Macro Theme:

Short Term Resistance: 4,350

Short Term Support: 4,300

Risk Pivot Level: 4,325

Major Range High/Resistance: 4,400

Major Range Low/Support: 4,200

‣ We target a market move <4,300 by 9/29, and would be stopped out on this view with a close >4,325.*

‣ If the SPX is <4,300 into 9/29 exp, it may mark a major short term low, as put positioning hits extreme highs.*

‣ 4,200 remains a zone for major market lows into 10/20 OPEX.**

*updated 9/27

**updated 9/30

Founder’s Note:

ES futures are 50bps higher to 4360. Key SPX levels are:

- Support: 4,315 (SPY 430), 4,300, 4,274, 4,250

- Resistance: 4,350

- 1 Day Implied Move: 0.82%

For QQQ, key support is 355 & 350

Put Wall,

with resistance at 360 & 365.

Traders will be watching the 8:30 AM ET PCE numbers. We also note that it is end-of-quarter, and so in addition to the heavily watched JPM collar roll, there may be large, active fund rebalancing activities. We up these factors as they can cause unsual movements due to options flows coming up against big macro flows.

IV’s are down (shown below), and futures are testing our key rally point of 4,325 this morning, and a break above that level may give bulls the all-clear for today. 4,300 should be strong support, and if that level fails we look to 4,275.

For all intents and purposes the 4,210 JPM put is dead, and it would take a break of 4,250 for that current put position to gain some gamma, which could pull the market lower into 4,200. This seems a rather unlikely scenario, particularly if the PCE is not a disaster. We discussed more on the collar roll in yesterdays webinar, here.

As also discussed in yesterday’s webinar, our major overhead target into next week is 4,400, with an outside chance of 4,500. A rally could be fueled by the negative delta (puts expiring today), negative gamma (hedging flows from puts), and positive vanna (IV collapse). We think of these factors as adding fuel to a tank – and in this situation the “rally fuel tank” is full. Therefore, if we rally today, there may be less fuel for a rise next week.

Said another way – if we somehow were to rally to 4,400 today (which we highly doubt), then our view for next week would be much more neutral as the fuel is exhausted.

The clearest depiction of why 4,400 matters comes from our vanna model, shown here. As you can see both our IV adjusted delta (purple) and standard delta (gray) “flatten out” into 4,400. This implies the dealer-delta buyback/short cover declines significantly into 4,400. This doesn’t mean that the rally has to sharply reverse from that 4,400 zone, just that the momentum may stall out (more on this below).

Turning to the downside, 4,200 will remain the major downside level out of today’s expiration – and likely into 10/20 OPEX. Further, we think a rally into 4,400 for early next week could be prone to a sharp reversal back to current lows. This is because we’d classify a rally from this point as “short covering”, with likely some speculative, short term “trading” longs in the mix. We will be looking for signals that long term “real money” buyers and/or volatility sellers have to stepped in, once that rally fuel drains off. This would add more stability around 4,400.

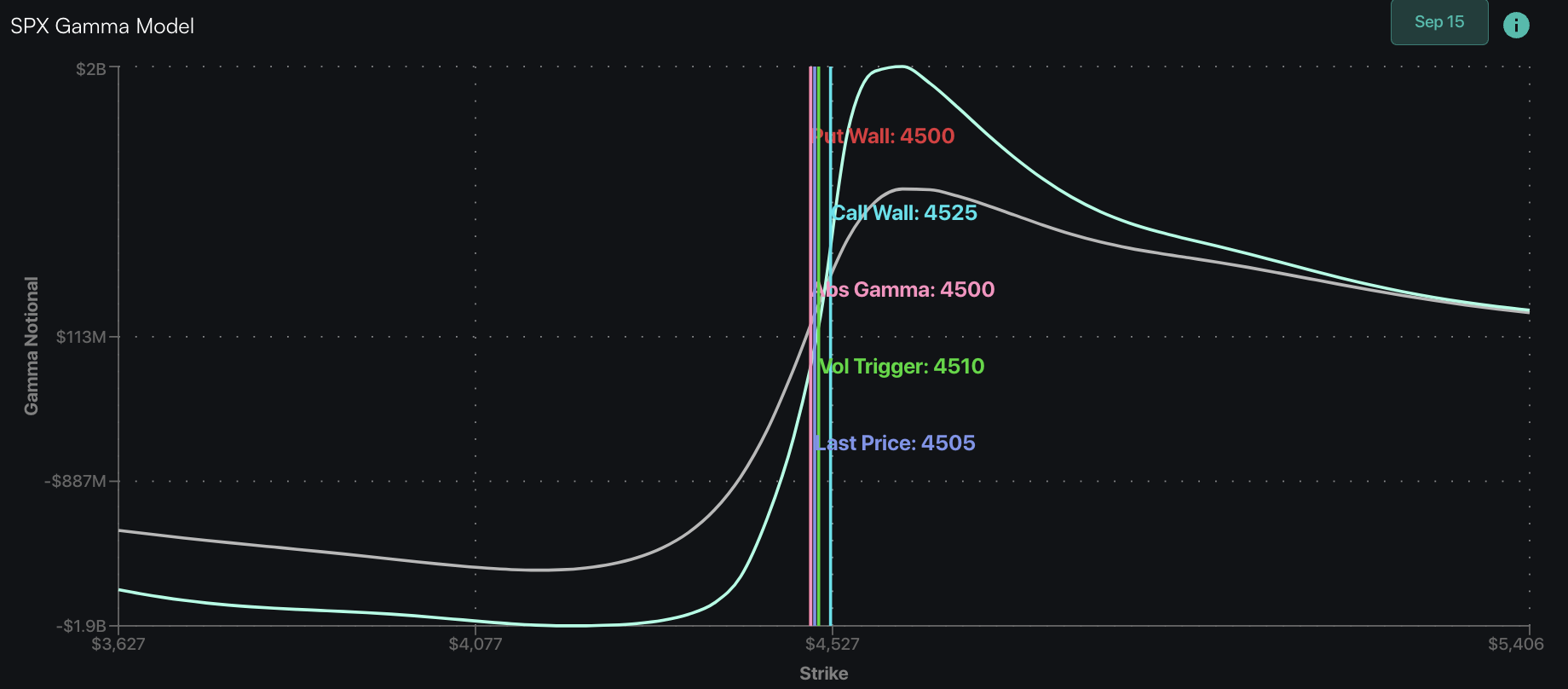

Below is the base gamma model, which shows the current gamma curve (teal) vs what the curve looks like if you remove today’s expiration positions (gray). As you can see we currently project little change to the curve after today, which informs us that this 4,200 area will still likely be the key downside zone into 10/20 (for a discussion on this curve go here).

| SpotGamma Proprietary Levels | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Reference Price: | $4299 | $428 | $14702 | $358 | $1794 | $177 |

| SpotGamma Implied 1-Day Move: | 0.82% | 0.82% |

|

|

|

|

| SpotGamma Implied 5-Day Move: | 2.21% |

|

|

|

|

|

| SpotGamma Volatility Trigger™: | $4350 | $430 | $15075 | $362 | $1820 | $185 |

| Absolute Gamma Strike: | $4300 | $430 | $15250 | $360 | $1850 | $180 |

| SpotGamma Call Wall: | $4500 | $460 | $15250 | $400 | $1880 | $210 |

| SpotGamma Put Wall: | $4200 | $425 | $13000 | $350 | $1700 | $175 |

| Additional Key Levels | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Zero Gamma Level: | $4405 | $437 | $14665 | $365 | $1944 | $188 |

| Gamma Tilt: | 0.624 | 0.553 | 0.951 | 0.674 | 0.565 | 0.405 |

| SpotGamma Gamma Index™: | -2.458 | -0.511 | -0.006 | -0.146 | -0.036 | -0.128 |

| Gamma Notional (MM): | ‑$1.249B | ‑$2.216B | ‑$930.978K | ‑$764.322M | ‑$38.639M | ‑$1.38B |

| 25 Day Risk Reversal: | -0.047 | -0.039 | -0.048 | -0.044 | -0.038 | -0.024 |

| Call Volume: | 539.776K | 2.155M | 14.023K | 1.057M | 13.622K | 328.267K |

| Put Volume: | 935.866K | 2.693M | 12.589K | 1.067M | 14.624K | 779.853K |

| Call Open Interest: | 6.055M | 7.236M | 51.334K | 4.602M | 186.321K | 3.337M |

| Put Open Interest: | 12.46M | 12.493M | 81.975K | 8.208M | 367.048K | 6.779M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [4400, 4350, 4300, 4000] |

| SPY Levels: [435, 430, 425, 420] |

| NDX Levels: [15500, 15250, 15000, 14500] |

| QQQ Levels: [370, 360, 355, 350] |

| SPX Combos: [(4502,85.65), (4325,77.38), (4317,89.72), (4313,79.38), (4300,99.08), (4295,72.90), (4291,88.61), (4278,83.82), (4274,92.57), (4270,87.35), (4265,94.18), (4252,78.33), (4248,98.47), (4244,75.64), (4240,83.41), (4235,85.54), (4227,93.60), (4218,73.92), (4214,95.12), (4209,95.70), (4205,73.06), (4201,99.61), (4175,82.44), (4162,88.34), (4149,93.24), (4123,82.37), (4115,75.79), (4102,97.68)] |

| SPY Combos: [421.24, 431.1, 425.96, 422.1] |

| NDX Combos: [14379, 15247, 14173, 14585] |

| QQQ Combos: [350.17, 345.16, 355.19, 354.11] |

SPX Gamma Model

Strike: $4,574

- Next Expiration: $729,772,106

- Current: $987,231,313

View All Indices Charts

0 comentarios