Macro Theme:

Short Term Resistance: 4,500

Short Term Support: 4,450

Risk Pivot Level: 4,500

Major Range High/Resistance: 4,500 SPX Call Wall

Major Range Low/Support: 4,400 SPX Put Wall

‣ Catalysts this week: VIX Exp & FOMC (20th). *

‣ Our trade is to enter “long volatility” positions out of CPI & into FOMC, with current ATM IV’s for a 30 day SPX option ~12% (too low, in our view). A bullish CPI/FOMC could produce a sharp upside shift, in which case we’d target >4,600 into the end of Sep. A bearish reaction could move the market <4,400. We think the market is underpricing market movement out of these events.*

*updated 9/18

Founder’s Note:

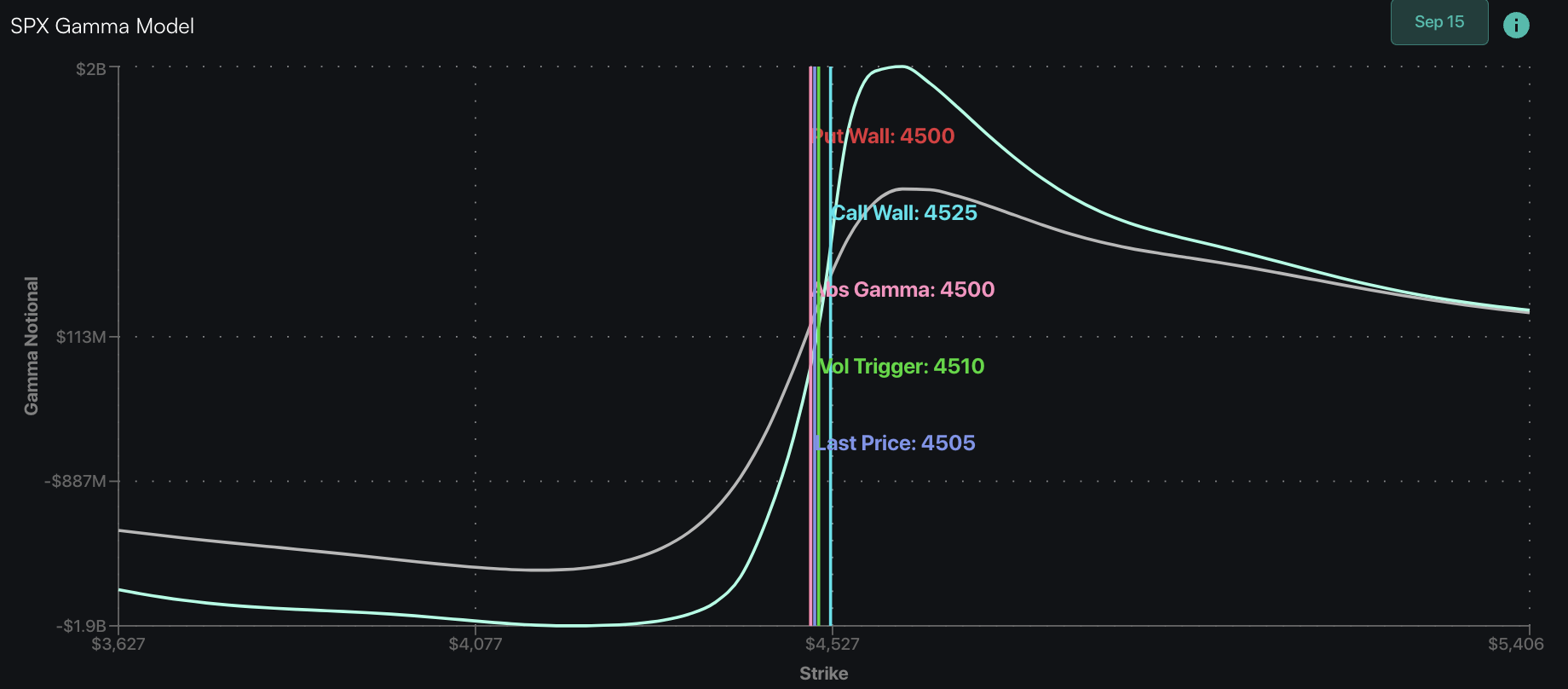

ES futures are flat to 4,500 ahead of 2PM ET FOMC. Key SPX support is staggered at several levels below: 4,435, 4,417 (= 440 SPY

Put Wall

) & 4,400 SPX

Put Wall

. Resistance above is at 4,450 then the 4,500

Call Wall.

The 1 day open/close implied SPX range is at 0.81%.

For QQQ, 370 is support, with the

Put Wall

rolling to 350. The

Put Wall

decline is due to 25k puts being added to 350. Resistance above it at 373 then 375.

This morning is VIX expiration at the market open (VIX currently 14), so those of you active pre-market may accordingly see some strange shifts in ES.

Today’s at-the-money SPX straddle is $28.8, which implies the market is pricing in just 65bps of movement for today (ref: 4,445, IV of 22%). Again we highlight that market volatility expectations now differ fairly sharply from our 1 Day Implied Move estimate of 81bps.

Last week, pre-OPEX, our range was in the low 50’s. This highlights one of our core views here: that traders should now anticipate higher short term volatility vs recent weeks, and we do not think the market has priced that in.

Today we’re looking for the SPX to shift to one of two large gamma zones after Powell’s presser this afternoon:

- to the upside its SPX 4,500

Call Wall,

- to the downside its the 4,400 – 4,417

Put Wall

(s) area.

We flag the SPY 440

Put Wall

in particular (4,417 SPX), as its holds a very large

gamma notional,

as shown below. This level was also the low in yesterday’s session.

Our outlook is, again, for the S&P to march toward one of these Walls today, and then for the Walls to shift tomorrow. A shift in the Walls, along with shifts in IV (discussed below), will help to mark our path into the end-of-month. We maintain the view that today triggers a move which feeds into large Sep 29th positions, which gives the market the opportunity for a ±5% move over the next ~10 sessions toward >4,600 or <4,300. Shifts in Wall’s will be a core competent to evaluating these upside & downside targets.

We’d also note that the SPX needs to recover 4,500 for bulls to be given an “all clear”. Our view is that options flows are not long-term supportive of equities until >4,500.

From an options perspective, the lever which should help reinforce market direction out of today and into the next few sessions is implied volatility. As noted at the top of our note, the market has rather low volatility expectations today, with that 65bps straddle.

If Powell comes off as dovish we should see the current term structure deflate from “quiet” to “fully asleep” (green line). If Powell sparks some concerns, then there can be a quick, jumpy pop in IV’s which lifts term structure (red). This is a chance for a spike in vol-of-vol as short term options prices may need to reset from daily move expectations of 65-75bps, to ~100bps moves.

However, if there is a strong pop in IV, we would not anticipate significant backwardation in term structure. In other words, a quick test of 20 for VIX is possible, but we are doubtful that anything larger than that manifests. Please see yesterday’s note for more on downside projections.

| SpotGamma Proprietary Levels | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Reference Price: | $4443 | $442 | $15191 | $369 | $1826 | $181 |

| SpotGamma Implied 1-Day Move: | 0.81% | 0.81% |

|

|

|

|

| SpotGamma Implied 5-Day Move: | 2.20% |

|

|

|

|

|

| SpotGamma Volatility Trigger™: | $4450 | $445 | $15175 | $373 | $1900 | $184 |

| Absolute Gamma Strike: | $4500 | $440 | $15250 | $370 | $1850 | $185 |

| SpotGamma Call Wall: | $4500 | $450 | $15250 | $382 | $1910 | $210 |

| SpotGamma Put Wall: | $4400 | $440 | $14000 | $350 | $1700 | $180 |

| Additional Key Levels | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Zero Gamma Level: | $4451 | $448 | $14703 | $375 | $1920 | $191 |

| Gamma Tilt: | 0.831 | 0.596 | 1.417 | 0.728 | 0.607 | 0.427 |

| SpotGamma Gamma Index™: | -0.933 | -0.478 | 0.035 | -0.127 | -0.03 | -0.11 |

| Gamma Notional (MM): | ‑$470.023M | ‑$1.92B | $4.04M | ‑$650.793M | ‑$32.05M | ‑$1.123B |

| 25 Day Risk Reversal: | -0.032 | -0.02 | -0.034 | -0.029 | -0.025 | -0.034 |

| Call Volume: | 474.858K | 1.816M | 7.468K | 786.057K | 11.957K | 247.154K |

| Put Volume: | 843.566K | 2.094M | 15.838K | 993.453K | 22.329K | 467.991K |

| Call Open Interest: | 5.509M | 6.047M | 46.324K | 4.138M | 174.228K | 3.009M |

| Put Open Interest: | 11.33M | 12.377M | 71.373K | 7.983M | 329.533K | 6.271M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [4550, 4500, 4450, 4400] |

| SPY Levels: [450, 445, 442, 440] |

| NDX Levels: [16000, 15500, 15250, 15000] |

| QQQ Levels: [375, 372, 370, 365] |

| SPX Combos: [(4648,88.25), (4599,96.40), (4573,86.38), (4568,74.14), (4551,95.67), (4528,74.56), (4524,95.59), (4515,85.76), (4511,76.45), (4506,80.16), (4502,97.74), (4488,77.62), (4448,79.34), (4435,93.15), (4426,94.84), (4422,80.35), (4417,93.86), (4413,87.13), (4408,89.09), (4400,99.12), (4395,84.46), (4391,84.34), (4386,90.05), (4382,77.95), (4373,91.97), (4368,92.37), (4360,79.86), (4355,75.13), (4351,96.61), (4342,78.45), (4324,78.66), (4315,91.72), (4302,97.94), (4288,77.01), (4275,80.23), (4266,76.04), (4248,91.12), (4226,81.34)] |

| SPY Combos: [437.44, 427.7, 447.18, 439.21] |

| NDX Combos: [15252, 14781, 14994, 15070] |

| QQQ Combos: [370.63, 369.15, 359.16, 364.34] |

SPX Gamma Model

View All Indices Charts

0 comentarios