Macro Theme:

Key dates ahead:

- 11/19: VIX Exp, NVDA ER

- 11/21: OPEX

- 11/27: Thanksgiving

- 12/10: FOMC

- 12/15: ORCL ER

SG Summary:

Update 11/19: With positive NVDA earnings, we see 7,000 as the major upside level into Dec as the Thanksgiving holiday combines with a calming of AI fears to crush vol and bring in some dip buying. An NVDA miss opens up a test of 6,500, with 6,350 being our “wash out” level. We like index call flies to play upside, and CRWV and/or ORCL put flies for downside (see 11/19 AM note).

VIX Exp is Wed AM, and we could make the case for a sneaky vol decline & equity support into tomorrow afternoon as traders roll out NOV VIX calls. Given this, we are going to be looking to add a few cheap upside call structures for Tuesday PM (spreads or flies as calls are not particularly cheap), which would profit if the SPX moves >=6,800.

11/10: With the government shutdown apparently ending we are adjusting our risk-on pivot from 6,900 to 6,800. We think the week of 11/10 is setting up to be a bullish one, with more eyes now on 11/19 NVDA ER.

Key SG levels for the SPX are:

- Resistance: 6,700, 6,800

- Pivot: 6,800 (bearish <, bullish >)

- Support: 6,600, 6,500, 6,350 (6,350 is a large put strike zone and a long term support line)

Founder’s Note:

Futures are +30bps ahead of 9:30AM ET VIX expiration and NVDA ER at the close.

Watch for unusual ES movements around the cash open due to VIX expiration.

TLDR: Vols, both index & NVDA are not too rich, nor too cheap to weight the outcome of tonights events. We do, however, think today triggers a fairly long directional trend into end-of-November allowing for a “wait and see” approach. Ultimately our best case for upside over the next few weeks is 7,000, with VIX returning to ~16. Downside we watch VIX 30 and 6,500 as first downside stop, with 6,350 being a larger “wash out” level.

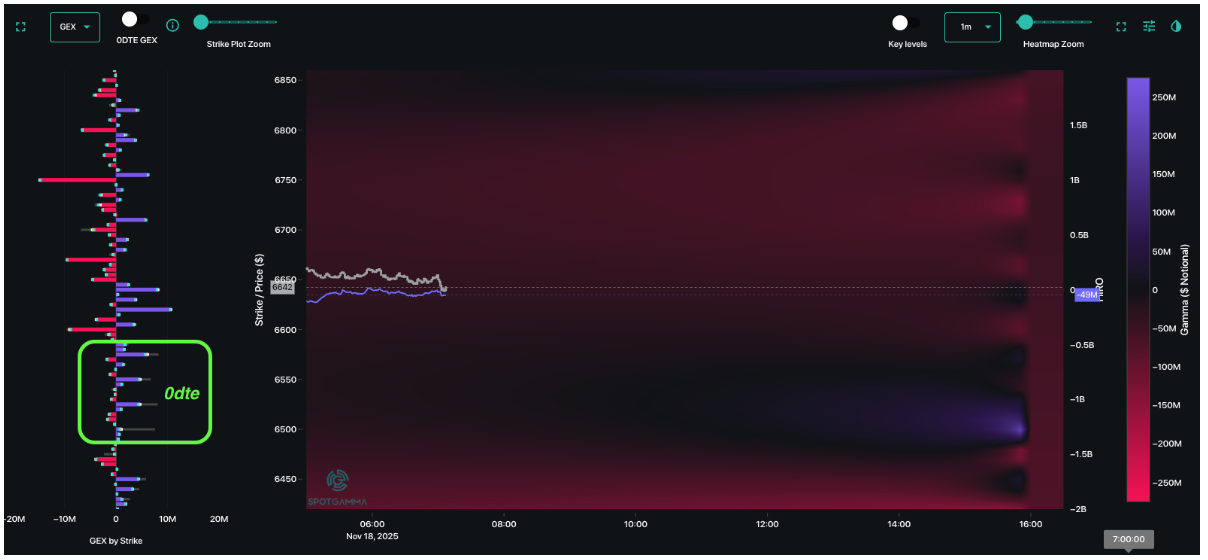

Below we assign the event vol for VIX exp as ~1 vol point, and NVDA ~2 vol points, implying that the benign passing of these events should reduce very short dated SPX vols by a total of ~3 points. We’d note that 2-3 vol points is sizable for a single stock earnings event, indicating its truly important for equities as a whole. SPX gamma is also negative across the board, backing a wide range of movement today and into tomorrow.

In this case, should NVDA earnings pass without issue we’ll likely see a substantial equity rally, which would reduce volatility much more, particularly into next weeks holiday (Thu market closed, Fri 1/2 session).

A miss obviously works the other way, as it likely boosts the negative narrative around AI growth. We would start to eye VIX 30, and SPX into 6,500 as the outcome to that situation.

NVDA’s implied earnings move is ~6.6% which is pretty average. Further, the skews are all fairly average, too, indicating there isn’t a strong positional lean into tonights earnings. You see this in Compass wherein NVDA is perfectly centered: IV Rank 50%, Risk Reversal 50%.

The stock is also down ~12% this month, and ~4% this week (1-month realized vol RV = 43%), lending the impression that this 1-month IV of 53% isn’t a home run in terms of vol collapse/IV earnings crush. If we think about the reflexive flows from NVDA earnings, we can make the case that NVDA vols are maybe even a bit cheap as NVDA moves the AI names which are 35% of SPX/NDX, and as SPX/NDX move they add to NVDA movement.

What we instead think is more interesting is broken wing call flies in the SPY/QQQ or even SMH to play upside, with the idea that positive NVDA news generates a large initial move, then vol contracts sharply into Friday.

Additionally, CRWV and ORCL may provide for interesting trades, as they are heavily dependent on this NVDA outcome. In the case of CRWV the stock is already down ~50% this month, but near term puts flag as not fairly expensive. The tiny puts seem to be bid up, though, and so put flies could be interesting downside plays there as near-the-money puts scan as relatively cheap relative to wings.

Lastly, with ORCL, they report on 12/15, so >=1-month vols are pricing in both NVDA ER + ORCL ER, additionally ORCL is -20% this month. This results in an IV rank near 100%, with traders actually leaning into calls (see above).

This presents an interesting opportunity in that >=12/15 dated options ORCL may be more stable out of this event (for long options plays), and pre-12/15 options are more of a pure-play on NVDA earnings.

To visualize this, you see the ORCL term structure below with short dated forward implied vol below that of Nov options (implying vol crush ahead), while Dec Options forward implied vol is above the term structure (we wouldn’t expect much Dec vol crush). Calendar spreads or diagonals may be interesting here as a result, particularly on the put wing. Recall too that the ORCL IV rank is near 100%, with a skew to calls and so positive NVDA earnings could bring that Dec exp vol in a bit, making it interesting for call flies with that idea that great NVDA earnings brings some ORCL relief.

©2025 TenTen Capital LLC DBA SpotGamma

All TenTen Capital LLC DBA SpotGamma materials, information, and presentations are for educational purposes only and should not be considered specific investment advice nor recommendations. Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. VIEW FULL RISK DISCLOSURE https://spotgamma.com/model-faq/disclaimer/

|

|

/ESZ25 |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|---|

|

Reference Price: |

$6637.26 |

$6617 |

$660 |

$24503 |

$596 |

$2348 |

$233 |

|

SG Gamma Index™: |

|

-1.612 |

-0.519 |

|

|

|

|

|

SG Implied 1-Day Move: |

|

0.63% |

0.63% |

|

|

|

|

|

SG Implied 5-Day Move: |

|

1.45% |

|

|

|

|

|

|

SG Implied 1-Day Move High: |

|

$6664.47 |

$664.94 |

|

|

|

|

|

SG Implied 1-Day Move Low: |

|

$6581.03 |

$656.62 |

|

|

|

|

|

SG Volatility Trigger™: |

$6735.26 |

$6715 |

$671 |

$24580 |

$605 |

$2440 |

$240 |

|

Absolute Gamma Strike: |

$6020.26 |

$6000 |

$670 |

$24600 |

$600 |

$2380 |

$230 |

|

Call Wall: |

$7020.26 |

$7000 |

$700 |

$24600 |

$640 |

$2450 |

$250 |

|

Put Wall: |

$6520.26 |

$6500 |

$650 |

$23000 |

$590 |

$2390 |

$230 |

|

Zero Gamma Level: |

$6698.26 |

$6678 |

$673 |

$24441 |

$608 |

$2470 |

$247 |

|

Key Support & Resistance Strikes |

|---|

|

SPX Levels: [6000, 6700, 6600, 6750] |

|

SPY Levels: [670, 640, 660, 650] |

|

NDX Levels: [24600, 24500, 25000, 23000] |

|

QQQ Levels: [600, 610, 590, 585] |

|

SPX Combos: [(6922,76.37), (6902,95.53), (6849,92.02), (6822,84.42), (6816,72.19), (6803,93.86), (6756,68.54), (6750,80.23), (6697,78.27), (6670,77.89), (6650,91.15), (6644,71.19), (6637,83.09), (6624,83.94), (6617,88.78), (6611,69.84), (6597,95.16), (6591,69.16), (6578,92.35), (6571,68.38), (6564,81.64), (6558,79.00), (6551,93.38), (6538,85.62), (6531,69.32), (6525,81.37), (6518,91.91), (6505,68.14), (6498,98.15), (6472,87.02), (6465,87.17), (6452,90.85), (6425,78.48), (6412,85.71), (6399,93.97), (6353,87.54), (6333,85.89), (6326,69.58), (6313,73.95), (6300,93.40)] |

|

SPY Combos: [698.29, 648.36, 663.67, 658.35] |

|

NDX Combos: [24601, 24234, 24650, 24454] |

|

QQQ Combos: [598.81, 600.02, 589.76, 595.19] |

0 comentarios