Macro Theme:

Key dates ahead:

- 11/27: Thanksgiving

- 11/28: Early Close

- 12/10: FOMC

- 12/15: ORCL ER

- 12/19: OPEX

SG Summary:

Update 11/24: We want to lean long of stocks with SPX >6,600 as we believe put option decay into a holiday week will be a dominant tailwind for stocks. 6,700-6,750 is our upside target into Wednesday night. Should SPX break <6,600 we would close short term swing longs, and watch for a test of 6,500. Our longer term “wash out” downside level remains 6,350. Note: even in a risk-off scenario we still hold a core Dec 1×2 call spread per 11/21 note.

11/21: Yesterday’s break of 6,700 opened the downside plunge which occurs into todays OPEX + a weekend. Puts are now expensive, which in the absence of a catalyst, can drive an equity bounce. Given that we are looking to enter SPY/QQQ 1×2 call flies for early December as a way to play/cover a right tail move. 6,500 is initial support, with 6,350 still our “wash out” level. Meaningful upside resistance is 6,700, which is our new Risk Pivot level.

Key SG levels for the SPX are:

- Resistance: 6,700, 6,750

- Pivot: 6,600 (bearish <, bullish >) NEW

- Support: 6,600, 6,500, 6,350 (6,350 is a large put strike zone and a long term support line)

Founder’s Note:

Futures are +35bps with no major news on the tape.

TLDR: Stocks are poised to move this AM. We want to lean long with SPX >6,600, with a short term target of 6,700 into tomorrow. Should 6,600 break, we go back to risk-off & 6,500 becomes the obvious first support. 6,350 remains our “wash out” risk area.

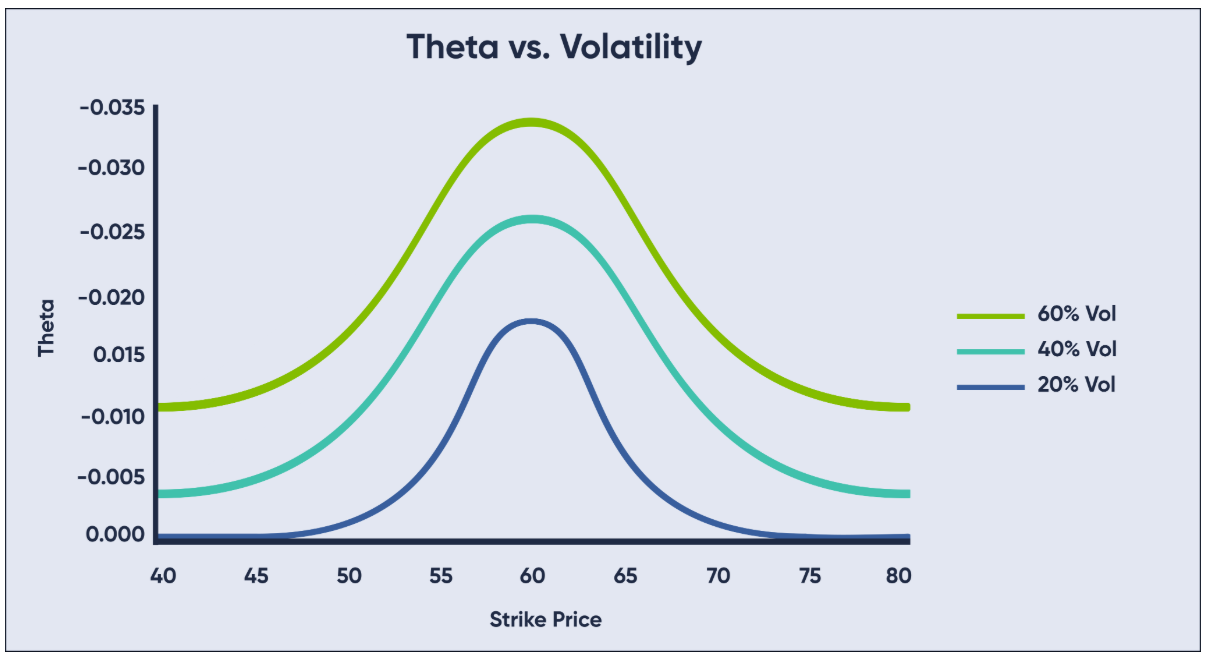

With Friday’s put-heavy OPEX behind us, the major event this week is Thanksgiving market closure (Th), followed by the 1/2 session on Friday. This matters particularly in this very high volatility environment, wherein time decay is exacerbated by high IV.

We’ve been

hammer

ing on this dynamic for the better part of the week, with the theme that if you are now long puts you are facing a very serious decay tax, and you must have high downside energy to pay that tax. The E.L.I.F. is this: higher IV = higher theta. The takeaway is this: there is currently a positive drift in this market, and new sellers has to overcome this drift. Given this, we want to play the long side if SPX remains >6,600. A break of 6,600 likely invokes a re-test of 6,500.

This decay dynamic plays into a very negative SPX GEX. You see this in TRACE wherein the map is “nothing but red”, and also in the EquityHub GEX, below. As you can see, with OPEX behind us gamma currently gets more negative to the upside, with 6,750 being the largest gamma strike on the board. To the downside, GEX remains stable into 6,350, which is our “wash out” downside target. Under 6,350 we currently see a reduction in positioning that could coincide with lows.

Here is one last dynamic: puts are pretty expensive. Below we see top stocks heavily skewed toward the put side, mainly due to an absence of call buying. However, IV’s are not yet screaming (IV Ranks are <50). We ultimately view this as puts being rather unreasonable buys here unless there is an actual, material trigger. Not rumor of an event, but an actual event. Otherwise this put skew and moderately elevated IV is tough to maintain.

For single stock highlights, we watch GOOGL today, which is +3% premarket after both Buffets small buy and Sam Altman allegedly sweating GOOGL’s growth. There are two big negative gamma strikes at 300 & 305, with relative positive gamma >310 (first resistance). If this is the start of a rotation into GOOGL, then a relative value play like short put spreads in QQQ for long GOOGL call spreads could be an interesting idea.

©2025 TenTen Capital LLC DBA SpotGamma

All TenTen Capital LLC DBA SpotGamma materials, information, and presentations are for educational purposes only and should not be considered specific investment advice nor recommendations. Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. VIEW FULL RISK DISCLOSURE https://spotgamma.com/model-faq/disclaimer/

|

| /ESZ25 | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $6619.25 | $6602 | $659 | $24239 | $590 | $2369 | $235 |

| SG Gamma Index™: |

| -1.347 | -0.399 |

|

|

|

|

| SG Implied 1-Day Move: |

| 0.65% | 0.65% |

|

|

|

|

| SG Implied 5-Day Move: |

| 1.47% |

|

|

|

|

|

| SG Implied 1-Day Move High: |

| After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: |

| After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $6687.25 | $6670 | $664 | $24475 | $600 | $2360 | $235 |

| Absolute Gamma Strike: | $6017.25 | $6000 | $640 | $24500 | $600 | $2400 | $240 |

| Call Wall: | $7017.25 | $7000 | $700 | $23950 | $640 | $2400 | $250 |

| Put Wall: | $6517.25 | $6500 | $650 | $24000 | $585 | $2320 | $225 |

| Zero Gamma Level: | $6681.25 | $6664 | $667 | $24360 | $602 | $2418 | $246 |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6000, 6700, 7000, 6600] |

| SPY Levels: [640, 660, 650, 670] |

| NDX Levels: [24500, 23950, 24000, 25500] |

| QQQ Levels: [600, 590, 585, 580] |

| SPX Combos: [(6927,70.70), (6900,92.98), (6847,90.76), (6801,94.06), (6775,70.39), (6755,76.46), (6748,84.74), (6702,86.19), (6649,82.05), (6623,73.67), (6610,86.16), (6596,85.00), (6577,84.58), (6570,68.72), (6563,73.07), (6550,92.06), (6537,82.90), (6530,81.77), (6524,83.10), (6517,73.49), (6511,88.79), (6497,98.01), (6491,67.24), (6478,81.76), (6471,69.14), (6464,84.92), (6451,88.63), (6425,78.36), (6412,88.40), (6398,93.40), (6372,68.60), (6359,67.98), (6352,85.47), (6332,86.22), (6312,75.60), (6299,92.95)] |

| SPY Combos: [648.61, 638.83, 653.84, 628.39] |

| NDX Combos: [24021, 24240, 23828, 23949] |

| QQQ Combos: [584.97, 590.24, 580.29, 575.02] |

0 comentarios