Macro Theme:

Key dates ahead:

- 2/5: AMZN, MSTR, Blue Owl ER

- 2/6: NFP

- 2/11: CPI

SG Summary:

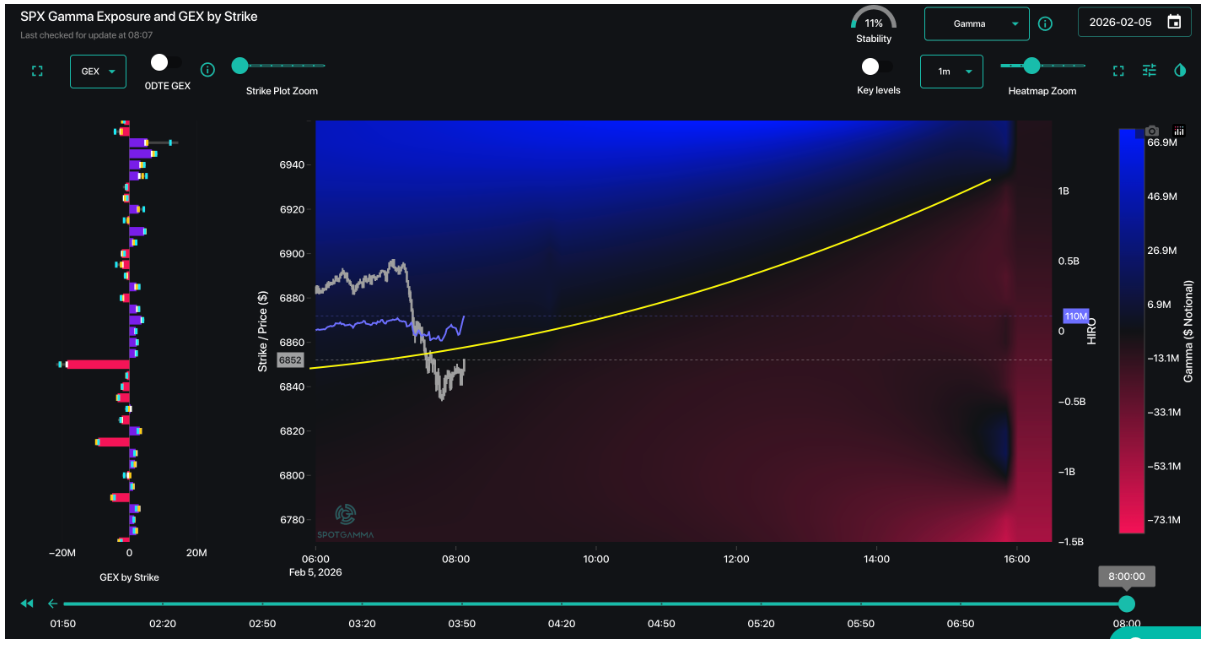

Update 2/5: As always, we remain neutral to short of equities as long as the SPX is below our Risk Pivot, which holds at 6,950. If we remain under 6,900 then we think a washout remains a viable outcome, and we’d eye 6,675 as major downside support. 7k remains major upside resistance due to positive gamma at that strike.

2/3: Short term now appear to be subsiding (Iran, MN, etc), and correlation metrics shifted higher after last weeks spasms (Sunday night futures traded to 6,875 before rallying to 7k). Further, we’ve uncovered a signal wherein the wild intraday swings vs overnight stability suggests positive SPX returns on a 3 to 5 day forward window. Given this, and the close back above 6,950, we will be long of stocks and looking to sell intraday calls against that position. Further, on the single stock side, we see TSLA has a IV Rank near 1, and so we will look to get into some longer dated TSLA calls for upside exposure. A break back <6,950 flips us back to risk-off.

Key SG levels for the SPX are:

- Resistance: 7,000, 7,020

- Pivot: 6,950 (bearish <, bullish >) UPDATED 1/28

- Support: 6,800, 6,675

Founder’s Note:

Futures have dropped about 60 bps.

GOOGL post ER: -4%

BTC plunging: $69k

AMZN and Blue Owl report tonight, both are important to the software story. MSTR also reports…could be interesting given BTC implies negative NAV.

TLDR: The worry here is that one of these spasms finally catches, and turns into a meaningful decline. Puts are clearly being bought, which adds probability to that sticky decline. <6,900 this is a major concern, and 6,675 is our current max downside target. We remain neutral to short of stocks while SPX is <6,950 Risk Pivot.

7k remains big resistance.

Sentiment has certainly shifted, with many bank notes focusing on “quakes” and the like. The reality is, as discussed yesterday, correlations have started to re-normalize but are far from normal. We also see that the daily 0DTE positive gamma supply is pretty much absent while SPX is <6,950. The risk here is that one of these spasms, which have been mean reverting over the past week, suddenly turn into a liquidity cascade. None of this should be new information if you’ve been a SG sub for more than a day.

The current negative gamma dynamic <6,900 suggests downside catches, as implied by the large zones of red on TRACE.

Further we note that vol is now bid, as you can see in the Fixed Strike Matrix. Here we compare fixed strike vol from Monday vs today, with a focus on slightly longer dated OTM puts. As you can see, vols are up, particularly in near term tenors. This syncs with the negative gamma above, telling us that puts are indeed being bought.

The question now becomes: What are people hedging, and what clears that risk? While its been software stocks plunging, metals mean reverting, etc we saw yesterday rate related names like housing up sharply. So that speaks to some equity sector rotation vs asset rotation (out of stocks and into, say, bonds).

Looking at the SPX term structure and forward implied vol, nothing really stands out as a key forward event. Yes short dated vols are a bit elevated, and so are vols for CPI next week – but thats nothing particularly notable. Given this, we still think that what’s happening here is more of a positional normalizing, particularly in the vol space.

Getting to the point, the worst case downside we see is around 6,675 given the negative gamma dynamics. If we see a sharp decline we would start thining about monetizing long puts and/or shorting some put spreads. To the upside, it seems like 7k is going to be formidable resistance into next week – if not Feb OPEX.

©2025 TenTen Capital LLC DBA SpotGamma

All TenTen Capital LLC DBA SpotGamma materials, information, and presentations are for educational purposes only and should not be considered specific investment advice nor recommendations. Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. VIEW FULL RISK DISCLOSURE https://spotgamma.com/model-faq/disclaimer/

|

|

/ESH26 |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|---|

|

Reference Price: |

$6906.2 |

$6882 |

$686 |

$24891 |

$605 |

$2624 |

$260 |

|

SG Gamma Index™: |

|

-0.971 |

-0.454 |

|

|

|

|

|

SG Implied 1-Day Move: |

|

0.60% |

0.60% |

|

|

|

|

|

SG Implied 5-Day Move: |

|

1.47% |

|

|

|

|

|

|

SG Implied 1-Day Move High: |

|

$6872.14 |

$685.03 |

|

|

|

|

|

SG Implied 1-Day Move Low: |

|

$6790.16 |

$676.85 |

|

|

|

|

|

SG Volatility Trigger™: |

$6964.2 |

$6940 |

$690 |

$25225 |

$617 |

$2630 |

$263 |

|

Absolute Gamma Strike: |

$7024.2 |

$7000 |

$690 |

$25550 |

$600 |

$2600 |

$260 |

|

Call Wall: |

$7124.2 |

$7100 |

$700 |

$25550 |

$621 |

$2680 |

$270 |

|

Put Wall: |

$6824.2 |

$6800 |

$675 |

$24000 |

$600 |

$2600 |

$250 |

|

Zero Gamma Level: |

$6918.2 |

$6894 |

$690 |

$25015 |

$618 |

$2678 |

$270 |

|

Key Support & Resistance Strikes |

|---|

|

SPX Levels: [7000, 6900, 6000, 6950] |

|

SPY Levels: [690, 680, 675, 670] |

|

NDX Levels: [25550, 25000, 24000, 26000] |

|

QQQ Levels: [600, 620, 610, 615] |

|

SPX Combos: [(7199,97.07), (7192,70.66), (7172,84.40), (7158,89.88), (7151,93.36), (7124,78.26), (7103,98.70), (7089,66.93), (7082,83.38), (7075,91.45), (7069,69.01), (7062,77.85), (7048,98.31), (7041,75.74), (7034,69.02), (7027,93.70), (7020,93.19), (7013,80.19), (7007,83.60), (7000,96.09), (6993,88.87), (6986,68.70), (6979,74.66), (6972,92.25), (6958,74.87), (6952,85.52), (6945,80.79), (6924,67.99), (6910,80.02), (6903,94.30), (6890,74.74), (6883,90.38), (6876,80.48), (6869,87.34), (6862,84.36), (6848,96.27), (6841,80.16), (6835,81.49), (6828,90.62), (6821,92.25), (6814,82.23), (6807,82.21), (6800,98.50), (6793,86.06), (6779,76.95), (6773,96.82), (6759,83.72), (6752,95.70), (6738,84.91), (6724,93.11), (6718,66.78), (6697,96.96), (6676,77.56), (6669,73.79), (6649,90.36), (6642,66.96), (6628,83.56), (6621,77.57), (6601,94.67), (6573,84.78), (6552,87.63)] |

|

SPY Combos: [677.74, 707.39, 687.39, 712.9] |

|

NDX Combos: [24667, 24244, 25538, 23846] |

|

QQQ Combos: [599.81, 621.38, 604.74, 610.29] |

|

|

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Gamma Tilt: |

0.902 |

0.630 |

0.889 |

0.625 |

0.565 |

0.493 |

|

Gamma Notional (MM): |

‑$473.92M |

‑$1.491B |

‑$4.795M |

‑$875.394M |

‑$62.875M |

‑$965.788M |

|

25 Delta Risk Reversal: |

-0.065 |

-0.046 |

-0.079 |

-0.062 |

-0.049 |

-0.033 |

|

Call Volume: |

687.561K |

1.648M |

12.827K |

1.479M |

14.303K |

360.277K |

|

Put Volume: |

824.276K |

2.348M |

11.725K |

1.749M |

22.105K |

881.309K |

|

Call Open Interest: |

7.407M |

4.795M |

61.199K |

3.787M |

225.95K |

2.865M |

|

Put Open Interest: |

12.284M |

11.166M |

99.589K |

5.672M |

429.457K |

7.298M |

0 comentarios