Macro Theme:

Key dates ahead:

- 11/20: Jobs

- 11/21: OPEX

- 11/27: Thanksgiving

- 12/10: FOMC

- 12/15: ORCL ER

- 12/19: OPEX

SG Summary:

Update 11/20: With decent NVDA earnings, should the Jobs data pass we’d look for a move to 6,800 into tomorrow’s OPEX (ref SPX 6,715). Following that, next week sets up as bullish due to holiday time decay. Conversely, if the SPX breaks <6,700, we would position for meaningful risk-off.

11/19: With positive NVDA earnings, we see 7,000 as the major upside level into Dec as the Thanksgiving holiday combines with a calming of AI fears to crush vol and bring in some dip buying. An NVDA miss opens up a test of 6,500, with 6,350 being our “wash out” level. We like index call flies to play upside, and CRWV and/or ORCL put flies for downside (see 11/19 AM note).

Key SG levels for the SPX are:

- Resistance: 6,800, 6,800

- Pivot: 6,800 (bearish <, bullish >)

- Support: 6,700, 6,600, 6,500, 6,350 (6,350 is a large put strike zone and a long term support line)

Founder’s Note:

Futures are 1.1% higher, with NVDA +4.7% after earnings.

Eyes have immediately shifted to the Sep delayed 8:30 AM ET jobs report.

Quite frankly, this isn’t feeling all that stable, and the passing of the AM jobs report is likely the last “all clear” hurdle before eyes turn to this upcoming holiday week.

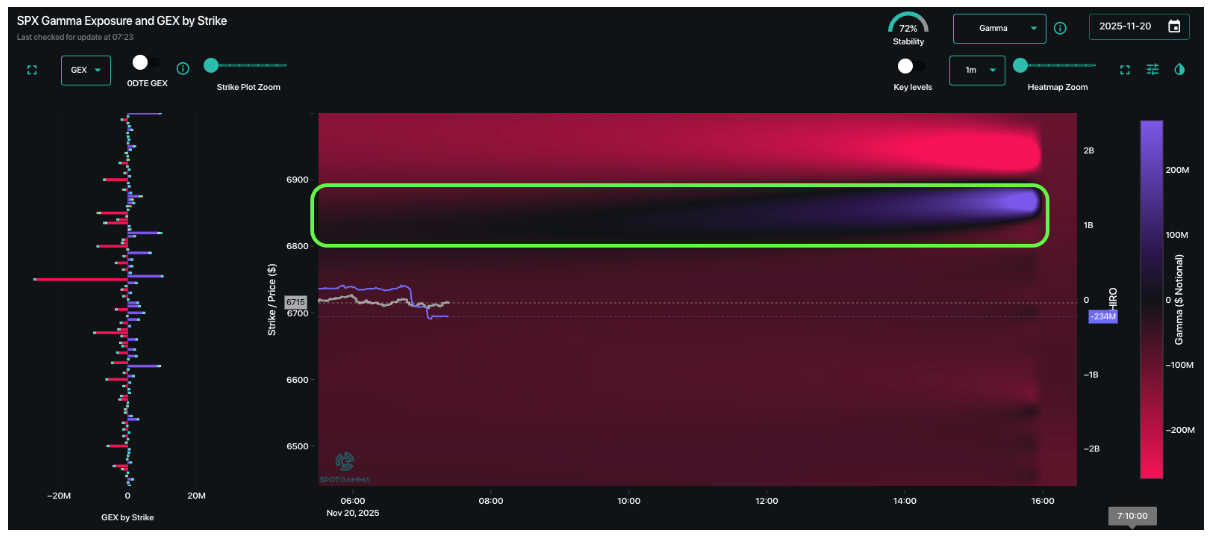

On that point of instability, S&P gamma remains negative across all near-term strikes, with the SPX implied open just above 6,700. >=6,800 remains our “safe zone”, meaning dealer hedging flows should be supportive of equity prices if that level is regained. We’d note that the path to 6,800 reads as quite open, as its primarily negative gamma up into that strike.

However, remain vigilant. Above 6,700 we want to lean long and anticipate a stronger move higher, but if SPX moves back <6,700, we’d take that as a meaningful risk-off signal.

In these moments we turn to IV’s as a source of truth. SPX fixed strike vols are generally down 1-2 vol points (thats bullish), but there clearly is some anxiety tied to this AM report. You see this in the SPX terms structure from last night vs this AM, wherein todays IV remains elevated. That said, its not a screamingly high IV, as the 0DTE SPX straddle is $56/83bps (ref 6,715), which, for upside movement that feels about right. A break <6,700 likely pushes that 80bps limit to the test.

©2025 TenTen Capital LLC DBA SpotGamma

All TenTen Capital LLC DBA SpotGamma materials, information, and presentations are for educational purposes only and should not be considered specific investment advice nor recommendations. Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. VIEW FULL RISK DISCLOSURE https://spotgamma.com/model-faq/disclaimer/

|

| /ESZ25 | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $6662.02 | $6642 | $662 | $24640 | $599 | $2347 | $233 |

| SG Gamma Index™: |

| -1.191 | -0.462 |

|

|

|

|

| SG Implied 1-Day Move: |

| 0.63% | 0.63% |

|

|

|

|

| SG Implied 5-Day Move: |

| 1.45% |

|

|

|

|

|

| SG Implied 1-Day Move High: |

| After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: |

| After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $6730.02 | $6710 | $665 | $24580 | $601 | $2440 | $240 |

| Absolute Gamma Strike: | $6020.02 | $6000 | $670 | $24600 | $600 | $2380 | $240 |

| Call Wall: | $7020.02 | $7000 | $700 | $24600 | $620 | $2450 | $250 |

| Put Wall: | $6520.02 | $6500 | $660 | $24000 | $590 | $2390 | $235 |

| Zero Gamma Level: | $6673.02 | $6653 | $671 | $24393 | $607 | $2450 | $245 |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6000, 6700, 6600, 6750] |

| SPY Levels: [670, 640, 660, 650] |

| NDX Levels: [24600, 24500, 25000, 25500] |

| QQQ Levels: [600, 610, 590, 585] |

| SPX Combos: [(6968,73.81), (6948,91.30), (6928,78.83), (6901,95.35), (6875,74.98), (6868,74.07), (6848,91.96), (6828,81.00), (6821,67.77), (6815,74.26), (6808,67.26), (6802,95.79), (6788,77.76), (6775,68.47), (6755,74.72), (6748,87.46), (6742,69.67), (6669,81.60), (6649,88.71), (6642,70.69), (6622,80.45), (6616,88.16), (6602,94.77), (6582,79.32), (6576,84.52), (6569,70.39), (6562,87.57), (6549,93.72), (6543,79.41), (6536,72.58), (6529,75.88), (6523,88.97), (6516,88.26), (6503,98.63), (6483,72.51), (6476,80.18), (6463,89.05), (6450,87.51), (6443,69.20), (6423,80.70), (6416,82.90), (6403,93.56), (6363,70.77), (6350,84.96), (6330,81.72), (6323,69.10), (6317,73.32)] |

| SPY Combos: [648.26, 688.53, 658.16, 638.36] |

| NDX Combos: [24591, 24246, 24641, 24025] |

| QQQ Combos: [598.7, 589.75, 599.89, 595.12] |

0 comentarios