Macro Theme:

Short Term Resistance: 4,400

Short Term Support: 4,300

Risk Pivot Level: 4,400

Major Range High/Resistance: 4,500

Major Range Low/Support: 4,300

‣ We target a market move <4,300 by 9/29, and would be stopped out on this view with a close >4,350.*

‣ If the SPX is <4,300 into 9/29 exp, it may mark a major short term low, as put positioning hits extreme highs.*

*updated 9/26

Founder’s Note:

Futures are lower to 4,360. Key SPX support remains with the SPY 430 (SPX 4,315) & SPX 4,300

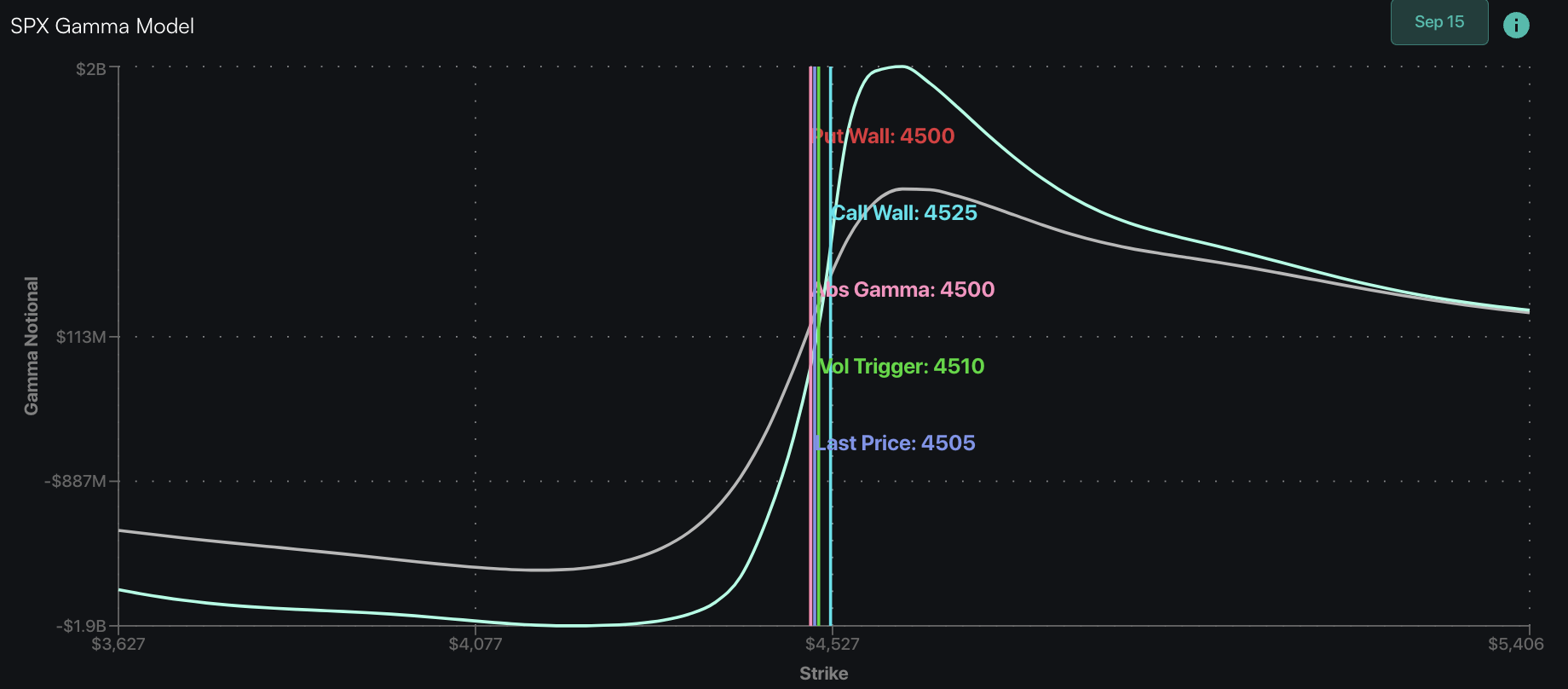

Put Walls

. Below there we mark support at 4,277. Resistance above is at 4,324 & 4,350. The

SG Implied 1-Day Move

is fractionally higher to 0.86%.

It’s a murky, churning mess right now which make it hard to have much conviction.

The

Put Walls

have failed to roll lower which suggests traders are not looking to add puts at lower strikes. We generally look at the Put Wall as our major support line, below which the market is oversold. There seems to currently be low demand to hedge against further downside.

Implied vols are up slightly as futures tested the SPX

Put Wall

overnight, and bounced (ES lows = 4,345).

Things are likely to remain unstable in through Friday unless the SPX can rally >4,350. Above 4,350 we think the pull of 4,400 increases, and volatility sellers will step up which breaks the negative feedback loop we discussed yesterday.

Unless the SPX recaptures that level, then the market may be prone to quick downside reversals. Further, Thursday’s GDP & Fridays PCE could be triggers to give equities a directional shove in this heavy negative gamma environment (negative gamma fosters large directional changes).

The heavily watched 50k, 9/29 exp 4,210 JPM Put position has a gamma of ~1.5 right now, and the decay of that position is increasing. Each day that passes requires a deeper SPX probe to wake up those puts, and give meaningful downside pull. Today requires a move under 4,300, and if we can close below there then it may increase the chance for 4,200 by Friday.

Below is a chart from our Sep 30th, 2022 Founder’s Note, wherein the S&P had dropped nearly 7% after FOMC and into the the Sept Quarterly OPEX. Our SG Implied Move was 1.2% (vs 0.86% today), and gamma index was -1.96 (vs -2.4 today).

The SPX rallied ~5% to start October ’22, before putting in fresh lows into October’s monthly expiration.

You can clearly see this pattern threatening to repeat here – with less magnitude. For example, if the SPX were to now trade down to the 4,210 JPM strike it would be a -4.5% move from FOMC (vs a -7% move in Sep ’22). The VIX was also +30 at this time last year, vs 17.5 today. There are just lighter downside forces to unwind for a possible bounce next week. We are still on watch for a rally out of this week, but initially only back up into the 4,400 – 4,500 area.

0 comentarios