Macro Theme:

Key dates ahead:

- 11/14: PPI

- 11/19: VIX Exp, NVDA ER

- 11/21: OPEX

SG Summary:

11/10: With the government shutdown apparently ending we are adjusting our risk-on pivot from 6,900 to 6,800. We think the week of 11/10 is setting up to be a bullish one, with more eyes now on 11/19 NVDA ER.

Key SG levels for the SPX are:

- Resistance: 6,700

- Pivot: 6,800 (bearish <, bullish >)

- Support: 6,600, 6,500

Founder’s Note:

Futures are off 1%, with PPI on deck.

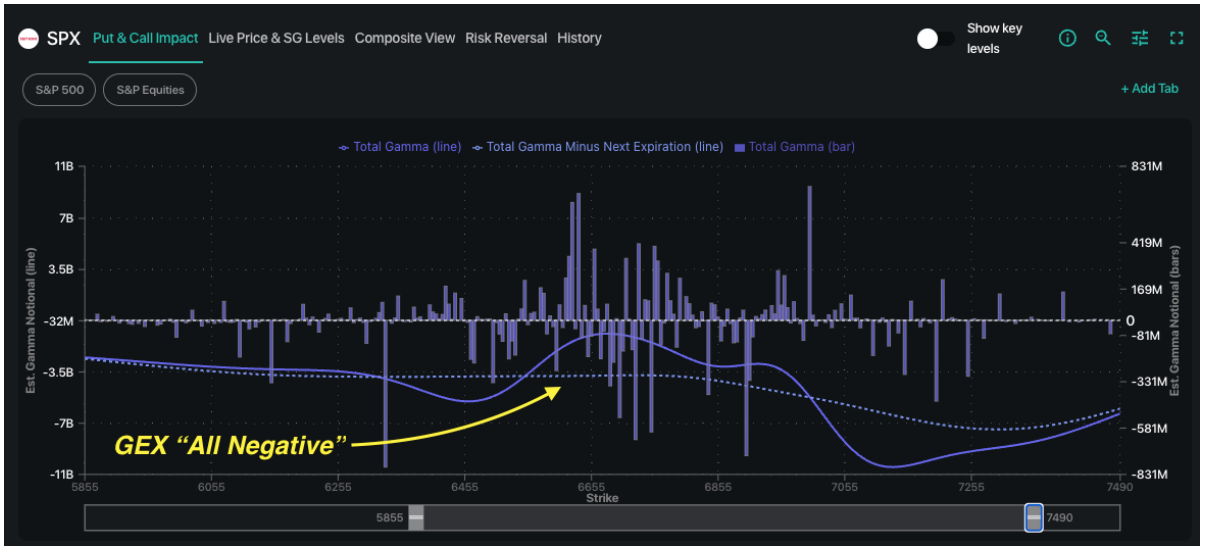

TLDR: While we were admittedly leaning long while SPX was above the 6,800 Risk Pivot, we are now all bearing witness to the “elevator down” dynamics present when flows shift from supportive to destructive. On this topic we have no clear risk-on level at the moment, as gamma is negative across the board and there is no clear sentiment/position clearing until Wed.

SPX gamma is negative across the full strike spectrum, which should keep volatility high. The key insight here is that gamma is pretty flat when you look south of current SPX levels (ref ~6,700, to the left of the yellow arrow). This suggests that traders are not long a lot of puts. Additionally, we don’t currently see a strong downside level to latch on to in terms of support and todays expiration does little to relieve the negative gamma condition.

This highlights a key point here: what can relieve the downside pressure? From a positioning standpoint we’d start to look at Wed VIX Exp & Friday OPEX, with NVDA earnings also falling on Wednesday. That time frame seems to be the chance for a change in sentiment along with a clearing of the positions driving volatility.

If you look at top single stocks you get a similar idea in that there isn’t a ton of negative gamma to the downside, but stocks are plunging (TSLA is 385 premarket!). You see this in the lack of GEX <375. The implication with this is that there is some “real money selling” – investors selling shares to escape with what they can into year end as AI sentiment has turned quite ugly after being euphoric just a week ago. For a bottoming signal we are looking for:

- Material put sellers step into these top single stocks.

- Put skews and IV ranks >50%

©2025 TenTen Capital LLC DBA SpotGamma

All TenTen Capital LLC DBA SpotGamma materials, information, and presentations are for educational purposes only and should not be considered specific investment advice nor recommendations. Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. VIEW FULL RISK DISCLOSURE https://spotgamma.com/model-faq/disclaimer/

|

| /ESZ25 | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $6758.98 | $6737 | $672 | $24993 | $608 | $2382 | $236 |

| SG Gamma Index™: |

| -0.784 | -0.33 |

|

|

|

|

| SG Implied 1-Day Move: |

| 0.62% | 0.62% |

|

|

|

|

| SG Implied 5-Day Move: |

| 1.38% |

|

|

|

|

|

| SG Implied 1-Day Move High: |

| After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: |

| After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $6801.98 | $6780 | $675 | $25170 | $615 | $2440 | $242 |

| Absolute Gamma Strike: | $6021.98 | $6000 | $670 | $24500 | $600 | $2450 | $240 |

| Call Wall: | $7021.98 | $7000 | $680 | $24600 | $640 | $2500 | $250 |

| Put Wall: | $6721.98 | $6700 | $660 | $24000 | $600 | $2390 | $235 |

| Zero Gamma Level: | $6770.98 | $6749 | $675 | $25118 | $616 | $2487 | $247 |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6000, 6800, 6700, 7000] |

| SPY Levels: [670, 680, 640, 675] |

| NDX Levels: [24500, 24600, 25000, 25500] |

| QQQ Levels: [600, 610, 615, 620] |

| SPX Combos: [(7047,90.06), (7027,72.08), (7020,78.86), (7000,99.23), (6973,91.35), (6960,68.21), (6953,96.31), (6926,84.27), (6919,81.60), (6906,74.52), (6899,98.39), (6892,72.68), (6879,74.73), (6872,87.88), (6866,75.94), (6852,94.97), (6825,83.91), (6818,87.48), (6798,91.56), (6751,84.03), (6737,81.53), (6731,86.82), (6724,85.08), (6717,90.24), (6711,77.50), (6697,96.90), (6690,79.40), (6684,78.74), (6677,90.54), (6670,93.29), (6657,92.78), (6650,95.38), (6643,79.76), (6636,85.19), (6630,70.15), (6623,88.77), (6616,89.26), (6609,70.35), (6603,93.67), (6576,75.30), (6569,69.00), (6562,68.49), (6549,83.14), (6522,79.10), (6515,78.72), (6502,95.20), (6475,75.20), (6468,87.24), (6448,83.25), (6428,72.15), (6414,75.73)] |

| SPY Combos: [688.07, 698.32, 686.02, 692.85] |

| NDX Combos: [24644, 24594, 24244, 24444] |

| QQQ Combos: [599.96, 598.72, 620.46, 645.3] |

0 comentarios