Macro Theme:

Key dates ahead:

- 2/11: CPI

- 2/12: PPI

- 2/20: OPEX

SG Summary:

Update 2/5: As always, we remain neutral to short of equities as long as the SPX is below our Risk Pivot, which holds at 6,950. If we remain under 6,900 then we think a washout remains a viable outcome, and we’d eye 6,675 as major downside support. 7k remains major upside resistance due to positive gamma at that strike.

Key SG levels for the SPX are:

- Resistance: 6,950, 7,000

- Pivot: 6,950 (bearish <, bullish >) UPDATED 1/28

- Support: 6,900l, 6,850, 6,800, 6,750, 6,675

Founder’s Note:

Futures are off fractionally, with no major data on deck for today.

Futures have buoyed back above 6,900, after the SPX touched 6,780 on Thursday. 6,950 remains our Risk Pivot, which means we view the SPX <6,950 as unstable. Being honest, the market has not exhibited much stability >6,950, but there remains non-0DTE positive gamma into the 7k strike which, if SPX >6,950, could start to offer stability into Feb OPEX.

Below 6,950 this rally remains quite unstable, and the risk of protracted downside increases sharply with SPX <6,900.

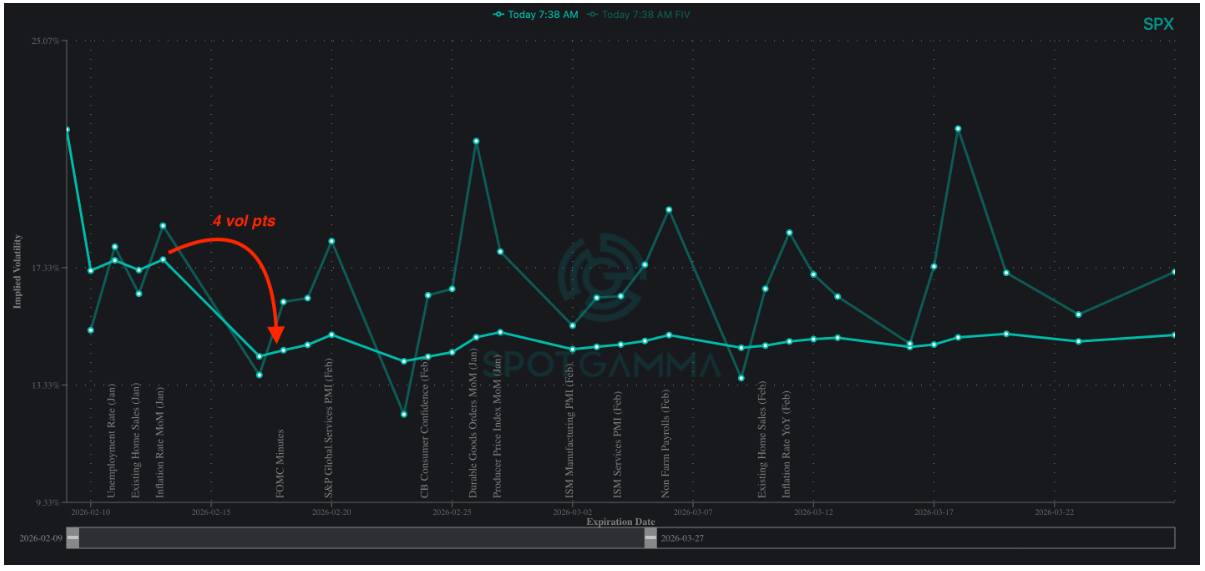

Traders are really watching macro data later this week, as evidenced by the SPX term structure. There is a 4 vol point drop between this week’s data which features Unemployment & CPI (both on 2/11) + PPI (2/12) vs next week. The argument here may be that this week’s macro data could further support a March rate cut. A week ago odds were 10%, now 18%. That’s certainly not a lock, but a big change could put a more consistent bid into stocks. Further, one can argue that there is some decent vol premium available.

On this topic: software. It has certainly been in the bears crosshairs this year, but we are seeing some signs of traders now selling puts and/or buying calls in the space. You see this with IGV (software ETF), which shows a slight favor to call IV vs put IV, with IV Rank exactly at 50%. There is obviously a lot of vol and price dispersion in this space, but with IGV and XLK having been nuked as of late we see signs of put selling. The software destruction which has taken place has occurred with the SPX currently being ~1% from all-time highs, which is remarkable. We wonder if a bid to that space gives the SPX lift to 7k into Feb OPEX.

Several of these key software names report this week: INTU, DDOG, CRM, ADBE, etc. These names all have very high IVs and so earnings plays may offer excess premium vs previous earnings. Also, rather than taking longs in something like IGV or XLK you may be able to find better risk/reward in combos (short put, long call).

©2025 TenTen Capital LLC DBA SpotGamma

All TenTen Capital LLC DBA SpotGamma materials, information, and presentations are for educational purposes only and should not be considered specific investment advice nor recommendations. Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. VIEW FULL RISK DISCLOSURE https://spotgamma.com/model-faq/disclaimer/

|

|

/ESH26 |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|---|

|

Reference Price: |

$6953.6 |

$6932 |

$690 |

$25075 |

$609 |

$2670 |

$264 |

|

SG Gamma Index™: |

|

0.579 |

-0.214 |

|

|

|

|

|

SG Implied 1-Day Move: |

|

0.64% |

0.64% |

|

|

|

|

|

SG Implied 5-Day Move: |

|

1.47% |

|

|

|

|

|

|

SG Implied 1-Day Move High: |

|

After open |

After open |

|

|

|

|

|

SG Implied 1-Day Move Low: |

|

After open |

After open |

|

|

|

|

|

SG Volatility Trigger™: |

$6936.6 |

$6915 |

$690 |

$25090 |

$615 |

$2660 |

$263 |

|

Absolute Gamma Strike: |

$7021.6 |

$7000 |

$690 |

$25550 |

$620 |

$2550 |

$260 |

|

Call Wall: |

$7021.6 |

$7000 |

$700 |

$25550 |

$630 |

$2680 |

$270 |

|

Put Wall: |

$6821.6 |

$6800 |

$685 |

$24000 |

$600 |

$2550 |

$250 |

|

Zero Gamma Level: |

$6913.6 |

$6892 |

$689 |

$24824 |

$617 |

$2684 |

$268 |

|

Key Support & Resistance Strikes |

|---|

|

SPX Levels: [7000, 6900, 6950, 6000] |

|

SPY Levels: [690, 685, 700, 670] |

|

NDX Levels: [25550, 25000, 24000, 25500] |

|

QQQ Levels: [620, 600, 610, 605] |

|

SPX Combos: [(7272,71.95), (7251,91.01), (7223,75.72), (7203,97.37), (7196,68.63), (7175,81.54), (7154,90.44), (7147,94.24), (7133,66.82), (7126,81.05), (7113,74.54), (7099,98.86), (7092,68.02), (7078,94.19), (7071,72.80), (7064,74.83), (7057,88.18), (7050,98.43), (7043,90.38), (7036,84.12), (7029,94.21), (7022,97.46), (7015,94.24), (7009,95.25), (7002,99.38), (6995,86.90), (6988,96.71), (6981,80.37), (6974,95.01), (6967,96.13), (6960,69.94), (6953,95.42), (6946,81.18), (6898,92.96), (6891,76.46), (6884,79.01), (6877,91.90), (6870,72.29), (6863,89.99), (6856,75.71), (6849,90.31), (6842,87.47), (6835,68.93), (6828,93.63), (6814,79.40), (6808,84.20), (6801,98.13), (6787,81.39), (6773,92.43), (6759,67.80), (6752,92.77), (6738,76.86), (6724,91.87), (6717,70.99), (6697,97.31), (6676,82.22), (6648,92.11), (6627,87.60), (6600,93.71)] |

|

SPY Combos: [667.96, 677.44, 657.79, 647.63] |

|

NDX Combos: [24675, 25552, 24273, 23847] |

|

QQQ Combos: [600.07, 589.92, 579.76, 583.94] |

|

|

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Gamma Tilt: |

1.058 |

0.813 |

1.083 |

0.634 |

0.885 |

0.671 |

|

Gamma Notional (MM): |

$304.912M |

‑$405.448M |

$3.018M |

‑$691.37M |

‑$11.033M |

‑$433.113M |

|

25 Delta Risk Reversal: |

-0.059 |

-0.046 |

-0.072 |

-0.057 |

-0.048 |

0.00 |

|

Call Volume: |

741.033K |

1.504M |

9.058K |

918.139K |

27.096K |

305.123K |

|

Put Volume: |

991.379K |

2.239M |

8.50K |

1.215M |

38.421K |

895.686K |

|

Call Open Interest: |

7.545M |

4.972M |

60.016K |

3.565M |

230.12K |

2.915M |

|

Put Open Interest: |

12.305M |

10.703M |

91.251K |

5.639M |

417.786K |

7.254M |

0 comentarios