Macro Theme:

Key dates ahead:

- 11/19: VIX Exp, NVDA ER

- 11/21: OPEX

- 11/27: Thanksgiving

- 12/10: FOMC

- 12/15: ORCL ER

SG Summary:

UPDATE 11/17: VIX Exp is Wed AM, and we could make the case for a sneaky vol decline & equity support into tomorrow afternoon as traders roll out NOV VIX calls. Given this, we are going to be looking to add a few cheap upside call structures for Tuesday PM (spreads or flies as calls are not particularly cheap), which would profit if the SPX moves >=6,800.

11/10: With the government shutdown apparently ending we are adjusting our risk-on pivot from 6,900 to 6,800. We think the week of 11/10 is setting up to be a bullish one, with more eyes now on 11/19 NVDA ER.

Key SG levels for the SPX are:

- Resistance: 6,700, 6,800

- Pivot: 6,800 (bearish <, bullish >)

- Support: 6,600, 6,500, 6,350 (6,350 is a large put strike zone and a long term support line)

Founder’s Note:

Futures are off 50 bps, with no major data on the board. Today is the last day Nov VIX options can trade.

We yesterday were looking for a tailwind to equities due to the aforementioned VIX expiration, working from the idea that vol would come for sale with traders having to roll calls. That trade seemed to be coming to fruition early in yesterday’s session before word of AMZN’s $3bn bond sale, and some hawkish Fed rhetoric took the wind out of stocks, and triggered a massive -$10bn in S&P500 HIRO (delta).

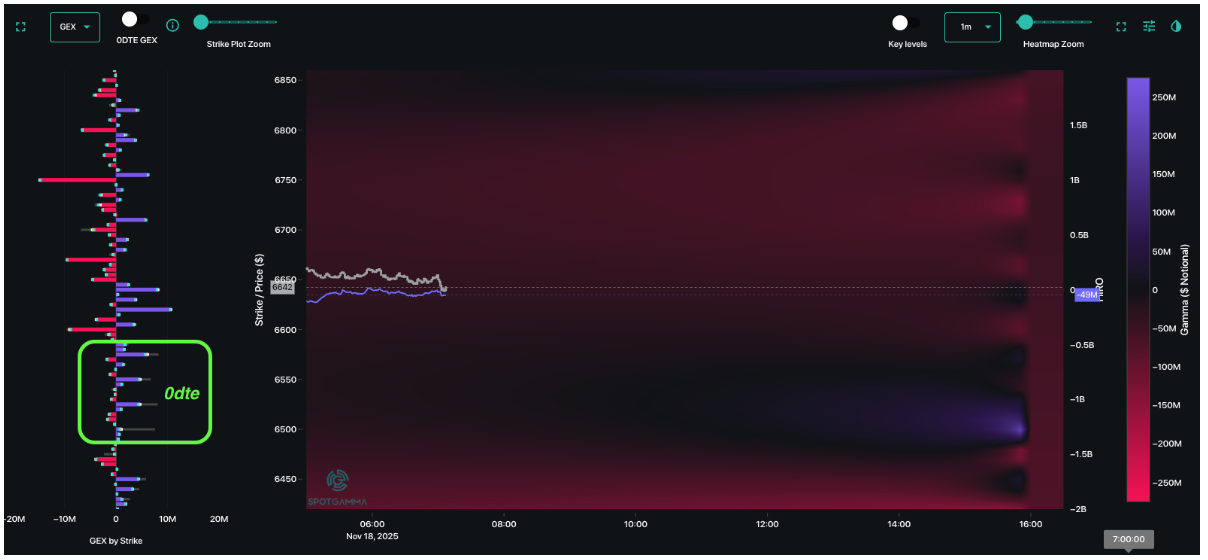

Today the SPX map starts off in the same position – with a lot of negative gamma (red in TRACE across the board) and some VIX positions that have to roll today, but that potential vol relief comes up against a real lack of belief in AI names, which accounts for ~35% of the SPY/QQQ. One thing of note for today’s session is that we see some layered 0DTE positive gamma into 6,500, and that similar setup was in yesterdays session, wherein negative HIRO delta fed down into a similar cluster of 0DTE puts around 6,650. Its as if the 0DTE traders knew the path of least resistance was lower, and pressed it…

While yesterday’s delta was driven by 0DTE put buying, that shouldn’t detract from a clear bit to put skews. You can see this clearly in the SDEX, which measures 1 std deviation SPY put prices. Interestingly we are still below the vol spasm of early October, wherein vol spiked (VIX ~30) even though stocks didn’t move much (SPX -2%).

With more detail, this is the change in SPX 6,500 IV since Friday’s close, with >=2 vol points across the board – that is material. This is setting up such that if NVDA earnings are poor, vol can easily jump more and stocks move lower together – thats more of an April selling situation as real money sells stocks and vol gets stick at higher relative levels. This, instead of a quick reverting spasm.

We are weary of overestimating the importance of NVDA ER, but the narrative that NVDA determines our destiny seems legitimate. Consider CRWV, which is -50% since October 30th (!), and tightly linked to NVDA. The term structures below compare the current (teal) vs that of pre-CRWV earnings (gray), and you can see that while the next expiration IV is off a bit (ie gray peak > teal), the longer dated options hold nearly an identical vol level. In other words – no one wants to buy this stock (or sell their puts) unless NVDA is a-ok. ORCL is another name that comes to mind in this bucket, and they report on 12/15.

©2025 TenTen Capital LLC DBA SpotGamma

All TenTen Capital LLC DBA SpotGamma materials, information, and presentations are for educational purposes only and should not be considered specific investment advice nor recommendations. Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. VIEW FULL RISK DISCLOSURE https://spotgamma.com/model-faq/disclaimer/

|

|

/ESZ25 |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|---|

|

Reference Price: |

$6692.48 |

$6672 |

$665 |

$24799 |

$603 |

$2341 |

$232 |

|

SG Gamma Index™: |

|

-2.034 |

-0.529 |

|

|

|

|

|

SG Implied 1-Day Move: |

|

0.65% |

0.65% |

|

|

|

|

|

SG Implied 5-Day Move: |

|

1.45% |

|

|

|

|

|

|

SG Implied 1-Day Move High: |

|

After open |

After open |

|

|

|

|

|

SG Implied 1-Day Move Low: |

|

After open |

After open |

|

|

|

|

|

SG Volatility Trigger™: |

$6750.48 |

$6730 |

$671 |

$24590 |

$615 |

$2440 |

$242 |

|

Absolute Gamma Strike: |

$6020.48 |

$6000 |

$670 |

$24600 |

$600 |

$2380 |

$230 |

|

Call Wall: |

$7020.48 |

$7000 |

$700 |

$24600 |

$640 |

$2500 |

$250 |

|

Put Wall: |

$6520.48 |

$6500 |

$660 |

$24000 |

$600 |

$2310 |

$230 |

|

Zero Gamma Level: |

$6703.48 |

$6683 |

$674 |

$24737 |

$616 |

$2462 |

$247 |

|

Key Support & Resistance Strikes |

|---|

|

SPX Levels: [6000, 6700, 6600, 6800] |

|

SPY Levels: [670, 640, 660, 650] |

|

NDX Levels: [24600, 24500, 24000, 25000] |

|

QQQ Levels: [600, 610, 590, 585] |

|

SPX Combos: [(6999,98.26), (6973,84.56), (6953,91.98), (6926,74.07), (6919,67.74), (6899,95.51), (6873,74.59), (6853,91.83), (6826,75.52), (6819,81.33), (6799,92.88), (6752,68.02), (6712,70.45), (6699,88.56), (6679,67.82), (6672,92.83), (6666,76.89), (6659,86.08), (6652,96.94), (6646,80.85), (6639,82.55), (6632,90.89), (6626,86.90), (6612,94.97), (6606,72.99), (6599,96.20), (6592,86.82), (6579,71.57), (6572,93.20), (6566,80.34), (6559,69.14), (6552,93.26), (6532,84.80), (6526,85.34), (6512,90.63), (6499,97.96), (6472,89.13), (6466,87.14), (6452,90.93), (6426,77.11), (6412,85.46), (6399,94.10), (6352,87.05)] |

|

SPY Combos: [698.16, 688.08, 663.21, 678.67] |

|

NDX Combos: [24602, 24651, 24230, 24453] |

|

QQQ Combos: [600.29, 598.46, 589.94, 594.81] |

0 comentarios