and this sector is under pressure given the recent events (see the earnings tab on the dashboard for specifics).

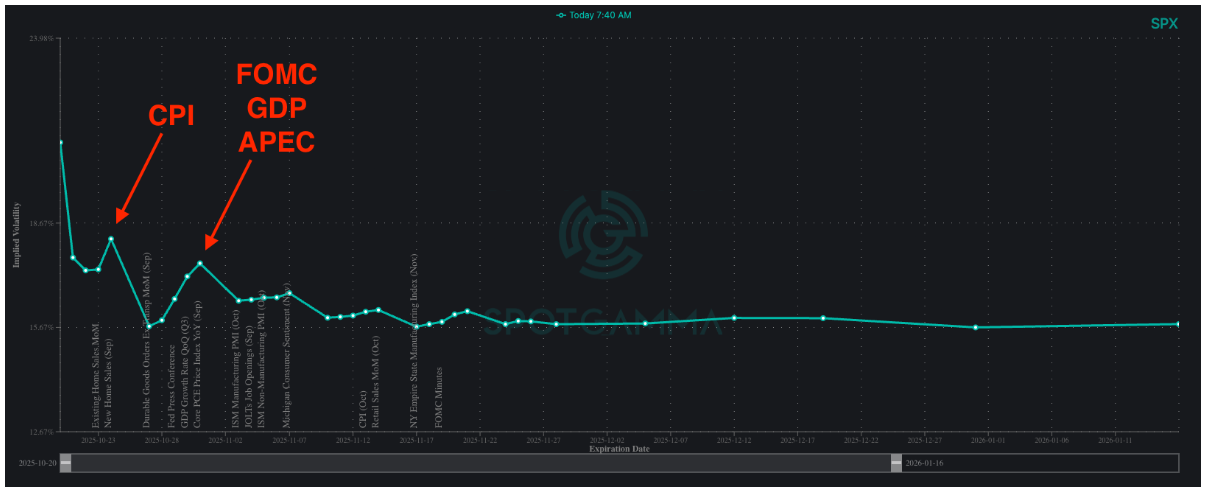

This week the focus is 1) VIX expiration – with the last day Oct VIX trading being tomorrow, then 2) CPI on 10/24 (confirmed via BLS site). Following that eyes turn to FOMC/GDP & the APEC Trump/Xi meeting. Amongst this is a slew of earnings reports.

We think that VIX expiration may provide a boost to stocks as traders that were long Oct VIX calls must sell those those calls, and the more VIX comes under pressure today/tomorrow the faster they are incentivized to sell. Further, data points like this much-anticipated CPI tend to be non events, which releases some event vol. Obviously a full vol-release isn’t on tap until the FOMC/APEC events pass into 11/1.

That bullish lean was our best idea last week due to puts being too expensive as a long, and the potential for expiration to add short term stock support.

As we eye updating positioning out of Oct OPEX, we can see that 6,700 is still the critical level that we need to close above in order to regain some longer-term stability. This is due to the relative positive gamma >=6,700, which infers that dealers should be supportive of stocks, which helps for vols to come in (i.e. removes those trap-doors which were so prevalent last week).

Flipping to single stocks, the picture is an uncorrelated mess. No longer is everyone on the call (long) or put (short) side, and IV’s are a mixed bag particularly with so many earnings coming up. This makes single stocks tricky here, as there is a lot of idiosyncratic data not only due to so many earnings, but also rapidly adjusting implied vols. This is another reason we looked at QQQ/SPY calls for Dec as its through some of this noise. The other thing that remains rich is GLD & SLV, and we favor Dec or Jan put flies in these ETF’s as a way to play some downside (ex: see OPEX Effect from Saturday AM).

©2025 TenTen Capital LLC DBA SpotGamma

|

|

/ESZ25 |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|---|

|

Reference Price: |

$6710.73 |

$6664 |

$664 |

$24817 |

$603 |

$2452 |

$243 |

|

SG Gamma Index™: |

|

0.117 |

-0.283 |

|

|

|

|

|

SG Implied 1-Day Move: |

|

0.62% |

0.62% |

|

|

|

|

|

SG Implied 5-Day Move: |

|

1.40% |

|

|

|

|

|

|

SG Implied 1-Day Move High: |

|

After open |

After open |

|

|

|

|

|

SG Implied 1-Day Move Low: |

|

After open |

After open |

|

|

|

|

|

SG Volatility Trigger™: |

$6726.73 |

$6680 |

$664 |

$24590 |

$600 |

$2440 |

$243 |

|

Absolute Gamma Strike: |

$6046.73 |

$6000 |

$670 |

$24500 |

$600 |

$2400 |

$240 |

|

Call Wall: |

$7046.73 |

$7000 |

$675 |

$24600 |

$610 |

$2600 |

$255 |

|

Put Wall: |

$6546.73 |

$6500 |

$655 |

$24000 |

$590 |

$2400 |

$240 |

|

Zero Gamma Level: |

$6671.73 |

$6625 |

$668 |

$24202 |

$607 |

$2502 |

$250 |

|

|

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Gamma Tilt: |

1.016 |

0.716 |

1.614 |

0.753 |

0.649 |

0.577 |

|

Gamma Notional (MM): |

$15.062M |

‑$705.996M |

$11.936M |

‑$368.617M |

‑$38.507M |

‑$544.903M |

|

25 Delta Risk Reversal: |

-0.076 |

0.00 |

-0.081 |

0.00 |

-0.06 |

-0.045 |

|

Call Volume: |

592.428K |

1.288M |

13.186K |

720.562K |

37.162K |

400.832K |

|

Put Volume: |

1.125M |

1.951M |

8.416K |

1.065M |

64.268K |

858.535K |

|

Call Open Interest: |

7.30M |

4.955M |

67.121K |

3.436M |

248.134K |

3.159M |

|

Put Open Interest: |

12.642M |

11.869M |

83.341K |

5.833M |

446.256K |

7.369M |

|

Key Support & Resistance Strikes |

|---|

|

SPX Levels: [6000, 6700, 6650, 6600] |

|

SPY Levels: [670, 660, 640, 650] |

|

NDX Levels: [24500, 24600, 24800, 25000] |

|

QQQ Levels: [600, 590, 610, 585] |

|

SPX Combos: [(6977,68.86), (6951,92.76), (6924,84.47), (6897,97.72), (6877,84.77), (6871,67.64), (6851,96.33), (6837,69.52), (6824,86.78), (6817,85.25), (6811,68.76), (6797,98.56), (6791,79.27), (6784,80.29), (6777,92.18), (6771,85.80), (6757,90.76), (6751,97.19), (6744,73.53), (6737,88.51), (6731,82.03), (6724,75.44), (6717,82.17), (6697,89.49), (6657,68.33), (6637,74.63), (6617,85.47), (6611,74.90), (6597,92.44), (6577,81.62), (6571,86.60), (6557,79.61), (6551,89.57), (6537,69.19), (6517,87.28), (6497,96.21), (6491,72.68), (6477,75.87), (6471,78.13), (6451,86.81), (6417,82.07), (6397,94.52), (6377,70.52), (6351,84.65)] |

|

SPY Combos: [648.09, 677.82, 687.73, 658] |

|

NDX Combos: [24247, 24595, 25066, 25488] |

|

QQQ Combos: [589.79, 592.19, 596.99, 580.19] |

0 comentarios