Macro Theme:

Key dates ahead:

- 2/12: PPI

- 2/18: VIX Exp

- 2/20: OPEX

SG Summary:

Update 2/10: Risk Pivot moved to 6,900 from 6,950, and we will look to buy SPX dips <6,950 with an eye on 7k for next weeks OPEX. <6,900 we would remove longs. The driver here is the removal of event vol from upcoming macro data. Second, we like mining the put skew in software stocks, with upcoming earnings a major catalyst for contraction. Put flies, 1×2’s and Combos may be interesting (consult the options calculator).

Key SG levels for the SPX are:

- Resistance: 6,960, 7,000

- Pivot: 6,900 (bearish <, bullish >) updated 2/10

- Support: 6,920, 6,900, 6,800, 6,700

Founder’s Note:

Futures are +20bps ahead of PPI at 8:30 AM ET.

Levels remain the same: Support is at 6,920 & 6,900, with resistance at 6,960 and 7,000. <6,900 we flip to risk-off, as we’d anticipate a large downside swing (6,800 test).

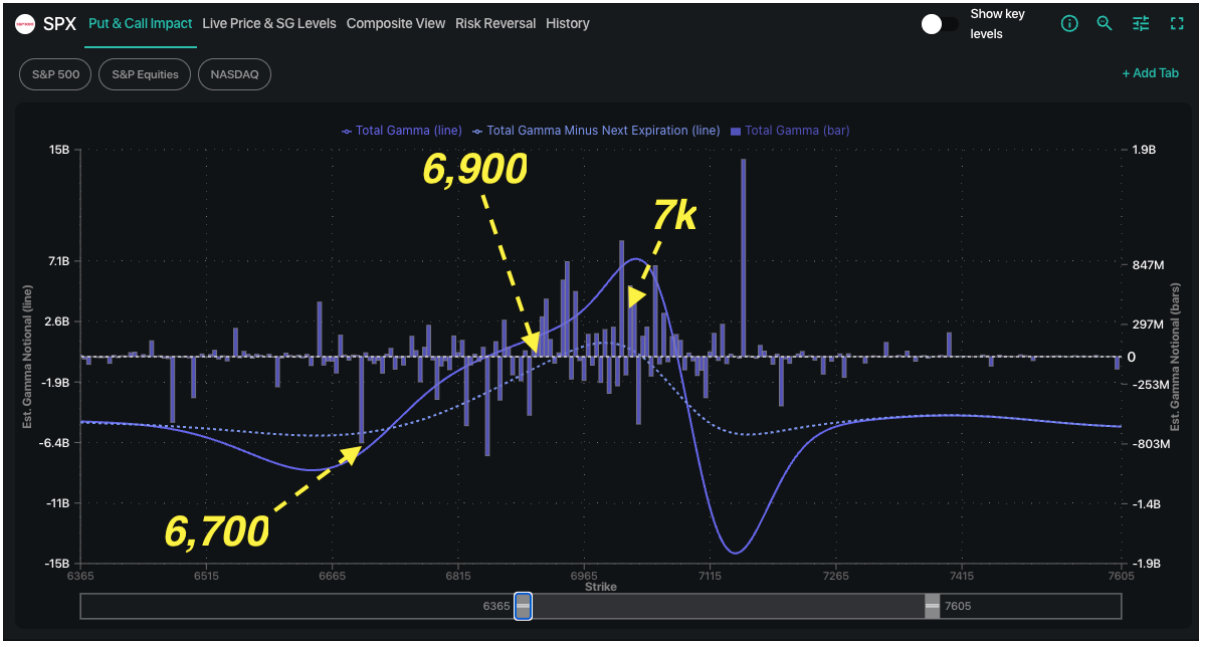

Zooming out, <6,900 is negative gamma (if you remove 0DTE positions), and negative gamma increases into 6,700. That would be the major downside inflection point. To the upside 7k is heavy positive gamma – but mainly when you incorporate 0DTE positions. That being said, 0DTE has been reloading at that level consistently for the last 1-2 weeks. Given that, we still currently eye a 7k high into VIX exp next week.

The major feature of this market continues to be the high sector volatility vs quiet index vol. Software has been heavily discussed (-25% YTD), while something like energy (XLE) is +22%. Long term SG members know we watch the CBOE COR1M metric as a measure of correlation, and in turn this is a major risk signal for us. That signal was flagging high risk (COR1M <8) to start Feb, but has since moderated a bit (COR1M = 11). However, single stock vol still seems quite high. COR1M really isn’t reflecting the broad dispersion because it measures the top 50 single stocks in the S&P500 only – and those names are often not including the big movers.

With this thought in mind, Nomura put out some interesting data on this, wherein they show that the return dispersion is at record 99th percentile highs. Nomura says this about the chart below (emphasis his): “…over the past ~1 month (Jan 15th through yday), the SPX is “unch” at 0.0%…but get this….the average S&P 500 stock saw an ABSOLUTE MOVE of 10.8% over the same window”.

SPX seems to be unch through this period because, while one sector loses (ex: software), another one gains (ex: energy). “Glory be” to the diversification of the S&P, right? On that point SPX is +1.5% YTD while NDX is -1%…

Correlation and dispersion are very similar concepts with respect to the way that we discuss them here and Nomura goes on to flag that forward 2 mo – 1 yr S&P returns from events like this are quite negative (albeit with a sample size of 8). We’d also suggest that “this time could be different” because the modern options market is way different (i.e. much larger) from periods with similar prior events. That being said, this dynamic highlights clear instability that has yet to infect the broader market.

The above disclaimer in place, we can’t help but wonder if Feb OPEX is what helps to reset some of this wide dispersion, with a window starting on 2/18 (VIX Exp). It’s a dynamic to strongly consider, as for this to rectify we’d likely have to see SPX vol go up to sync with higher single stock vol moves. Why do we suggest SPX vol has to go up? Because SPY IV Rank is 10 – hard to go much lower from there. This is why we must respect the Risk Pivot (6,900) & Vol Trigger levels as this dispersion unwind could be a hidden “jump risk”.

©2025 TenTen Capital LLC DBA SpotGamma

All TenTen Capital LLC DBA SpotGamma materials, information, and presentations are for educational purposes only and should not be considered specific investment advice nor recommendations. Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. VIEW FULL RISK DISCLOSURE https://spotgamma.com/model-faq/disclaimer/

|

| /ESH26 | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $6960.13 | $6941 | $691 | $25201 | $612 | $2669 | $264 |

| SG Gamma Index™: |

| 0.376 | -0.274 |

|

|

|

|

| SG Implied 1-Day Move: |

| 0.58% | 0.58% |

|

|

|

|

| SG Implied 5-Day Move: |

| 1.47% |

|

|

|

|

|

| SG Implied 1-Day Move High: |

| After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: |

| After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $6959.13 | $6940 | $690 | $25190 | $615 | $2660 | $264 |

| Absolute Gamma Strike: | $7019.13 | $7000 | $690 | $25550 | $620 | $2600 | $260 |

| Call Wall: | $7119.13 | $7100 | $700 | $25550 | $630 | $2680 | $270 |

| Put Wall: | $6819.13 | $6800 | $685 | $24000 | $600 | $2550 | $250 |

| Zero Gamma Level: | $6920.13 | $6901 | $690 | $25137 | $621 | $2663 | $268 |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [7000, 6900, 6950, 6000] |

| SPY Levels: [690, 695, 685, 700] |

| NDX Levels: [25550, 25000, 25200, 26000] |

| QQQ Levels: [620, 600, 610, 615] |

| SPX Combos: [(7275,77.69), (7247,91.98), (7226,81.61), (7198,98.32), (7177,77.38), (7157,91.93), (7150,95.14), (7129,67.20), (7122,89.35), (7108,79.26), (7101,99.01), (7087,80.08), (7080,75.30), (7073,97.16), (7059,85.47), (7053,98.80), (7046,78.22), (7039,81.83), (7032,95.75), (7025,96.55), (7018,97.28), (7011,96.38), (7004,87.12), (6997,99.07), (6990,92.50), (6983,94.59), (6976,87.58), (6969,87.89), (6962,87.68), (6928,89.56), (6921,85.13), (6914,82.34), (6907,85.53), (6900,96.90), (6893,90.14), (6879,83.59), (6872,95.47), (6865,81.40), (6858,83.79), (6851,91.84), (6844,69.78), (6837,81.38), (6830,75.24), (6823,93.60), (6810,77.47), (6803,98.74), (6789,75.14), (6782,79.80), (6775,91.17), (6768,75.44), (6761,73.92), (6747,90.57), (6733,71.62), (6726,79.59), (6719,80.29), (6699,96.23), (6678,78.18), (6671,72.28), (6657,73.50), (6650,88.58), (6622,85.39), (6601,93.24)] |

| SPY Combos: [697.65, 708.03, 703.18, 678.27] |

| NDX Combos: [25554, 24672, 24269, 25075] |

| QQQ Combos: [599.89, 621.91, 590.11, 604.78] |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.035 | 0.783 | 1.136 | 0.664 | 0.836 | 0.622 |

| Gamma Notional (MM): | $60.972M | ‑$780.695M | $2.792M | ‑$782.73M | ‑$14.264M | ‑$524.996M |

| 25 Delta Risk Reversal: | -0.062 | -0.045 | -0.077 | -0.06 | -0.047 | -0.032 |

| Call Volume: | 517.488K | 1.451M | 9.008K | 864.915K | 14.604K | 361.455K |

| Put Volume: | 758.793K | 2.058M | 9.124K | 1.209M | 29.434K | 852.434K |

| Call Open Interest: | 7.671M | 5.002M | 61.825K | 3.661M | 238.672K | 2.96M |

| Put Open Interest: | 12.597M | 11.051M | 100.248K | 6.055M | 430.54K | 7.539M |

0 comentarios