Macro Theme:

Key dates ahead:

- 11/21: OPEX

- 11/27: Thanksgiving

- 12/10: FOMC

- 12/15: ORCL ER

- 12/19: OPEX

SG Summary:

Update 11/21: Yesterday’s break of 6,700 opened the downside plunge which occurs into todays OPEX + a weekend. Puts are now expensive, which in the absence of a catalyst, can drive an equity bounce. Given that we are looking to enter SPY/QQQ 1×2 call flies for early December as a way to play/cover a right tail move. 6,500 is initial support, with 6,350 still our “wash out” level. Meaningful upside resistance is 6,700, which is our new Risk Pivot level.

11/20: With decent NVDA earnings, should the Jobs data pass we’d look for a move to 6,800 into tomorrow’s OPEX (ref SPX 6,715). Following that, next week sets up as bullish due to holiday time decay. Conversely, if the SPX breaks <6,700, we would position for meaningful risk-off.

11/19: With positive NVDA earnings, we see 7,000 as the major upside level into Dec as the Thanksgiving holiday combines with a calming of AI fears to crush vol and bring in some dip buying. An NVDA miss opens up a test of 6,500, with 6,350 being our “wash out” level. We like index call flies to play upside, and CRWV and/or ORCL put flies for downside (see 11/19 AM note).

Key SG levels for the SPX are:

- Resistance: 6,600, 6,700

- Pivot: 6,700 (bearish <, bullish >) NEW

- Support: 6,500, 6,350 (6,350 is a large put strike zone and a long term support line)

Founder’s Note:

Futures are 50bps lower ahead of 9:30AM ET SPX AM expiration, with all other options expiring at 4PM ET.

Watch out for wide swings at the 9:30 AM ET cash open due to SPX OPEX, similar to what just happened on 11/19 VIX exp.

TLDR: Very tricky market here, our one clear warning here is to mind risk over this weekend as these types of weekends can carry a lot of tail risk. 6,500 is interim support, with 6,350 remaining as the “wash out” level to the downside. Conversely with clear upside into the 6,700 level.

We, like many traders, were leaning long out of NVDA ER & Jobs data, and that plan went violently south starting at 10:30AM ET yesterday. Our saving grace was the strong risk off signal if SPX went <6,700, as <6,700 opened a portal of negative gamma and higher volatility (see last nights note on the huge size). This morning we still exist in this negative gamma realm, which is only to be compounded by today’s OPEX. You see this in TRACE wherein the SPX map gets more red after 9:30AM, which is when the largest trachne of SPX options roll off. There is another set expiring at 4PM, which includes the fairly large 0DTE positive gamma strikes at 6,500 & 6,475.

On this positive gamma point, its clear there are some 0DTE traders taking a stand in the 6,400’s, but sub <6,400 its more negative gamma. 6,350 remains a big downside zone to watch a “full flush” level.

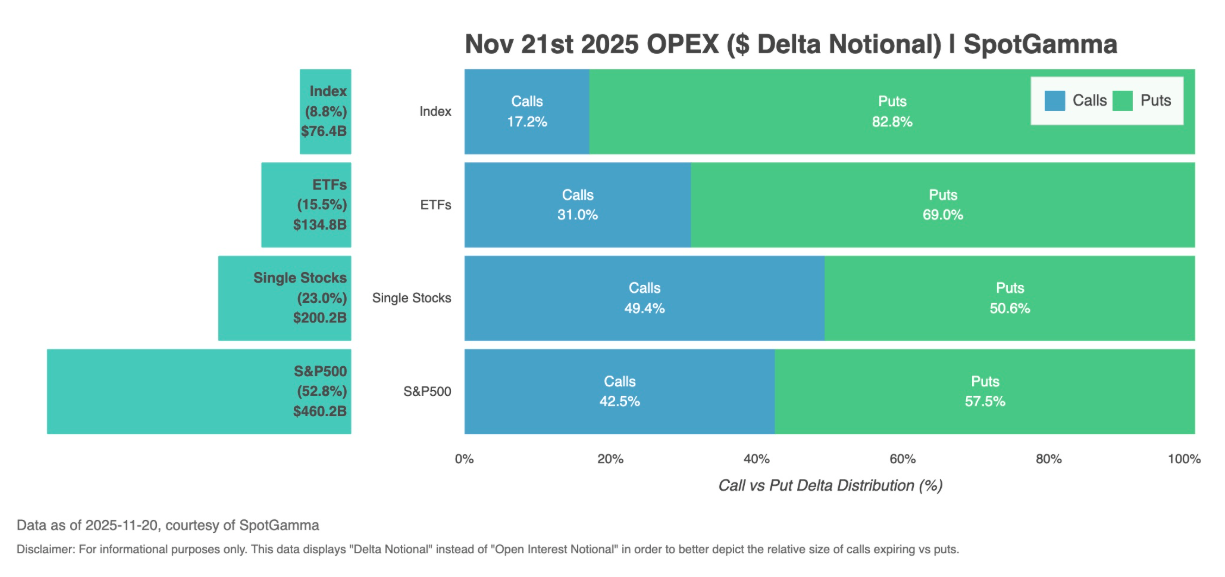

Volatility and negative gamma “work both ways”, and so we have to be weary of a very fast move back into the 6,600’s as OPEX will clear a bunch of puts, and we are about to head into a weekend. Consider our OPEX plot below which has some very bearish delta put/call ratios expiring in Index & ETF’s (these values were closer 50/50), with SPX being more 60/40 calls to puts. This is not a giant quarterly OPEX, but its enough to matter, particularly in the absence of another catalyst + big negative gamma & high VIX/IV’s.

The tricky part here is that there is no one clear catalyst for this selling (we’ve heard up to 10 different reasons), and these types of weekends carry a lot of risk in that respect. Carry/crypto/credit/margin issues love to flare up on a Sunday night, making carrying short vol over the weekend a bit perilous.

Here is the other problem for downside: puts are expensive as you can see by the clustering of stocks on the left of Compass (puts rich vs calls + IV Ranks near 50). Okay, its not April ’24 kind of expensive, but its the kind of expensive that really hurts if the market just stops going lower – particularly into a weekend backed by a holiday.

What’s the trade?

We like SPY/QQQ call 1×2 or broken wing call flies for early December, which can be structured for near even money. The idea here is that we have fixed risk downside, but if there is a stock pop due to weekend decay + OPEX, those higher stock prices should be met with a big vol crush. For this we want to be long the SPY 666 & QQQ 600 area, and we are okay have some short exposure in the SPY >675 and QQQ >610.

Flavors of short puts are more of a clear play here, but we strongly warn against naked put structures at this juncture. Weekend risks considered, broken wing flies in top tech names in Dec OPEX are some decent targets.

©2025 TenTen Capital LLC DBA SpotGamma

All TenTen Capital LLC DBA SpotGamma materials, information, and presentations are for educational purposes only and should not be considered specific investment advice nor recommendations. Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. VIEW FULL RISK DISCLOSURE https://spotgamma.com/model-faq/disclaimer/

|

|

/ESZ25 |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|---|

|

Reference Price: |

$6557.2 |

$6538 |

$652 |

$24054 |

$585 |

$2305 |

$229 |

|

SG Gamma Index™: |

|

-2.881 |

-0.738 |

|

|

|

|

|

SG Implied 1-Day Move: |

|

0.64% |

0.64% |

|

|

|

|

|

SG Implied 5-Day Move: |

|

1.45% |

|

|

|

|

|

|

SG Implied 1-Day Move High: |

|

After open |

After open |

|

|

|

|

|

SG Implied 1-Day Move Low: |

|

After open |

After open |

|

|

|

|

|

SG Volatility Trigger™: |

$6729.2 |

$6710 |

$661 |

$24590 |

$601 |

$2425 |

$240 |

|

Absolute Gamma Strike: |

$6019.2 |

$6000 |

$640 |

$24500 |

$600 |

$2300 |

$230 |

|

Call Wall: |

$7019.2 |

$7000 |

$700 |

$24600 |

$640 |

$2500 |

$250 |

|

Put Wall: |

$6519.2 |

$6500 |

$650 |

$24000 |

$585 |

$2320 |

$230 |

|

Zero Gamma Level: |

$6668.2 |

$6649 |

$666 |

$24357 |

$602 |

$2442 |

$243 |

|

Key Support & Resistance Strikes |

|---|

|

SPX Levels: [6000, 6600, 6500, 6700] |

|

SPY Levels: [640, 650, 660, 670] |

|

NDX Levels: [24500, 24600, 24000, 23000] |

|

QQQ Levels: [600, 585, 590, 580] |

|

SPX Combos: [(6853,87.27), (6800,91.24), (6748,76.28), (6650,80.40), (6637,75.66), (6624,73.57), (6611,87.01), (6598,93.29), (6591,73.10), (6578,90.81), (6565,80.14), (6552,96.49), (6539,75.25), (6532,90.05), (6526,87.33), (6519,71.60), (6513,95.20), (6506,79.00), (6500,99.29), (6493,84.59), (6486,71.28), (6473,94.78), (6467,82.64), (6460,88.02), (6447,93.16), (6441,74.48), (6428,89.44), (6415,88.28), (6401,97.52), (6382,73.86), (6375,82.72), (6362,78.53), (6349,88.51), (6330,84.61), (6323,85.11), (6310,79.63), (6297,95.56), (6290,68.73), (6277,74.27), (6264,69.69), (6251,88.79)] |

|

SPY Combos: [648.73, 678.55, 688.49, 658.67] |

|

NDX Combos: [24030, 24247, 23838, 23621] |

|

QQQ Combos: [598.61, 590.21, 599.81, 584.81] |

0 comentarios