Macro Theme:

Short Term Resistance: 4,500

Short Term Support: 4,450

Risk Pivot Level: 4,500

Major Range High/Resistance: 4,600 SPX Call Wall

Major Range Low/Support: 4,400 SPX Put Wall

‣ Catalysts this week: VIX Exp & FOMC (20th). *

‣ Our trade is to enter “long volatility” positions out of CPI & into FOMC, with current ATM IV’s for a 30 day SPX option ~12% (too low, in our view). A bullish CPI/FOMC could produce a sharp upside shift, in which case we’d target >4,600 into the end of Sep. A bearish reaction could move the market <4,400. We think the market is underpricing market movement out of these events.*

*updated 9/18

Founder’s Note:

ES futures are flat at 4,505. SPX support is at 4,450 & 4,436. Resistance is at 4,460 & 4,500. Our daily estimated range is 0.82%.

In QQQ support is at the 370

Put Wall,

with resistance at 373.

With tomorrow being FOMC, we anticipate a low risk market for today. Further, with VIX exp tomorrow AM, we are looking for positive SPX drift >=4,450.

There was an incredibly tight 24 handle range yesterday, as traders wait for the Fed. As shown below, SPX IV for Wednesday, at 15.2%, is markedly above the 12% seen around 1 month out. There is little fear out there.

This is also being seen in the MOVE Index (aka Bond VIX), which is back to 100.

Before FOMC, we do have the VIX expiration, with Sep VIX options settling tomorrow morning. Today, premarket, the VIX is at 13.9 with the bulk of VIX open interest expiring tomorrow >=15. There are 150k puts at 13, and that may be the target for VIX into tomorrow AM. If the VIX does push lower it would like start today, and that would likely generate a bid for the SPX into tomorrows market open.

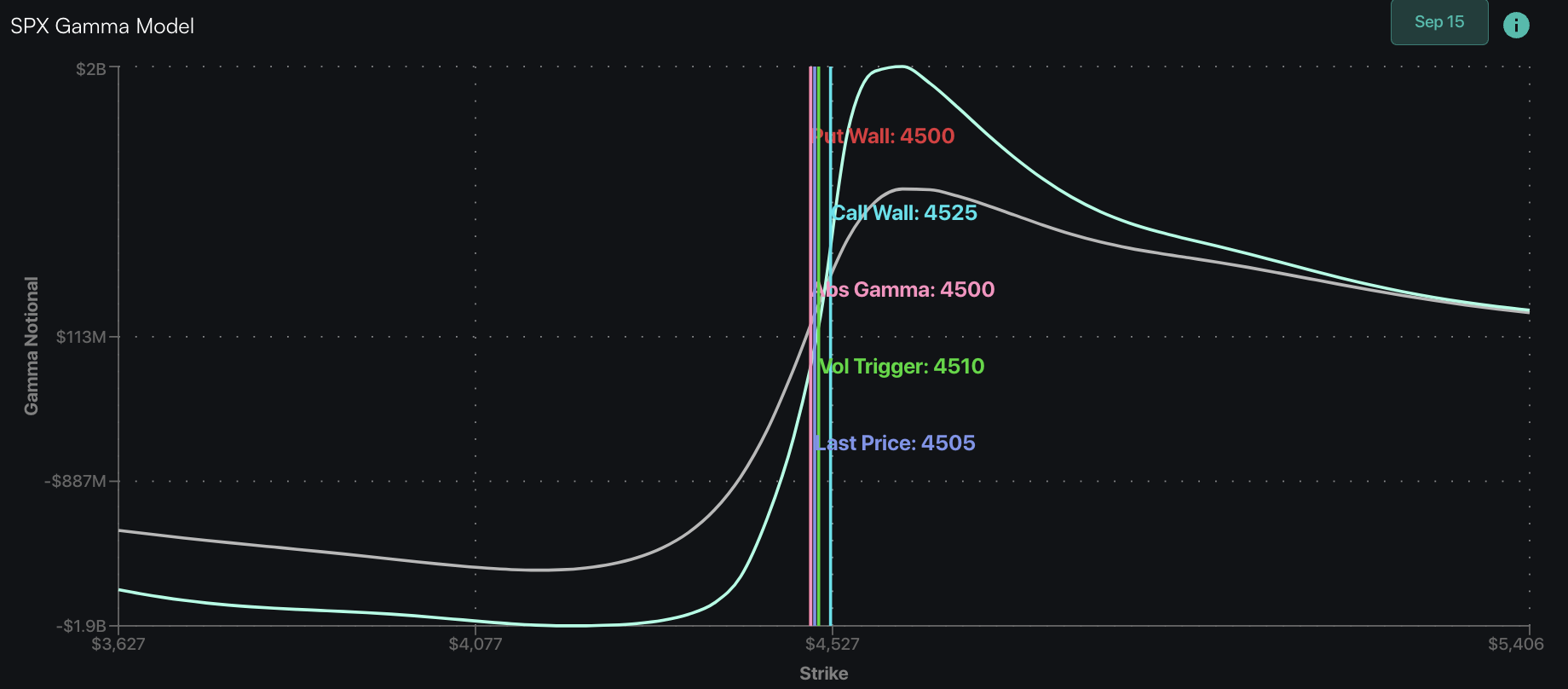

One of the things catching our eye this morning is our gamma model, which measures the rate of change of gamma over various SPX prices. As this curve goes lower it implies that dealers have negative deltas to hedge (sell futures), and when the curve turns higher, as it does <4,300, it suggests that incremental delta demand turns higher (buy futures). As we’ve previously discussed, this model assumes all puts are sold to dealers, which while it is not truth, gives us a clean baseline to use over time. This baseline is the “extreme” scenario, and then we can discount/adjust using elements like skew.

Because its likely there is a healthy short put position in equities, the gamma curve depicted below likely turns higher >=4,300 instead of <4,300, as shown. This implies that if the equity market does head lower after FOMC, that volatility may remain somewhat muted after an initial vol pop, due to a lack of downside hedging demand from the dealer community. Said another way – it seems like isn’t a whole lot of dealer shorting if we break the 4,400

Put Wall.

This muted volatility in the face of lower equities has been a major theme for the last ~2 years. This is something that Nomura flagged recently, and is plotted below (h/t TME). In this chart they essentially show how much the VIX moves relative to SPX, and as you can see the VIX seems less responsive now vs recent history. It’s not that the market can’t/won’t go lower, its just that it may do so at a slower speed.

This may matter for how you seek to hedge downside, with payoffs in a down market possibly being better short delta vs long vega. Delta being higher for ATM options, vs vega typically being longer dated OTM options.

| SpotGamma Proprietary Levels | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Reference Price: | $4453 | $443 | $15225 | $370 | $1834 | $182 |

| SpotGamma Implied 1-Day Move: | 0.82% | 0.82% |

|

|

|

|

| SpotGamma Implied 5-Day Move: | 2.20% |

|

|

|

|

|

| SpotGamma Volatility Trigger™: | $4460 | $445 | $15225 | $373 | $1900 | $186 |

| Absolute Gamma Strike: | $4500 | $445 | $15250 | $370 | $1850 | $185 |

| SpotGamma Call Wall: | $4500 | $455 | $15250 | $382 | $1910 | $210 |

| SpotGamma Put Wall: | $4400 | $440 | $14000 | $370 | $1700 | $180 |

| Additional Key Levels | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Zero Gamma Level: | $4461 | $449 | $14626 | $375 | $1929 | $192 |

| Gamma Tilt: | 0.850 | 0.544 | 1.499 | 0.722 | 0.629 | 0.392 |

| SpotGamma Gamma Index™: | -0.818 | -0.534 | 0.039 | -0.131 | -0.028 | -0.114 |

| Gamma Notional (MM): | ‑$400.741M | ‑$2.115B | $4.401M | ‑$649.387M | ‑$29.145M | ‑$1.164B |

| 25 Day Risk Reversal: | -0.036 | -0.019 | -0.037 | -0.027 | -0.024 | -0.034 |

| Call Volume: | 438.796K | 1.234M | 5.457K | 665.599K | 10.574K | 134.037K |

| Put Volume: | 767.295K | 1.782M | 12.757K | 907.523K | 27.117K | 432.847K |

| Call Open Interest: | 5.437M | 5.781M | 45.817K | 4.073M | 173.556K | 2.887M |

| Put Open Interest: | 11.249M | 12.233M | 68.818K | 7.887M | 325.905K | 6.209M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [4550, 4500, 4450, 4400] |

| SPY Levels: [450, 445, 442, 440] |

| NDX Levels: [16000, 15500, 15250, 15000] |

| QQQ Levels: [375, 372, 371, 370] |

| SPX Combos: [(4650,89.52), (4601,96.86), (4574,87.64), (4569,77.20), (4552,95.77), (4538,78.56), (4529,77.98), (4525,96.15), (4520,73.74), (4516,82.94), (4511,74.49), (4507,79.09), (4498,97.51), (4494,75.56), (4489,80.63), (4458,78.21), (4449,94.29), (4445,85.53), (4440,80.94), (4436,95.65), (4431,81.18), (4427,96.30), (4418,97.19), (4413,86.64), (4409,86.73), (4400,98.61), (4396,80.76), (4391,82.69), (4387,85.23), (4378,80.91), (4373,90.06), (4369,90.76), (4360,74.94), (4351,94.28), (4342,73.60), (4324,73.30), (4316,90.61), (4302,97.53), (4289,73.96), (4275,76.58), (4267,73.51), (4249,90.24)] |

| SPY Combos: [438.76, 428.56, 440.98, 440.09] |

| NDX Combos: [15256, 15196, 14784, 14998] |

| QQQ Combos: [371.7, 359.84, 364.66, 370.96] |

SPX Gamma Model

View All Indices Charts

0 comentarios